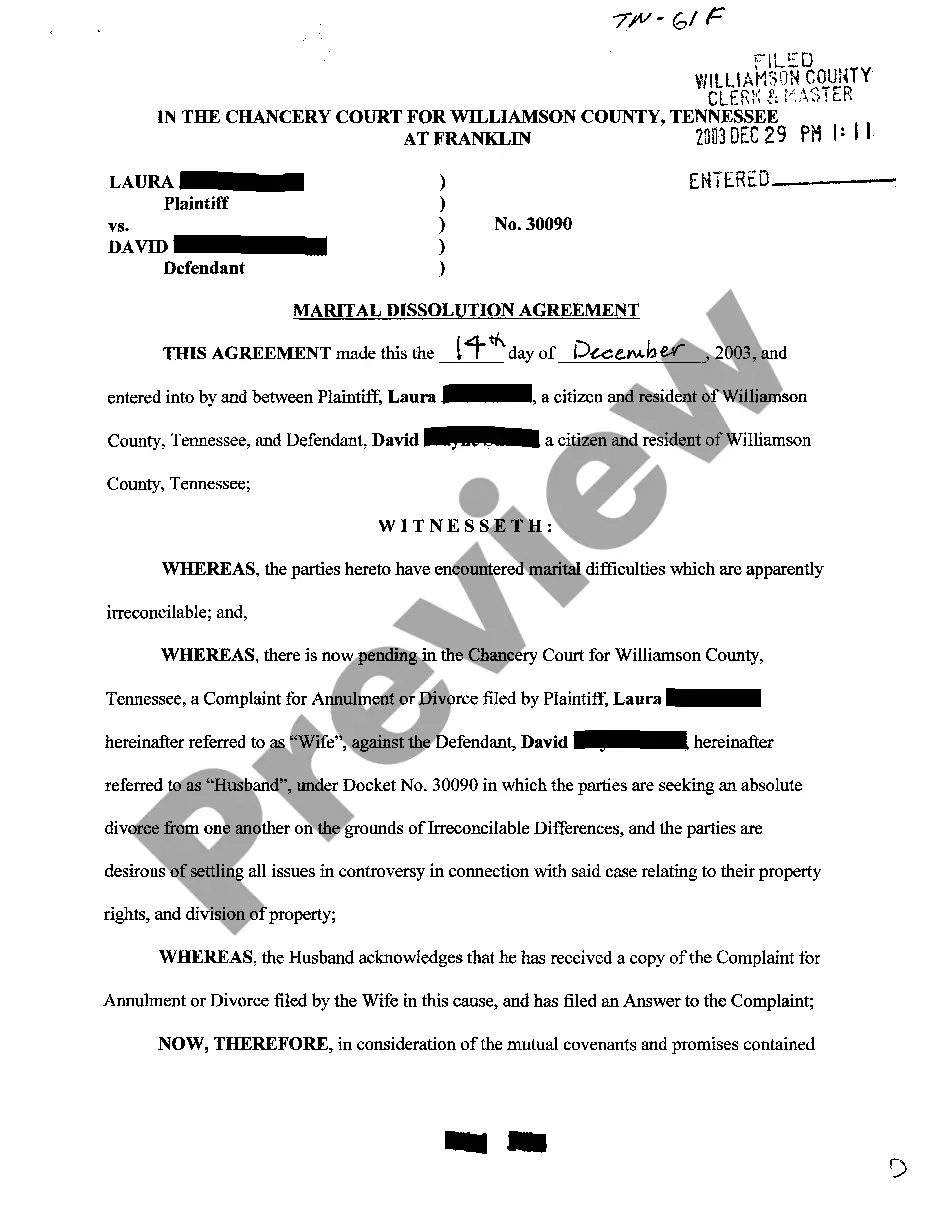

The North Dakota Asset Purchase Agreement — Business Sale is a legally binding contract that outlines the terms and conditions of a sale of a business's assets in the state of North Dakota. This agreement is essential to ensure a smooth transfer of ownership and protect the rights and interests of both the buyer and the seller. The agreement covers various key aspects of the transaction, including the identification and description of the assets being sold. These assets may include tangible items such as equipment, inventory, real estate, intellectual property rights, contracts, customer lists, and goodwill. Additionally, intangible assets like trademarks, patents, licenses, and permits may also be included. Furthermore, the agreement specifies the purchase price and the payment terms. This can include the payment structure, such as lump sum, installments, or a combination of both. The agreement may also outline any adjustments to the purchase price, such as inventory valuation, prorated expenses, or contingent payments based on future performance. Another important element of the North Dakota Asset Purchase Agreement — Business Sale is the allocation of liabilities. This includes detailing whether the buyer assumes any existing debts, warranties, or legal obligations of the seller. The agreement may also include provisions for indemnification, where the seller agrees to compensate the buyer for any losses resulting from undisclosed liabilities or breaches of warranties. The agreement typically contains representations and warranties from both the buyer and the seller. These are assurances made by each party regarding the accuracy of the information provided, the legal authority to enter into the agreement, and the compliance with applicable laws. There are various types of North Dakota Asset Purchase Agreements — Business Sale depending on the nature of the transaction and the specific needs of the parties involved. Some common types include: 1. Standard Asset Purchase Agreement: This is a generic agreement that covers the sale of business assets without any customized provisions. 2. Stock Purchase Agreement: This agreement is used when the sale involves the transfer of stock in a corporation rather than the individual assets of the business. 3. Distressed Asset Purchase Agreement: This type of agreement is utilized in situations where the business being sold is financially troubled, and the buyer is acquiring the assets at a discounted price. 4. Intellectual Property Asset Purchase Agreement: When the primary focus of the sale is the transfer of intellectual property rights, such as patents, trademarks, or copyrights, this agreement is used. In summary, the North Dakota Asset Purchase Agreement — Business Sale is a vital legal document that establishes the terms and conditions for the sale of a business's assets. It covers various aspects of the transaction, including asset description, purchase price, payment terms, liability allocation, and representations and warranties. Different types of agreements exist to cater to specific circumstances, ensuring a comprehensive and tailored approach to the sale process.

Asset Purchase Agreement

Description purchase agreement letter

How to fill out North Dakota Asset Purchase Agreement - Business Sale?

Are you in a location where you need to have documents for potential business or personal reasons almost every day.

There are many legal document templates available online, but locating credible ones can be challenging.

US Legal Forms offers a wide range of form templates, including the North Dakota Asset Purchase Agreement - Business Sale, which is designed to meet both federal and state requirements.

Once you find the right form, click on Buy now.

Choose the payment plan you desire, fill out the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Asset Purchase Agreement - Business Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and make sure it is for your appropriate town/county.

- Use the Review button to examine the document.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you need, utilize the Lookup field to find the form that meets your needs and specifications.

purchase agreement employees Form popularity

FAQ

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Interesting Questions

More info

Free Sale of Business Bill Sale Personal Advance Direct Free Sale of Business Free Business Bill Sale Word forms The first sentence of the Agreement is as follows: “The parties acknowledge that the business is a going concern and that they will execute this Agreement in good faith knowing that business is in danger of being foreclosed on by said City”. The agreement is then signed by both parties by an authorized employee or agent of the party being sold. The party being sold is either a business or a person. Once the signature of the parties is made the agreement is considered to be in full effect. Businesses are usually required for the city to execute a sale of their real estate to a bidder. However, the agreement allows a person who does not have business interests in the business being sold to own the business after such a sale takes place.