North Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding contract that establishes the terms and conditions of employment between a business and a self-employed independent contractor in North Dakota. In this type of agreement, the contractor is compensated based on a percentage of the sales revenue they generate for the company. Some relevant keywords for this topic include: 1. North Dakota Employment Agreement: Refers to the specific contract that governs the employment relationship between the business and the independent contractor in the state of North Dakota. 2. Percentage of Sales: Indicates the method of compensation agreed upon, where the contractor receives a percentage of the sales revenue they generate for the company. This form of remuneration aligns the contractor's earnings directly with their performance and sales outcomes. 3. Self-Employed Independent Contractor: Refers to an individual who provides services to a company without being considered an employee. Independent contractors typically have more control and autonomy over their work and are responsible for their own taxes, insurance, and other business expenses. Different variations of the North Dakota Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor may include: 1. Commission-based Employment Agreement: Similar to the percentage of sales agreement, this type of contract compensates the contractor with a fixed commission fee or a percentage of the total value of each sale made. 2. Sales Agent Employment Agreement: This agreement outlines the terms of employment for a contractor who exclusively focuses on sales and plays a crucial role in driving revenue growth for the company. 3. Referral Partner Agreement: This type of agreement is applicable when a self-employed independent contractor acts as a referral partner, introducing potential customers to the business and receiving a percentage of any sales resulting from those referrals. Remember, it is important to consult with legal professionals or advisors versed in North Dakota employment laws to ensure compliance and accuracy when drafting or reviewing any employment agreements.

North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

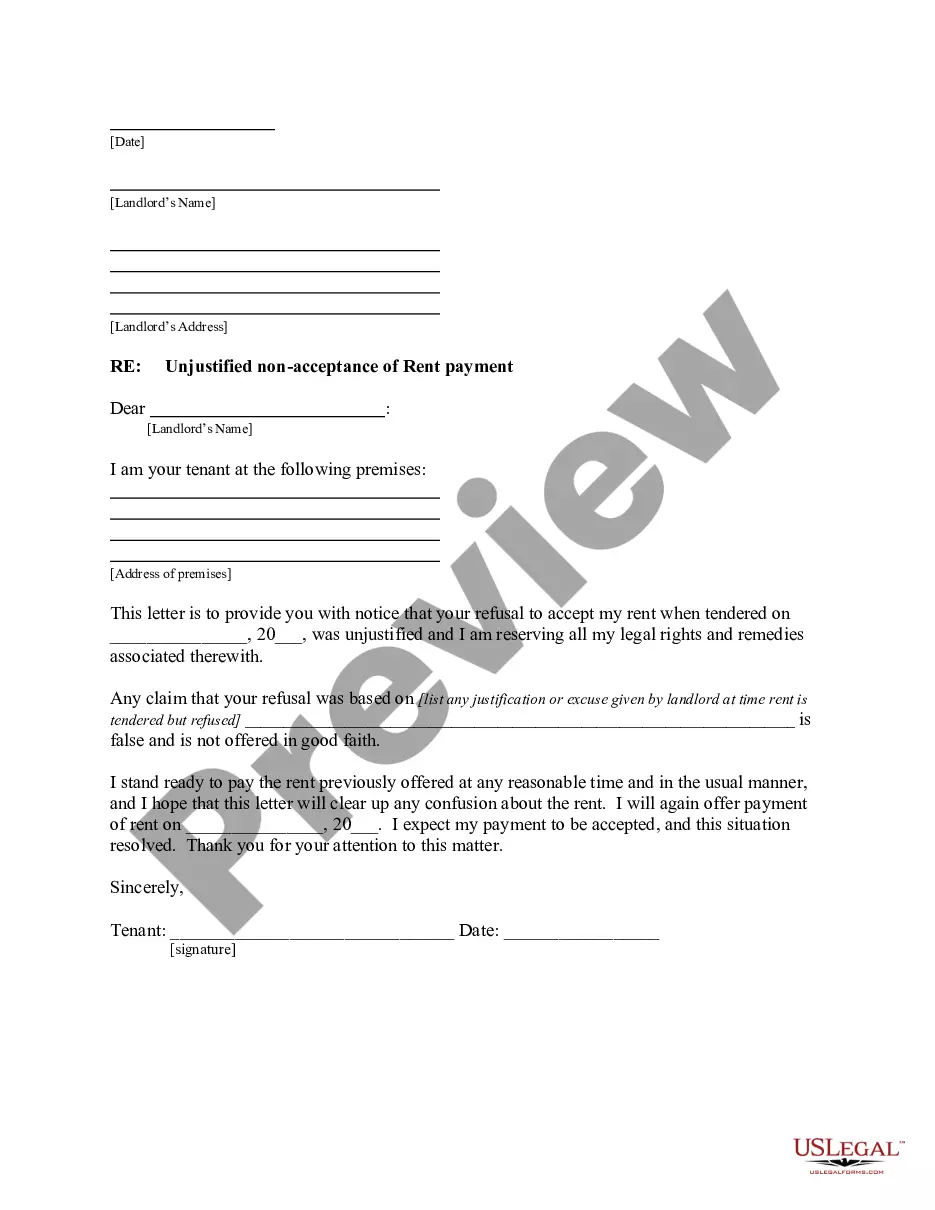

How to fill out North Dakota Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

If you require to summarize, download, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site's simple and user-friendly search feature to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the desired form, click the Get now button. Select your preferred pricing plan and enter your credentials to sign up for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to obtain the North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download button to retrieve the North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to read the content carefully.

- Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Yes, a sales representative can operate as an independent contractor, allowing flexibility and autonomy in their work. This arrangement is common in many industries where sales performance directly influences compensation. When drafting a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it's crucial to consider the specific terms that define their independent status. This ensures both parties understand the expectations and legal implications involved.

Setting up an independent contractor agreement involves drafting a document that clearly outlines the roles, responsibilities, and payment terms. Start with a detailed description of the services and how compensation will be calculated. For a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, consider using online resources like uslegalforms, which offer customizable templates to streamline the process. This ensures you cover all necessary aspects and maintain legal compliance.

The percentage for independent contractors can vary widely based on industry, services provided, and negotiation between parties. Typically, commission rates can range from 10% to 30%, depending on the sales model and agreement. When drafting a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, clearly specify the percentage to avoid future disputes. Understanding market standards and discussing expectations with clients can lead to a successful arrangement.

To create an independent contractor agreement, begin by outlining the scope of work, payment terms, and responsibilities. It’s essential to include provisions that define the relationship, particularly in a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor context. Utilizing a platform like uslegalforms can simplify this process by providing templates tailored to your needs. This can ensure compliance with local laws and protect your interests.

Setting up an LLC as an independent contractor can provide benefits such as personal liability protection and potential tax advantages. By forming an LLC, you separate your personal assets from your business liabilities, which can offer peace of mind. Additionally, it may enhance your credibility with clients and partners. When considering a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it's wise to discuss your options with a legal professional.

Independent contractors are typically responsible for their own taxes, which includes self-employment tax, income tax, and potentially state taxes in North Dakota. It's essential to understand your tax obligations to avoid any surprises at the end of the year. Utilizing the North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor can help clarify financial arrangements and tax responsibilities. For detailed guidance, consider consulting a tax professional who understands the implications of being a self-employed contractor.

In the construction industry, approximately 30% to 40% of workers operate as independent contractors. This trend reflects a growing preference for flexibility among self-employed individuals. When you consider the North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it becomes crucial to understand these dynamics. By knowing the percentage of independent contractors in your industry, you can make informed decisions about work agreements and project management.

Sales commissions are taxed as income, and they may also be subject to self-employment tax. When operating under a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, your commissions will contribute to your overall tax liability. Ensure you set aside a portion of your earnings for taxes, and consider consulting a tax advisor to navigate this effectively.

As an independent contractor, you can show proof of income by providing invoices, bank statements, and tax returns. If you’re working under a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, maintaining accurate financial documentation is key for confirming your earnings. Platforms like uslegalforms can assist you in generating professional invoices to streamline this process.

Yes, sales commissions are generally subject to self-employment tax. When working under a North Dakota Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, your commissions will be included as part of your gross income. This tax helps fund Social Security and Medicare, so understanding your obligations is important as you manage your finances.

Interesting Questions

More info

Terms of Employment Last Will Testament Power Attorney Living Will Health Care Directive Estate Vault A more few more things to note, 1) When you make use of the template document, make sure the name and address appear exactly the same. Make it identical to the company name and address and make sure to include the full address within that text. If the document was not the original source, you will need to make sure everything matches up, for example you will need to match the last name and full address for the employee that has the same name as the employer. For example, if Mary works under her own name in her own address and office, you would need to match them by adding “Mary” to this text. You won't be able to modify or update the document for the next step. Just make sure everything is correct, then save and send the template document. 2) Now you need to go to the page where you upload the documents on. Just click on the little tab labeled “Upload Documents.