Title: North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card — A Comprehensive Overview Introduction: The North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card is an essential document provided by credit card companies in the state to enable cardholders to promptly report any instances of lost or stolen credit cards. This detailed description will outline the purpose, process, and essential information related to the report, highlighting its significance in protecting cardholders from potential financial liabilities and identity theft risks. Types of North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card: 1. North Dakota Lost Credit Card Report: This report is used to inform credit card issuers when a credit card goes missing due to misplacement or theft. It seeks to expedite the card cancellation process and alert the issuer about unauthorized or fraudulent activities that may occur with the missing card. 2. North Dakota Stolen Credit Card Report: This variant of the report is specifically designed for situations where the credit card is stolen by an unauthorized individual. Similar to the lost credit card report, it enables cardholders to immediately notify the credit card issuer and initiate necessary security measures to prevent unauthorized transactions. Detailed Description and Keywords: 1. Purpose and Significance: The North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card serves as a crucial tool for cardholders to actively participate in safeguarding their financial well-being. It allows individuals to promptly notify credit card issuers about the disappearance or theft of their cards, enabling effective measures to freeze accounts, prevent fraudulent activities, and provide replacements. Keywords: North Dakota credit card report, lost credit card report, stolen credit card report, importance of reporting, prompt notification, financial protection, identity theft prevention, account freeze, preventing unauthorized transactions. 2. Reporting Process: To report a lost or stolen credit card, a cardholder must contact the respective credit card issuer immediately upon discovering the incident. The contact details, typically found on the back of the credit card or on the issuer's website, should be noted to ensure a swift response. Cardholders are encouraged to provide accurate and detailed information about the circumstances of the card's disappearance or theft. Keywords: Reporting process, contact credit card issuer, immediate action, cardholder responsibilities, accurate information, detailed description, incident circumstances. 3. Information Required: When filing the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card, certain essential information should be provided to facilitate the process effectively. This usually includes personal details of the cardholder (name, address, phone number, date of birth), credit card information (card number, issuing bank), incident details (date, time, location), and any additional relevant information as requested by the card issuer. Keywords: Essential information, personal details, credit card information, incident details, issuing bank, contact information, date and time, requested details. Conclusion: The North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card is a vital tool for cardholders in protecting themselves against financial fraud and identity theft. By promptly reporting any loss or theft, individuals can mitigate potential risks and allow credit card issuers to take immediate action. Understanding the process, providing accurate information, and acting swiftly are crucial for effectively utilizing this report and minimizing any adverse consequences associated with lost or stolen credit cards. Keywords: Credit card protection, prompt reporting, financial fraud prevention, identity theft mitigation, accurate information, immediate action, effective utilization.

North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out North Dakota Credit Cardholder's Report Of Lost Or Stolen Credit Card?

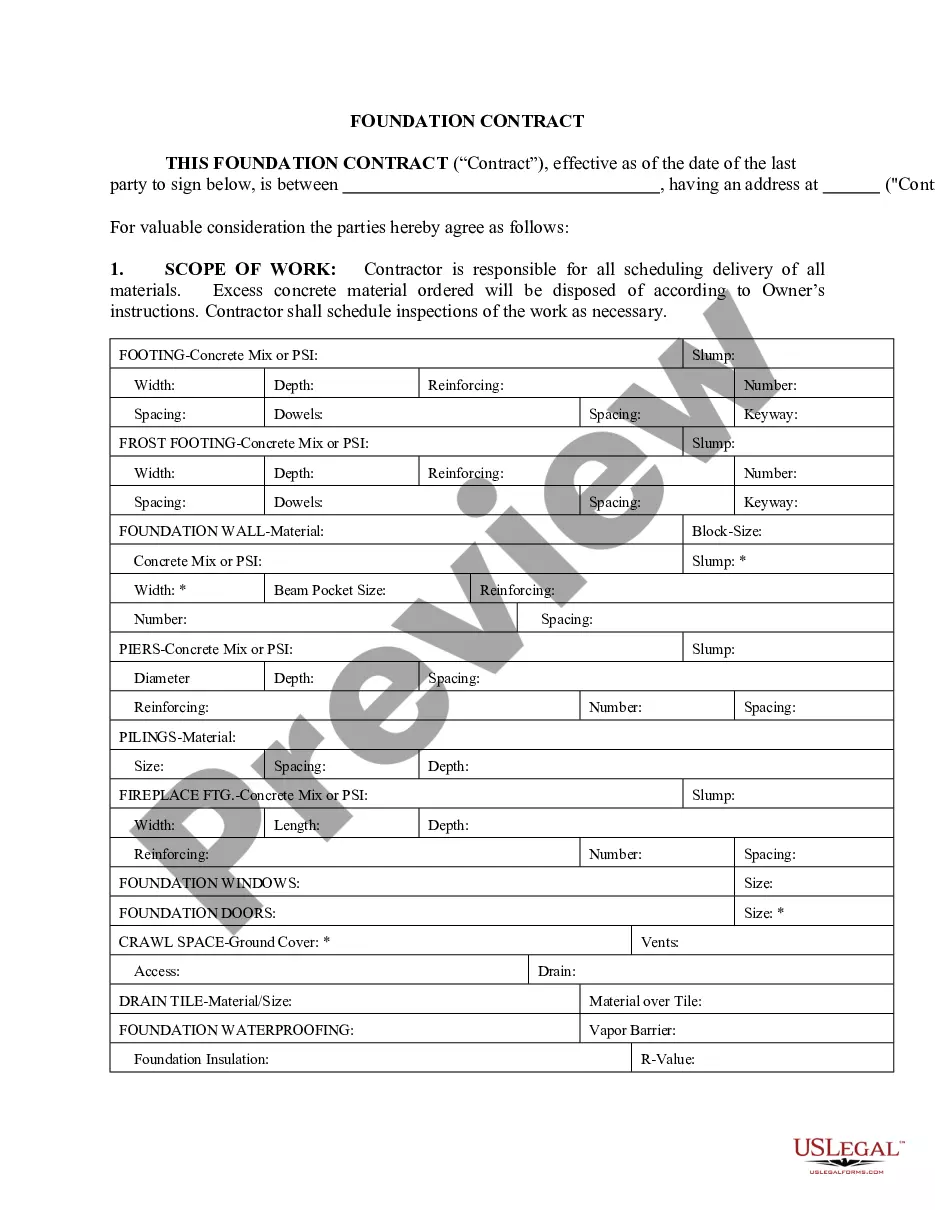

Are you inside a position that you will need documents for either company or person uses almost every time? There are a variety of legal record templates available on the Internet, but getting types you can rely on is not simple. US Legal Forms provides a huge number of type templates, such as the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card, which can be published to meet federal and state requirements.

In case you are presently knowledgeable about US Legal Forms internet site and get a merchant account, basically log in. Afterward, you may download the North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card template.

If you do not come with an accounts and wish to start using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is for the correct area/county.

- Use the Preview button to examine the shape.

- Browse the explanation to actually have chosen the correct type.

- When the type is not what you are looking for, utilize the Search discipline to discover the type that meets your needs and requirements.

- When you get the correct type, click on Buy now.

- Opt for the prices plan you would like, submit the required details to make your bank account, and purchase your order making use of your PayPal or credit card.

- Pick a practical file format and download your backup.

Get all the record templates you have purchased in the My Forms food selection. You may get a more backup of North Dakota Credit Cardholder's Report of Lost or Stolen Credit Card at any time, if needed. Just select the required type to download or produce the record template.

Use US Legal Forms, probably the most considerable selection of legal varieties, in order to save some time and steer clear of errors. The support provides expertly manufactured legal record templates which can be used for a variety of uses. Generate a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

Notify Your Credit Card Issuer Some issuers allow for fraud reporting in their app or on their website, though you may need to call the number on the back of your card.

You should consistently take steps to protect your credit so you minimize the chance that you'll become a victim of fraud. If you find that your card has been lost or stolen, it's important that you act fast to safeguard your credit card information and alert your card issuer that your account has been compromised.

Credit card companies hire multiple fraud investigators whose primary responsibility is investigating reports of fraud. A credit card company's fraud investigation largely depends on whether the credit card owner is aware of the fraudulent transactions and reports them to the company.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

Lying to obtain a financial benefit is a fraud crime, even if the lie is small. It may take some time for the lie to be discovered, but if it is, you could face criminal charges, and you could end up with jail time.

Police won't spend much time on it. They understand that credit cards can be turned off and reissued and that you are insured against fraud. They will only be interested in the report if they suspect you have been pickpocketed so they will know the area where such crimes are happening.

Most credit card issuers will not hold the cardholder responsible for fraudulent charges. A stolen or lost credit card can hurt a consumer's credit score if the card is used and the cardholder doesn't report the fraud and then fails to pay the charges. Review your credit report regularly to monitor for signs of fraud.