North Dakota Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

If you require to complete, obtain, or reproduce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the paperwork you need.

An array of templates for business and personal purposes are categorized and presented by themes, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find other forms in the legal format.

Step 4. After locating the form you need, click the Buy now button. Choose the payment plan you prefer and input your information to register for an account.

- Employ US Legal Forms to quickly find the North Dakota Balloon Unsecured Promissory Note.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the North Dakota Balloon Unsecured Promissory Note.

- You can also retrieve forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for the correct state/region.

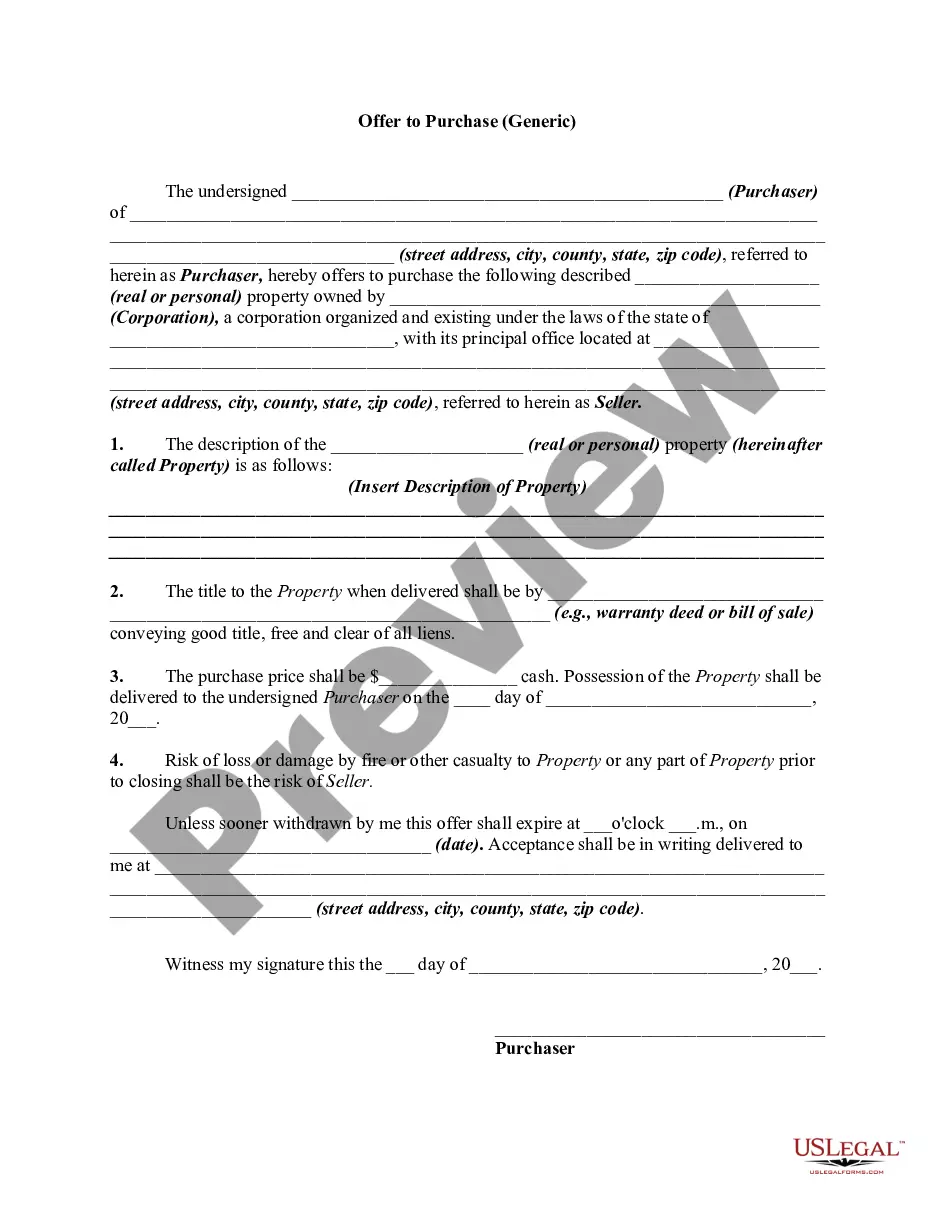

- Step 2. Use the Preview option to review the content of the form. Remember to check the summary.

Form popularity

FAQ

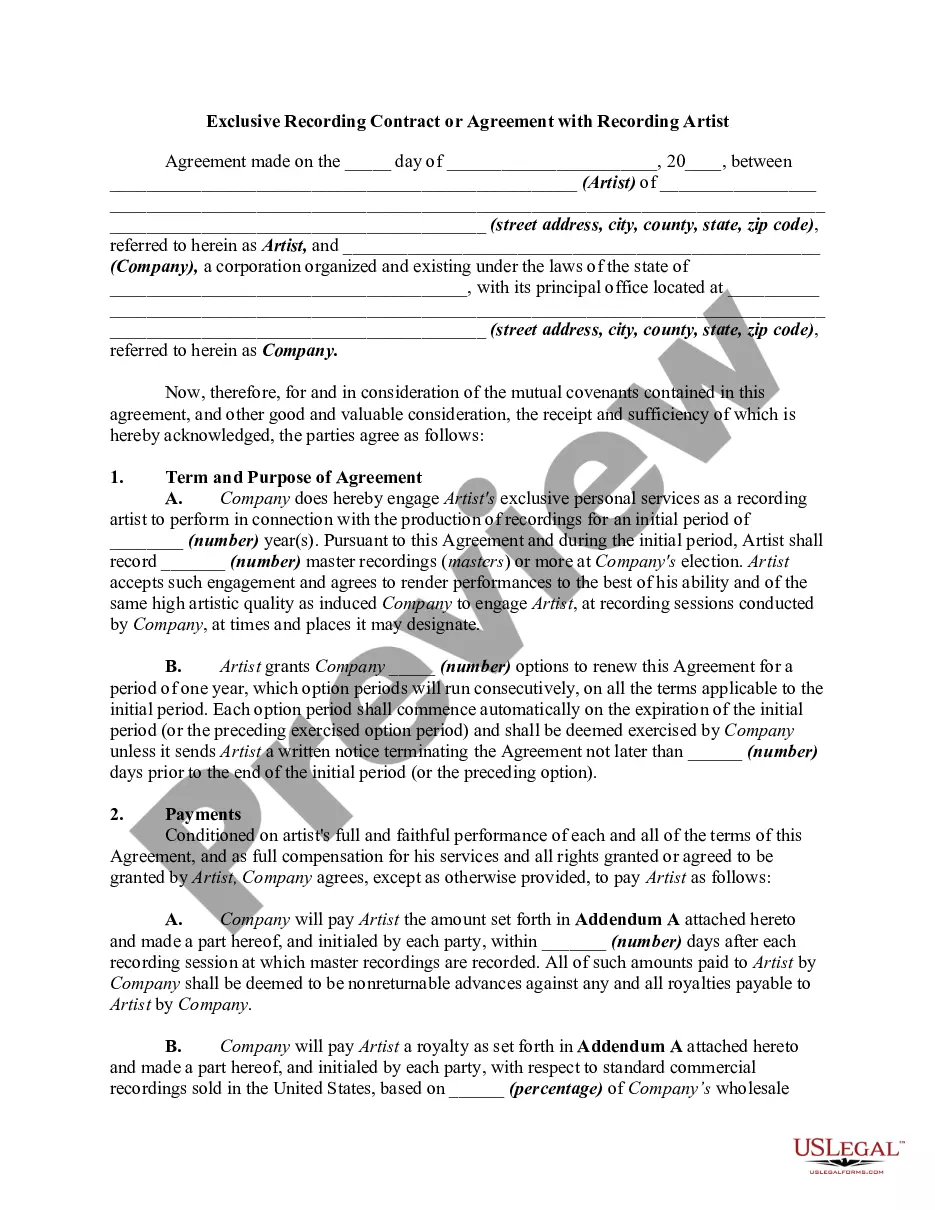

Generally, an unsecured promissory note is not classified as a security under federal law, given its nature and context. However, interpretations can vary based on state regulations and specific circumstances surrounding the North Dakota Balloon Unsecured Promissory Note. It’s vital to consult with legal experts to understand any potential implications. By doing so, you can make informed investment and lending decisions.

Yes, a properly drafted promissory note, including North Dakota Balloon Unsecured Promissory Notes, can hold up in court if a dispute arises. To ensure enforceability, it's essential to include clear terms, signatures, and relevant details. Courts tend to uphold the validity of promissory notes as long as they meet legal standards. As always, consulting with a legal professional about draft specifications and enforceability can provide added assurance.

To get a promissory note, you can either draft one yourself or use templates available online. Platforms like USLegalForms simplify this process by offering specialized documents, including the North Dakota Balloon Unsecured Promissory Note. This option saves time, ensures proper formatting, and provides peace of mind by covering legal aspects.

The format of a promissory note typically includes the title, date, borrower's information, lender's information, the principal amount, interest rate, payment terms, and a signature line. Each section should be clearly defined to ensure understanding. For a North Dakota Balloon Unsecured Promissory Note, it's crucial to detail the balloon payment structure.

For the lender, an invalid promissory note may mean you can't sue for any money the borrower promises but fails to pay. The whole point of signing a promissory note is to create a legal document.

An unsecured note is not backed by any collateral and thus presents more risk to lenders. Due to the higher risk involved, these notes' interest rates are higher than with secured notes. In contrast, a secured note is a loan backed by the borrower's assets, such as a mortgage or auto loan.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.