Title: Understanding North Dakota Sale of Business — Promissory Not— - Asset Purchase Transaction Introduction: In North Dakota, the Sale of Business — Promissory Not— - Asset Purchase Transaction is a legally binding agreement that outlines the terms and conditions for transferring ownership of a business from one party to another. This detailed description aims to shed light on the various aspects of this transaction and the different types of Sale of Business agreements available in North Dakota. Key Elements of a North Dakota Sale of Business — Promissory Not— - Asset Purchase Transaction: 1. Parties Involved: The agreement typically involves two parties: the Seller, who is the current owner of the business, and the Buyer, who wishes to acquire the business assets and assume its operations. 2. Purchase Price and Terms: The agreement should clearly state the purchase price of the business assets and the proposed payment terms. It may also include specifics on any financing, such as a promissory note, detailing the repayment schedule and interest rates. 3. Asset Description and Transfer: A comprehensive list of the business assets being sold should be included, such as tangible assets (property, inventory, equipment) and intangible assets (customer lists, intellectual property rights). The agreement should specify how the transfer of these assets will take place. 4. Representations and Warranties: Both parties often provide representations and warranties to ensure the accuracy of information shared during the transaction. These include statements about the business's financial condition, contracts, and legal compliance. 5. Closing and Transition Period: This section outlines the timeline for completing the sale, including the closing date and any transitional support that the Seller agrees to provide to the Buyer during the transition phase. 6. Indemnification and Dispute Resolution: The agreement should include provisions for indemnification, protecting both parties from potential financial losses due to breaches of the agreement. It may also outline the preferred method of dispute resolution, such as mediation or arbitration. Types of North Dakota Sale of Business — Promissory Not— - Asset Purchase Transactions: 1. Stock Purchase Agreement: In this type of transaction, the Buyer purchases the Seller's stock or shares in the business, acquiring ownership and control of the entire entity, along with its assets and liabilities. 2. Asset Purchase Agreement: Here, the Buyer purchases specific business assets, such as equipment, inventory, intellectual property, and customer lists, while excluding liabilities and debts tied to the business. 3. Merger or Consolidation: In a merger or consolidation, two or more businesses combine to form a new entity, which may involve the exchange of stock, assets, or both. Conclusion: Understanding the intricacies of a North Dakota Sale of Business — Promissory Not— - Asset Purchase Transaction is crucial for both Sellers and Buyers. By clearly outlining the terms of the agreement like purchase price, asset transfer, representations, and warranties, it ensures a smooth handover and minimizes potential disputes in the future. Different types of transactions, such as stock purchase, asset purchase, and mergers, provide flexibility in structuring the sale based on the specific needs of the parties involved.

North Dakota Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out North Dakota Sale Of Business - Promissory Note - Asset Purchase Transaction?

If you want to complete, acquire, or print legitimate document templates, utilize US Legal Forms, the most extensive variety of legal forms available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and claims, or keywords.

Step 4. Once you have found the form you need, select the Buy now option. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the North Dakota Sale of Business - Promissory Note - Asset Purchase Transaction with just a few clicks.

- If you are currently a US Legal Forms subscriber, Log In to your account and click on the Purchase option to obtain the North Dakota Sale of Business - Promissory Note - Asset Purchase Transaction.

- Additionally, you can access documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate state/territory.

- Step 2. Use the Preview option to view the contents of the form. Remember to read the description.

- Step 3. If you’re not satisfied with the form, utilize the Search area at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

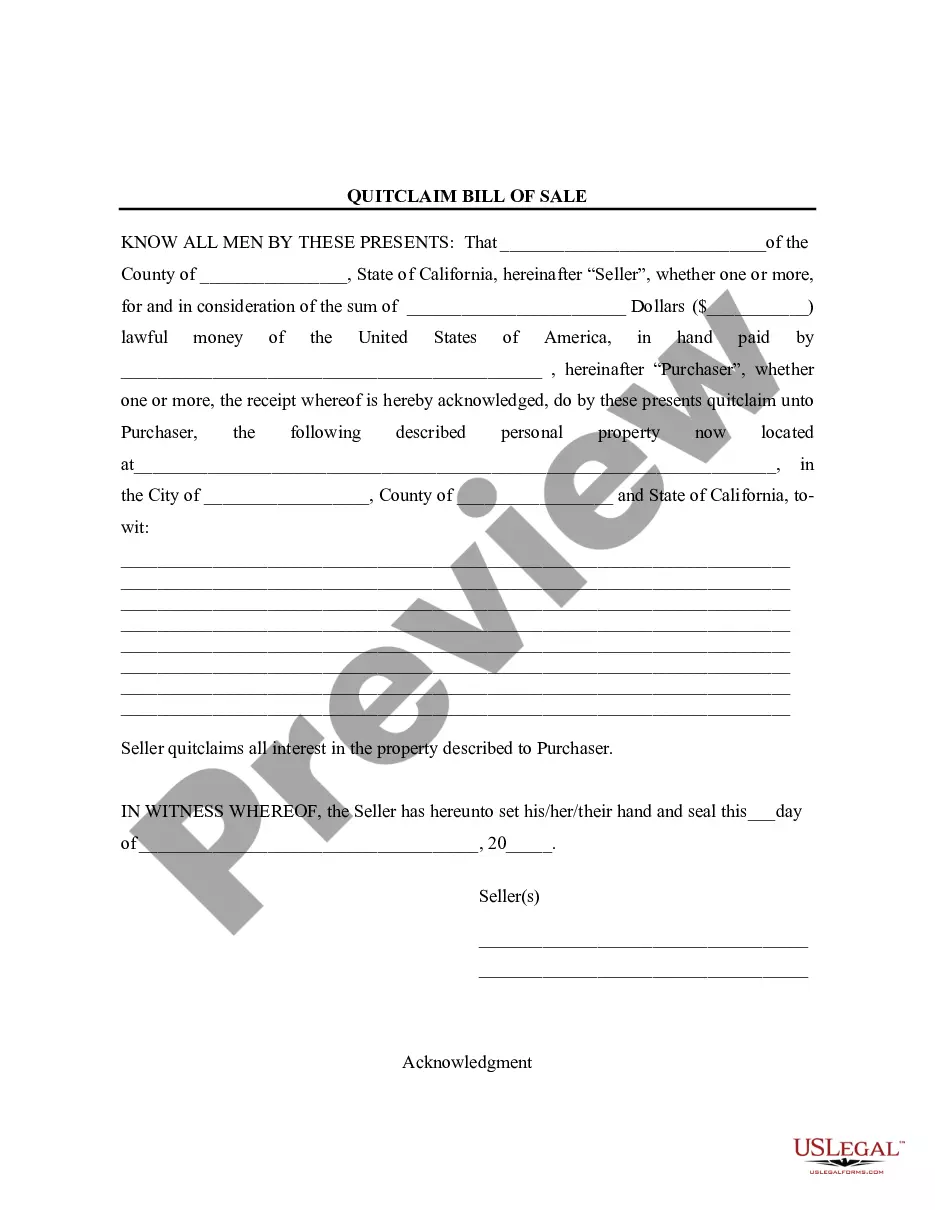

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

CLOSING. The closing of an acquisition transaction can be a simultaneous sign and close or a sign and then later close. In a sign and then later close, a buyer may continue its due diligence after signing, and there are usually pre-closing obligations the parties must meet in order to close.