North Dakota Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

Are you currently in a situation where you require documents for either business or personal uses frequently.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms provides thousands of document templates, such as the North Dakota Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Buyer, which are designed to meet federal and state requirements.

Select the payment plan you desire, fill in the required details to create your account, and finalize the transaction using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Buyer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

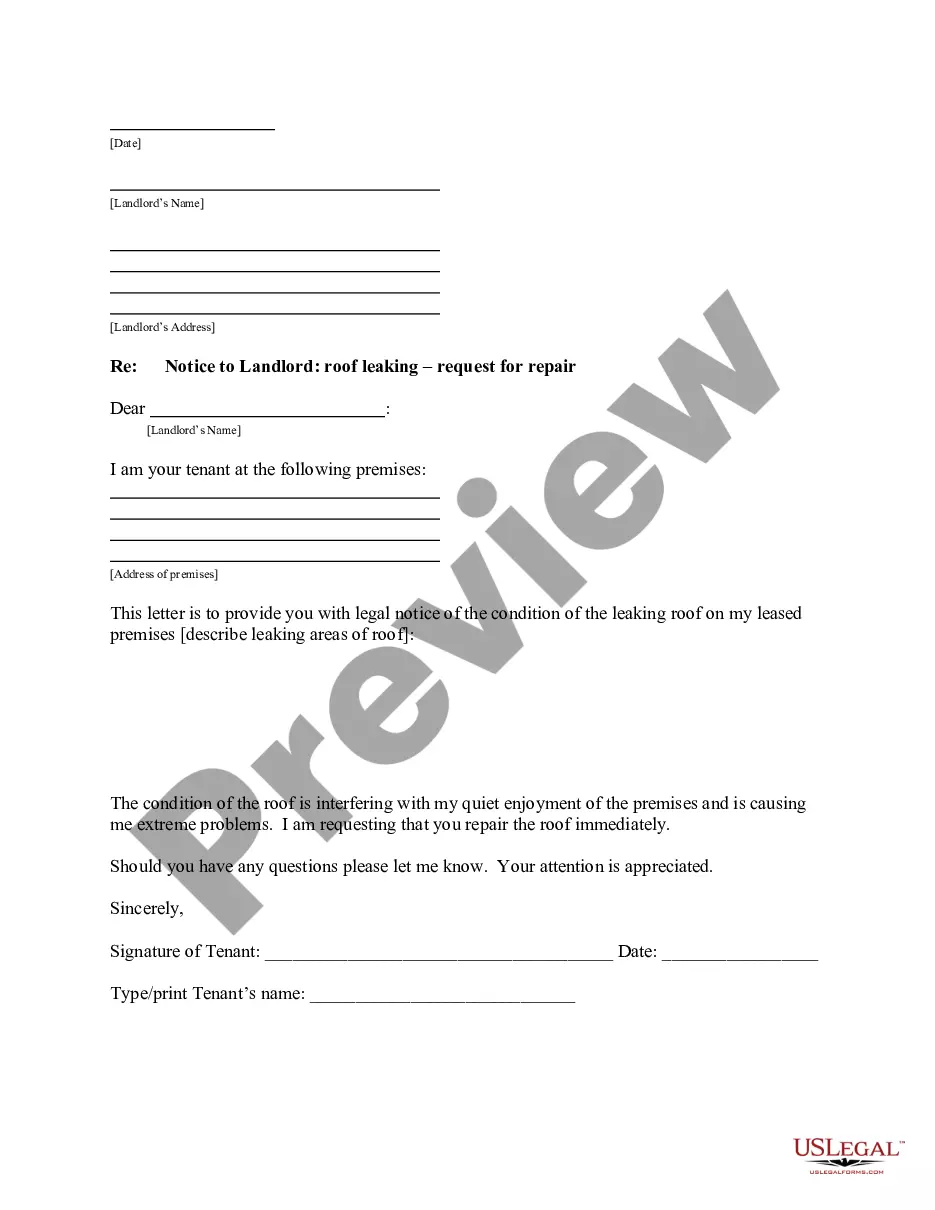

- Use the Preview option to review the document.

- Check the information to make sure you have selected the right document.

- If the document isn’t what you want, use the Search area to find the document that fits your needs.

- When you find the appropriate document, click on Get now.

Form popularity

FAQ

Common contingencies in real estate include an appraisal contingency, inspection contingency, sale contingency or funding contingency.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place.

What's Included In A Purchase And Sale Agreement?Purchase Price. One major purpose of the PSA is to establish an agreed-upon sale price in writing between the buyer and the seller.Earnest Money Details.Closing Date.Title Insurance Company Details.Title Condition.Escrow Company.Contingencies.Addendum.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

The cash out clause Otherwise known as the escape clause, the cash out clause gives the seller the right to cancel a sale and purchase agreement if they receive a better offer.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

First and foremost, a purchase agreement must outline the property at stake. It should include the exact address of the property and a clear legal description. Additionally, the contract should include the identity of the seller and the buyer or buyers.

Another common type of buy-sell agreement is the stock redemption agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.