This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

It is feasible to spend time online searching for the legal document template that meets the federal and state requirements you require. US Legal Forms provides a vast collection of legal templates that can be reviewed by experts.

You can download or print the North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children from my service.

If you possess a US Legal Forms account, you may Log In and then click the Obtain button. Following that, you can complete, modify, print, or sign the North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

Once you have found the template you need, click Buy now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make edits to the document as needed. You can complete, revise, sign, and print the North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Access and print a wide range of document templates through the US Legal Forms website, which offers the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any downloaded form, go to the My documents tab and click the respective button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm you have selected the appropriate template.

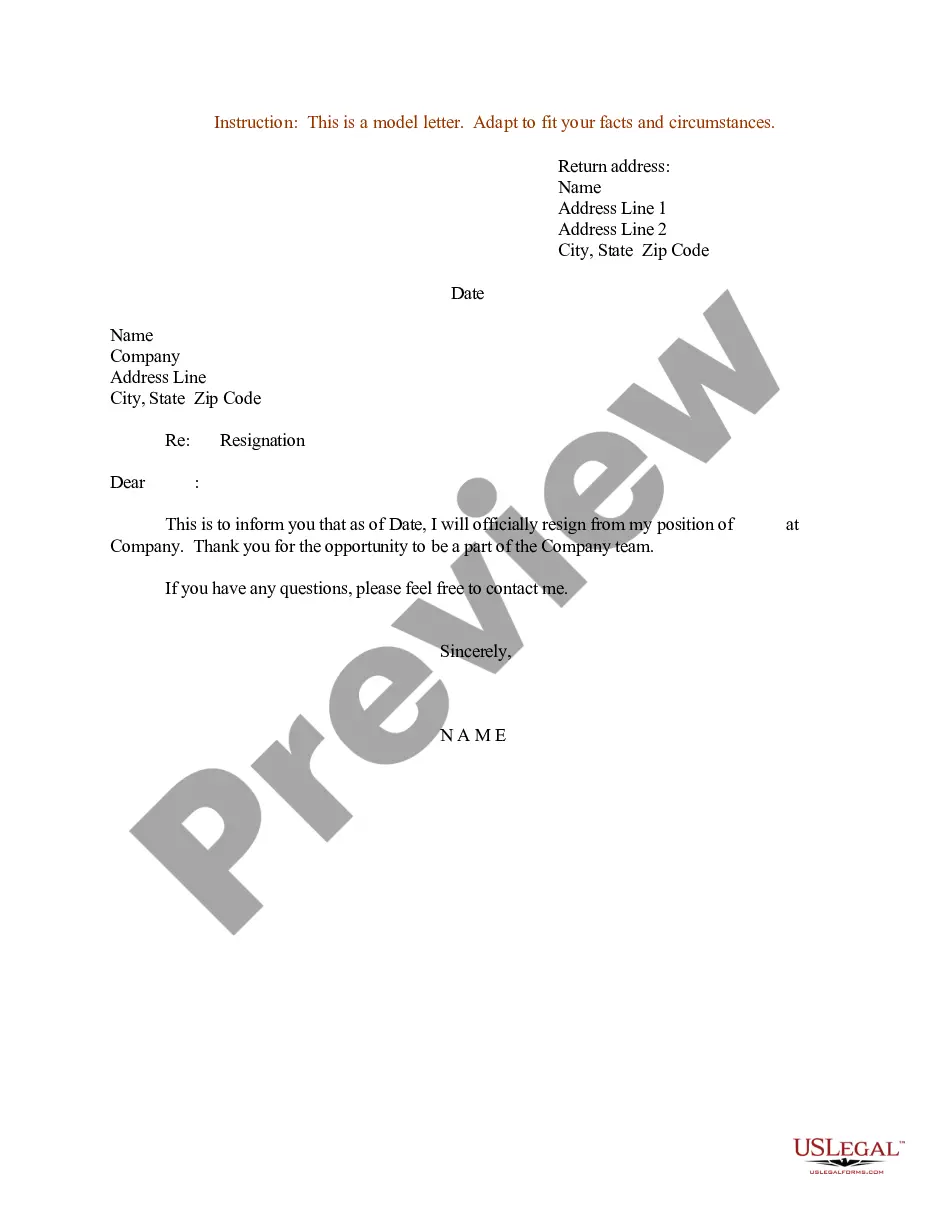

- If available, use the Preview button to view the document template as well.

- In order to seek another version of the template, utilize the Search area to find the template that fulfills your requirements.

Form popularity

FAQ

An age contingent trust allows for the distribution of trust assets to beneficiaries when they reach a specified age. This feature is crucial in a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, as it ensures that minors receive their inheritance at a responsible age. By setting these age milestones, you can protect assets until the beneficiaries are mature enough to handle them. Additionally, this type of trust can offer flexibility in managing distributions tailored to each child's needs.

In North Dakota, fiduciary income tax applies to trusts and estates, which are treated as separate taxable entities. When you set up a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you should consider the implications of this tax on the income generated by the trust. The tax rates can vary depending on the income level, so consult with a tax advisor to ensure compliance. Understanding these details helps in effective trust management.

To use the gift tax exemption effectively, you can give away assets without incurring taxes up to a certain limit. This strategy is especially beneficial when establishing a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. You can fund each child's trust with exempt gifts, allowing you to support their future while minimizing your tax obligations. Remember, meticulous documentation is crucial to substantiate your claims.

To qualify for a trust, you must meet specific criteria including having a definite purpose, designated beneficiaries, and a legally competent trustee. In the context of a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it’s vital to ensure that the trust complies with both state laws and tax regulations. Furthermore, ensuring that the beneficiaries are clearly identified can avoid future disputes and misunderstandings. Achieving clarity in the qualifications can lead to a smoother management process.

Establishing a trust involves several prerequisites including choosing your trustees, defining beneficiaries, and deciding on the trust assets. For a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it is essential to have a clear plan for managing and distributing assets. Additionally, you must ensure that the trust complies with state regulations to avoid complications. Taking the time to prepare adequately can streamline the process and provide peace of mind.

The minimum requirement for a trust varies by state, but generally, you need at least one trustee, a specific asset to place into the trust, and at least one beneficiary. With the North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, ensuring these elements are in place is crucial for proper implementation. Additionally, clarity in the terms of the trust helps establish how assets will be managed for the benefit of minors. Working with a professional can help ensure all requirements are met.

In North Dakota, a trust must have a clear purpose, identifiable beneficiaries, and a trustee who manages the trust assets. Furthermore, to create a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, documentation must comply with state laws. This includes a properly drafted trust agreement that outlines the terms, responsibilities, and powers of the trustee. Understanding these legal requirements ensures the trust serves its intended purpose.

The best type of trust for a minor often depends on individual circumstances, but revocable trusts are commonly recommended. These trusts allow flexibility and control, which is beneficial when creating a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. A guardian can manage the trust until the child reaches a certain age, ensuring that funds are used wisely. Additionally, this structure can help minimize tax implications and ensure financial support.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their goals and objectives. Without a solid understanding of what they want to achieve, the North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children may not meet their needs. Parents should take time to consider how they want to benefit their children through the trust. Understanding the specifics can help in avoiding costly errors.

Gifts that qualify for the GST annual exclusion include direct payments made to educational or medical institutions on behalf of another individual. When planning gifts through a North Dakota Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it's critical to understand these exclusions to maximize the benefits for minors while minimizing tax responsibilities. This strategy helps preserve assets for future generations.