The North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the process of terminating a business partnership when one partner decides to retire and sell their share to the remaining partner(s). This agreement provides a framework for settling the financial and operational aspects of the partnership, ensuring a smooth transition and fair resolution for all parties involved. Keywords: North Dakota, Agreement to Dissolve, Wind up Partnership, Sale to Partner, Retiring Partner There are different types of North Dakota agreements to dissolve and wind up partnerships with the sale to the partner by the retiring partner. These may include: 1. Voluntary Partnership Dissolution: In this type of agreement, the retiring partner willingly chooses to leave the partnership due to retirement or other personal reasons. The agreement specifies the retiring partner's intention to sell their share of the business to the remaining partner(s) and outlines the terms and conditions for the sale. 2. Retirement Buyout Agreement: This agreement is specifically designed for partnerships where one partner is reaching retirement age or wishes to depart from the business. It includes provisions for valuing the retiring partner's interest in the partnership, determining the purchase price, and setting a timeline for the buyout to occur. 3. Partnership Dissolution due to Agreement Breach: In some cases, a partnership may be dissolved due to a breach of the partnership agreement by one party. If the retiring partner decides to dissolve the partnership and sell their share to the remaining partner(s), this type of agreement clarifies the terms and conditions of the sale while addressing any legal issues arising from the breach. 4. Dissolution and Wind up with Distribution of Assets: This variation of the agreement is applicable when the retiring partner's exit triggers the partnership's complete dissolution. The agreement outlines the process of settling the partnership's debts, liquidating assets, distributing profits, and dividing any remaining liabilities among the partners. 5. Dissolution and Reformation Agreement: In certain cases, after a partner's retirement and sale of their share, the remaining partner(s) might choose to continue the business under a different legal structure or by forming a new partnership. This agreement covers the dissolution of the existing partnership, sale of the retiring partner's interest, and the subsequent formation of a new entity. All these North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner variations aim to ensure a fair and orderly separation, protect the rights and interests of all partners involved, and facilitate a smooth transition for the continuity of the business.

North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

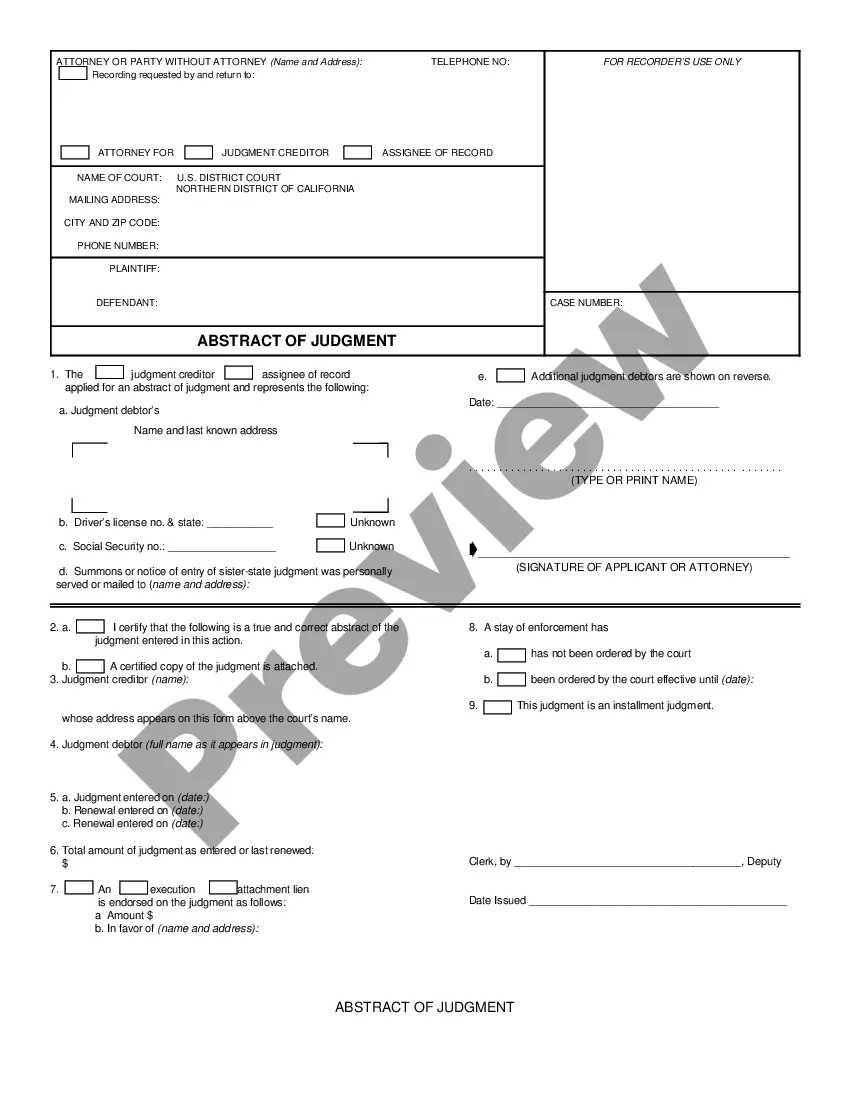

How to fill out North Dakota Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Have you been within a place the place you need to have papers for possibly enterprise or personal reasons almost every time? There are a variety of lawful file web templates available on the Internet, but locating versions you can trust isn`t effortless. US Legal Forms delivers thousands of form web templates, like the North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which are written to meet state and federal demands.

If you are already informed about US Legal Forms internet site and also have your account, merely log in. Following that, you may acquire the North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner template.

Unless you provide an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for that appropriate city/state.

- Make use of the Review option to examine the shape.

- Browse the explanation to ensure that you have chosen the proper form.

- When the form isn`t what you`re trying to find, take advantage of the Search industry to discover the form that fits your needs and demands.

- Once you get the appropriate form, click on Buy now.

- Select the costs plan you need, fill in the required info to create your money, and purchase the order using your PayPal or credit card.

- Select a hassle-free document formatting and acquire your duplicate.

Get all of the file web templates you possess bought in the My Forms food selection. You can get a more duplicate of North Dakota Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner any time, if required. Just click the needed form to acquire or print the file template.

Use US Legal Forms, probably the most comprehensive assortment of lawful varieties, to conserve time as well as avoid faults. The services delivers appropriately manufactured lawful file web templates which you can use for a selection of reasons. Produce your account on US Legal Forms and commence creating your daily life easier.