North Dakota Lease to Own for Commercial Property

Description

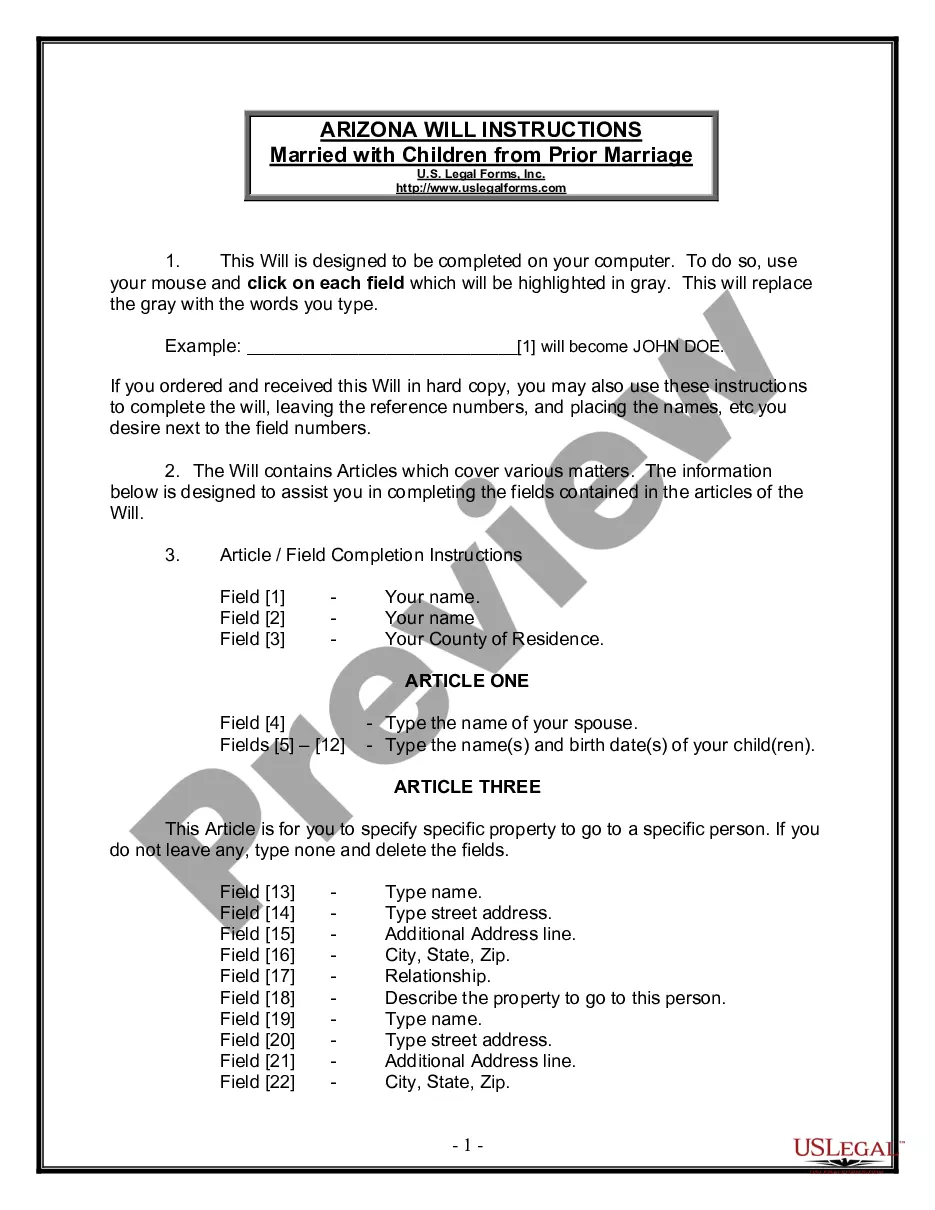

How to fill out Lease To Own For Commercial Property?

Are you currently in a situation where you frequently require documentation for potential organizational or specific reasons.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the North Dakota Lease to Own for Commercial Property, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

You can find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Dakota Lease to Own for Commercial Property anytime, if needed. Just click on the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the North Dakota Lease to Own for Commercial Property template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Get the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click on Buy now.

- Choose the payment plan you want, fill in the required information to create your account, and purchase your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Commercial property valuations are based more on the tenant than on the property itself. If you've previously invested in residential buy-to-let then you'll have probably covered rental yields to a degree (usually when taking out a mortgage) but it's much more in-depth with how the values of commercial are calculated.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

Triple Net Lease Arguably the favorite among commercial landlords, the triple net lease, or NNN lease makes the tenant responsible for the majority of costs, including the base rent, property taxes, insurance, utilities and maintenance.

And, how the most common retail leases are structured: Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Commercial tenants usually remain in a property when a lease has expired because they are still negotiating the terms of a new, renewed lease with the landlord or they have an informal agreement to stay on.

The important thing to remember is that with commercial real estate, short term leases are generally anything that is 3 years or less, while long term is 10+ years.

Your landlord can refuse to renew your lease if: you're in breach of your obligations (for example, you've not paid your rent) they want to use the premises themselves, for their business, or to live there.

Commercial tenants usually remain in a property when a lease has expired because they are still negotiating the terms of a new, renewed lease with the landlord or they have an informal agreement to stay on.