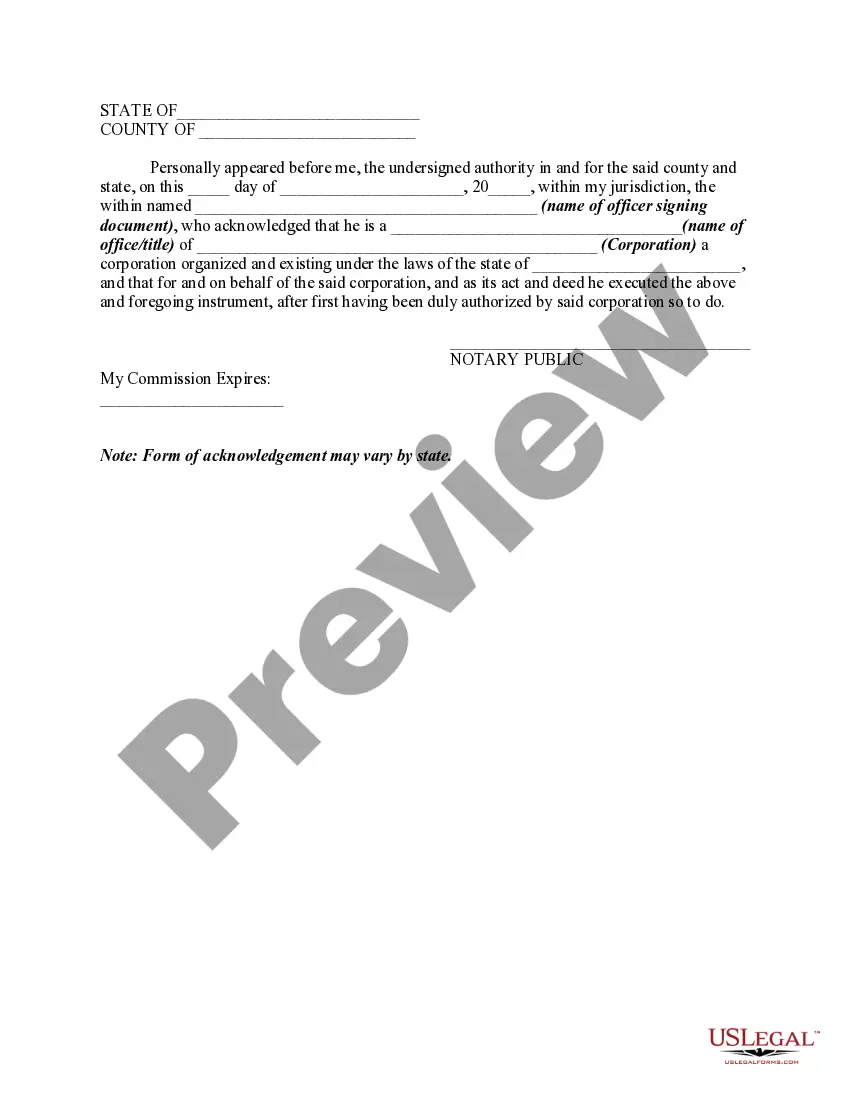

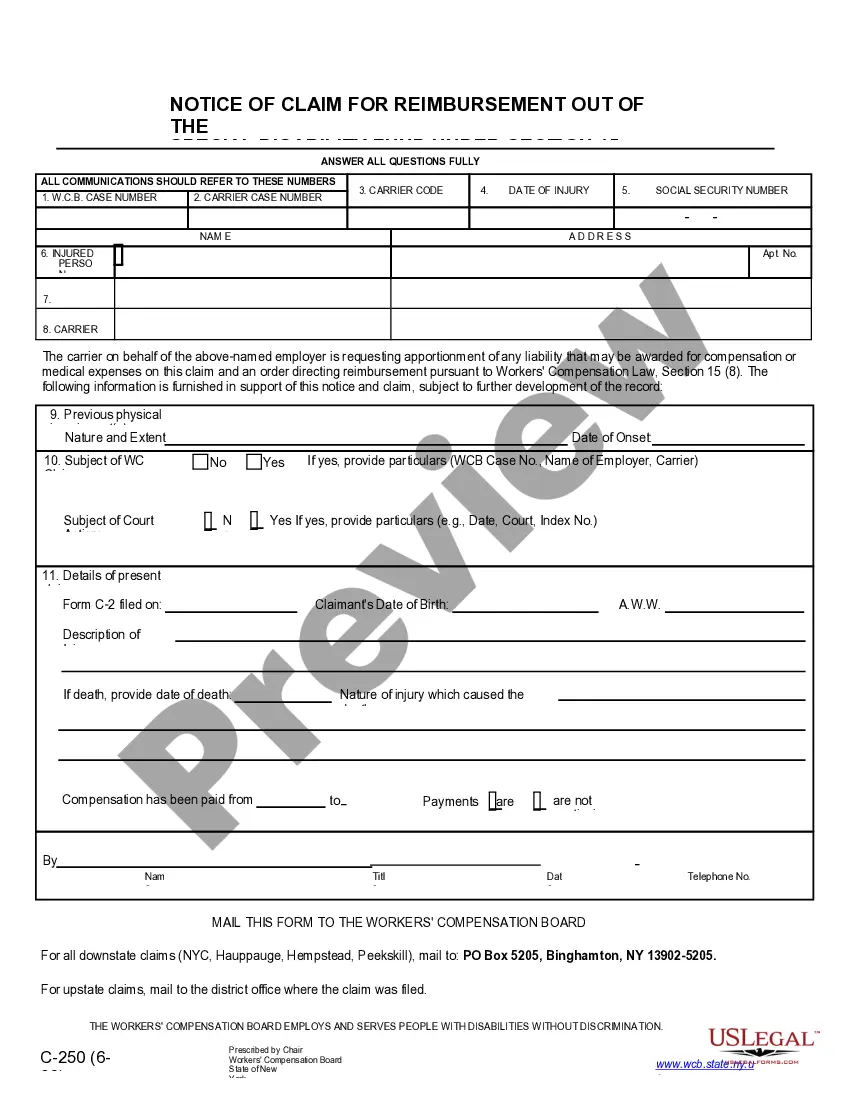

A North Dakota Bill of Sale with Notary is a legal document used to record the transfer of ownership of personal property between a buyer and seller in the state of North Dakota. This document serves as proof of the transaction and can be utilized in various situations such as vehicle sales, boat sales, equipment sales, and more. The North Dakota Bill of Sale with Notary must include essential information such as the names and contact details of both the buyer and seller, a detailed description of the property being sold including any identification numbers, the agreed-upon purchase price, and the date of the transaction. Additionally, this document should contain a statement verifying that the seller is the lawful owner of the property and has the authority to sell it. By including a notary public's acknowledgment, a North Dakota Bill of Sale becomes notarized, which adds an extra layer of authenticity and credibility to the document. The notary public will validate the identities of both parties involved and their intent to enter into a legally binding agreement. This ensures that the transaction is executed in compliance with North Dakota state laws. Different types of North Dakota Bill of Sale with Notary can be catered to specific types of properties or transactions. For example: 1. North Dakota Vehicle Bill of Sale with Notary: Used when transferring ownership of a motor vehicle, including cars, trucks, motorcycles, etc. 2. North Dakota Boat Bill of Sale with Notary: Employed for the sale of watercraft such as boats, yachts, jet skis, and other marine vessels. 3. North Dakota Equipment Bill of Sale with Notary: Designed for selling various types of equipment, including machinery, tools, agricultural implements, etc. It is crucial to obtain a North Dakota Bill of Sale with Notary at the time of purchase or sale to legally protect both the buyer and seller and ensure a smooth transfer of ownership. Consulting with a legal professional is advisable to ensure compliance with specific requirements and regulations related to a particular transaction.

Notarized Bill Of Sale

Description

How to fill out North Dakota Bill Of Sale With Notary?

You can invest time online trying to locate the legal document format that meets both state and federal requirements you will require.

US Legal Forms provides thousands of legal templates that can be reviewed by professionals.

You can easily download or print the North Dakota Bill of Sale with Notary from your resources.

First, ensure that you have selected the correct document format for the county/area of your choice. Check the document details to confirm you have chosen the right template. If available, use the Review feature to examine the document format simultaneously. If you want to find another version of the document, use the Lookup section to search for the format that fulfills your requirements. Once you have found the format you need, click Get now to proceed. Choose the payment plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make adjustments to your document if possible. You can complete, modify, sign, and print the North Dakota Bill of Sale with Notary. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal formats. Utilize professional and state-specific templates to address your business or personal needs.

- If you currently possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Next, you can complete, modify, print, or sign the North Dakota Bill of Sale with Notary.

- Every legal document format you receive is your own property indefinitely.

- To obtain another copy of a document you've acquired, navigate to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To fill out a North Dakota title, start by entering the vehicle information, including the make, model, year, and Vehicle Identification Number (VIN). Next, provide information about the buyer and seller, making sure to include their names and addresses as required. It’s important to verify that all details are correct, as errors can lead to complications. Finally, if you're using a North Dakota Bill of Sale with Notary, ensure that both parties sign in the presence of a notary to validate the document.

No, a notary commissioned in North Dakota cannot notarize documents in another state. Notaries are authorized to perform notarial acts only in the state where they are commissioned. If you need to use a North Dakota Bill of Sale with Notary across state lines, consider finding a notary within the appropriate state to ensure compliance with local laws.

In North Dakota, notarization is not strictly required for titles; however, having a North Dakota Bill of Sale with Notary can facilitate the registration process. A notary provides additional verification, which can help prevent disputes later. When buying or selling a vehicle, it's wise to check the specific requirements to ensure a smooth transaction.

Yes, North Dakota does require a bill of sale for certain transactions, especially when dealing with vehicles or personal property. This document serves as a legal record of the transfer of ownership. While not mandatory for every sale, having a North Dakota Bill of Sale with Notary can simplify the process and provide peace of mind to both the buyer and seller.

To privately sell a car in North Dakota, start by obtaining a North Dakota Bill of Sale with Notary. This document serves as proof of the transaction and includes vital details about the buyer, seller, and vehicle. Ensure you transfer the title and provide necessary documents to the buyer, facilitating a smooth and legal transaction.

In North Dakota, it is preferable for both parties to be present during the title transfer. This enhances transparency and helps address any immediate questions. However, if one party cannot be present, a North Dakota Bill of Sale with Notary can still facilitate the process, as it can serve as a valid representation of the transaction.

Transferring a title in North Dakota requires specific documents and procedures. You need the original title signed by the seller, a completed application for a title transfer, and a valid form of identification. Utilizing a North Dakota Bill of Sale with Notary can enhance the title transfer process and ensure a smooth transaction.

To register a vehicle in North Dakota, you need several documents. These include a completed application form, the vehicle title, proof of identity, and the sales tax payment receipt. If you have a North Dakota Bill of Sale with Notary, it can streamline the process and ensure all requirements are met effectively.

In North Dakota, it is not mandatory for a bill of sale to be notarized. However, having a North Dakota Bill of Sale with Notary provides additional legal protection and credibility to the document. It can help in resolving disputes or verifying the transaction in the future. Therefore, while not required, notarization is highly recommended.

Interesting Questions

More info

5% sales tax if it is not state based tax will be charged a 5% local sales tax if it is state based the local sales tax will not be charged if seller is in a state that does not charge sales tax the state will not charge any additional taxes on the bill sale if the person selling the bill sale is in a state that charges sales tax the seller will be charged a 15% additional state sales tax the state may also charge a local tax on the bill sale when the buyer purchased the vehicle from an independent mechanic or if the seller purchased it from a dealer and the buyer purchased from the dealer at an established sale center, but the local sales tax will not be charged on the vehicle if the bill sale is not set up in a dealer's or independent mechanic's establishment state that applies to it, the state has the power to regulate this so that the sales tax is not imposed the new owner and the seller have to agree on the bill sale location, but the buyer also needs to agree on this information