North Dakota Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

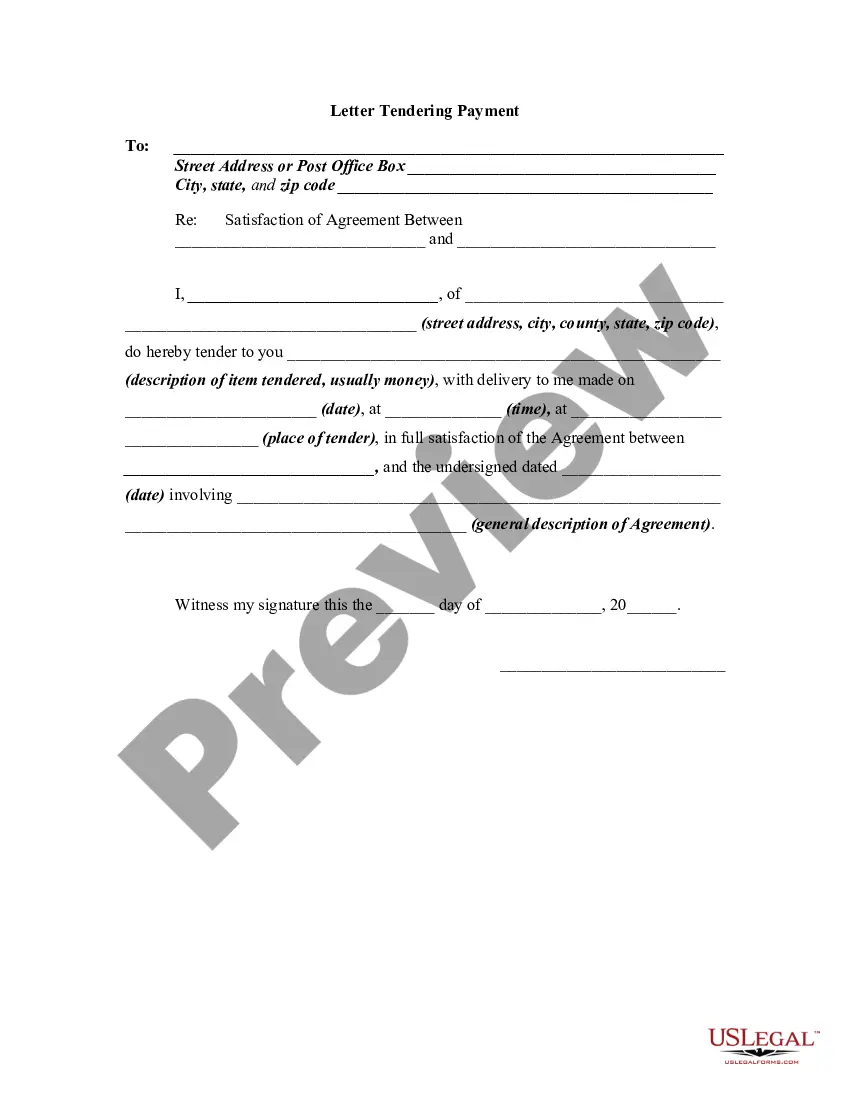

How to fill out Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Choosing the best lawful document design can be a struggle. Needless to say, there are a lot of themes available on the net, but how can you discover the lawful kind you require? Use the US Legal Forms internet site. The service provides 1000s of themes, like the North Dakota Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, which you can use for company and private requirements. All the forms are examined by experts and meet federal and state needs.

Should you be previously signed up, log in to your account and click the Acquire key to get the North Dakota Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises. Make use of your account to appear throughout the lawful forms you have bought in the past. Proceed to the My Forms tab of your own account and acquire an additional copy of your document you require.

Should you be a brand new user of US Legal Forms, listed below are simple guidelines that you should comply with:

- Initial, ensure you have selected the correct kind for your metropolis/region. You are able to examine the shape using the Preview key and study the shape information to make certain this is basically the right one for you.

- When the kind does not meet your preferences, utilize the Seach discipline to find the appropriate kind.

- When you are certain the shape is acceptable, go through the Acquire now key to get the kind.

- Select the pricing program you want and enter the required details. Build your account and buy the transaction utilizing your PayPal account or credit card.

- Choose the file file format and obtain the lawful document design to your device.

- Comprehensive, modify and print out and indication the acquired North Dakota Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises.

US Legal Forms is the greatest library of lawful forms for which you will find different document themes. Use the company to obtain expertly-produced documents that comply with state needs.

Form popularity

FAQ

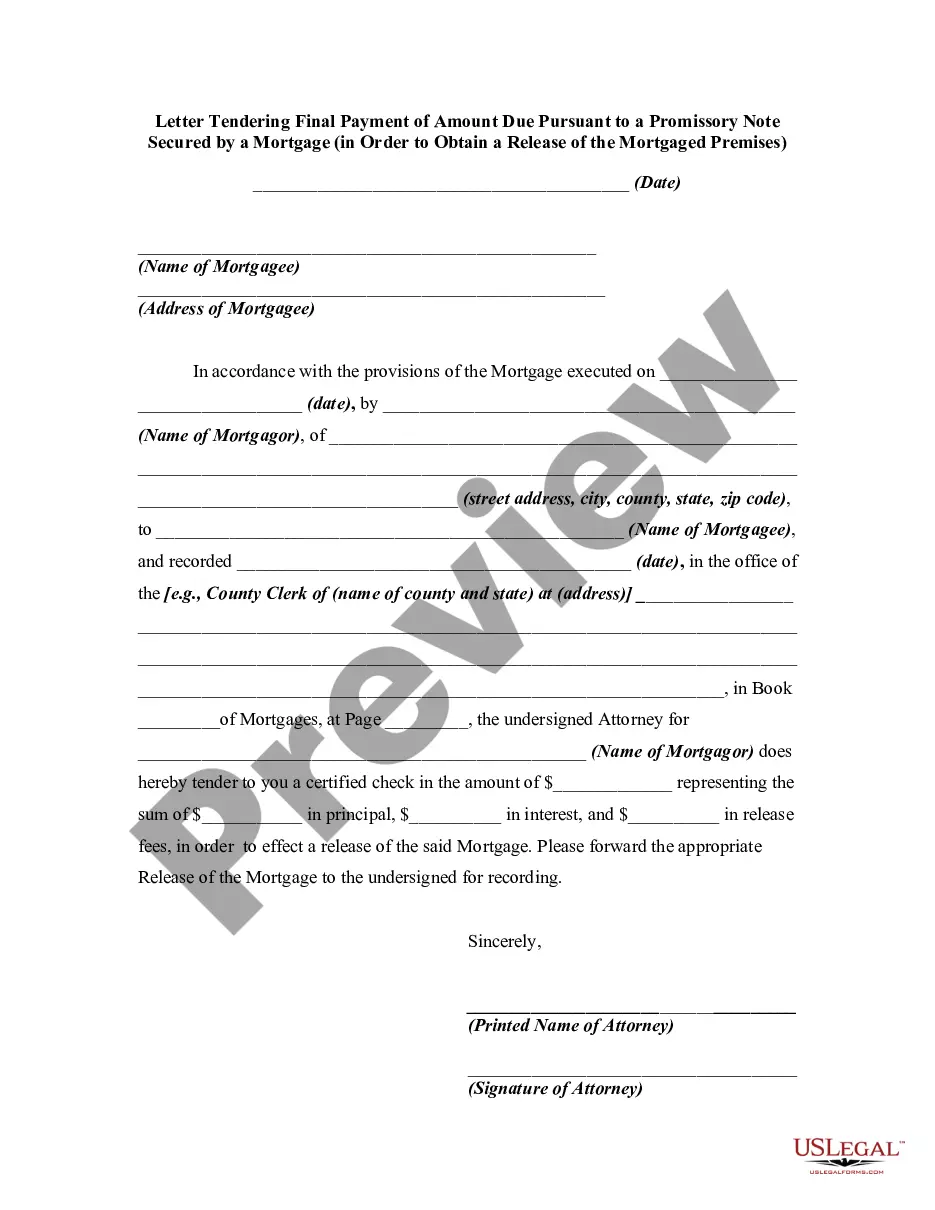

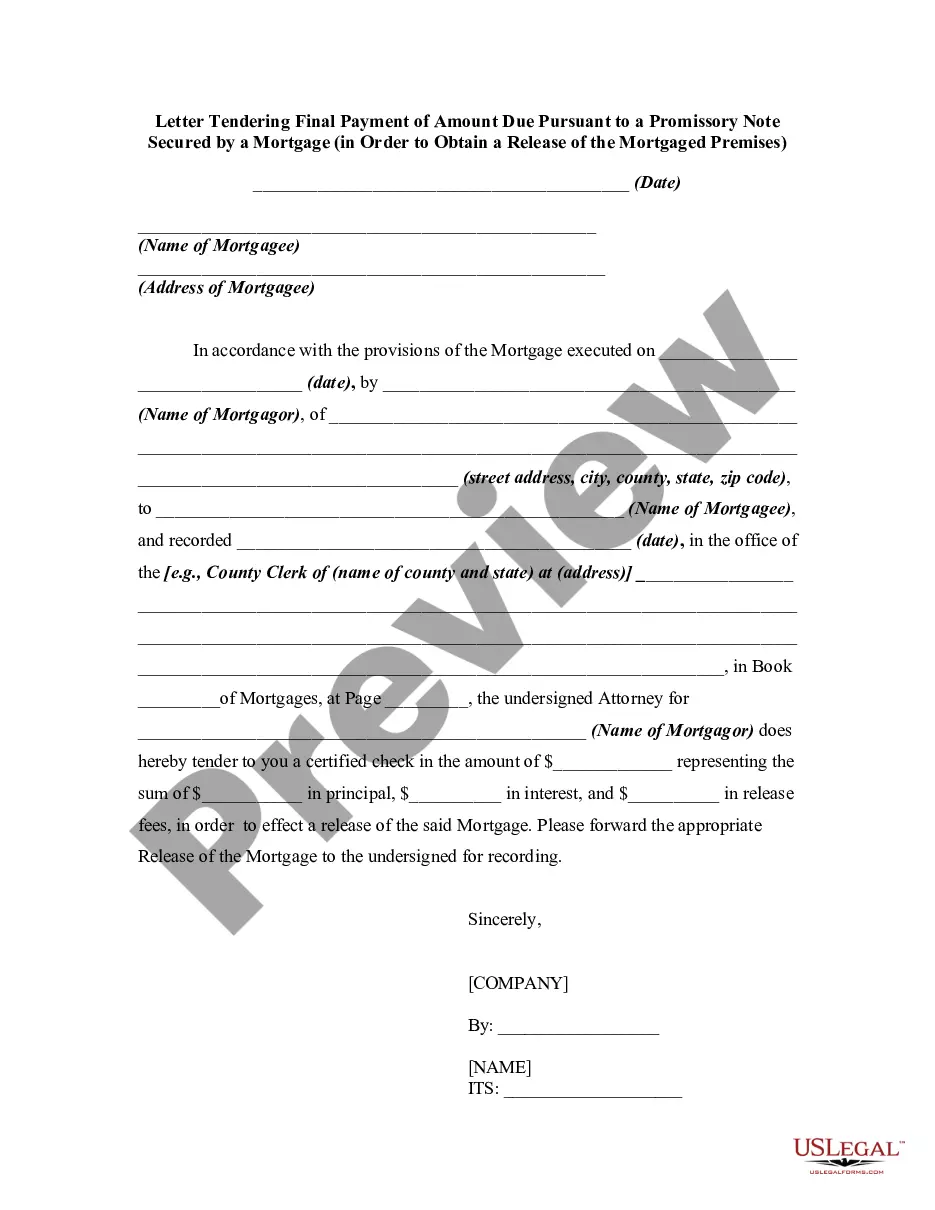

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property.

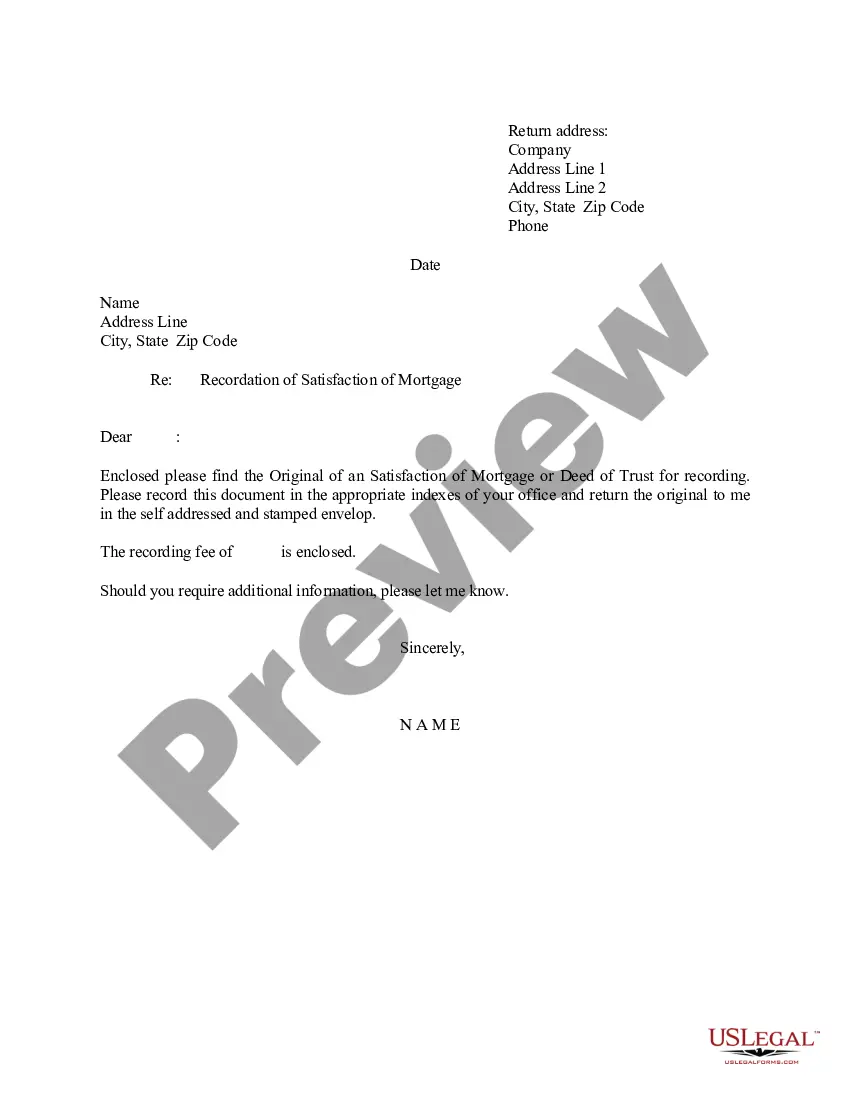

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

Primary tabs. A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.