A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

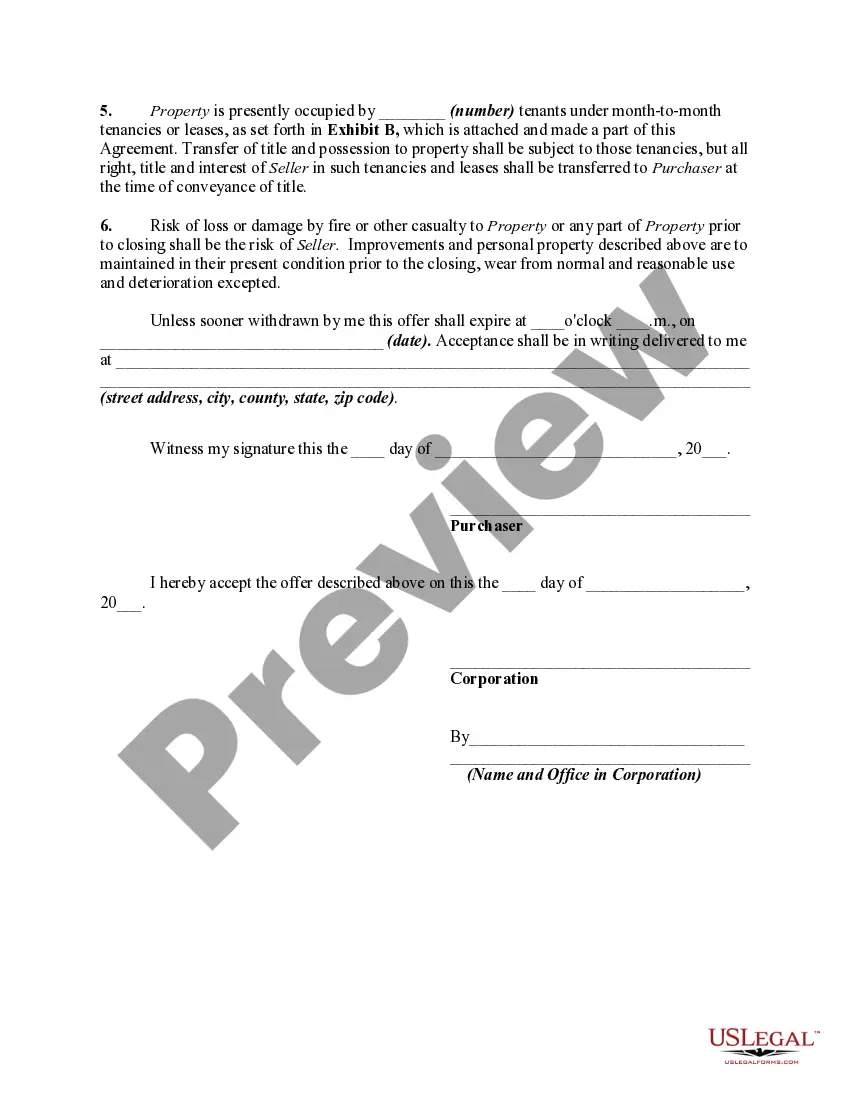

Title: North Dakota Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: In the vibrant state of North Dakota, investing in commercial real estate can provide lucrative opportunities for businesses and individuals looking to expand their portfolios. To facilitate these transactions, an Offer to Purchase Commercial Property is a crucial document. This article provides a detailed description of what a North Dakota Offer to Purchase Commercial Property entails, outlining its significance and key elements. 1. Understanding the North Dakota Offer to Purchase Commercial Property: A North Dakota Offer to Purchase Commercial Property is a legally binding contract for the acquisition of a commercial property within the state. This document serves as an initial offer made by the interested buyer to the seller, formalizing their intention to purchase the property under specific terms and conditions. 2. Key Elements of a North Dakota Offer to Purchase Commercial Property: a. Cover Page: The offer's cover page typically includes essential details such as the property address, buyer's and seller's names, purchase price, and date of offer submission. b. Property Description: A detailed description of the commercial property, including its legal description, boundaries, size, and any existing structures or features. c. Purchase Price and Terms: Clear identification of the purchase price, payment method, and proposed financing options. d. Due Diligence Period: A timeframe allowing the buyer to conduct inspections, surveys, appraisals, and any necessary feasibility studies before finalizing the transaction. e. Contingencies: Common contingencies include financing, property inspection, and approval of zoning and land usage permits. f. Closing Date and Location: The desired date for the closing of the transaction and the agreed-upon location, often a title company or attorney's office. g. Earnest Money Deposit: A sum of money provided by the buyer as a show of good faith, typically held in escrow until closing. h. Closing Costs: Identification of which party will be responsible for various closing costs, such as title insurance, recording fees, and taxes. i. Seller's Acceptance: A section where the seller acknowledges acceptance of the offer, converting it into a legally binding contract upon signing. 3. Different Types of North Dakota Offer to Purchase Commercial Property: While the basic structure remains consistent, there can be variations in offer formats, depending on the nature of the commercial property being purchased. Some common types of commercial properties include: a. Retail Spaces: Offer to Purchase Commercial Property specifically designed for retail businesses, outlining specific requirements such as location, foot traffic, signage, etc. b. Office Buildings: Details related to office space requirements, number of floors, parking facilities, shared amenities, etc. c. Industrial Properties: Emphasis on features like warehouse space, loading docks, clear heights, power supply, and zoning compliance. d. Mixed-use Properties: Properties combining multiple commercial uses, such as office and retail, where the offer may include terms reflecting the diverse needs of each segment. e. Land for Development: Offers targeting vacant commercial land for future development, focusing on zoning provisions, land use restrictions, and development timelines. Conclusion: A North Dakota Offer to Purchase Commercial Property plays a pivotal role in initiating successful commercial real estate transactions. Understanding its significance and including comprehensive details is crucial to ensure both buyers and sellers outline their terms and conditions effectively. By adhering to the specific requirements of different types of commercial properties, individuals can make informed decisions and streamline the purchasing process effectively.Title: North Dakota Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: In the vibrant state of North Dakota, investing in commercial real estate can provide lucrative opportunities for businesses and individuals looking to expand their portfolios. To facilitate these transactions, an Offer to Purchase Commercial Property is a crucial document. This article provides a detailed description of what a North Dakota Offer to Purchase Commercial Property entails, outlining its significance and key elements. 1. Understanding the North Dakota Offer to Purchase Commercial Property: A North Dakota Offer to Purchase Commercial Property is a legally binding contract for the acquisition of a commercial property within the state. This document serves as an initial offer made by the interested buyer to the seller, formalizing their intention to purchase the property under specific terms and conditions. 2. Key Elements of a North Dakota Offer to Purchase Commercial Property: a. Cover Page: The offer's cover page typically includes essential details such as the property address, buyer's and seller's names, purchase price, and date of offer submission. b. Property Description: A detailed description of the commercial property, including its legal description, boundaries, size, and any existing structures or features. c. Purchase Price and Terms: Clear identification of the purchase price, payment method, and proposed financing options. d. Due Diligence Period: A timeframe allowing the buyer to conduct inspections, surveys, appraisals, and any necessary feasibility studies before finalizing the transaction. e. Contingencies: Common contingencies include financing, property inspection, and approval of zoning and land usage permits. f. Closing Date and Location: The desired date for the closing of the transaction and the agreed-upon location, often a title company or attorney's office. g. Earnest Money Deposit: A sum of money provided by the buyer as a show of good faith, typically held in escrow until closing. h. Closing Costs: Identification of which party will be responsible for various closing costs, such as title insurance, recording fees, and taxes. i. Seller's Acceptance: A section where the seller acknowledges acceptance of the offer, converting it into a legally binding contract upon signing. 3. Different Types of North Dakota Offer to Purchase Commercial Property: While the basic structure remains consistent, there can be variations in offer formats, depending on the nature of the commercial property being purchased. Some common types of commercial properties include: a. Retail Spaces: Offer to Purchase Commercial Property specifically designed for retail businesses, outlining specific requirements such as location, foot traffic, signage, etc. b. Office Buildings: Details related to office space requirements, number of floors, parking facilities, shared amenities, etc. c. Industrial Properties: Emphasis on features like warehouse space, loading docks, clear heights, power supply, and zoning compliance. d. Mixed-use Properties: Properties combining multiple commercial uses, such as office and retail, where the offer may include terms reflecting the diverse needs of each segment. e. Land for Development: Offers targeting vacant commercial land for future development, focusing on zoning provisions, land use restrictions, and development timelines. Conclusion: A North Dakota Offer to Purchase Commercial Property plays a pivotal role in initiating successful commercial real estate transactions. Understanding its significance and including comprehensive details is crucial to ensure both buyers and sellers outline their terms and conditions effectively. By adhering to the specific requirements of different types of commercial properties, individuals can make informed decisions and streamline the purchasing process effectively.