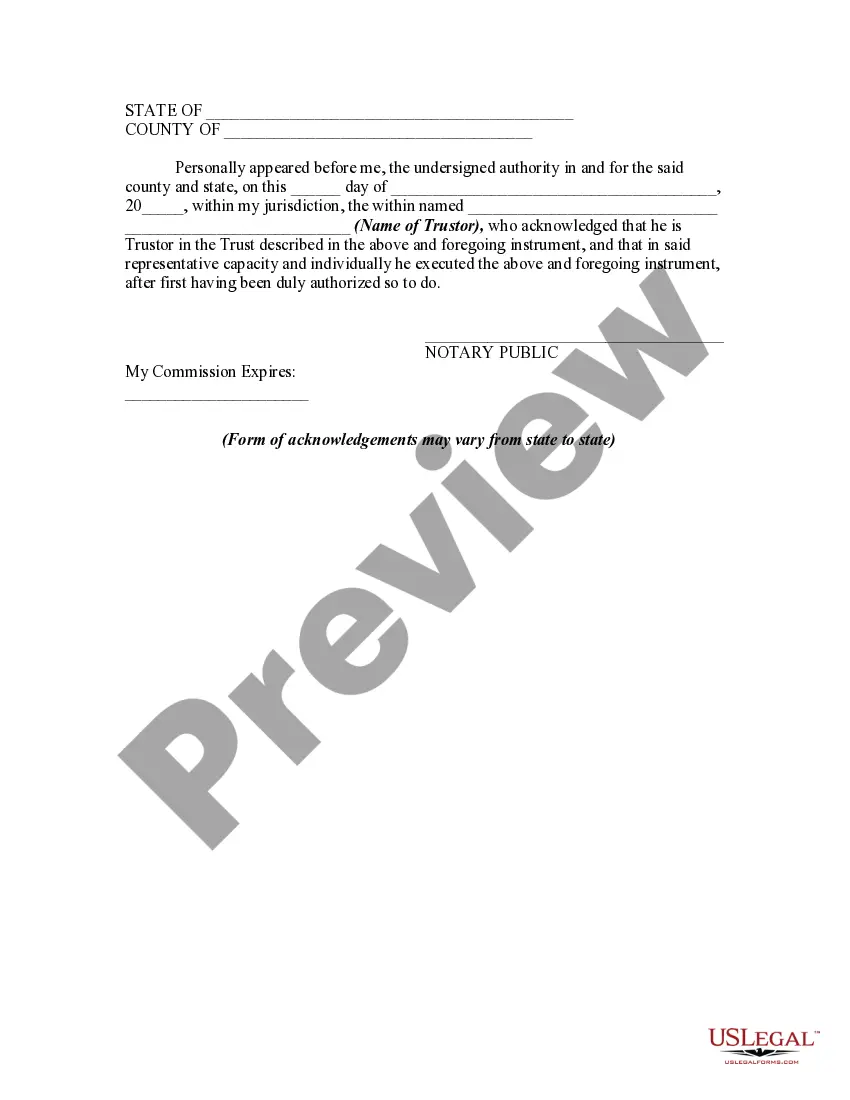

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

Selecting the optimal legal document template may present challenges.

Unquestionably, there is a plethora of templates accessible online, but how can you locate the legal document you require.

Utilize the US Legal Forms website. This service offers thousands of designs, such as the North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust, which you can utilize for both business and personal purposes.

First, ensure you have selected the correct form for your region/state. You can review the form using the Preview button and check the form description to confirm it suits your needs.

- All of the forms are verified by specialists and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Use your account to search through the legal forms you have previously purchased.

- My documents tab of your account allows you to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

To find the contents of a trust, you can start by reviewing the original trust document if you have access to it. If you are unsure where to locate it, consider contacting the trustee or a legal representative who manages the trust. You can also check with the court or registry where the trust may have been filed. Remember, obtaining a North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust can aid in understanding the trust's assets.

Upon the death of the owner of a revocable trust, the trust becomes irrevocable and the trustee takes over management responsibilities. The trustee is obligated to follow the instructions stated in the trust regarding asset distribution to beneficiaries. The transition can sometimes be challenging, especially without clear documentation. Utilizing resources like the North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust can help outline the necessary steps to ensure everything is handled as intended.

A revocable declaration of trust is a legal document that allows the trustor to maintain control over the assets within the trust during their lifetime. The trustor can modify or revoke the trust at any point before their death, providing flexibility. This type of trust can simplify the estate settlement process and avoid probate, making it a popular choice for many individuals. The North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust will also play a vital role if the trust is revoked.

In North Dakota, a trust must meet certain requirements to be valid, including having a designated trustee and stated beneficiaries. Additionally, the trust document must outline specific terms and conditions regarding asset management and distribution. Drafting a trust that complies with state regulations can be complex, so utilizing a reliable service like US Legal Forms can be beneficial. This ensures that the trust adheres to North Dakota laws and reflects the trustor’s wishes.

The distribution of assets from a trust after the trustor’s death occurs based on the terms laid out in the trust document. The appointed trustee manages this distribution process and ensures that beneficiaries receive their allotted shares in accordance with the trust's provisions. If any issues arise, having a guide like the North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust can provide clarity and legal backing. Timely distribution can help minimize conflict among heirs.

Yes, a revocable trust typically becomes irrevocable upon the death of the trustor. This transition ensures that the assets are managed and distributed according to the predetermined instructions laid out in the trust. It protects the intentions of the trustor, which is crucial for maintaining family harmony and clarity regarding asset distribution. A legal document, such as the North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust, may be necessary to acknowledge this change.

When the trustor passes away, the revocable trust usually becomes irrevocable. This means that no changes can be made to the trust without the consent of beneficiaries, unless specific provisions exist. The trust then directs how the assets are distributed among beneficiaries according to the trust's terms. Ensuring clarity in these terms can help facilitate a smoother transfer of assets.

Yes, creditors can pursue assets held in a revocable trust after the trustor's death. Typically, since the trust is revocable, it is treated as part of the trustor’s estate for debt settlement purposes. Therefore, if the trustor had outstanding debts, creditors may claim against the assets in the trust. It’s essential to keep this in mind when designing your estate plan to ensure your intentions are clear.

Closing a revocable trust involves a few straightforward steps, starting with notifying the beneficiaries and settling any outstanding debts. You will also need to distribute the trust property, which may involve preparing a North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust to document the transfer. Finally, it’s wise to consult legal expertise or use US Legal Forms to ensure you complete all necessary legal requirements efficiently.

To sell a property within an irrevocable trust, you typically need approval from the trustee. The trustee must act in the best interest of the beneficiaries while ensuring compliance with the trust's terms. Additionally, you may need a North Dakota Receipt by Trustor for Trust Property Upon Revocation of Trust, if you are considering revoking the trust to facilitate the sale. Using a platform like US Legal Forms can simplify this process by providing the necessary documentation and guidance.