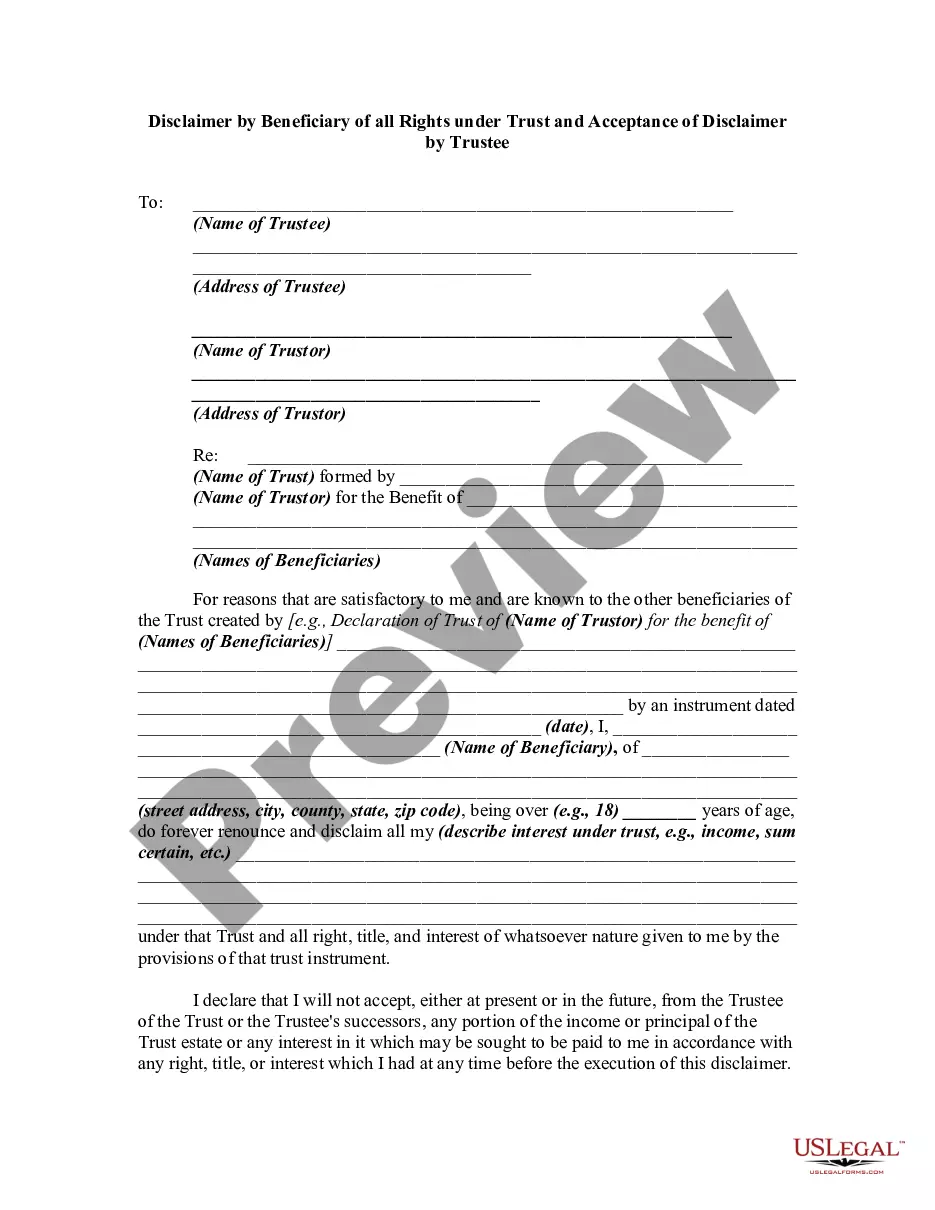

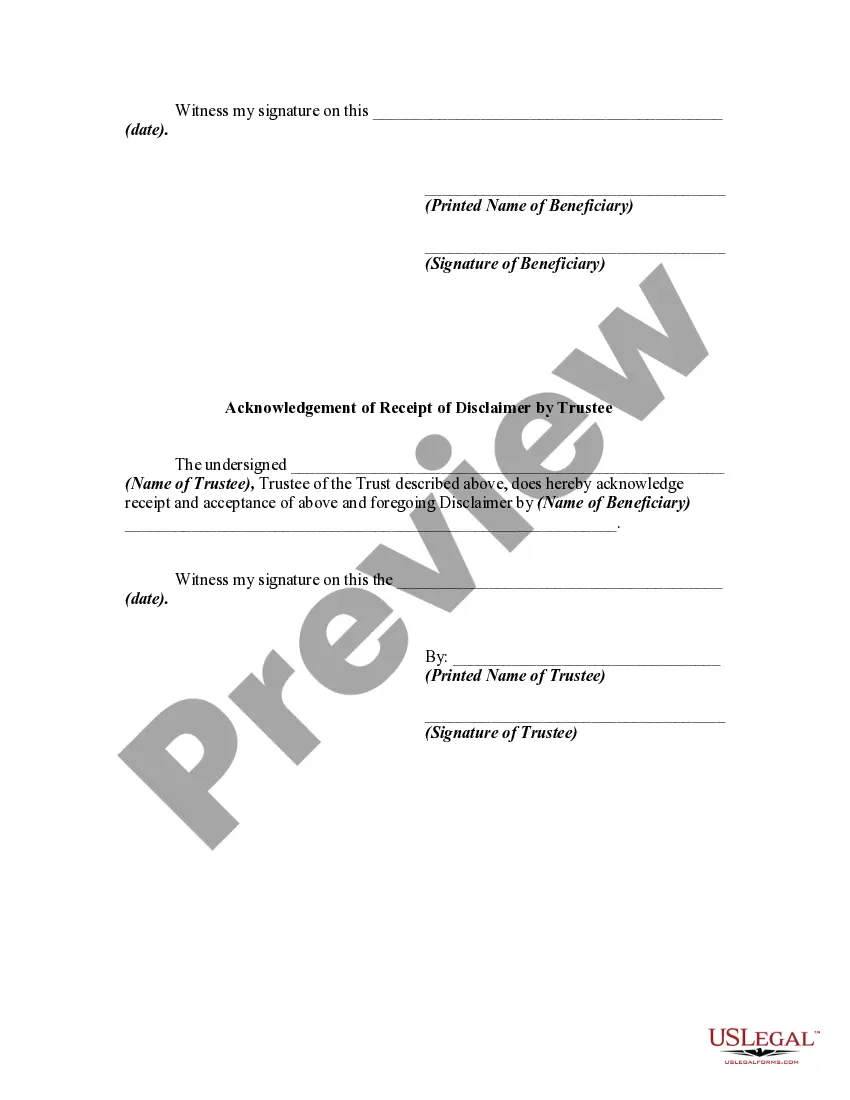

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that allows a beneficiary of a trust in North Dakota to disclaim or renounce their rights and interests in the trust property. By doing so, the beneficiary effectively refuses any benefits or obligations associated with the trust. This disclaimer can be accepted by the trustee, who then assumes full responsibility for the trust property. The North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides an avenue for beneficiaries who may not wish to accept their entitlements or may prefer to avoid potential tax consequences, liabilities, or other obligations that come with being a beneficiary. By disclaiming their interests, beneficiaries essentially relinquish their rights, allowing the assets to pass to subsequent beneficiaries or heirs according to the terms of the trust or applicable state law. There are different types of North Dakota Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including: 1. General Disclaimer: This refers to the broadest form of disclaimer, where the beneficiary renounces all rights, interests, and benefits associated with the trust. By doing so, they will not receive any distributions or have any control over the trust property. 2. Partial Disclaimer: In this case, the beneficiary disclaims only a portion of their interests in the trust, while still retaining other rights or benefits. The remaining assets will be distributed according to the terms of the trust or applicable state laws. 3. Conditional Disclaimer: This type of disclaimer allows the beneficiary to disclaim their rights only under certain conditions or circumstances. For example, they may disclaim their interests if certain tax implications arise or if the trust assets do not meet a specified value. The North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee should be executed voluntarily by the beneficiary and must comply with the state's specific requirements, including timelines and notification procedures. It is essential to consult with an attorney or legal professional familiar with trust laws and estate planning in North Dakota before executing such a disclaimer to ensure compliance and understand the potential consequences.

North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that allows a beneficiary of a trust in North Dakota to disclaim or renounce their rights and interests in the trust property. By doing so, the beneficiary effectively refuses any benefits or obligations associated with the trust. This disclaimer can be accepted by the trustee, who then assumes full responsibility for the trust property. The North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides an avenue for beneficiaries who may not wish to accept their entitlements or may prefer to avoid potential tax consequences, liabilities, or other obligations that come with being a beneficiary. By disclaiming their interests, beneficiaries essentially relinquish their rights, allowing the assets to pass to subsequent beneficiaries or heirs according to the terms of the trust or applicable state law. There are different types of North Dakota Disclaimers by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, including: 1. General Disclaimer: This refers to the broadest form of disclaimer, where the beneficiary renounces all rights, interests, and benefits associated with the trust. By doing so, they will not receive any distributions or have any control over the trust property. 2. Partial Disclaimer: In this case, the beneficiary disclaims only a portion of their interests in the trust, while still retaining other rights or benefits. The remaining assets will be distributed according to the terms of the trust or applicable state laws. 3. Conditional Disclaimer: This type of disclaimer allows the beneficiary to disclaim their rights only under certain conditions or circumstances. For example, they may disclaim their interests if certain tax implications arise or if the trust assets do not meet a specified value. The North Dakota Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee should be executed voluntarily by the beneficiary and must comply with the state's specific requirements, including timelines and notification procedures. It is essential to consult with an attorney or legal professional familiar with trust laws and estate planning in North Dakota before executing such a disclaimer to ensure compliance and understand the potential consequences.