The North Dakota Bill of Transfer to a Trust is a legal document that facilitates the transfer of property, assets, or ownership rights to a trust in the state of North Dakota. This bill is an essential tool used in estate planning and asset protection. A Bill of Transfer to a Trust ensures that an individual's assets are placed under the management and control of a designated trustee. By transferring assets to a trust, individuals can enjoy increased protection, avoid probate, and maintain control over their assets even after their passing. One type of North Dakota Bill of Transfer to a Trust is the Revocable Living Trust. This type of trust allows individuals to maintain ownership and control over their assets during their lifetime while designating beneficiaries who will eventually receive the assets upon the individual's death. The Revocable Living Trust can be modified or revoked by the individual at any time, offering flexibility in estate planning. Another type of North Dakota Bill of Transfer to a Trust is the Irrevocable Trust. Unlike the Revocable Living Trust, this type of trust cannot be modified or revoked by the granter once it is established. Assets transferred to an Irrevocable Trust is no longer considered part of the individual's estate, which may offer tax advantages. Although the individual loses control over the assets, this type of trust provides increased protection against creditors and potential litigation. Additionally, there are Special Needs Trusts, which are designed to protect the assets of individuals with disabilities while allowing them to remain eligible for government benefits. These trusts ensure that the individual's needs are met while preserving their access to important assistance programs. Overall, the North Dakota Bill of Transfer to a Trust serves as a crucial document in the realm of estate planning and asset protection. It enables individuals to secure their assets, avoid probate, and govern the distribution of their wealth according to their wishes. Whether individuals opt for a Revocable Living Trust, Irrevocable Trust, or Special Needs Trust, consulting with a qualified attorney is highly recommended ensuring compliance with North Dakota state laws and regulations.

North Dakota Bill of Transfer to a Trust

Description

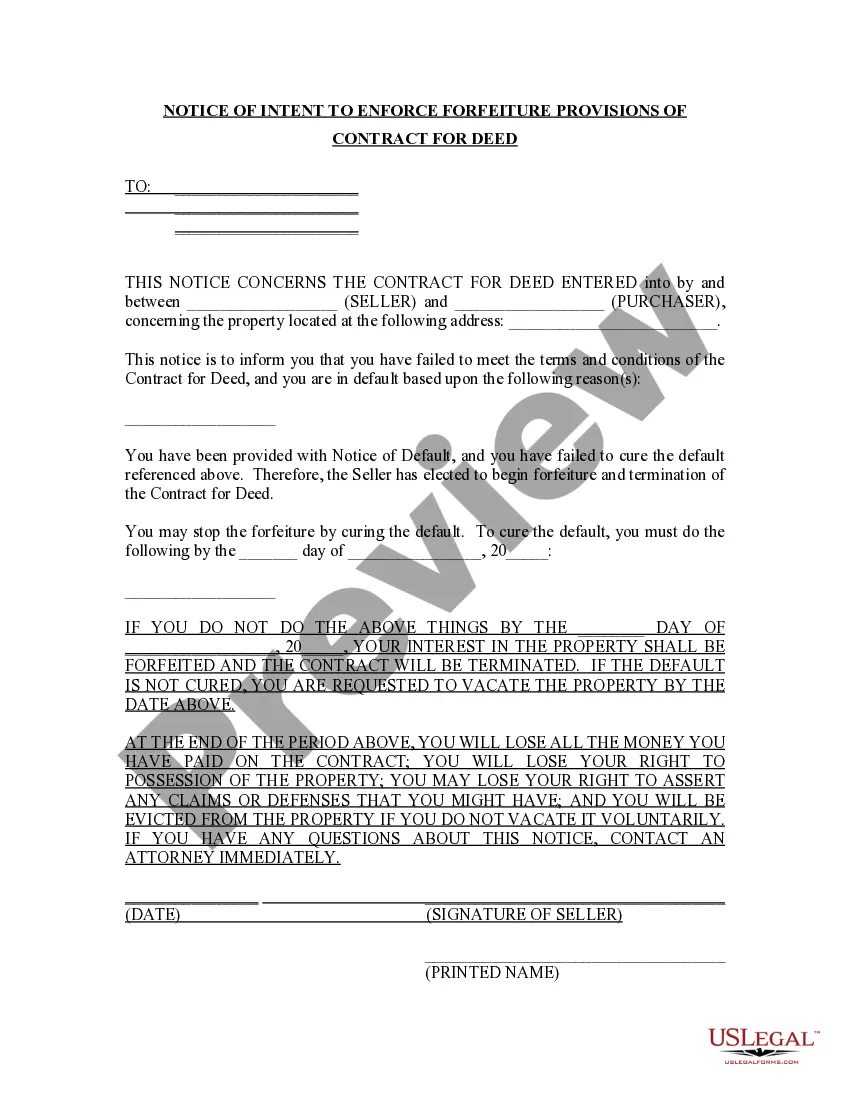

How to fill out North Dakota Bill Of Transfer To A Trust?

If you want to complete, download, or printing authorized record themes, use US Legal Forms, the greatest assortment of authorized varieties, that can be found on-line. Take advantage of the site`s simple and easy practical lookup to find the files you need. Various themes for organization and individual uses are categorized by categories and suggests, or key phrases. Use US Legal Forms to find the North Dakota Bill of Transfer to a Trust with a couple of click throughs.

If you are already a US Legal Forms buyer, log in for your account and click the Down load button to get the North Dakota Bill of Transfer to a Trust. You can even accessibility varieties you in the past delivered electronically in the My Forms tab of the account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your right area/nation.

- Step 2. Make use of the Preview method to examine the form`s articles. Do not overlook to read through the explanation.

- Step 3. If you are unsatisfied with all the form, use the Look for discipline towards the top of the display to discover other types in the authorized form format.

- Step 4. Once you have discovered the shape you need, click the Purchase now button. Select the prices program you choose and include your qualifications to register on an account.

- Step 5. Method the transaction. You can utilize your bank card or PayPal account to accomplish the transaction.

- Step 6. Pick the file format in the authorized form and download it on your product.

- Step 7. Total, modify and printing or signal the North Dakota Bill of Transfer to a Trust.

Every authorized record format you purchase is yours for a long time. You may have acces to every form you delivered electronically within your acccount. Select the My Forms portion and select a form to printing or download once more.

Remain competitive and download, and printing the North Dakota Bill of Transfer to a Trust with US Legal Forms. There are many expert and express-particular varieties you can use for the organization or individual demands.

Form popularity

FAQ

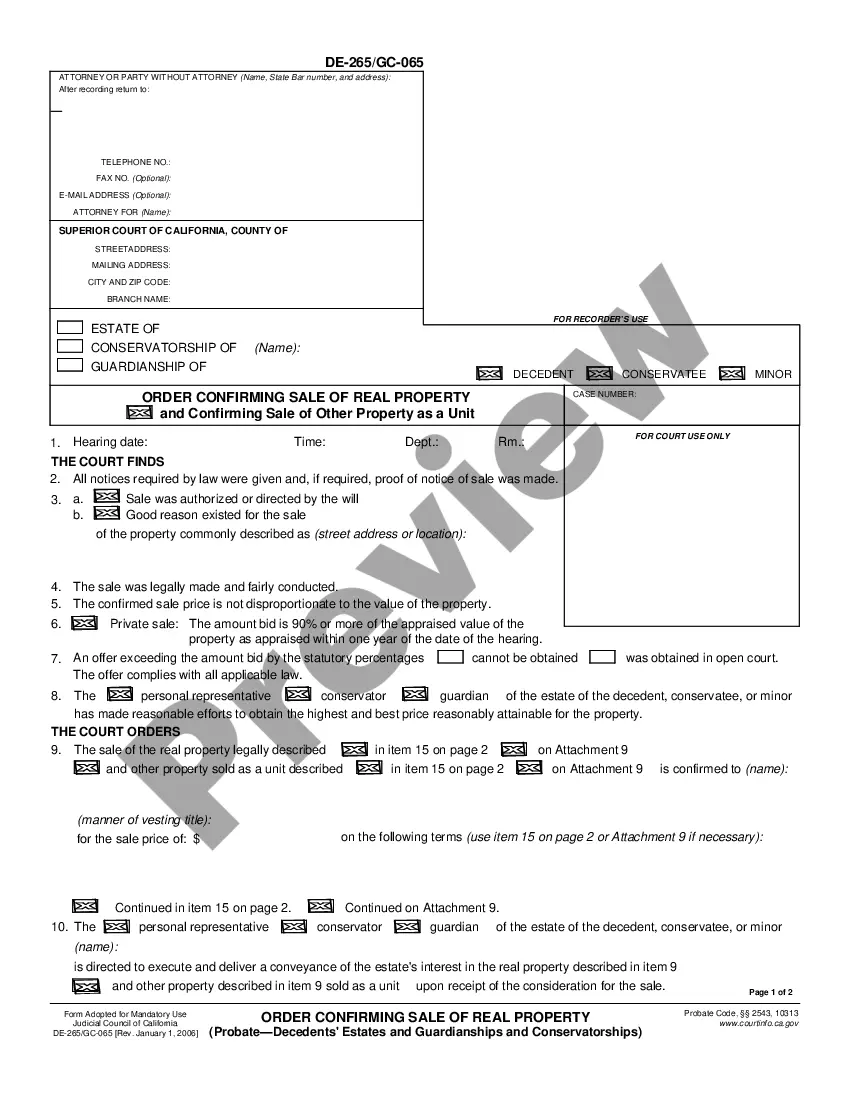

To establish a trust in North Dakota, certain requirements must be met as outlined by the North Dakota Bill of Transfer to a Trust. Firstly, the trust must have a clearly defined purpose and identifiable beneficiaries. Additionally, there must be a trustee who manages the trust assets responsibly. Given the complexities involved, it's advisable to utilize reliable platforms like uSlegalforms for accurate guidance and to ensure compliance.

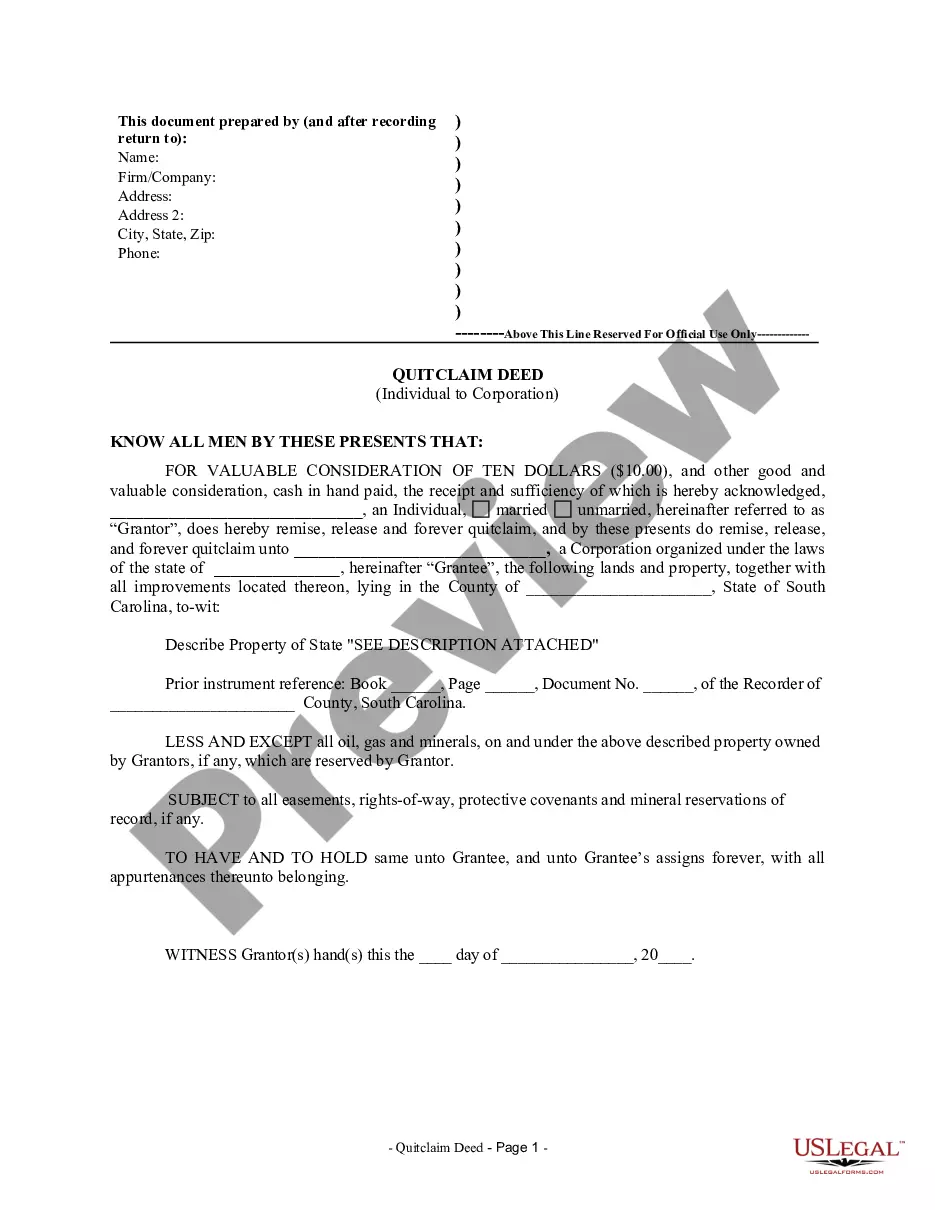

A bill of transfer in a trust, particularly in the context of the North Dakota Bill of Transfer to a Trust, serves as a document that conveys ownership of assets to the trust. This document outlines the specifics of what is being transferred and formalizes the intent to place these assets within the trust’s control. Understanding this process is crucial for ensuring that your assets are well-managed and protected according to your wishes.

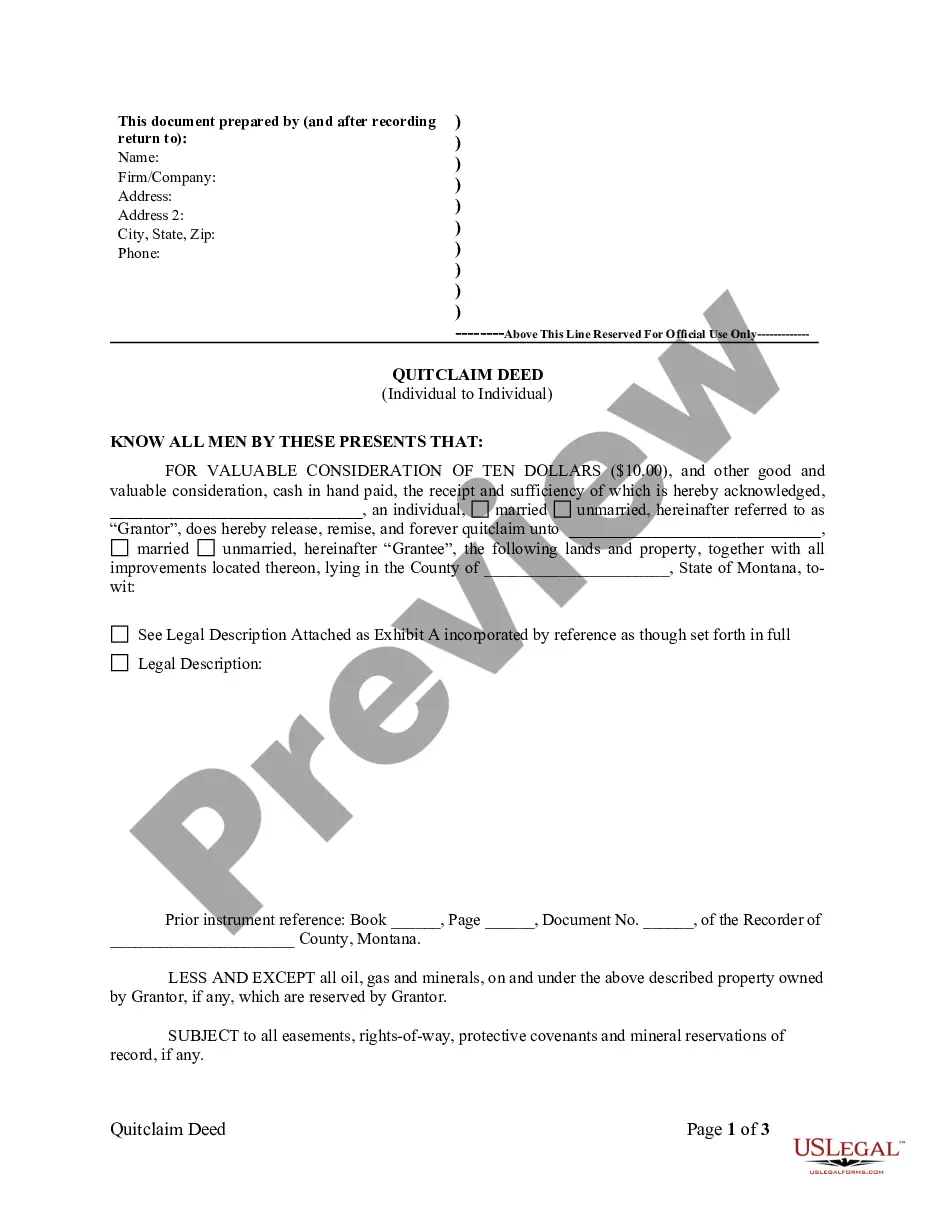

When creating a North Dakota Bill of Transfer to a Trust, it's essential to know which assets to exclude. Typically, assets like personal items with significant emotional value, life insurance policies, and retirement accounts might not be suitable for a trust. Such assets may have specific beneficiary designations that should be preserved outside of the trust structure. To make informed decisions, consider consulting an expert or using online resources.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly document their intentions and assets in the North Dakota Bill of Transfer to a Trust. A lack of clarity can lead to confusion and disputes among beneficiaries. Additionally, parents might overlook the importance of regularly updating their trust to reflect life changes. Using a reliable platform, like US Legal Forms, can simplify this process and ensure everything is organized correctly.

Assets are added to a trust through a legal process that typically involves creating a bill of transfer. This document delineates the assets and formalizes their inclusion in the trust. Understanding the North Dakota Bill of Transfer to a Trust will guide you through this essential step.

To transfer assets into a trust, first, identify the assets you want to move. Then, execute a bill of transfer that accurately describes each asset. Using the North Dakota Bill of Transfer to a Trust simplifies this process and helps ensure compliance with state law.

Transferring items to a trust often involves drafting a bill of transfer that specifies the items being moved. Detailed documentation is essential, as it serves to record the items placed in the trust. Utilize the North Dakota Bill of Transfer to a Trust to ensure the transfer is executed legally and effectively.

To transfer accounts to a trust, you typically need to contact your financial institutions and provide them with the necessary documentation. This includes the trust agreement and potentially the North Dakota Bill of Transfer to a Trust. Each institution may have its own requirements, so be prepared for specific steps to finalize the transfer.

The bill of transfer for a trust is a legal document that facilitates the transfer of assets into a trust. This document outlines the specifics of the assets being transferred and formalizes your intentions to place them under the trust's management. Understanding the North Dakota Bill of Transfer to a Trust is crucial to ensuring your assets are correctly allocated.

One downside of placing assets in a trust includes potential costs associated with setting up and maintaining the trust. Additionally, you may lose direct control over your assets once they are transferred. It's important to consider these factors when contemplating the North Dakota Bill of Transfer to a Trust.

Interesting Questions

More info

If you enjoy these articles, you will love my book. The free content in this book is made possible by the advertisers I link to, in order to keep us on the internet and to help keep our website up and running.