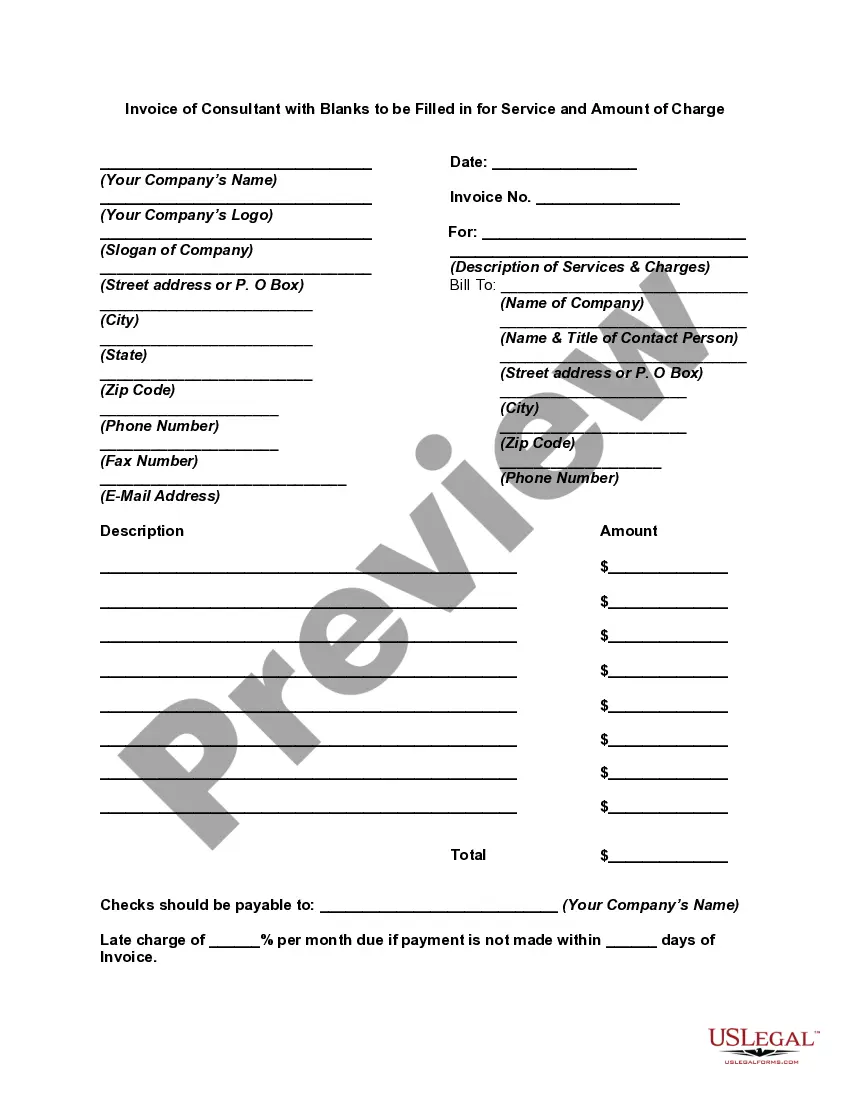

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge Introduction: A North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a formal document that allows consultants to outline their provided services and declare the corresponding charges. When creating this invoice, certain blank fields are included, which the consultant needs to fill in with accurate information, including the nature of the service rendered and the amount charged. Here, we will explore the key components of this invoice and discuss different types that may exist. 1. Understanding the North Dakota Invoice of Consultant: The North Dakota Invoice of Consultant serves as a legally binding contract between a consultant and their client. It acts as a descriptive record of the provided service and the associated monetary value. This document ensures clear communication, transparent billing, and the settlement of any financial obligations. 2. Key Elements of a North Dakota Invoice of Consultant: — Heading: Include your business name, address, contact details, and logo (if applicable). — Client Information: Provide the client's name, address, and contact information. — Invoice Number: Assign a unique identifier to the invoice for tracking and reference purposes. — Invoice Date: Indicate the date when the invoice is created. — Description of Service: Clearly state the nature of the service or consultation provided. — Itemized List of Charges: Document each service or product offered along with its corresponding cost. — Subtotal: Calculate the total amount for all services provided. — Taxes: Include applicable taxes or indicate when they are already included in the prices. — Grand Total: Calculate the final amount payable by the client. — Payment Terms: Specify the acceptable payment methods, due date, and any late payment penalties if applicable. — Additional Notes: Provide any relevant additional information or special instructions. 3. Types of North Dakota Invoice of Consultant: While the basic structure of an invoice remains consistent, there can be different variations based on specific industries or situations. Here are some common types: — Hourly Rate Invoice: Suitable for consultants who charge an hourly fee, allowing them to detail the number of hours worked and the corresponding charges. — Fixed Fee Invoice: Appropriate for consultants who provide a pre-defined service at a fixed price, enabling them to outline the service and its flat rate charge. — Retainer Invoice: Used when a consultant has a retainer agreement with a client, indicating the services provided within a specific timeframe and the associated charges deducted from the retainer. — Progress Payment Invoice: Utilized for long-term projects with multiple milestones or stages, allowing the consultant to bill for completed portions while the project is ongoing. In conclusion, a North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a crucial document for consultants to communicate their services and collect payment. By completing the designated fields accurately, consultants ensure transparency and smooth financial transactions with their clients.

Title: Understanding North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge Introduction: A North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a formal document that allows consultants to outline their provided services and declare the corresponding charges. When creating this invoice, certain blank fields are included, which the consultant needs to fill in with accurate information, including the nature of the service rendered and the amount charged. Here, we will explore the key components of this invoice and discuss different types that may exist. 1. Understanding the North Dakota Invoice of Consultant: The North Dakota Invoice of Consultant serves as a legally binding contract between a consultant and their client. It acts as a descriptive record of the provided service and the associated monetary value. This document ensures clear communication, transparent billing, and the settlement of any financial obligations. 2. Key Elements of a North Dakota Invoice of Consultant: — Heading: Include your business name, address, contact details, and logo (if applicable). — Client Information: Provide the client's name, address, and contact information. — Invoice Number: Assign a unique identifier to the invoice for tracking and reference purposes. — Invoice Date: Indicate the date when the invoice is created. — Description of Service: Clearly state the nature of the service or consultation provided. — Itemized List of Charges: Document each service or product offered along with its corresponding cost. — Subtotal: Calculate the total amount for all services provided. — Taxes: Include applicable taxes or indicate when they are already included in the prices. — Grand Total: Calculate the final amount payable by the client. — Payment Terms: Specify the acceptable payment methods, due date, and any late payment penalties if applicable. — Additional Notes: Provide any relevant additional information or special instructions. 3. Types of North Dakota Invoice of Consultant: While the basic structure of an invoice remains consistent, there can be different variations based on specific industries or situations. Here are some common types: — Hourly Rate Invoice: Suitable for consultants who charge an hourly fee, allowing them to detail the number of hours worked and the corresponding charges. — Fixed Fee Invoice: Appropriate for consultants who provide a pre-defined service at a fixed price, enabling them to outline the service and its flat rate charge. — Retainer Invoice: Used when a consultant has a retainer agreement with a client, indicating the services provided within a specific timeframe and the associated charges deducted from the retainer. — Progress Payment Invoice: Utilized for long-term projects with multiple milestones or stages, allowing the consultant to bill for completed portions while the project is ongoing. In conclusion, a North Dakota Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a crucial document for consultants to communicate their services and collect payment. By completing the designated fields accurately, consultants ensure transparency and smooth financial transactions with their clients.