North Dakota Complaint to Contest Will

Description

How to fill out Complaint To Contest Will?

Are you currently in a situation where you require documentation for either business or personal use almost all the time.

There are numerous legal document templates accessible online, but finding reliable versions isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the North Dakota Complaint to Contest Will, which are designed to fulfill state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the North Dakota Complaint to Contest Will template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

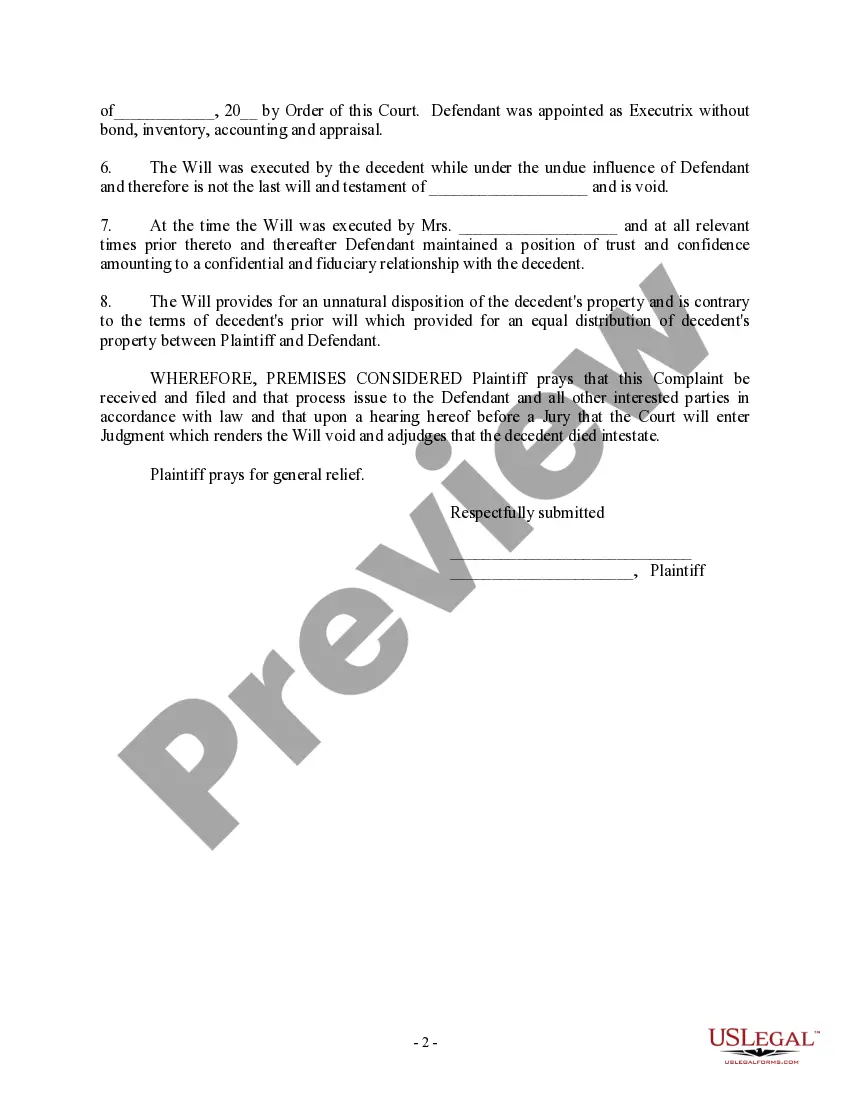

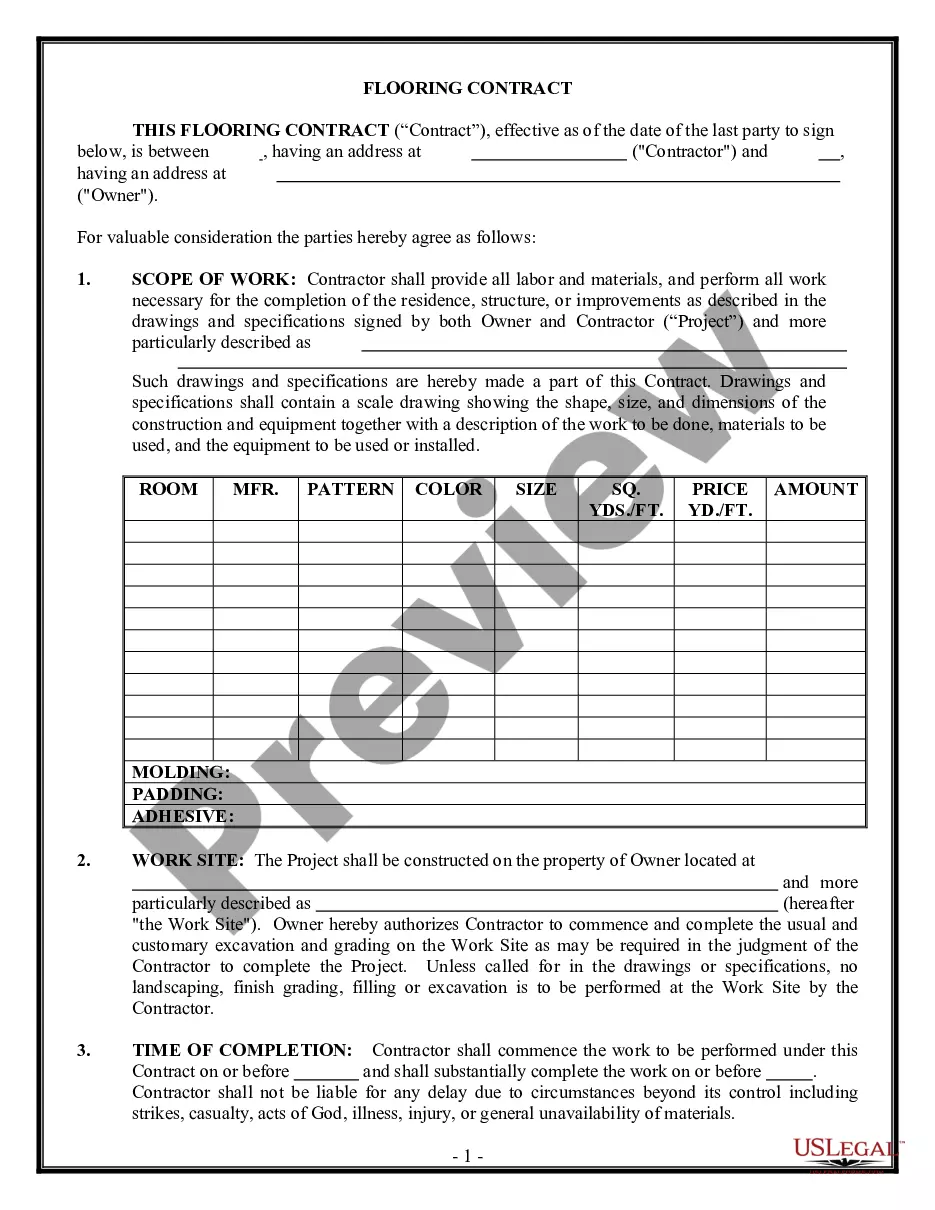

- Use the Preview button to review the document.

- Check the details to ensure that you have chosen the correct form.

- If the form isn't what you're looking for, use the Search field to find the document that meets your needs.

- Once you find the right form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the North Dakota Complaint to Contest Will at any time if necessary. Just click on the required form to download or print the document template.

Form popularity

FAQ

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

One of the most important reasons to make a will is to name your executor -- commonly called a "personal representative" in South Carolina. After your death, your executor's primary job is to protect your property until any debts and taxes have been paid, and then transfer what's left to those who are entitled to it.

If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will. Debates over the proper heir.

Appointing a Personal Representative The order from highest to lowest priority is: The person named as personal representative in decedent's will. The decedent's surviving spouse if the spouse is a devisee. Other devisees of the decedent.

Initially, it is important for the Personal Representative or Trustee to gather all information about the decedent's assets. These assets include cash, stocks, bonds, mutual funds, life insurance, retirement accounts, tangible personal property (e.g., art, jewelry and vehicles), partnerships and real property.

In order for a will to be valid, its owner must be of sound mind when it is created. If the owner is not of sound mind, the will not be valid. The will must also be in writing and signed by the owner or by someone in the owner's presence and at the owner's direction.

A personal representative (or legal personal representative), also known as the executor, is the individual chosen to administer the estate of a deceased person. They are designated as such by the decedent or by a court.

A proceeding to contest an informally probated will and to secure appointment of the person with legal priority for appointment in the event the contest is successful may be commenced within the later of twelve months from the informal probate or three years from the decedent's death.