North Dakota Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

You can spend numerous hours online searching for the legal document template that meets both federal and state requirements you need.

US Legal Forms offers a vast array of legal forms reviewed by professionals.

You can easily acquire or print the North Dakota Hippa Release Form for Insurance through my service.

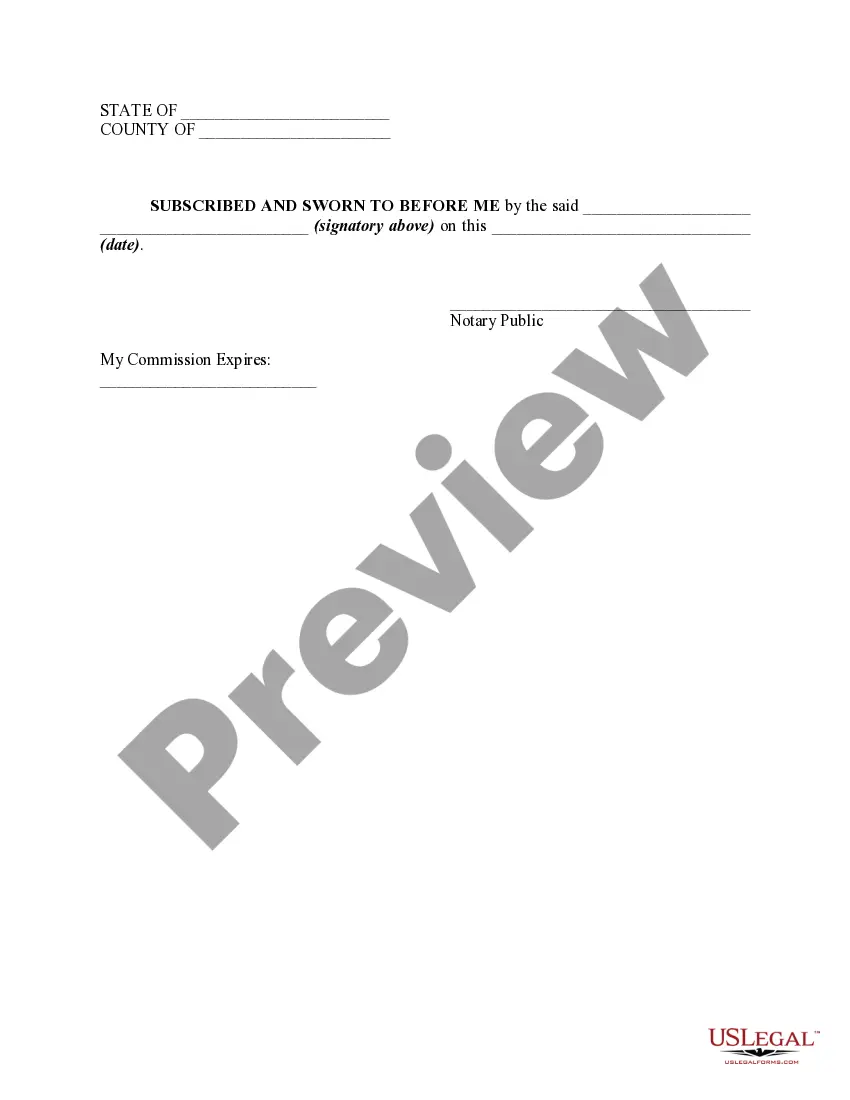

If available, utilize the Preview option to review the document template as well.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the North Dakota Hippa Release Form for Insurance.

- Every legal document template you purchase is yours for life.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click on the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, verify that you have chosen the correct document template for the region/city of your choice.

- Review the document description to ensure you have selected the right form.

Form popularity

FAQ

To fill out a HIPAA form, start by reviewing the information required, including names, addresses, and specific health information. When dealing with a North Dakota HIPAA Release Form for Insurance, ensure you clearly indicate who can access the information and under what circumstances. Online platforms like US Legal Forms provide templates that guide you through this process step-by-step, ensuring accuracy and compliance. Take your time to review the completed form before submission to confirm all details are correct.

Yes, HIPAA forms can be signed electronically, making the process much more efficient. When using an electronic signing platform, it's critical to ensure that the platform meets all HIPAA standards to protect your information. US Legal Forms offers compliant options that allow you to electronically sign a North Dakota HIPAA Release Form for Insurance securely. This method not only saves time but also helps ensure your documents are organized and easily accessible.

Typically, a HIPAA release form does not require notarization, but it's important to check specific state requirements. In North Dakota, for example, a HIPAA Release Form for Insurance generally does not need a notary, though having it notarized can add an extra layer of authenticity. Always ensure that you understand the expectations and regulations in your jurisdiction, as some situations might necessitate additional verification. Consulting with legal resources can provide clarity on your specific needs.

Filling out a HIPAA form online is definitely possible and quite convenient. Utilizing platforms like US Legal Forms can simplify this process for you, especially when working on a North Dakota HIPAA Release Form for Insurance. These platforms often provide templates that guide you through the necessary fields, ensuring that you complete the form correctly and comprehensively. Online form-filling saves time and avoids potential errors associated with paper forms.

Yes, you can pursue HIPAA certification online. Various organizations offer training programs that help you understand HIPAA compliance, including the details relevant to a North Dakota HIPAA Release Form for Insurance. These programs often cover the necessary regulations and provide resources to ensure you meet all compliance requirements. Completing this training will enhance your understanding of HIPAA and help you implement the knowledge in real-life scenarios.

When filling out a release form, such as the North Dakota HIPAA Release Form for Insurance, begin with providing your full name and contact details. Specify the type of information or records that need to be released, along with the names of the healthcare providers. Ensure you sign and date the form, which is vital for its legality. By taking these steps, you enable smoother communication with your healthcare professionals.

To complete a medical record release, use the North Dakota HIPAA Release Form for Insurance as a guide. Fill in your personal information and the healthcare provider's details. Identify the records you wish to access, and ensure that your signature and date are included. This careful approach grants you the rights and access you need to your medical history.

Filling out the North Dakota HIPAA Release Form for Insurance is straightforward. Begin by entering your contact information, followed by the details of the healthcare provider. Be specific about the type of medical records you wish to obtain, and conclude with your signature and date. By following these steps, you can access your health information easily and legally.

To fill out the North Dakota HIPAA Release Form for Insurance, start by providing your personal details, including your name and address. Next, clearly specify the information you want to be released and the healthcare provider who must release it. Lastly, sign and date the form to ensure it is valid. This process helps you manage your medical information efficiently.

To create a HIPAA release form, start by gathering essential information, such as the parties involved and details about the information being disclosed. Using reliable templates, such as those available through the uslegalforms platform, can simplify the process. A proper North Dakota HIPAA Release Form for Insurance ensures compliance with regulations and protects patient privacy.