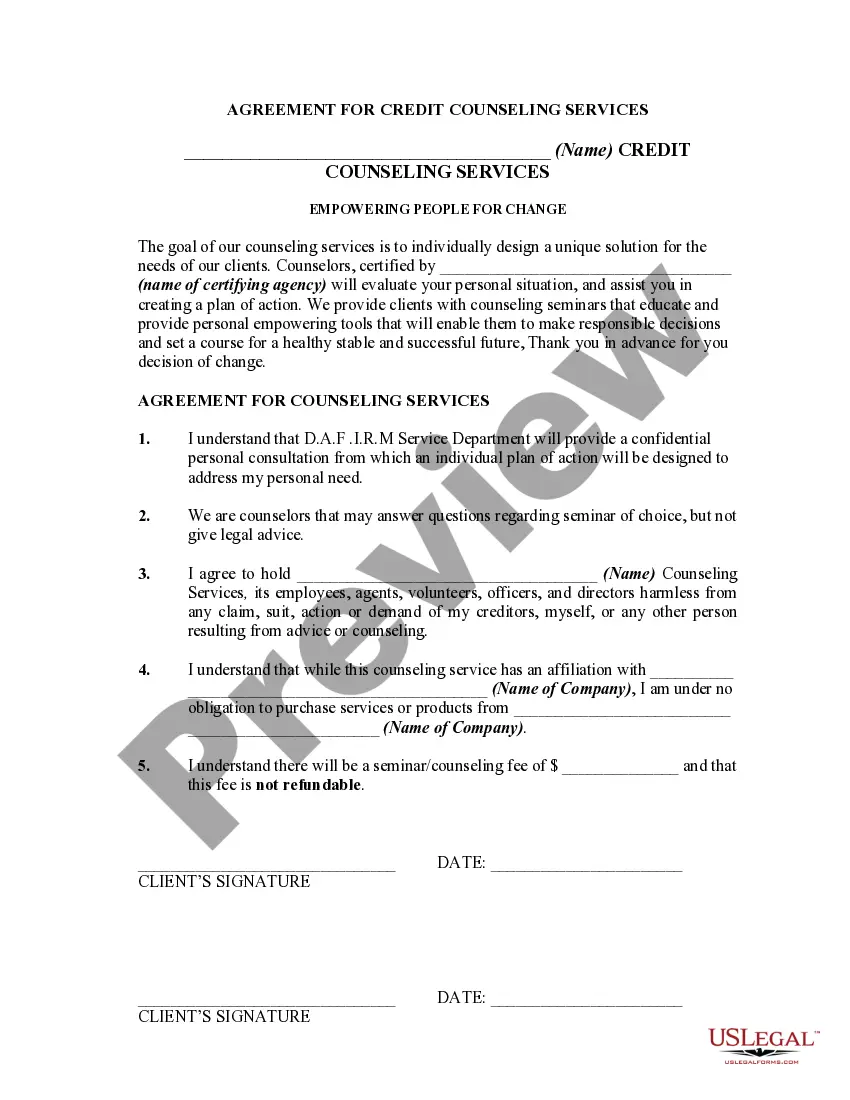

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Agreement for Credit Counseling Services

Description

How to fill out Agreement For Credit Counseling Services?

It is feasible to invest time on the web searching for the valid document format that meets the state and federal criteria you will require.

US Legal Forms offers thousands of valid templates that are verified by experts.

You can download or print the North Dakota Agreement for Credit Counseling Services from our service.

If available, use the Preview button to review the document format as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the North Dakota Agreement for Credit Counseling Services.

- Every valid document format you obtain is yours indefinitely.

- To acquire another copy of the acquired form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the appropriate document format for the area/town of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

During credit counseling, you will participate in a one-on-one meeting with a trained counselor who will evaluate your financial situation comprehensively. They will discuss your income, expenses, debts, and financial objectives. This process leads to the development of a tailored plan to address your financial challenges. The North Dakota Agreement for Credit Counseling Services plays a crucial role in facilitating this effective and supportive environment.

Credit counseling works by providing individuals with advice and resources to manage their debts effectively. First, you meet with a certified counselor to review your financial situation and explore your options. The counselor will then create a customized plan that may include a debt management plan or suggestions for improving your budgeting skills. Engaging in the North Dakota Agreement for Credit Counseling Services helps you establish a clear path toward financial stability.

Credit counseling organizations provide a range of services tailored to different financial situations. Common offerings include budgeting guidance, debt management plans, and educational workshops on financial literacy. Additionally, many organizations assist with negotiating terms with creditors, helping you navigate your repayment options. Utilizing the North Dakota Agreement for Credit Counseling Services can help you access these valuable resources.

The duration of credit counseling varies based on individual needs and the complexity of financial situations. Typically, a session lasts about an hour, where you discuss your financial history and future goals. Following this initial meeting, your counselor may provide ongoing support, which can take several sessions. By engaging in the North Dakota Agreement for Credit Counseling Services, you ensure a structured approach to improving your financial health.

Credit counseling and debt settlement serve different purposes, making one better than the other based on individual needs. Credit counseling focuses on educating you about managing debt and budgeting effectively. In contrast, debt settlement aims to reduce your total debts through negotiations. Engaging with a trusted advisor can clarify how the North Dakota Agreement for Credit Counseling Services can facilitate effective strategies for your situation.

It's best to consult a certified credit counselor or a financial advisor when discussing debt. These professionals provide tailored advice based on your financial circumstances. They can also help you understand the North Dakota Agreement for Credit Counseling Services and how it can benefit you. Seeking guidance from experts can empower you to take control of your financial future.

To obtain a credit counseling certificate, you usually need to complete a credit counseling session with an approved agency. These sessions are often online or in-person and cover various topics related to managing debt. Once you complete the counseling, the agency will provide you with the certificate, which may be essential for processes like filing for bankruptcy. Platforms like USLegalForms can guide you through obtaining the North Dakota Agreement for Credit Counseling Services efficiently.

Trustworthy credit counseling agencies will be accredited by a recognized body and will clearly explain their fees and services. Look for agencies that offer transparency about their practices and provide educational resources. Agencies that operate under the North Dakota Agreement for Credit Counseling Services have established standards that promote trust and accountability in their services.

Credit counselors focus on providing education, budgeting advice, and debt management plans, often emphasizing long-term financial health. In contrast, debt settlement companies negotiate with creditors to reduce the total debt owed, which can have negative effects on your credit score. For comprehensive support, consider utilizing the North Dakota Agreement for Credit Counseling Services through a certified credit counseling agency.

Yes, credit counseling is a legitimate service when provided by a qualified and accredited agency. These services can offer valuable guidance and support to help you manage your debts effectively. The North Dakota Agreement for Credit Counseling Services further legitimizes the process, ensuring a structured approach to conflict resolution and financial stability.