The North Dakota Simple Equipment Lease is a legally binding agreement between a lessor (equipment owner) and a lessee (equipment user) that allows the lessee to rent equipment for business or personal use, within the state of North Dakota. This lease agreement outlines the terms, conditions, and responsibilities associated with the equipment rental. Keywords: North Dakota, Simple Equipment Lease, legally binding agreement, lessor, lessee, equipment rental. Types of North Dakota Simple Equipment Leases: 1. Agricultural Equipment Lease — This type of lease agreement specifically caters to farmers and agricultural businesses in North Dakota, allowing them to rent farm equipment such as tractors, plows, harvesters, etc., for seasonal or short-term use. 2. Construction Equipment Lease — This lease is designed for construction companies and contractors in North Dakota who require heavy machinery and tools for construction projects. It covers equipment like excavators, bulldozers, cranes, and other construction-related tools. 3. Medical Equipment Lease — This type of lease agreement is tailored for healthcare facilities, clinics, or private practitioners in North Dakota who require medical equipment such as imaging machines, X-ray equipment, ultrasound machines, or even specialized medical devices on a short-term or long-term basis. 4. Office Equipment Lease — Suitable for North Dakota's businesses and organizations, this lease allows the renting of office equipment like printers, photocopiers, computers, or phone systems. It helps businesses to manage their office infrastructure without the need for long-term commitments or significant upfront expenses. 5. Technology Equipment Lease — This lease option targets technology-based companies and startups in North Dakota who need access to the latest tech equipment but want to avoid hefty purchasing costs. It includes leasing computers, servers, networking devices, software, or any other technology hardware required by businesses to operate efficiently. 6. Transportation Equipment Lease — This lease agreement is specific to transportation companies or businesses that require vehicles for logistics purposes. It covers the rental of delivery trucks, vans, trailers, or other types of vehicles used for transportation in North Dakota. These various types of North Dakota Simple Equipment Leases ensure that businesses and individuals in the state can easily obtain the necessary equipment and technology resources without having to make substantial upfront investments or commit to long-term ownership.

North Dakota Simple Equipment Lease

Description

How to fill out North Dakota Simple Equipment Lease?

Are you currently in a situation where you require documentation for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides a wide range of template options, including the North Dakota Simple Equipment Lease, which can be customized to comply with federal and state regulations.

When you find the correct document, click Purchase now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and process your payment using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Simple Equipment Lease template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/region.

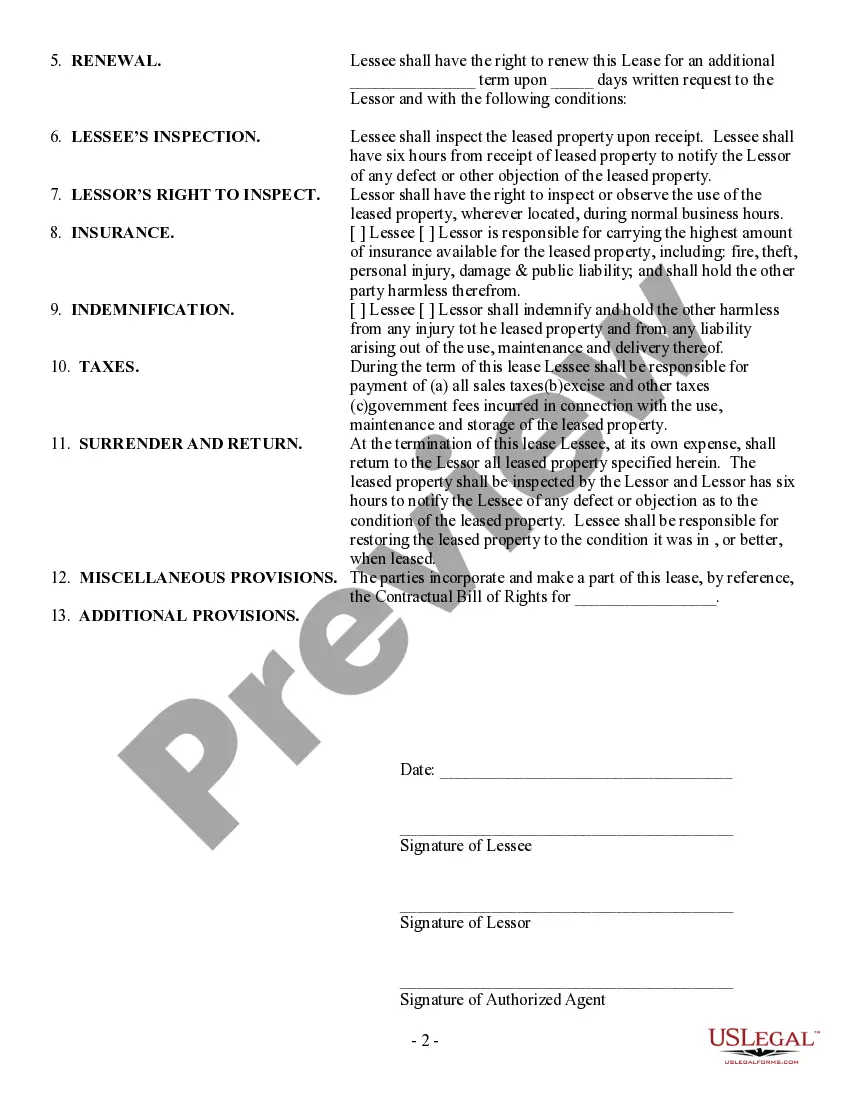

- Utilize the Preview button to review the form.

- Read the description to make sure you have selected the right document.

- If the document isn't what you require, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Nexus for state income tax in North Dakota typically involves a business having sufficient physical presence or economic activity within the state. This includes offices, employees, or tangible assets. As you consider how your North Dakota Simple Equipment Lease fits into your overall business operations, recognize these nexus factors as they can influence your income tax obligations.

The nexus threshold in North Dakota is primarily determined by sales volume and transaction frequency, which impacts tax obligations. If a business surpasses $100,000 in sales or completes 200 transactions, it establishes nexus. Being aware of this threshold is crucial when engaging in a North Dakota Simple Equipment Lease, as it affects tax assessments.

Yes, rental equipment is generally taxable in North Dakota, and the tax applies to the rental fees charged. This includes items leased under a North Dakota Simple Equipment Lease, so it’s imperative to account for this in your financial planning. Familiarizing yourself with tax implications can enhance your budgeting and compliance efforts.

To determine if you have nexus in a state, analyze your business presence, including physical locations, employees, and interactions with customers. In North Dakota, you may establish nexus through sales thresholds or rental activities like a North Dakota Simple Equipment Lease. Regularly reviewing your business activities can help you stay compliant with tax laws.

In North Dakota, lease tax applies to many types of leases, including equipment leases. The standard rate is 5% of the gross rental receipts. When entering into a North Dakota Simple Equipment Lease, knowing this tax rate can help you budget accordingly and avoid surprises.

The total loss threshold in North Dakota signifies the minimum loss amount a business can claim before it impacts tax liabilities. This threshold can be significant when calculating profits or losses from your North Dakota Simple Equipment Lease. It's essential to be informed of this figure to manage potential loss situations effectively.

The economic nexus threshold in North Dakota refers to the minimum level of business activity required to establish a tax obligation. Businesses generally trigger nexus if they exceed $100,000 in sales or have 200 transactions in a given year. Understanding this threshold is crucial for determining how it affects your North Dakota Simple Equipment Lease and tax responsibilities.

The credit score needed to lease equipment varies, but generally, a score of 650 or above is desirable. With a North Dakota Simple Equipment Lease, having a good credit score can improve your chances of securing favorable lease terms. However, some lessors may work with you even if your score is lower, focusing on your overall business health. It’s essential to discuss your options with your leasing provider.

Under a North Dakota Simple Equipment Lease, you can lease numerous items tailored to your business needs. Options range from heavy-duty machinery to essential office supplies. You might also consider leasing technology, such as computers and software, which can keep your operations up-to-date. Leasing provides a practical way to acquire necessary items without large upfront costs.

A variety of assets can be leased under a North Dakota Simple Equipment Lease. Common categories include industrial machinery, computers, vehicles, and office furniture. Each type of asset serves a specific function and purpose within a business or organization. By choosing the right assets, companies can enhance their productivity and efficiency.