North Dakota Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

You might spend hours online looking for the legal document template that meets the federal and state standards you need.

US Legal Forms offers numerous legal templates that are vetted by experts.

You can easily download or print the North Dakota Revocable Trust for Lottery Winnings from the service.

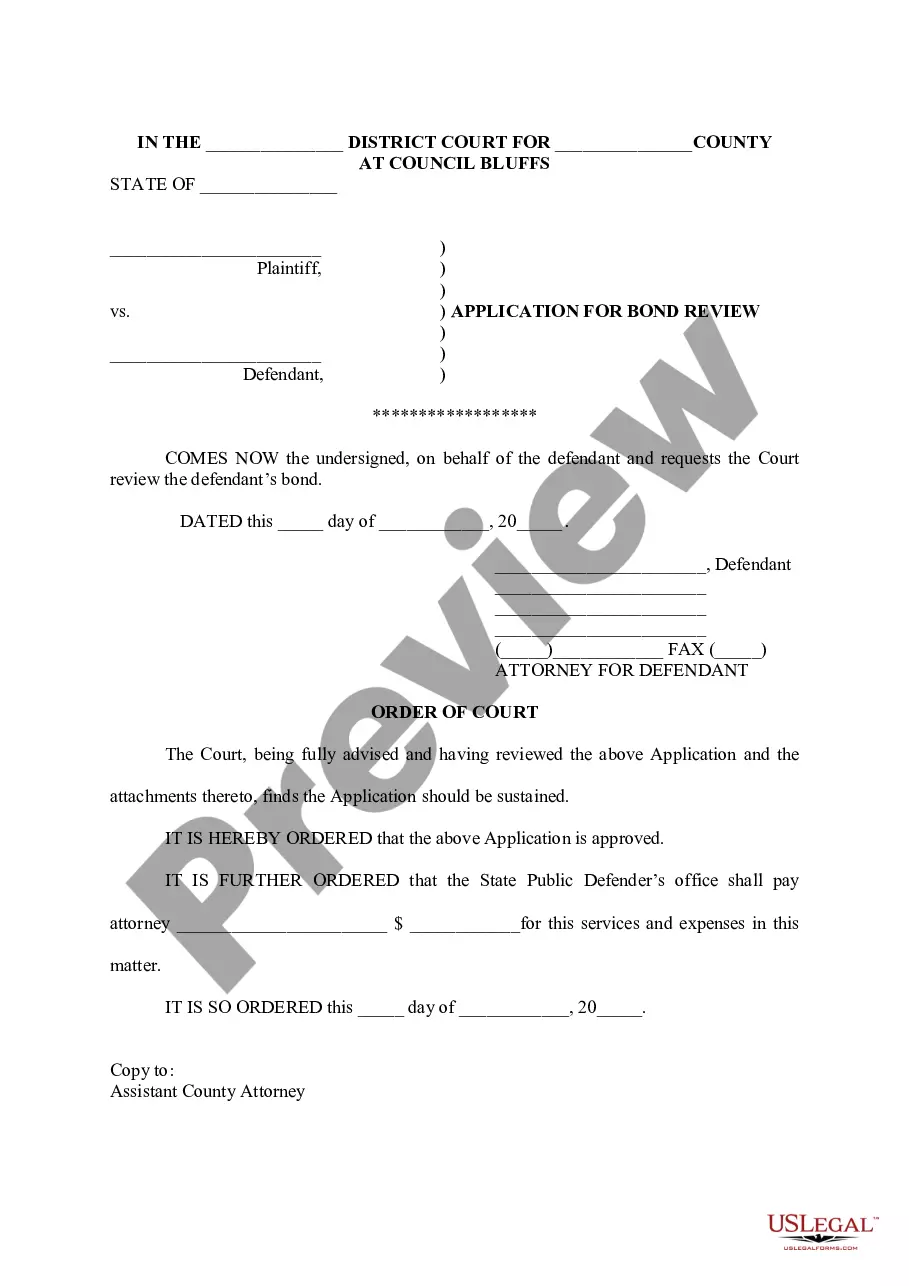

If available, utilize the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the North Dakota Revocable Trust for Lottery Winnings.

- Each legal document template you obtain is yours for an extended period.

- To obtain another copy of any purchased form, go to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have selected the right document template for the area/region you choose.

- Review the form details to ensure you have selected the correct form.

Form popularity

FAQ

The best place to deposit your lottery winnings is typically a secure financial institution that offers services tailored to high-value deposits. By using a North Dakota Revocable Trust for Lottery Winnings, you can manage and protect these funds effectively. This trust allows for flexibility in distribution and helps safeguard your assets against unforeseen circumstances. It is wise to consult with a financial advisor or legal expert to determine the optimal deposit strategy that aligns with your goals.

To claim lottery winnings using a North Dakota Revocable Trust for Lottery Winnings, you first need to establish the trust before claiming your prize. This involves setting up the trust documentation, where you designate the trust as the recipient of the winnings. After winning, present the trust documents along with identification to the lottery organization. This process ensures that your winnings are managed according to your wishes and can provide benefits such as privacy and estate planning advantages.

To open a North Dakota Revocable Trust for Lottery Winnings, begin by gathering all relevant documents, such as your lottery ticket and personal identification. Next, create a trust document that outlines the terms of the trust, including the beneficiaries and how the winnings will be managed. You can utilize the uslegalforms platform to access templates and guidance for drafting your trust. Finally, consider consulting with a legal professional to ensure compliance with state laws and to maximize the benefits of your trust.

The first thing you should do if you win the lottery is to remain calm and seek professional advice. Consider setting up a North Dakota Revocable Trust for Lottery Winnings to manage your wealth strategically. Engaging with a financial planner and an attorney can provide you with guidance on how to maximize your winnings while protecting your assets.

To avoid incurring gift tax on lottery winnings, consider creating a North Dakota Revocable Trust for Lottery Winnings. This trust allows you to manage how you choose to distribute your lottery winnings and helps keep your financial legacy intact. By carefully planning your gift distributions, you can enjoy your winnings while minimizing tax liabilities.

In the case of lottery winnings, a revocable trust is often the best choice. A North Dakota Revocable Trust for Lottery Winnings allows you to maintain control over your assets while also optimizing your tax obligations. With this trust, you can easily adapt your financial plan as your needs change, ensuring a secure future.

The best trust to set up after winning the lottery is a revocable trust, specifically a North Dakota Revocable Trust for Lottery Winnings. This type of trust gives you the flexibility to change terms if your circumstances evolve, and it keeps your assets organized. By utilizing this trust, you can manage your winnings effectively while benefiting from tax advantages.

North Dakota allows winners of the lottery to claim their prizes anonymously through a legal entity. Establishing a North Dakota Revocable Trust for Lottery Winnings enables you to collect your winnings while keeping your identity protected. This approach not only maintains your privacy but also creates a structured way to manage your funds.

If you win the lottery, consider consulting a financial advisor to evaluate your options. An effective strategy might involve setting up a North Dakota Revocable Trust for Lottery Winnings to manage your newfound wealth. This kind of trust can help you make informed decisions regarding real estate, stocks, and other investment opportunities, ensuring your financial growth while providing flexibility.