North Dakota Sample Letter sending Check for Copying Expense

Description

How to fill out Sample Letter Sending Check For Copying Expense?

Have you been inside a place where you require papers for possibly enterprise or person reasons nearly every time? There are plenty of legitimate record layouts accessible on the Internet, but locating versions you can depend on isn`t straightforward. US Legal Forms provides thousands of form layouts, such as the North Dakota Sample Letter sending Check for Copying Expense, which are written to meet federal and state specifications.

When you are previously familiar with US Legal Forms site and get a merchant account, simply log in. Afterward, you may down load the North Dakota Sample Letter sending Check for Copying Expense design.

If you do not offer an profile and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is to the appropriate area/state.

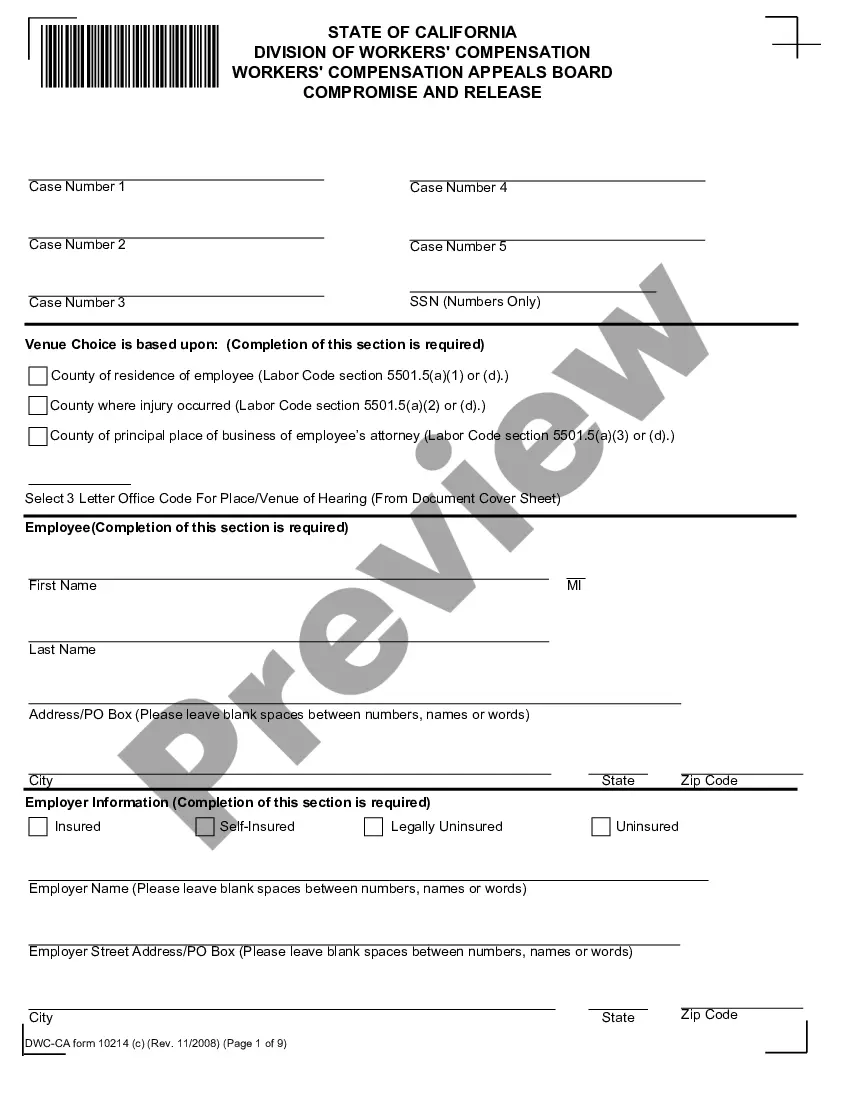

- Use the Review button to check the form.

- See the information to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re looking for, use the Lookup area to get the form that meets your requirements and specifications.

- Whenever you get the appropriate form, just click Buy now.

- Select the prices plan you need, submit the specified information and facts to create your money, and pay money for an order using your PayPal or credit card.

- Pick a hassle-free file structure and down load your duplicate.

Get all the record layouts you have purchased in the My Forms food list. You may get a further duplicate of North Dakota Sample Letter sending Check for Copying Expense at any time, if possible. Just click the essential form to down load or print out the record design.

Use US Legal Forms, one of the most comprehensive variety of legitimate forms, to save lots of some time and prevent faults. The service provides skillfully manufactured legitimate record layouts that can be used for a variety of reasons. Produce a merchant account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

As of 2023, nine states ? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming ? do not levy a state income tax. New Hampshire Department of Revenue Administraton. Frequently Asked Questions - Interest & Dividend Tax.

Some goods are exempt from sales tax under North Dakota law. Examples include most non-prepared food items, food stamps, prescription medications, and medical supplies.

States with no income tax Alaska. Florida. Nevada. South Dakota. Tennessee. Texas. Washington. Wyoming.

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn't tax earned wages.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Income Tax Withholding Returns Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more.

The North Dakota Office of State Tax Commissioner mandates the filing of Form 1099. If the payee is a resident or non-residence of North Dakota. In case the payee is a non-resident of North Dakota, Form 1099 should be filed only if the income is sourced in North Dakota.

While Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming don't impose state income taxes, are they really the best states for taxes?

North Dakota Tax Rates, Collections, and Burdens North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate.

While not having to pay state income tax can save you considerable money, it is only one piece of the financial picture of a place to live. There are several other financial considerations that could affect how affordable a particular state is, including property taxes and the cost of insurance.