A bond placement is the process of selling a new bond issue often to an intitutional investor. For a company in need of financing, this a typical transaction arranged through an investment banker.

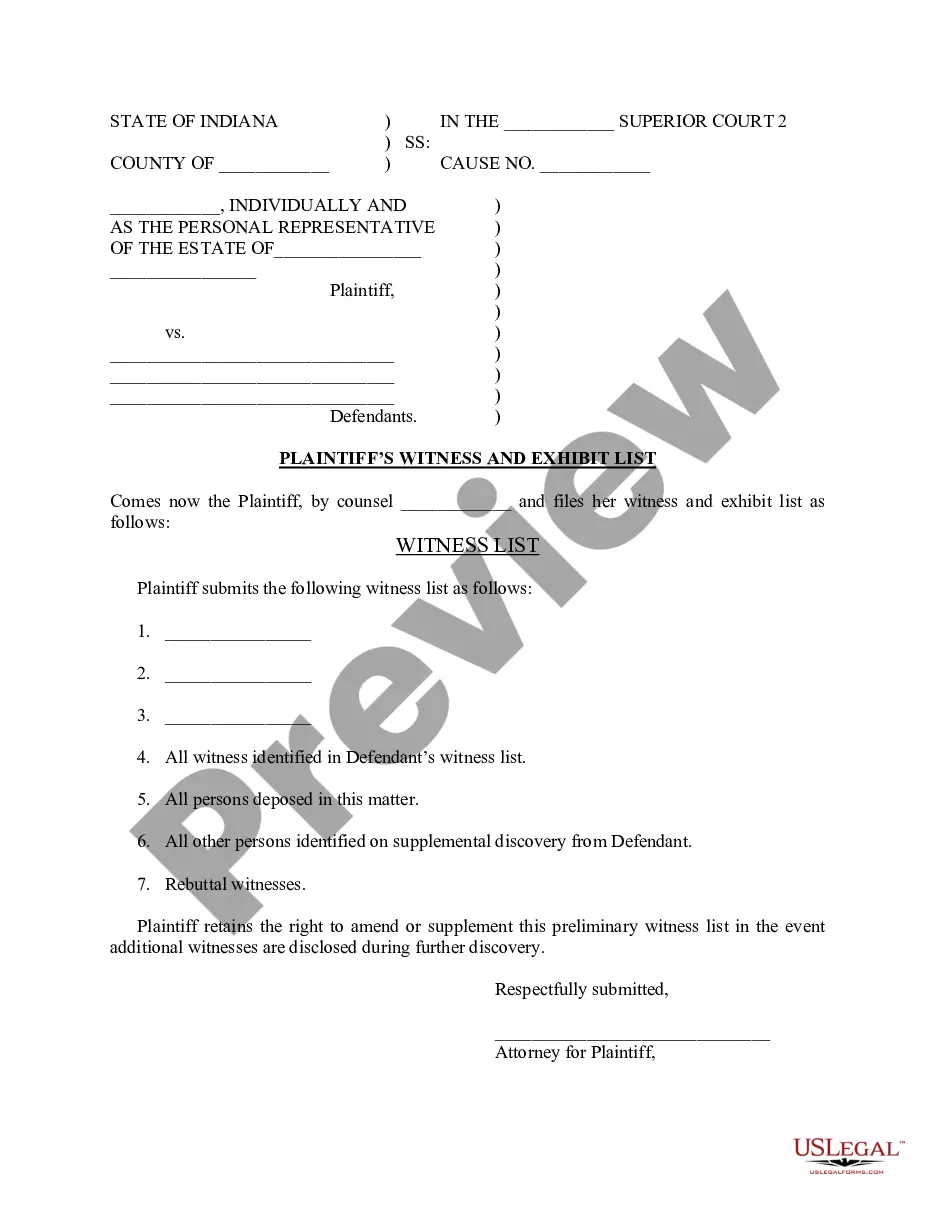

North Dakota Bond placement agreement

Description

How to fill out Bond Placement Agreement?

Choosing the best lawful document template could be a have a problem. Obviously, there are tons of layouts accessible on the Internet, but how will you find the lawful form you need? Use the US Legal Forms website. The support gives thousands of layouts, like the North Dakota Bond placement agreement, which can be used for business and private needs. All the varieties are inspected by specialists and fulfill state and federal needs.

Should you be previously signed up, log in for your account and click the Down load switch to find the North Dakota Bond placement agreement. Use your account to search throughout the lawful varieties you have ordered earlier. Go to the My Forms tab of your account and acquire yet another duplicate of your document you need.

Should you be a whole new consumer of US Legal Forms, here are easy instructions that you should comply with:

- Very first, make sure you have selected the proper form for the city/area. You are able to examine the shape utilizing the Review switch and look at the shape description to guarantee this is basically the best for you.

- In the event the form does not fulfill your requirements, use the Seach discipline to get the proper form.

- When you are sure that the shape is acceptable, click the Buy now switch to find the form.

- Select the rates prepare you want and enter in the required info. Make your account and buy the order with your PayPal account or credit card.

- Select the document file format and acquire the lawful document template for your device.

- Total, revise and print and indicator the obtained North Dakota Bond placement agreement.

US Legal Forms is definitely the biggest local library of lawful varieties in which you can find numerous document layouts. Use the service to acquire professionally-produced files that comply with status needs.

Form popularity

FAQ

The act, among other things, provides that a ?person may not engage in the business of money transmission or advertise, solicit, or hold itself out as providing money transmission unless the person is licensed under this chapter.? The provision does not apply to a ?person that is an authorized delegate of a person ...

Getting a North Dakota contractor license bond is a simple process. Submit details about the bond amount and type to the surety company, and they will provide a quote for your bond premium. Once the premium is paid, the bond is in place until it's time for renewal, typically one or two years after it is issued.

Personal Bond ? The defendant is released under the conditions that they must sign a bond. This means that they will be liable for criminal penalties if they do not appear in court for their trial. Nothing needs to be paid, but they may incur fees and other penalties if they fail to appear for their future court date. What is the difference between Bail and Bond? - Sand Law North Dakota sandlawnd.com ? bail-vs-bond sandlawnd.com ? bail-vs-bond

Do I have to pay for Bondee? The Bondee app is free to download. Everything you need to know about Bondee - NME nme.com ? en_asia ? guides ? gaming-guides nme.com ? en_asia ? guides ? gaming-guides

The taking of bail consists of the acceptance by a competent court or magistrate, or a legally authorized officer, of an undertaking with sufficient sureties for the appearance of the defendant in person, ing to the terms of the undertaking, or that the sureties will pay to the state a specified sum. 29-08-03.1.

Interest received from obligations of the United States or of its possessions and from this state or its political subdivisions is not subject to income tax imposed by this state.

Resident You live in North Dakota full time. You do not live in North Dakota full-time but maintain a home and spend more than 7 months (which is equal to 210 days) of the tax year in North Dakota. The 7-month threshold does not apply to: Resident - North Dakota Office of State Tax Commissioner nd.gov ? news ? resources ? residency nd.gov ? news ? resources ? residency

While many states require vehicle owners to purchase a surety bond as part of the titling process, some don't, such as North Dakota. Am I eligible for a bonded title in my state? Contact your local DMV to determine your eligibility. Many states don't allow for bonded titles. North Dakota Vehicle Title - ZipBonds zipbonds.com ? types-of-surety-bonds ? title-bonds zipbonds.com ? types-of-surety-bonds ? title-bonds