Attorney's fees are assessed in a number of ways, usually set by contract in advance of the representation, including by billable hours, flat fees, or contingent fees. Attorneys who voluntarily accept work on behalf of indigent clients often work pro bono. An upfront fee paid to a lawyer is called a retainer. A contingent fee is a percentage of the monetary judgment or settlement.

The range of fees charged by lawyers varies widely from one city to the next. Most large law firms in the United States bill between $200 and $500 per hour for their lawyers' time, though fees charged by smaller firms are much lower. The rate varies tremendously by location as well as the specific area of law practiced.

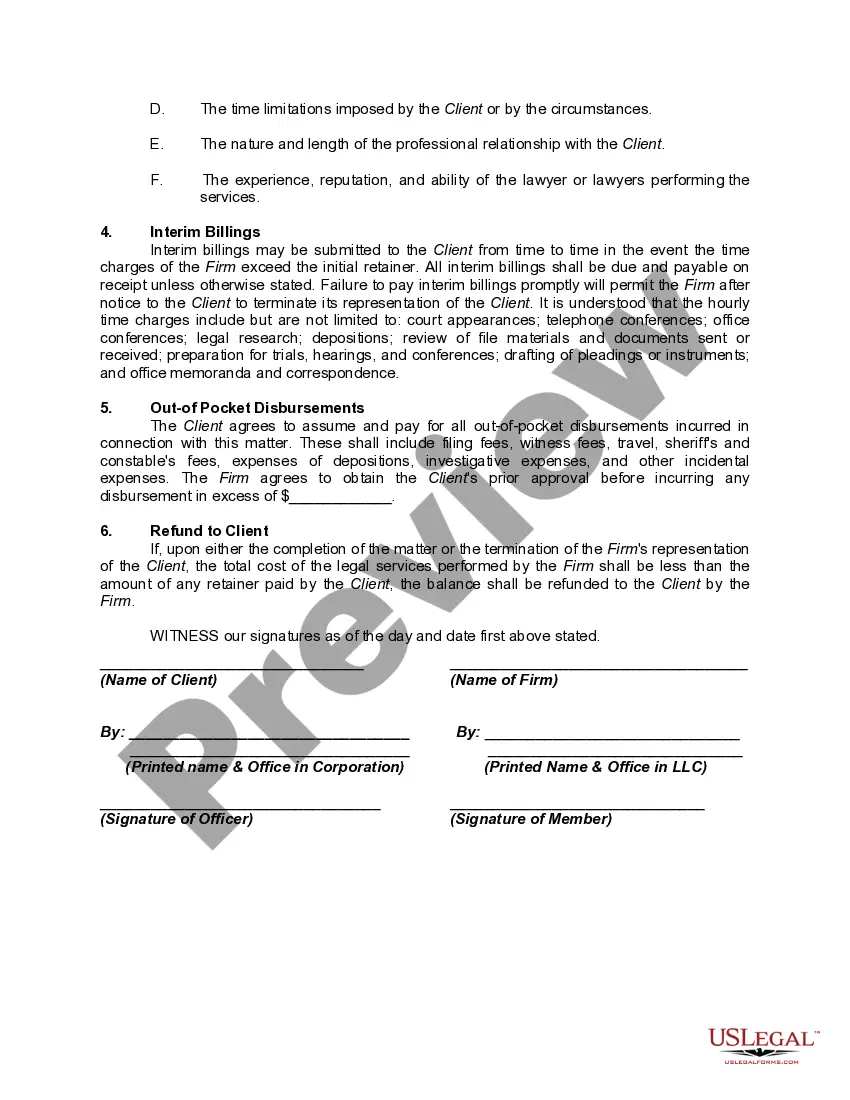

North Dakota Contract to Employ Law Firm — Hourly Fe— - with Retainer: A Complete Guide Overview: A North Dakota Contract to Employ Law Firm, specifically an agreement with an hourly fee structure and a retainer, is a legally binding document that outlines the terms and conditions between a client, typically an individual or business entity, and a law firm based in North Dakota. This agreement ensures the provision of legal services on an hourly basis while also requiring an upfront retainer payment to secure the law firm's services. Keywords: North Dakota, contract, employ law firm, hourly fee, retainer Types of North Dakota Contract to Employ Law Firm — Hourly Fe— - with Retainer: 1. General Law Firm Retainer Agreement: This type of agreement is applicable when a client seeks legal assistance across various legal matters, such as litigation, corporate law, real estate, or family law. The client pays an upfront retainer fee, which is deposited into a trust account and used to cover hourly fees incurred by legal services. The hourly fee structure details the billing rates for attorneys, paralegals, and any additional costs, ensuring transparency in financial matters. 2. Litigation Law Firm Retainer Agreement: Primarily designed for clients involved in complex litigation, this type of agreement focuses on legal representation in courts. It defines the scope of services, such as filing lawsuits, responding to motions, attending hearings, and conducting legal research. Clients engage law firms by paying a retainer fee, ensuring the availability of resources required as the case progresses. The hourly fee structure in this agreement covers activities related to case management, document preparation, or negotiations. 3. Corporate Law Firm Retainer Agreement: Business entities seeking ongoing legal assistance regarding corporate matters such as contracts, intellectual property, regulatory compliance, or mergers and acquisitions may opt for this agreement. By paying a retainer fee, businesses retain a law firm's services for legal advice, drafting or reviewing contracts, forming entities, or other corporate-related matters. The hourly fee structure applies when law firm members participate in meetings, negotiation sessions, or prepare legal documents. 4. Estate Planning Law Firm Retainer Agreement: Individuals or families requiring comprehensive estate planning services, including wills, trusts, power of attorney, or healthcare directives, can enter into this specific agreement. The client pays a retainer fee upfront, securing the law firm's services, and the hourly fee structure covers activities like consultation, document drafting, review, and legal advice. This type of agreement ensures that clients receive personalized attention from experienced estate planning attorneys. 5. Real Estate Law Firm Retainer Agreement: Designed for individuals, businesses, or developers involved in real estate transactions, this agreement covers legal services related to property acquisition, lease agreements, title searches, and due diligence. A retainer fee is paid by the client upfront, and the hourly fee structure applies when the law firm conducts legal research, negotiates terms, drafts or reviews contracts, or resolves disputes related to real estate matters. Conclusion: When engaging a law firm in North Dakota, entering into a Contract to Employ Law Firm — Hourly Fe— - with Retainer is a common practice. These agreements ensure that clients receive professional legal services for their specific needs, with the retainer fee providing security and the hourly fee structure ensuring transparent billing. From general law firm retainer agreements to more specialized types like litigation, corporate, estate planning, or real estate, these contracts serve as a foundation for a strong client-law firm relationship.