North Dakota Indemnification of Buyer and Seller of Business is a legal provision that aims to protect parties involved in a business transaction by transferring the risks and liabilities associated with the business from the seller to the buyer. It ensures that the buyer is safeguarded against any undisclosed or potential risks that may arise after the transaction is completed. In North Dakota, there are two common types of indemnification for the buyer and seller of a business: 1. Full Indemnification: This type of indemnification provides the buyer with complete protection against all claims, liabilities, and losses related to the business before the sale. The seller assumes full responsibility to indemnify the buyer for any financial damages resulting from undisclosed liabilities, pending legal matters, or any other claims that may arise after the sale is finalized. Full indemnification offers the highest level of protection to the buyer. 2. Limited Indemnification: This type of indemnification limits the seller's liability to specific agreed-upon issues, risks, or time period. The terms of limited indemnification are negotiated and outlined in the purchase agreement. Here, the buyer is protected only for the specified risks or liabilities mentioned, while other risks are assumed by the buyer themselves. Limited indemnification may be chosen if the seller wants to reduce their exposure to potential future liabilities or specific risks associated with the business. The North Dakota Indemnification of Buyer and Seller of Business typically includes certain key provisions and clauses to ensure comprehensive protection, such as: 1. Identifiable Claims: Clearly defining the types of claims, liabilities, or losses that would be covered by the indemnification provision, such as tax liabilities, pending lawsuits, contract breaches, or environmental violations. 2. Notice and Defense: Outlining the process for the buyer to provide notice to the seller of any potential claims that may trigger indemnification obligations. It also addresses the seller's duty to defend the buyer against such claims. 3. Limits of Indemnification: Determining any limitations on the amount or duration of indemnity, ensuring there is a cap on the seller's indemnification obligations. This is particularly important in limited indemnification scenarios. 4. Survival Period: Stating the duration for which the indemnification provision remains valid, typically beyond the closing date of the transaction. This enables the buyer to raise indemnification claims within the specified timeframe. 5. Remedies: Describing the available remedies for the buyer in case of breach of the indemnification provision, such as reimbursement of costs, damages, or any other equitable relief. It is crucial for both buyers and sellers of a business in North Dakota to thoroughly review and negotiate the indemnification clauses of a purchase agreement to protect their respective interests and mitigate potential risks. Seeking guidance from legal professionals with experience in business transactions is highly recommended ensuring a fair and comprehensive indemnification provision.

North Dakota Indemnification of Buyer and Seller of Business

Description

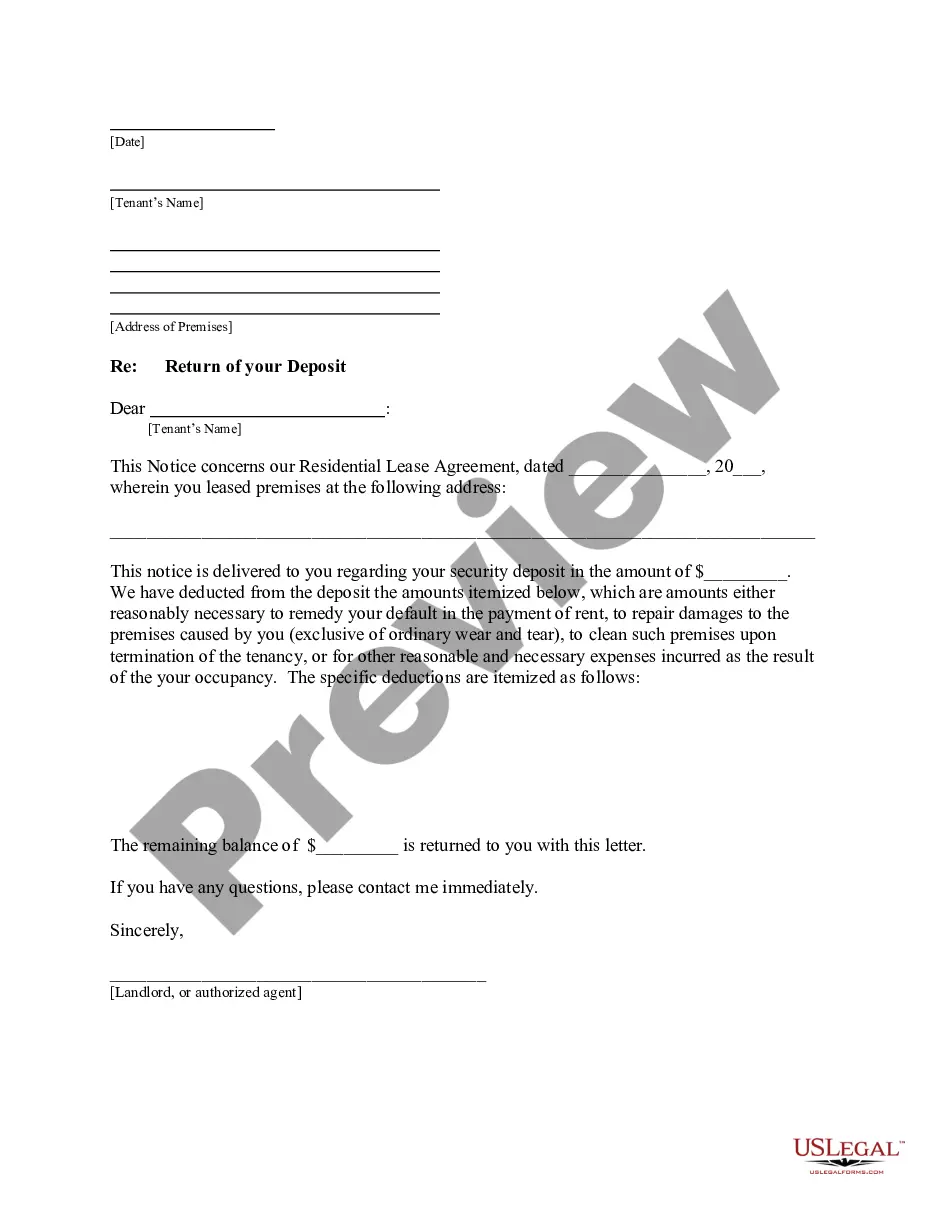

How to fill out North Dakota Indemnification Of Buyer And Seller Of Business?

US Legal Forms - one of the most important compilations of legal documents in the United States - offers a vast selection of legal templates that you can download or print.

Using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest forms such as the North Dakota Indemnification of Buyer and Seller of Business in no time.

If you already have a monthly subscription, Log In and retrieve the North Dakota Indemnification of Buyer and Seller of Business from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill in, modify, print, and sign the saved North Dakota Indemnification of Buyer and Seller of Business. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and select the form you need. Gain access to the North Dakota Indemnification of Buyer and Seller of Business with US Legal Forms, one of the largest collections of legal document templates. Utilize a wide array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you select the correct form for your city/state.

- Click the Review button to examine the form's content.

- Check the form's details to confirm you have selected the correct one.

- If the form does not meet your needs, use the Search field at the top of the screen to find a suitable one.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

Drafting an indemnity agreement involves outlining the specific parties, defining the scope of indemnification, and stating the obligations of each party. For individuals dealing with North Dakota indemnification of buyer and seller of business, it's essential to ensure clarity and mutual understanding within the agreement. Utilizing a platform like uslegalforms can simplify this process, providing templates and legal guidance.

An indemnification request is a formal proposal made by one party, asking for coverage against potential risks or losses incurred during business dealings. In the context of North Dakota indemnification of buyer and seller of business, this request is vital for articulating the type of protection sought. Understanding this process can prevent misunderstandings and foster trust between the parties.

The indemnification clause for the seller protects the seller against claims arising from a buyer's actions or conduct post-sale. When discussing North Dakota indemnification of buyer and seller of business, this clause is important for safeguarding the seller’s interests, ensuring that they are not held liable for issues the buyer may encounter after the transaction.

A request for indemnification is a document that one party submits to another, seeking compensation for specific losses or liabilities. In the framework of North Dakota indemnification of buyer and seller of business, it outlines the circumstances and reasons for the claim. This request is essential for establishing clear boundaries on financial responsibilities.

A request for indemnity is a formal appeal for financial protection against potential liabilities or damages linked to a business agreement. Within North Dakota indemnification of buyer and seller of business, this request helps clarify responsibilities and ensures the parties involved are aware of the implications. A clear understanding fosters a safer business environment.

Seeking indemnification involves requesting protection or compensation for potential losses or damages incurred during a business transaction. In the context of North Dakota indemnification of buyer and seller of business, this means that either party wants assurance that they will not bear financial responsibility for certain claims. It is a crucial step to minimize risks associated with business dealings.

In real estate, indemnity refers to the assurance that one party will compensate another for losses or damages that may arise from the property transaction. This can cover claims related to defects, disputes, or financial liabilities linked to the property. In light of North Dakota indemnification of buyer and seller of business, an effective indemnity agreement can help both buyers and sellers minimize risk and manage their real estate investments with confidence.

To indemnify the owner means to provide financial protection to the owner against losses resulting from specific claims or actions. This can be crucial in business transactions, ensuring that owners remain safeguarded from unforeseen liabilities that might emerge after the sale. Within the context of North Dakota indemnification of buyer and seller of business, this term emphasizes the importance of contractual agreements in protecting both buyers and sellers.

Typically, the party responsible for the indemnity claim will cover the costs associated with it. This is usually the seller, if the claim arises from a breach of warranties or undisclosed liabilities linked to the sale. Understanding the implications of North Dakota indemnification of buyer and seller of business can help clarify financial responsibilities and promote fair business practices.

Indemnification in the sale of a business refers to the legal agreement where one party agrees to protect the other from certain risks linked to the transaction. This may include financial losses due to claims, liabilities, or violations of warranties post-sale. When dealing with North Dakota indemnification of buyer and seller of business, it becomes crucial for both parties to understand their responsibilities and protections to ensure a successful deal.

More info

At Legal Accounting Pragmatic Legal Agencies (Pratt AG).