North Dakota Company Customer Profile Questionnaire

Description

How to fill out Company Customer Profile Questionnaire?

Are you presently in a circumstance where you require files for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template forms, such as the North Dakota Company Customer Profile Questionnaire, designed to comply with federal and state regulations.

Once you locate the correct form, click Get now.

Choose your preferred pricing plan, provide the necessary information to create your account, and complete the purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Company Customer Profile Questionnaire template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the right city/state.

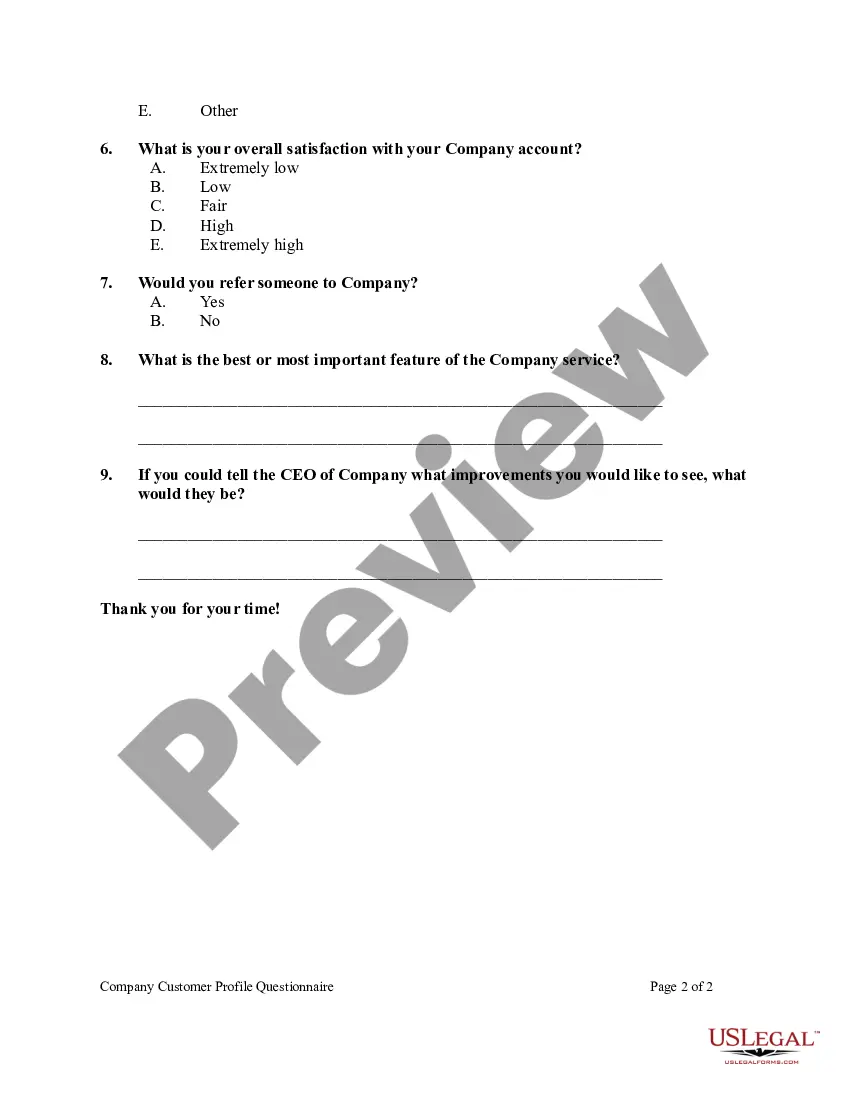

- Use the Review button to examine the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Creating a game and fish account in North Dakota is a straightforward process. Start by visiting the North Dakota Game and Fish Department's website where you'll find the account registration option. Follow the prompts to enter your information and select your preferences. For any inquiries or additional guidance, accessing the North Dakota Company Customer Profile Questionnaire can help clarify the requirements for outdoor activities.

To find out if a business name is taken by the IRS, you can review the IRS's database, but note that they don’t maintain real-time records like the state. Instead, start by checking with the Secretary of State’s website for registered names. Securing accuracy early on can save you time and hassle later. Using the North Dakota Company Customer Profile Questionnaire can provide clarity and guidance throughout this search.

Finding out if a business name is already taken involves searching the state database maintained by the Secretary of State. You can perform a business name lookup online for quick results. This step is essential for anyone looking to establish a new business. Additionally, the North Dakota Company Customer Profile Questionnaire can help provide a structured approach to the necessary steps.

You can check if a business name is taken in North Dakota by accessing the online tool provided by the Secretary of State. Simply enter the business name you’re considering to see if it is already registered. This search is crucial in avoiding potential legal issues. For a comprehensive overview, the North Dakota Company Customer Profile Questionnaire can offer valuable resources throughout your search.

Starting an LLC in North Dakota involves several steps, including choosing a unique LLC name and filing the Articles of Organization with the Secretary of State. Additionally, you will need to create an Operating Agreement and obtain any necessary licenses or permits. Using the North Dakota Company Customer Profile Questionnaire can simplify this process by providing clear steps and required information, ensuring you get everything right.

To determine if a business name is available in North Dakota, utilize the North Dakota Secretary of State's online business name search tool. Enter your desired business name to see if it’s already taken or if variations are available. It's beneficial to confirm availability before filing any paperwork. The North Dakota Company Customer Profile Questionnaire can guide you through this process effectively.

You can check if a business exists in North Dakota by visiting the Secretary of State's website. They offer a business entity search tool that allows you to search by name or ID. This tool is straightforward and efficient, helping you verify the status of any business you investigate. Utilizing the North Dakota Company Customer Profile Questionnaire can provide additional insights about the companies you find.

Yes, if you plan to conduct business in North Dakota, you must register your business with the state. This applies to all types of business entities, including corporations, LLCs, and partnerships. Registration ensures compliance with state regulations and can help you avoid potential penalties. To facilitate this process, the North Dakota Company Customer Profile Questionnaire can provide tailored guidance specific to your business needs.

The supplemental tax rate in North Dakota typically applies to certain types of income, such as income from partnerships or other pass-through entities. This rate is designed to ensure that all sources of income are properly taxed. For more detailed and personalized information on your specific situation, consider using the North Dakota Company Customer Profile Questionnaire, which can help clarify tax obligations.

A composite return works by aggregating the income of all non-resident partners into one tax return filed by the partnership. This return reports the income and pays the necessary tax on behalf of all partners. As a result, individual partners do not need to file separate North Dakota tax returns. The North Dakota Company Customer Profile Questionnaire can guide you through the specifics of this process.