North Dakota Sample Letter Requesting Signature for Annual Corporate Report Forms

Description

How to fill out Sample Letter Requesting Signature For Annual Corporate Report Forms?

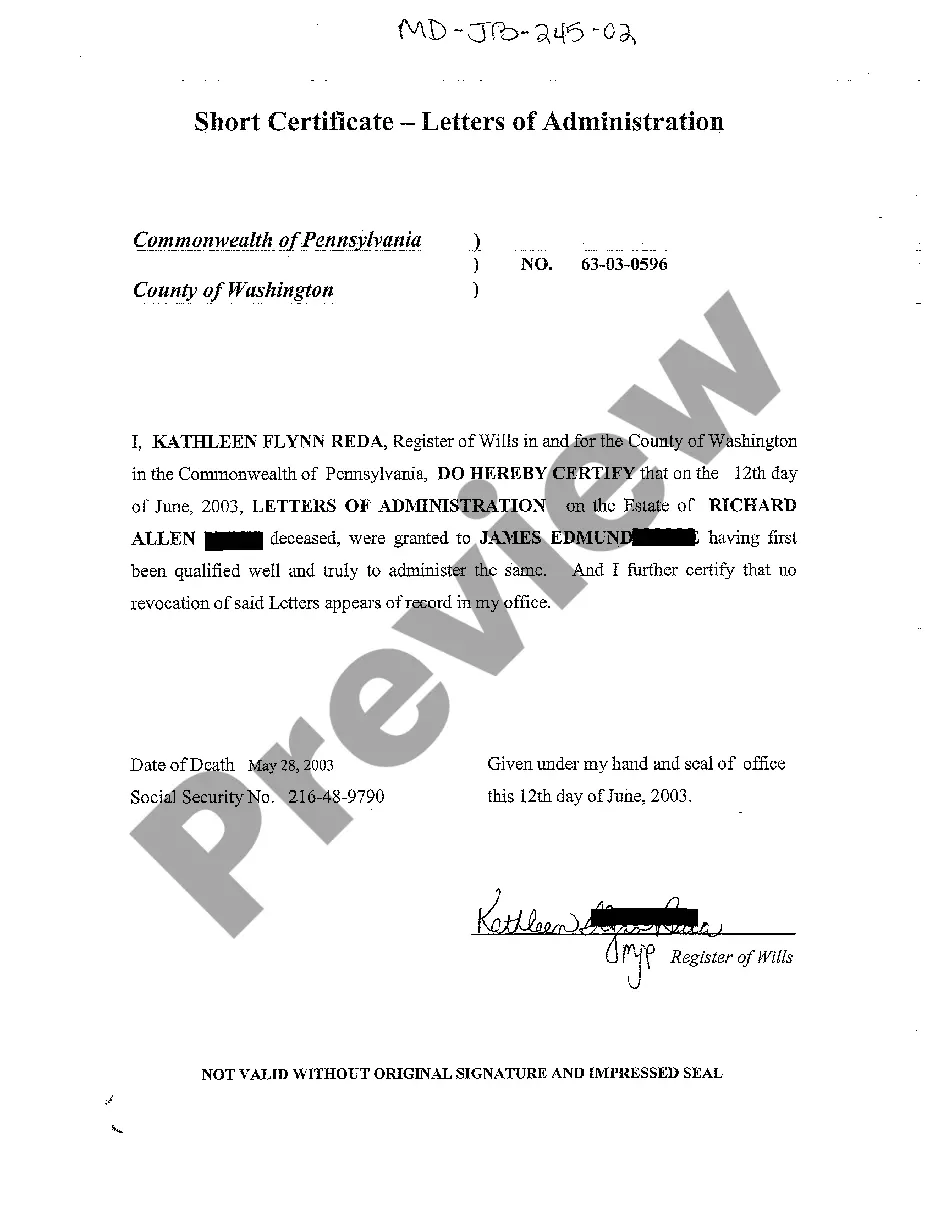

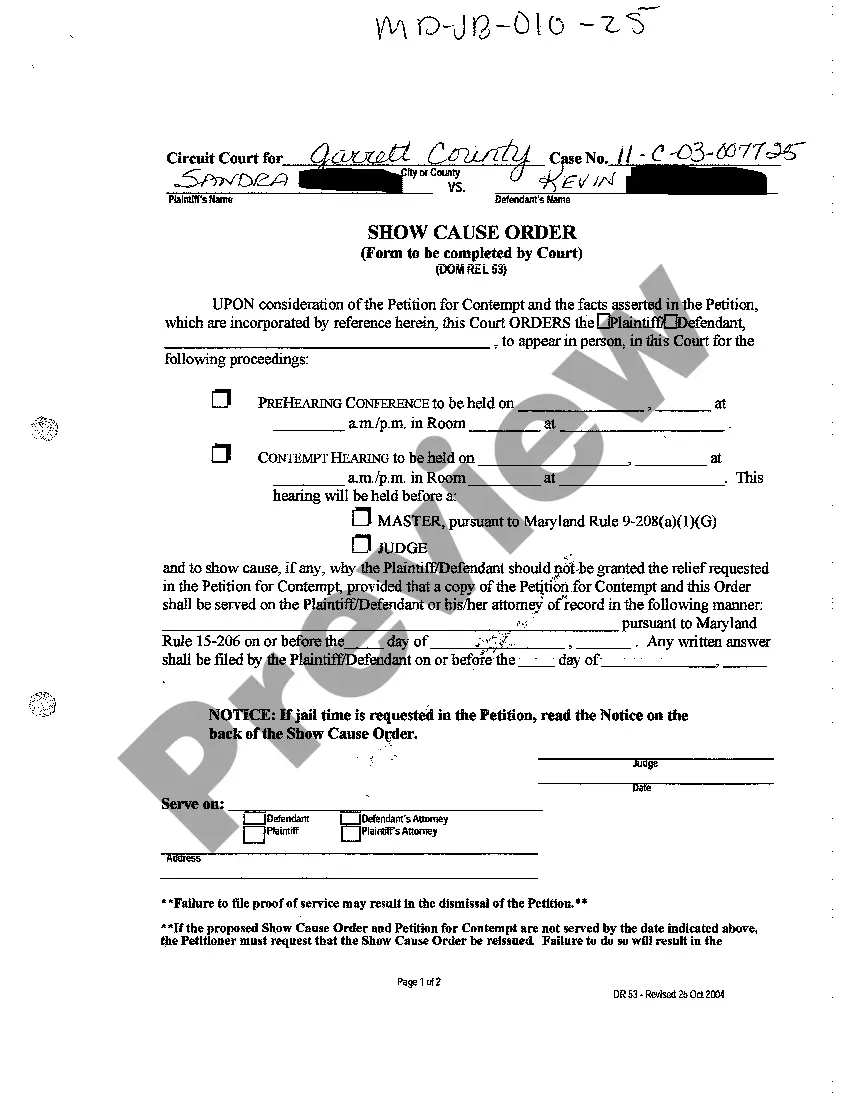

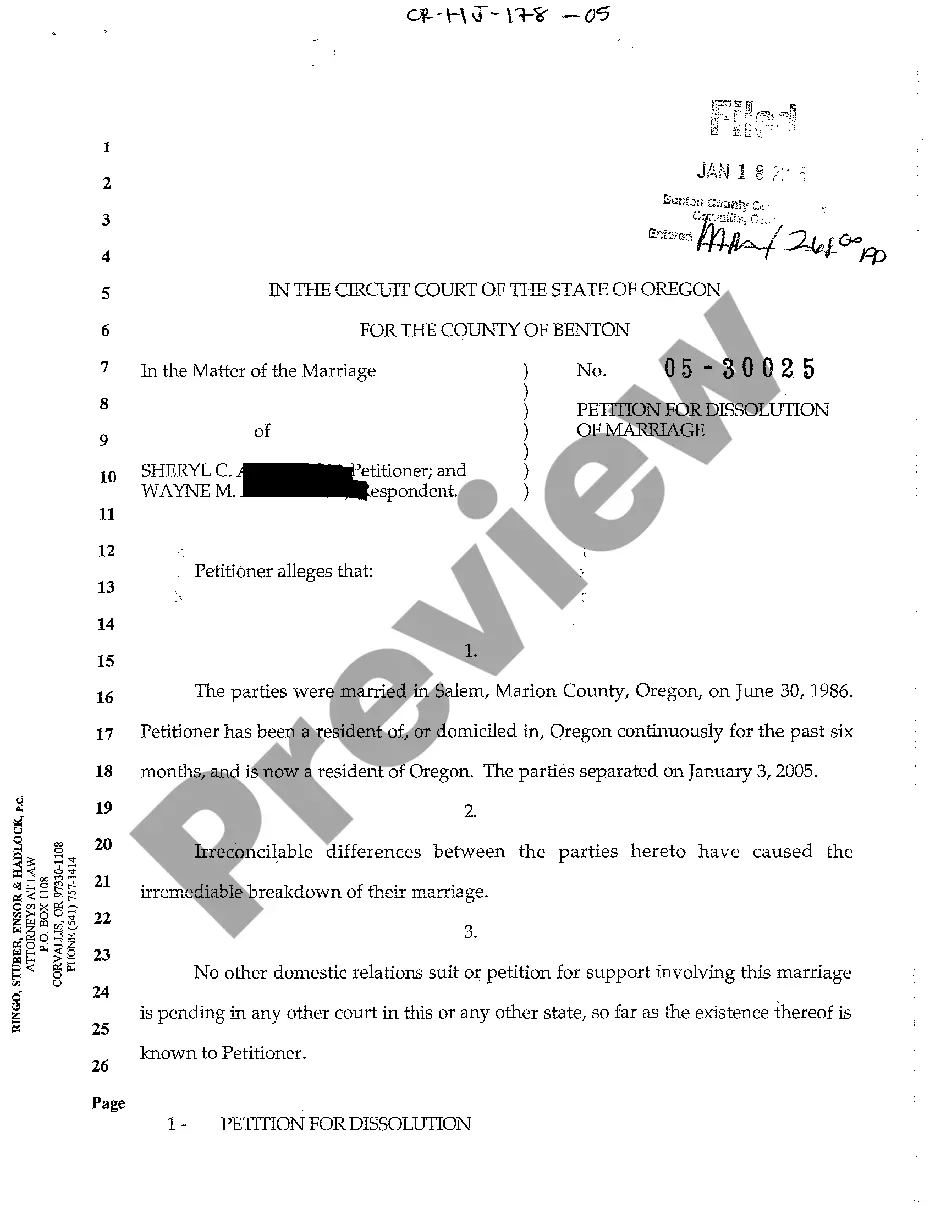

Choosing the best legitimate papers format could be a struggle. Naturally, there are tons of themes available on the net, but how do you discover the legitimate develop you want? Use the US Legal Forms site. The assistance delivers a huge number of themes, for example the North Dakota Sample Letter Requesting Signature for Annual Corporate Report Forms, which can be used for business and private demands. All the varieties are inspected by professionals and satisfy state and federal demands.

Should you be presently signed up, log in in your account and click the Acquire option to find the North Dakota Sample Letter Requesting Signature for Annual Corporate Report Forms. Use your account to appear throughout the legitimate varieties you might have ordered formerly. Proceed to the My Forms tab of your account and get another version from the papers you want.

Should you be a fresh user of US Legal Forms, listed here are basic directions for you to stick to:

- First, be sure you have chosen the correct develop for the town/state. You are able to look over the shape making use of the Preview option and browse the shape explanation to make sure this is basically the right one for you.

- When the develop does not satisfy your requirements, use the Seach discipline to find the appropriate develop.

- When you are certain that the shape is acceptable, click on the Purchase now option to find the develop.

- Opt for the pricing program you would like and enter in the needed information and facts. Design your account and purchase the order using your PayPal account or bank card.

- Pick the submit structure and obtain the legitimate papers format in your product.

- Full, change and printing and signal the obtained North Dakota Sample Letter Requesting Signature for Annual Corporate Report Forms.

US Legal Forms may be the greatest collection of legitimate varieties that you will find various papers themes. Use the service to obtain appropriately-manufactured documents that stick to express demands.

Form popularity

FAQ

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information.

An annual report must be completed on FirstStop and may be filed online with a credit card payment or it may be printed and mailed with a check, cashier's check, or money order payable to "Secretary of State."

A certificate of good standing may be requested online with a credit card payment through FirstStop, the Secretary of State's online filing system, or upon written request or by phone if payment is made by check, cashier's check, or money order payable to ?Secretary of State.? A certificate of fact is not available ...

North Dakota Articles of Organization are what you file when you are forming an LLC in the state. Without this filing, your LLC will not be able to conduct business in North Dakota.

North Dakota Transmittal Of Wage And Tax Statement.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone or in person, but we recommend calling. Normal processing takes up to 2 days, plus additional time for mailing, and costs approximately $20 plus .

North Dakota LLC Cost. Starting an LLC in North Dakota will cost $135. Your state annual report will cost $50, but since that's a once-a-year fee, you can budget for that later. Basically you can start an LLC in North Dakota for under two hundred bucks, and that's pretty awesome.

There are two filing options when you dissolve your North Dakota LLC. You can file either the Articles of Dissolution by Organizers or the Articles of Dissolution by Members. The Articles of Dissolution by Organizers does not require the filing of a Notice of Dissolution with the North Dakota Secretary of State (SOS).