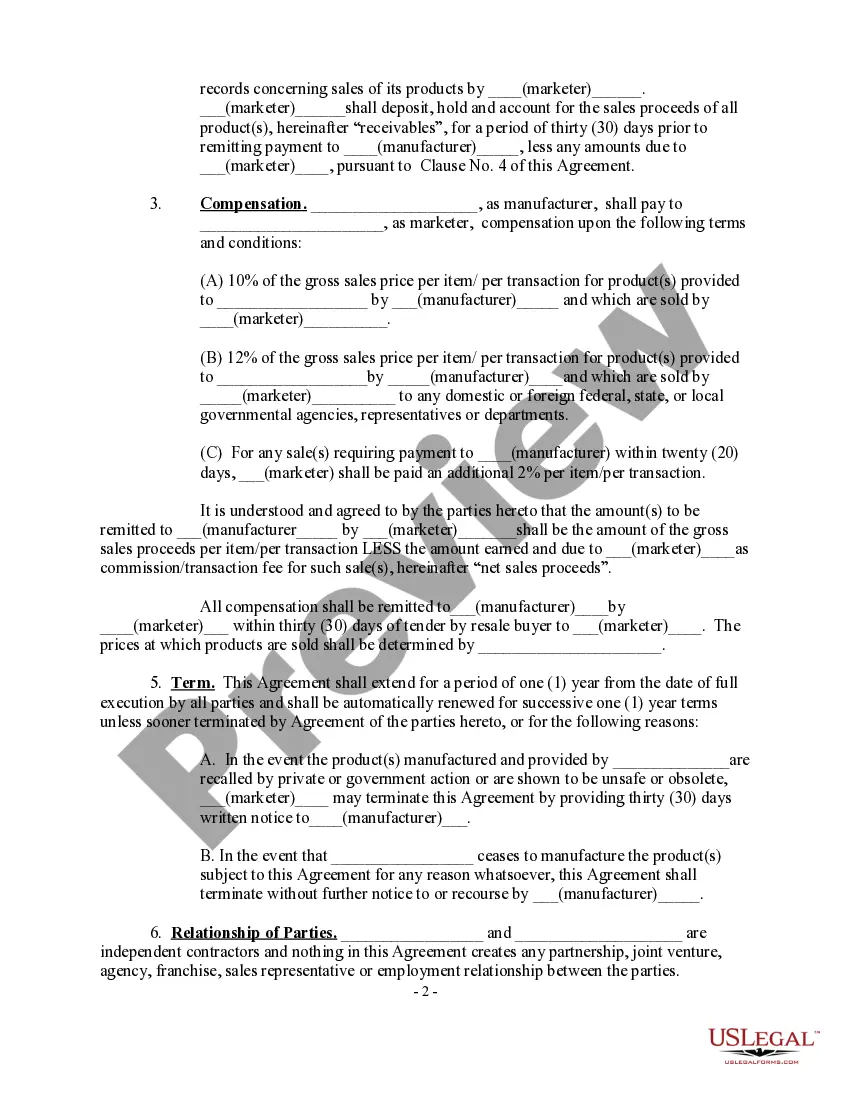

North Dakota Marketing and Participating Internet Agreement

Description

How to fill out Marketing And Participating Internet Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal paper templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the North Dakota Marketing and Participating Internet Agreement within moments.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- If you have a monthly subscription, Log In and download the North Dakota Marketing and Participating Internet Agreement from your US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/region.

- Select the Preview button to examine the form's content.

Form popularity

FAQ

Yes, North Dakota does offer an automatic extension for filing returns. However, it is essential to file the extension request correctly to avoid penalties. For thorough guidance on this process, the North Dakota Marketing and Participating Internet Agreement provides valuable insights.

Yes, obtaining a business license is generally required in North Dakota, depending on your business type. Different sectors may have different licensing requirements. For clarity on your specific needs, reference the North Dakota Marketing and Participating Internet Agreement, as it provides valuable information on compliance.

Yes, North Dakota does recognize Pass-Through Entities (PTE) for taxation purposes. This allows income from partnerships and S corporations to be passed directly to the owners without being taxed at the corporate level. Understanding the implications under the North Dakota Marketing and Participating Internet Agreement can be beneficial for business owners.

Yes, partnerships can file for an extension on their tax returns. This gives them additional time to prepare their taxation documents. Familiarizing yourself with the North Dakota Marketing and Participating Internet Agreement can help streamline this process.

Yes, North Dakota accepts federal extensions for partnership tax returns. When you file for an extension federally, it typically carries over to the state level. However, it's always recommended to review specific guidelines under the North Dakota Marketing and Participating Internet Agreement to ensure all requirements are met.

A composite return in North Dakota allows partnerships to file taxes on behalf of their non-resident partners. This simplifies tax obligations for individuals who do not reside in the state. If you are involved with partnerships, understanding the North Dakota Marketing and Participating Internet Agreement can provide clarity on tax responsibilities.

Starting a cleaning business in North Dakota involves several steps, including registering your business name and obtaining necessary licenses. It's crucial to understand the local market and customer needs. Utilizing resources like the North Dakota Marketing and Participating Internet Agreement can help you navigate marketing strategies effectively.

Yes, a federal extension applies to income tax returns for all states, including North Dakota. However, it is important to check specific state requirements to ensure compliance. The North Dakota Marketing and Participating Internet Agreement outlines the nuances of tax filings, so make sure to stay informed.

Yes, most businesses operating in North Dakota need to obtain a business license. This requirement helps ensure that businesses comply with local laws and regulations. For anyone engaging in the North Dakota Marketing and Participating Internet Agreement, having the proper licensing is critical to building trust and credibility in your target market.

The Nexus threshold in North Dakota establishes the point at which a business has a sufficient connection to the state for tax purposes. This generally includes having physical presence, employees, or a certain level of sales within the state. For businesses engaged in the North Dakota Marketing and Participating Internet Agreement, understanding your Nexus position is vital for compliance and ensuring the success of your marketing strategies.