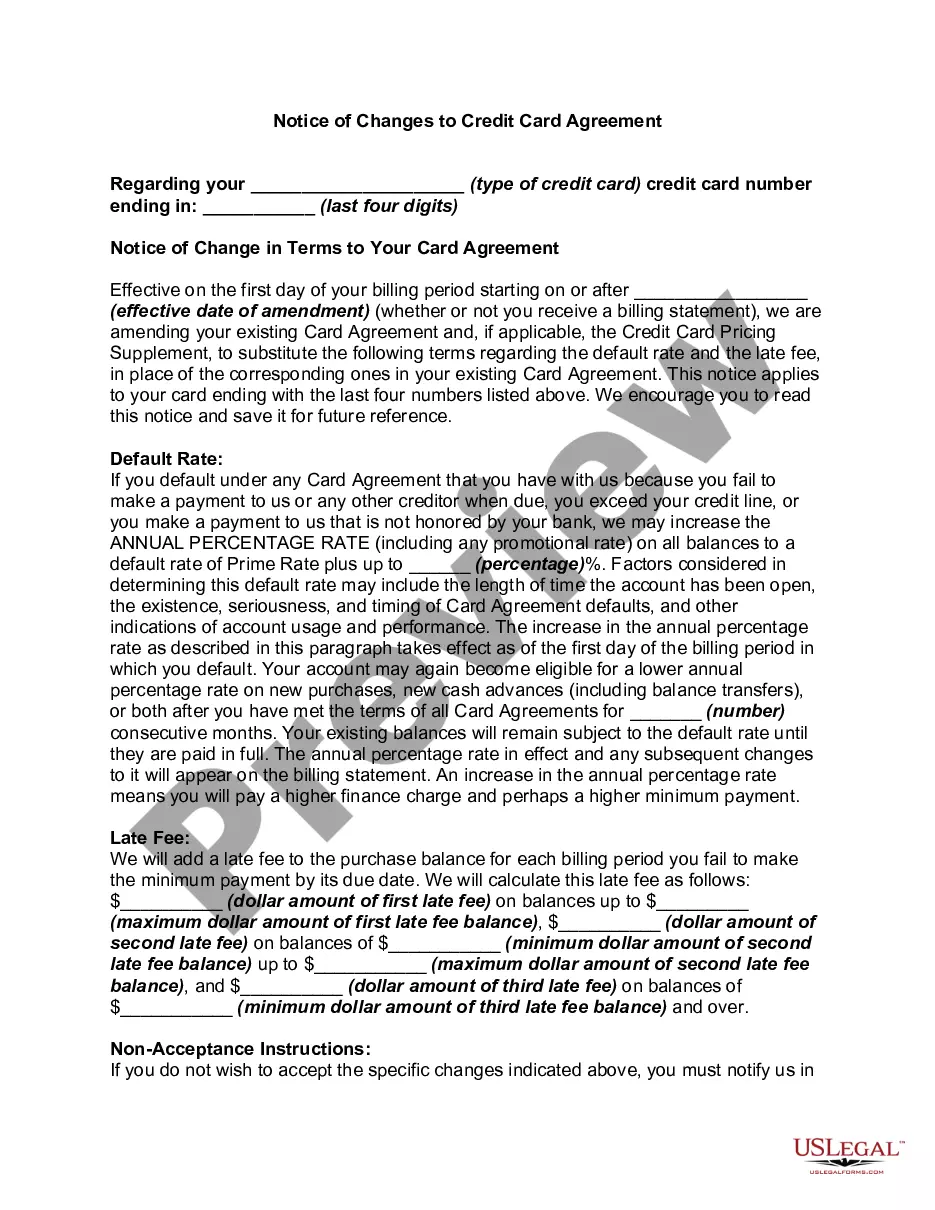

North Dakota Notice of Changes to Credit Card Agreement: Understanding the Terms and Conditions A North Dakota Notice of Changes to Credit Card Agreement is a document that outlines the modifications being made to the terms and conditions of a credit card agreement issued to residents of North Dakota. It serves as a legally binding notice between the credit card issuer and the cardholder, informing them of any changes that might affect their rights, obligations, or fees associated with the credit card. There are different types of North Dakota Notice of Changes to Credit Card Agreement, each addressing specific aspects of the agreement. Some common categories include: 1. Interest Rate Modifications: This type of notice informs cardholders about any changes made to the interest rates associated with their credit cards. Common reasons for these adjustments might include changes in the prime rate or a cardholder's creditworthiness. It specifies how the changes impact both new and existing balances. 2. Fee Adjustments: This notice category describes changes regarding various fees payable by the cardholder. Examples include annual fees, late payment fees, cash advance fees, foreign transaction fees, and penalty fees. The notice details the updated fee amounts, providing transparency and allowing cardholders to plan their finances accordingly. 3. Term Modifications: These notices pertain to changes concerning the general terms and conditions of the credit card agreement. They might include alterations to grace periods, billing cycles, dispute resolution processes, and other terms that govern the relationship between the cardholder and the credit card issuer. 4. Credit Limit Adjustments: This category involves any alterations made to the credit limits assigned to cardholders. It notifies them of changes in the maximum credit amount available for usage, which impacts their purchasing power and borrowing capacity. It is crucial for cardholders to thoroughly review each North Dakota Notice of Changes to Credit Card Agreement they receive. By doing so, they can understand the adjustments made to their credit card terms and conditions, allowing them to make informed financial decisions and proactively manage their credit. When analyzing these notices, cardholders should pay attention to the effective date of the changes, as well as any opt-out options available to them. Some agreements may provide an opportunity to decline the proposed modifications, but this often results in the account closure or termination of certain benefits associated with the credit card. In conclusion, a North Dakota Notice of Changes to Credit Card Agreement serves as a vital communication tool between credit card issuers and North Dakota residents. By providing explicit details about modifications to interest rates, fees, terms, and credit limits, these notices empower cardholders to understand and adapt to any changes affecting their financial obligations and benefits.

North Dakota Notice of Changes to Credit Card Agreement

Description

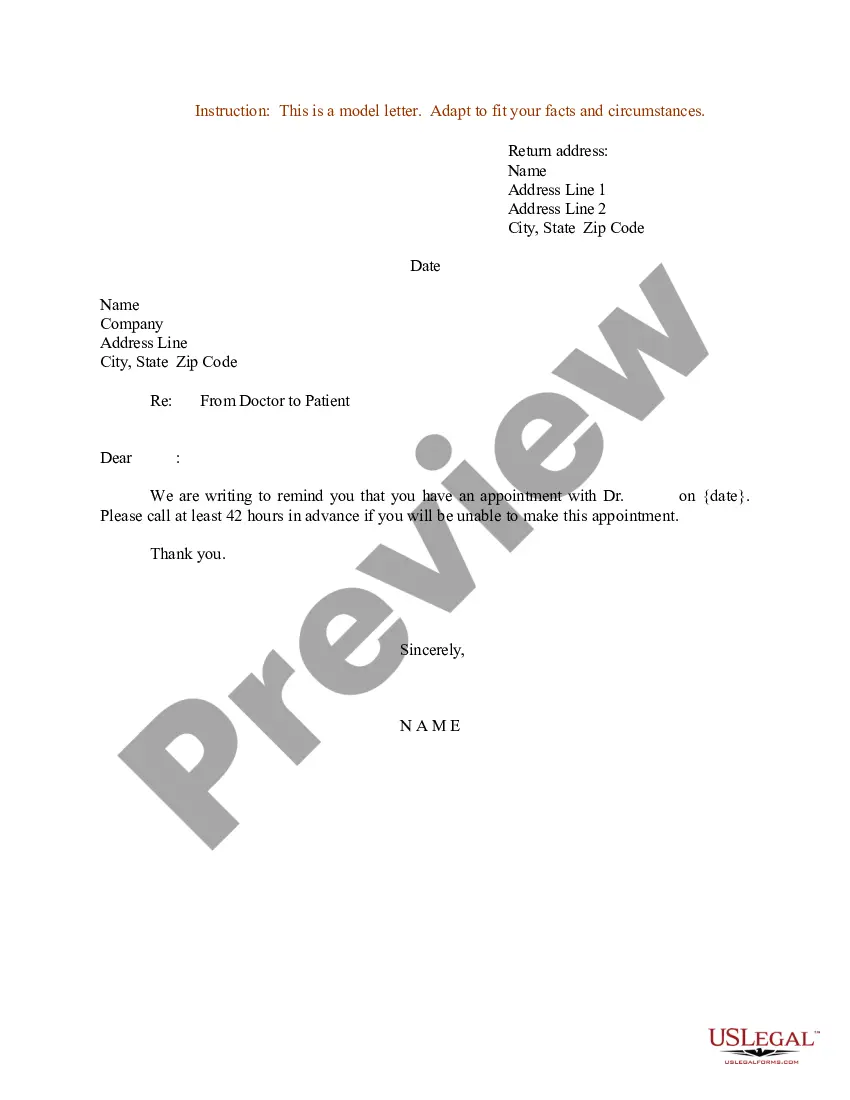

How to fill out North Dakota Notice Of Changes To Credit Card Agreement?

If you want to total, down load, or produce legitimate document layouts, use US Legal Forms, the biggest assortment of legitimate types, which can be found online. Utilize the site`s easy and hassle-free research to find the papers you want. Various layouts for organization and individual functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to find the North Dakota Notice of Changes to Credit Card Agreement in a number of click throughs.

In case you are presently a US Legal Forms buyer, log in to the account and click the Acquire switch to obtain the North Dakota Notice of Changes to Credit Card Agreement. Also you can access types you earlier downloaded from the My Forms tab of your own account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the appropriate town/country.

- Step 2. Use the Preview option to examine the form`s content material. Do not overlook to see the outline.

- Step 3. In case you are unsatisfied with all the develop, make use of the Look for discipline towards the top of the monitor to get other models from the legitimate develop template.

- Step 4. After you have discovered the shape you want, select the Acquire now switch. Select the costs program you like and add your qualifications to register for an account.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Select the file format from the legitimate develop and down load it on your own product.

- Step 7. Full, modify and produce or signal the North Dakota Notice of Changes to Credit Card Agreement.

Each legitimate document template you purchase is your own permanently. You possess acces to every develop you downloaded in your acccount. Click on the My Forms area and pick a develop to produce or down load again.

Remain competitive and down load, and produce the North Dakota Notice of Changes to Credit Card Agreement with US Legal Forms. There are millions of expert and condition-specific types you may use for your organization or individual needs.

Form popularity

FAQ

The statute of limitations for actions on notes and contracts, including credit card debt, is six years. N.D. CENT. CODE §§ 28-01-16; 41-03-18.

North Dakota has $23.4 billion of assets available to pay the state's bills totaling $10.5 billion. North Dakota has $12.8 billion available after bills have been paid, which breaks down to $47,400 per taxpayer.

In the fiscal year of 2019, the state of North Dakota had state debt totaling 3.04 billion U.S. dollars. However, the local government debt was slightly higher at 5.38 billion U.S. dollars.

The North Dakota Department of Financial Institutions is responsible for chartering, regulating, and examining North Dakota state-chartered banks, credit unions, and trust companies.

North Dakota ranks 46th in economy size among states and Washington, DC. In 1st quarter of 2023, North Dakota accounted for 0.3% of the US economy.

Debt collectors in North Dakota must be licensed and bonded; noncompliance can result in felony charges. North Dakota imposes a six-year statute of limitations on most debts, preventing legal action beyond this period.

Agriculture is the leading industry sector in North Dakota and points clearly to the extraordinarily important role North Dakota plays in raising crops and livestock to feed the world's growing population and meet increasing demands for renewable energy and life science applications.

Overview of the North Dakota Economy The top three sectors by total employment are Mining, Agriculture, Forestry, Fishing and Hunting, Real Estate and Rental and Leasing, while the unemployment rate across the state in 2022 was 2.8%.