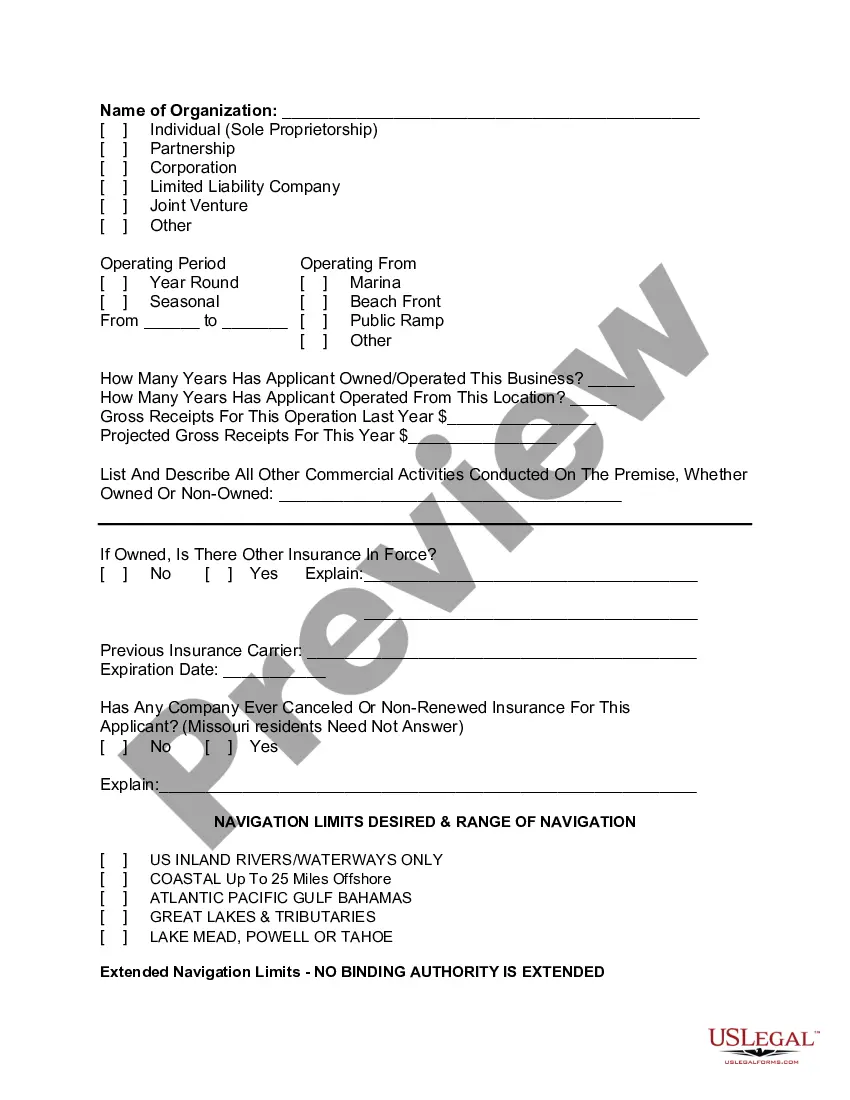

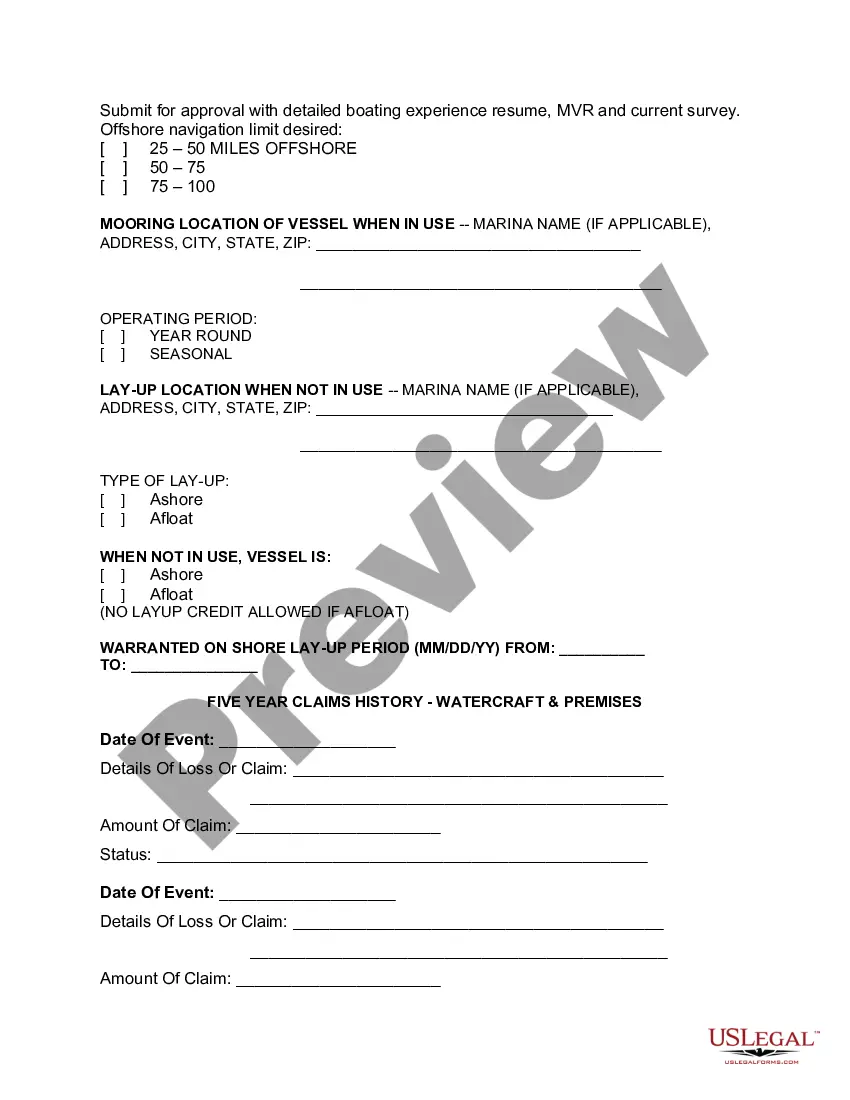

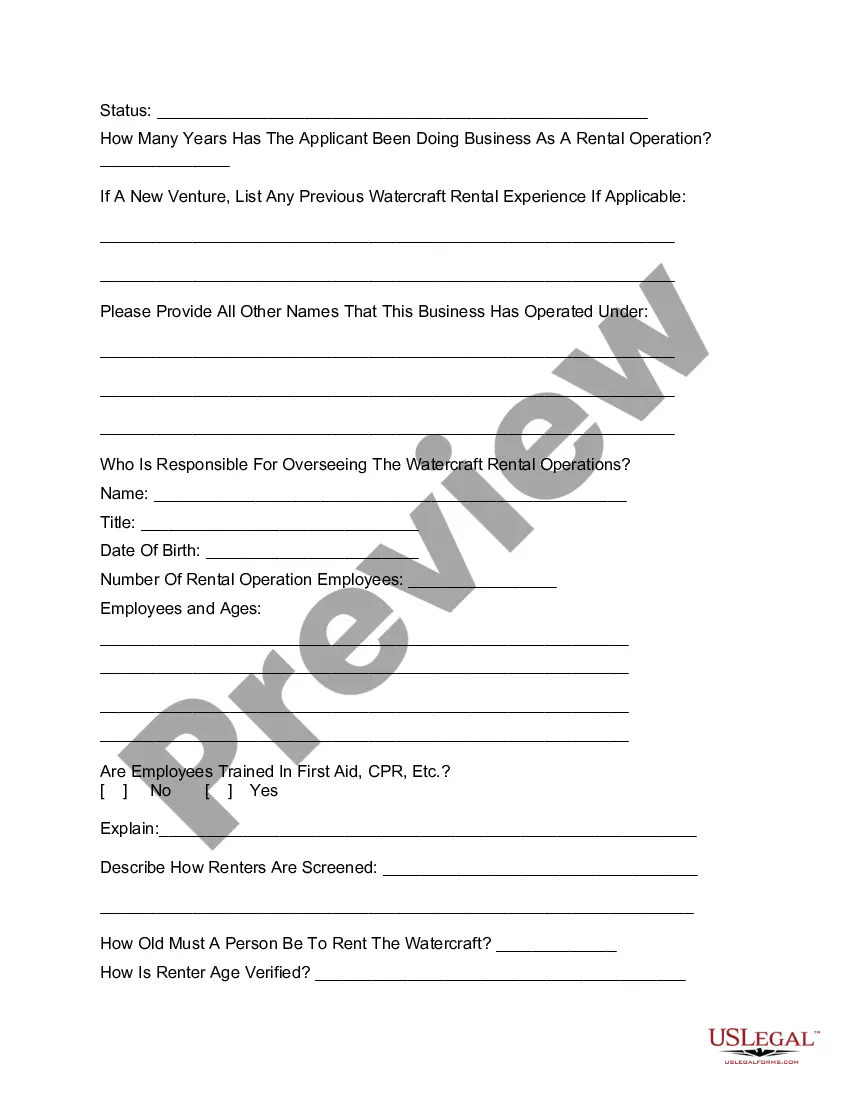

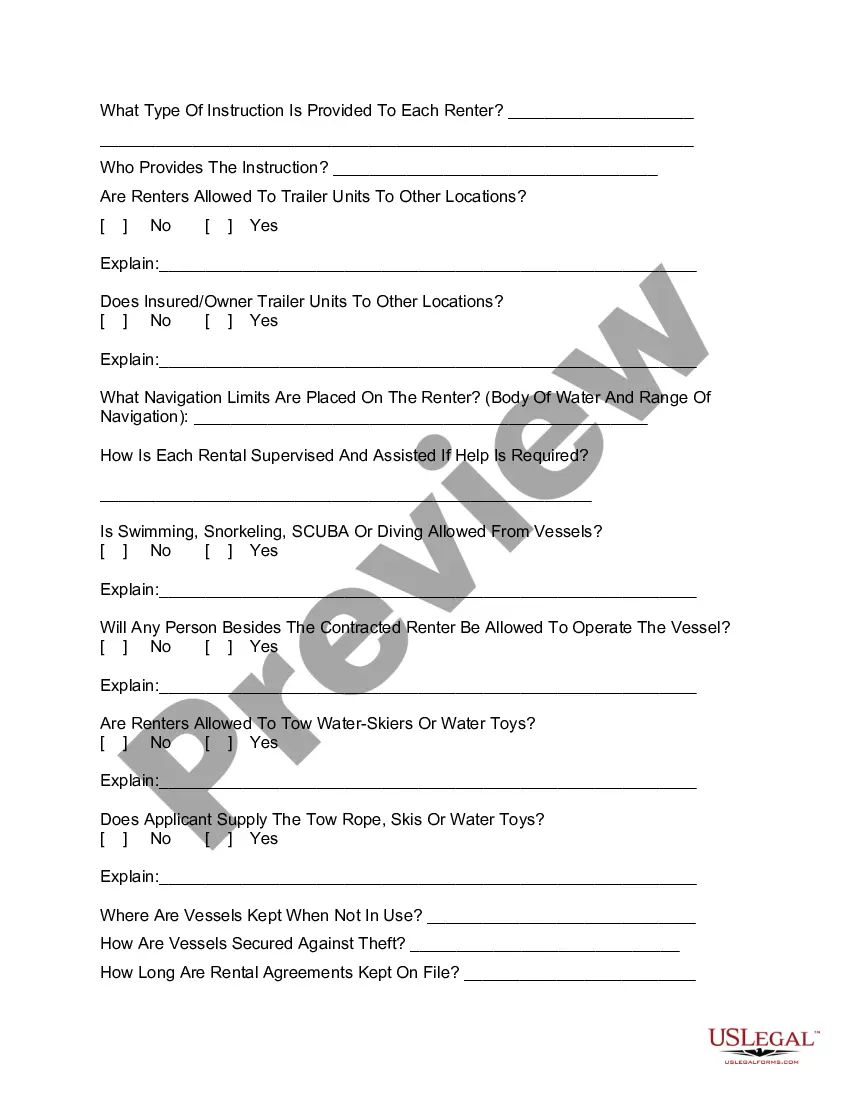

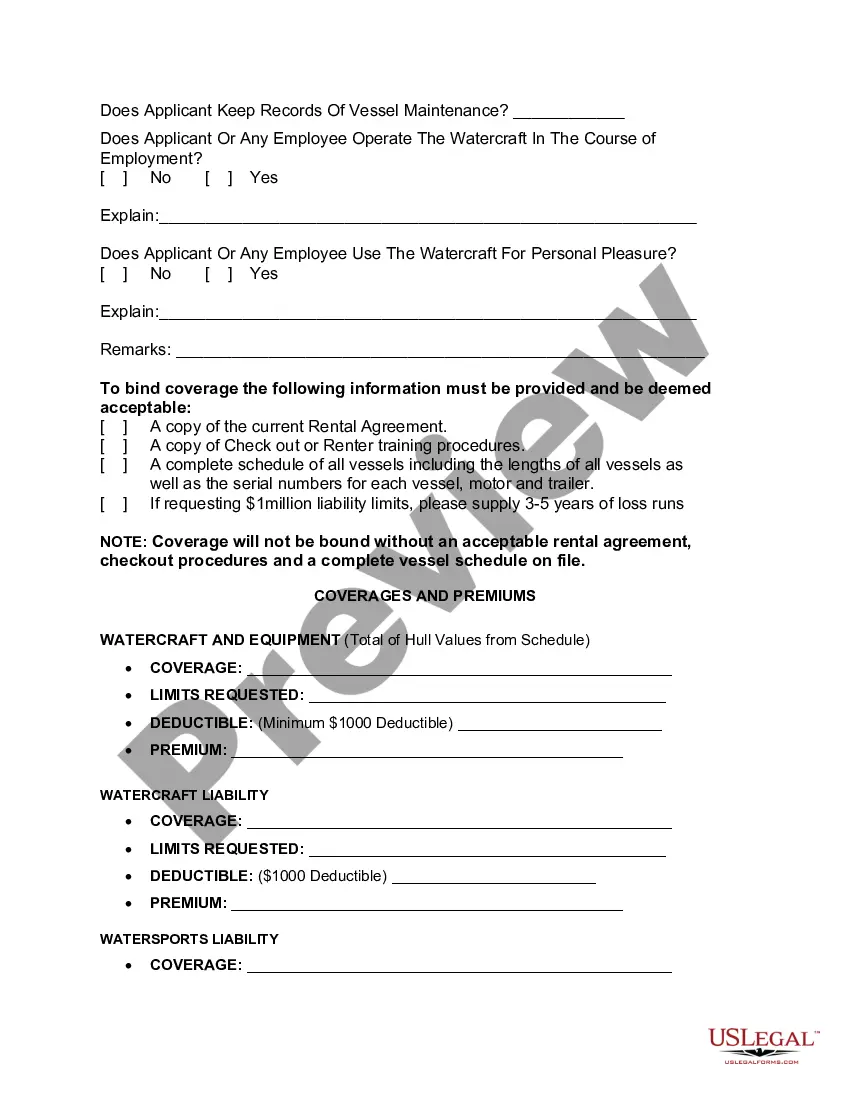

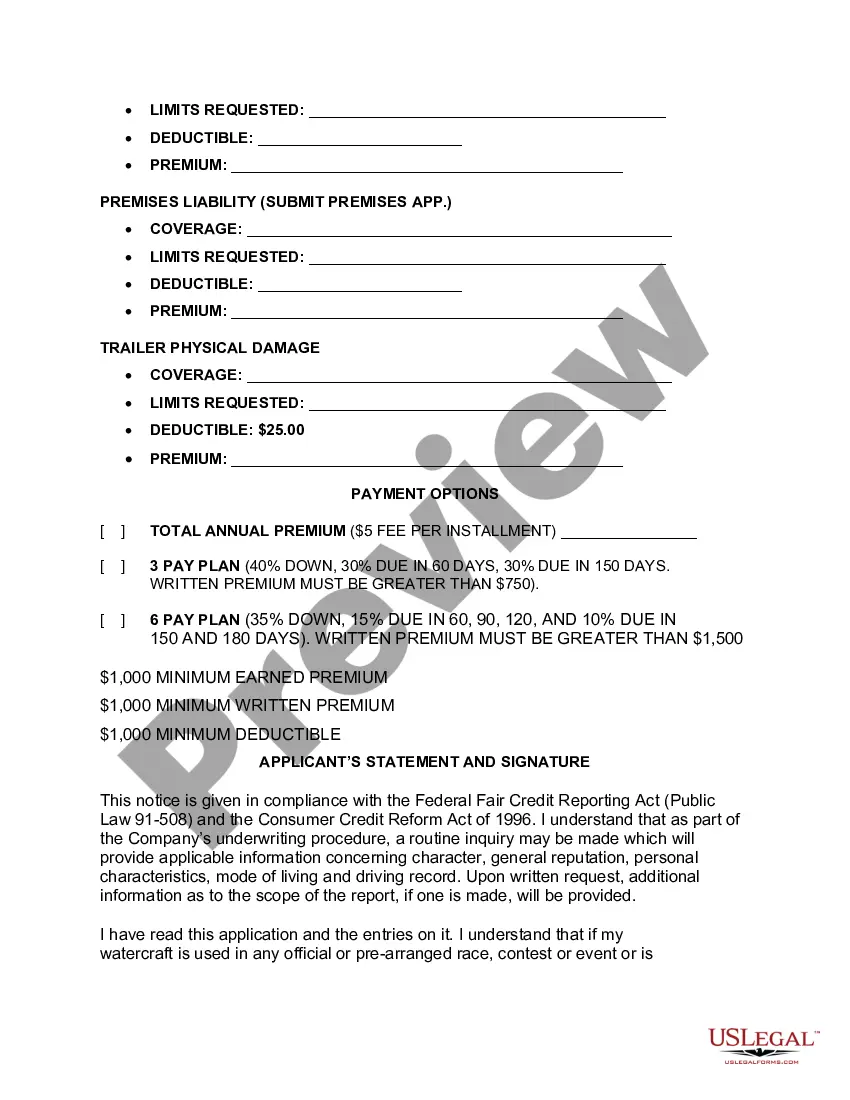

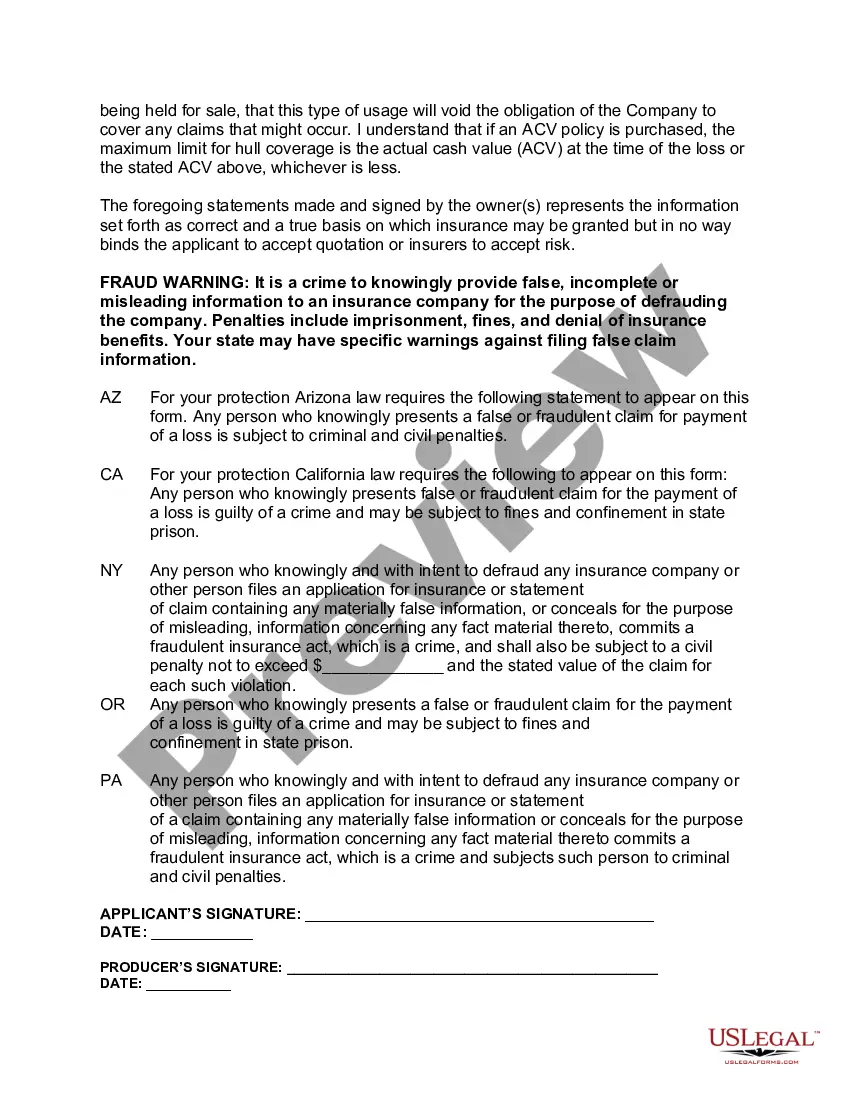

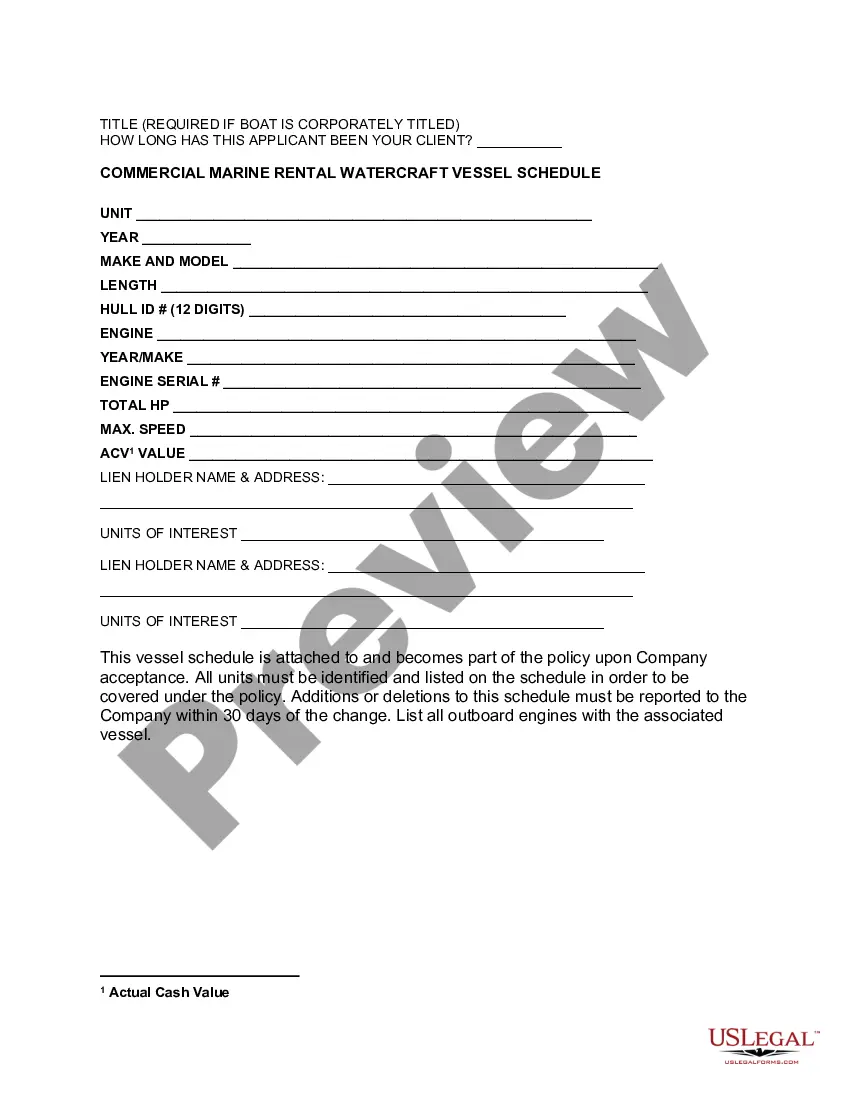

North Dakota Commercial Watercraft Rental Insurance Application is a comprehensive form designed to provide insurance coverage for businesses involved in renting out watercraft in North Dakota. This type of insurance is specifically tailored to protect commercial watercraft rental operators from potential liabilities and risks associated with their business operations. Keywords: North Dakota, commercial, watercraft rental, insurance, application, coverage, liabilities, risks, business operations. Different types of North Dakota Commercial Watercraft Rental Insurance Applications include: 1. Liability Coverage Application: This application focuses on providing coverage for bodily injury or property damage caused to third parties while renting out watercraft. It ensures that the commercial watercraft rental operator is financially protected in case of an accident or injury involving their rented watercraft. 2. Property Coverage Application: This application is specifically designed to protect the physical assets owned by the commercial watercraft rental operator, such as the watercraft, equipment, trailers, docks, and other property used in their business. It covers losses or damages caused by perils like fire, theft, vandalism, or natural disasters. 3. Watercraft Damage or Theft Application: This type of application focuses on providing coverage for damages or total loss of the rented watercraft due to accidents, theft, or other covered risks. It helps the rental operator recover the costs of repairs, replacement, or the watercraft's actual cash value in case of a loss. 4. Pollution Coverage Application: This application is crucial for businesses involved in watercraft rental, as it provides coverage for liabilities arising from accidental spills, discharge, or pollution caused by the rented watercraft. It helps cover the costs of cleanup, restoration, and legal expenses if pollution incidents occur. 5. Personal Injury Coverage Application: This application addresses coverage for personal injuries suffered by renters or passengers while using the rented watercraft. It offers financial protection for medical expenses, disability, or loss of income resulting from accidents such as slips, falls, or onboard injuries. 6. Umbrella Coverage Application: This type of application provides additional liability coverage beyond the limits of the primary commercial watercraft rental insurance policy. It acts as a supplemental policy, offering higher amounts of coverage, thus providing an extra layer of protection against unforeseen circumstances. It is important for North Dakota businesses engaged in commercial watercraft rental to carefully fill out the relevant insurance applications to ensure adequate coverage for their specific operations and potential risks. These applications require detailed information about the business, watercraft, safety measures, rental agreements, and previous claims history to assess the risks and calculate insurance premiums accurately.

North Dakota Commercial Watercraft Rental Insurance Application

Description

How to fill out North Dakota Commercial Watercraft Rental Insurance Application?

US Legal Forms - one of the biggest libraries of legal varieties in the United States - offers a variety of legal file layouts you are able to obtain or print out. Making use of the site, you can get a huge number of varieties for business and personal functions, categorized by groups, says, or key phrases.You can find the latest types of varieties much like the North Dakota Commercial Watercraft Rental Insurance Application within minutes.

If you currently have a membership, log in and obtain North Dakota Commercial Watercraft Rental Insurance Application through the US Legal Forms catalogue. The Down load option will show up on every single develop you see. You have access to all previously delivered electronically varieties inside the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, listed here are simple guidelines to get you started off:

- Ensure you have picked out the proper develop for your personal town/state. Select the Preview option to analyze the form`s information. See the develop outline to actually have chosen the right develop.

- In case the develop doesn`t match your specifications, take advantage of the Search field on top of the display screen to obtain the one that does.

- Should you be content with the form, affirm your option by clicking the Acquire now option. Then, choose the costs prepare you prefer and offer your accreditations to register for the bank account.

- Approach the deal. Make use of bank card or PayPal bank account to accomplish the deal.

- Pick the format and obtain the form on the system.

- Make adjustments. Fill up, change and print out and indicator the delivered electronically North Dakota Commercial Watercraft Rental Insurance Application.

Each and every web template you put into your money does not have an expiry time and is the one you have permanently. So, in order to obtain or print out yet another backup, just proceed to the My Forms area and click on in the develop you need.

Obtain access to the North Dakota Commercial Watercraft Rental Insurance Application with US Legal Forms, one of the most substantial catalogue of legal file layouts. Use a huge number of skilled and express-certain layouts that fulfill your company or personal requirements and specifications.