North Dakota Assignment and Transfer of Stock: A Comprehensive Overview In North Dakota, assignment and transfer of stock is an essential process that allows individuals and entities to legally transfer ownership rights of stocks or securities. This article aims to provide you with a detailed description of the North Dakota Assignment and Transfer of Stock, highlighting its key aspects, procedures, and relevant keywords. Keywords: North Dakota, assignment, transfer, stock, securities, ownership rights, process, procedures, legal, shares, certificates, uniform commercial code. I. Understanding North Dakota Assignment and Transfer of Stock: The assignment and transfer of stock in North Dakota involves the transfer of ownership rights, whether partial or full, from one party to another. As defined under the laws governing securities, this process revolves around the exchange of shares or securities' certificates, enabling the transferee to become the rightful owner and enjoy the associated rights and benefits. II. Types of North Dakota Assignment and Transfer of Stock: 1. Voluntary Assignment and Transfer: This type of assignment occurs by choice, where the current stockholder willingly transfers their ownership rights to another party. It typically involves a private agreement or contract, often facilitated through a stock transfer form. 2. Involuntary Assignment and Transfer: In certain circumstances, stock assignment or transfer may occur involuntarily. Factors leading to this type of transfer can include court-ordered transfers, bankruptcies, foreclosures, or legal disputes. In such cases, the process follows specific legal procedures and court rulings. III. Procedures for North Dakota Assignment and Transfer of Stock: 1. Stock Transfer Form Completion: Both the assignor (current stockholder) and the assignee (transferee) need to complete a stock transfer form, commonly provided by the issuing company. This form includes details such as the names of the parties involved, stock certificate numbers, and date of transfer. 2. Endorsement and Delivery of Stock Certificates: The current stockholder endorses the back of the stock certificate(s) being transferred, ensuring the assignment to the transferee is legally recognized. The stock certificates are then physically delivered to the new owner or their authorized representative. 3. Record Update: Upon receiving the endorsed stock certificates, the issuing company updates its records to reflect the assignment and transfer. This involves updating the ownership details, name, and contact information of the new stockholder in their official records. 4. Fees and Notarization: In North Dakota, some transfer agents or issuing companies may require a fee for processing the assignment and transfer of stock. Additionally, notarization of the assignment documents may be necessary to make the transfer legally binding. It is crucial to note that the outlined procedures are general in nature and may vary depending on the specific issuing company or financial institution involved. Engaging legal counsel or consulting applicable laws and regulations is advisable for a smooth and compliant transfer. In conclusion, the North Dakota Assignment and Transfer of Stock involves the voluntary or involuntary transfer of stock ownership rights from one party to another. By understanding the procedures, types, and legal requirements associated with this process, individuals and entities can confidently navigate the transfer of securities and ensure compliance with state laws and regulations.

North Dakota Assignment and Transfer of Stock

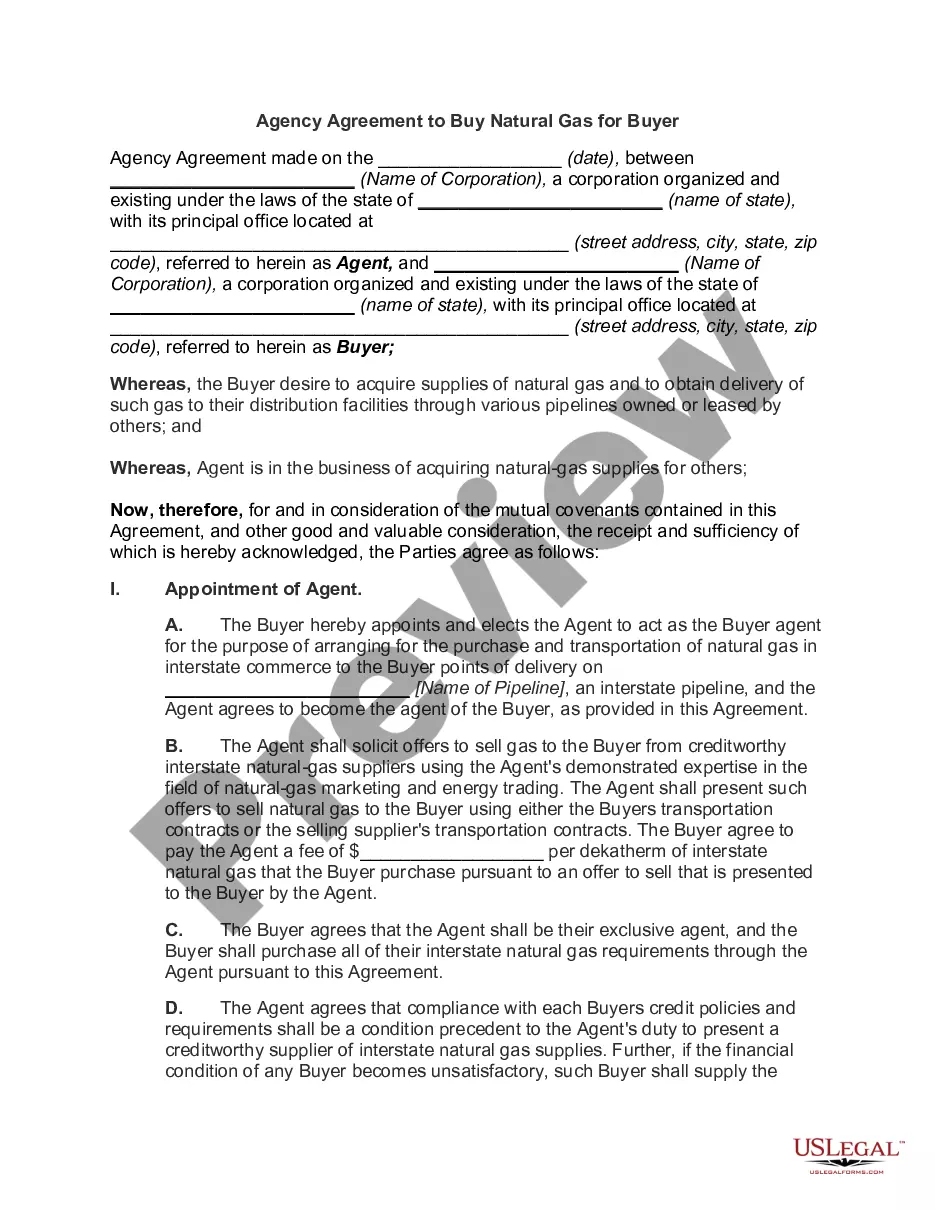

Description

How to fill out North Dakota Assignment And Transfer Of Stock?

US Legal Forms - one of several greatest libraries of legal forms in America - delivers a wide array of legal papers web templates you may acquire or produce. Utilizing the website, you can get a large number of forms for enterprise and person reasons, categorized by categories, suggests, or keywords and phrases.You can get the latest models of forms such as the North Dakota Assignment and Transfer of Stock within minutes.

If you already possess a monthly subscription, log in and acquire North Dakota Assignment and Transfer of Stock from your US Legal Forms local library. The Download switch can look on every single form you view. You have accessibility to all earlier downloaded forms inside the My Forms tab of your respective profile.

If you would like use US Legal Forms the first time, listed below are easy recommendations to help you began:

- Be sure to have picked out the correct form for the metropolis/region. Click on the Review switch to examine the form`s content. Browse the form explanation to ensure that you have chosen the appropriate form.

- In the event the form does not satisfy your demands, use the Lookup discipline towards the top of the screen to obtain the the one that does.

- In case you are satisfied with the shape, confirm your option by clicking on the Buy now switch. Then, pick the rates strategy you prefer and offer your references to sign up on an profile.

- Process the deal. Make use of bank card or PayPal profile to perform the deal.

- Pick the format and acquire the shape on the device.

- Make changes. Load, edit and produce and signal the downloaded North Dakota Assignment and Transfer of Stock.

Each and every template you added to your account lacks an expiration time and is the one you have permanently. So, in order to acquire or produce another copy, just check out the My Forms portion and click about the form you require.

Obtain access to the North Dakota Assignment and Transfer of Stock with US Legal Forms, by far the most comprehensive local library of legal papers web templates. Use a large number of skilled and express-distinct web templates that meet up with your small business or person requirements and demands.