North Dakota Charge Account Terms and Conditions

Description

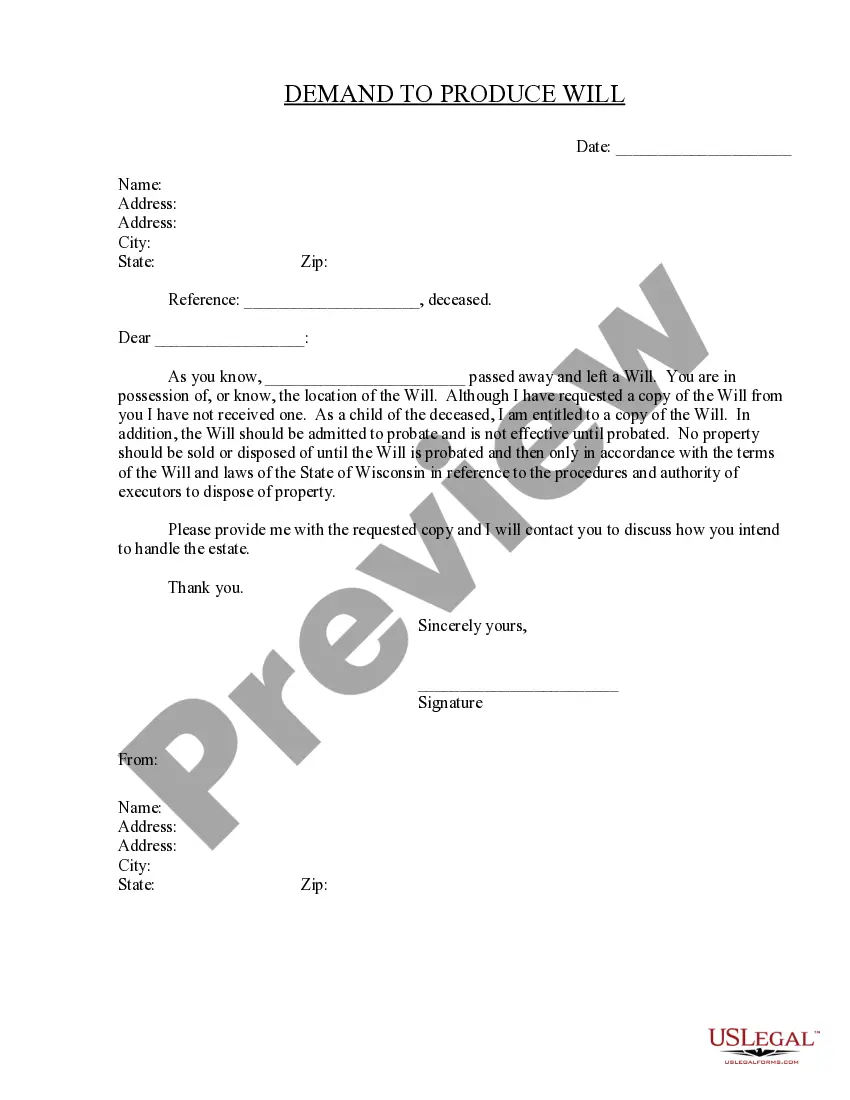

How to fill out Charge Account Terms And Conditions?

Choosing the best legitimate file format might be a struggle. Of course, there are tons of web templates available on the Internet, but how can you find the legitimate type you want? Make use of the US Legal Forms site. The service gives thousands of web templates, such as the North Dakota Charge Account Terms and Conditions, which you can use for company and private needs. All of the forms are inspected by experts and satisfy federal and state specifications.

If you are currently registered, log in in your accounts and click the Download option to have the North Dakota Charge Account Terms and Conditions. Utilize your accounts to appear with the legitimate forms you might have ordered earlier. Go to the My Forms tab of your respective accounts and have yet another copy in the file you want.

If you are a brand new user of US Legal Forms, here are easy directions that you can stick to:

- First, make sure you have selected the appropriate type for your personal area/county. You can check out the shape utilizing the Preview option and read the shape information to make sure it is the right one for you.

- If the type is not going to satisfy your requirements, utilize the Seach field to discover the appropriate type.

- Once you are sure that the shape is acceptable, go through the Purchase now option to have the type.

- Choose the prices program you desire and enter in the needed details. Make your accounts and purchase the order using your PayPal accounts or Visa or Mastercard.

- Opt for the document structure and down load the legitimate file format in your device.

- Comprehensive, modify and printing and indication the acquired North Dakota Charge Account Terms and Conditions.

US Legal Forms may be the biggest library of legitimate forms for which you can discover different file web templates. Make use of the service to down load professionally-made paperwork that stick to condition specifications.

Form popularity

FAQ

In 2022, the GDP of North Dakota amounted to around 53.13 billion U.S. dollars. The mining, quarrying, and oil and gas extraction industry added the most real value to the gross domestic product of the state, totaling around 9.05 billion U.S. dollars.

In the fiscal year of 2019, the state of North Dakota had state debt totaling 3.04 billion U.S. dollars. However, the local government debt was slightly higher at 5.38 billion U.S. dollars.

The act, among other things, provides that a ?person may not engage in the business of money transmission or advertise, solicit, or hold itself out as providing money transmission unless the person is licensed under this chapter.? The provision does not apply to a ?person that is an authorized delegate of a person ...

The North Dakota Department of Financial Institutions is responsible for chartering, regulating, and examining North Dakota state-chartered banks, credit unions, and trust companies.

Doug Burgum said. North Dakota experienced the highest growth in real GDP among all 50 states in the first quarter of 2023, surging by 12.4% in the last year ? more than six times higher than the nationwide increase of 2%, ing to BEA estimates.

North Dakota ranks 46th in economy size among states and Washington, DC. In 1st quarter of 2023, North Dakota accounted for 0.3% of the US economy.

The statute of limitations for actions on notes and contracts, including credit card debt, is six years.

North Dakota has $23.4 billion of assets available to pay the state's bills totaling $10.5 billion. North Dakota has $12.8 billion available after bills have been paid, which breaks down to $47,400 per taxpayer.