North Dakota Aging of Accounts Receivable

Description

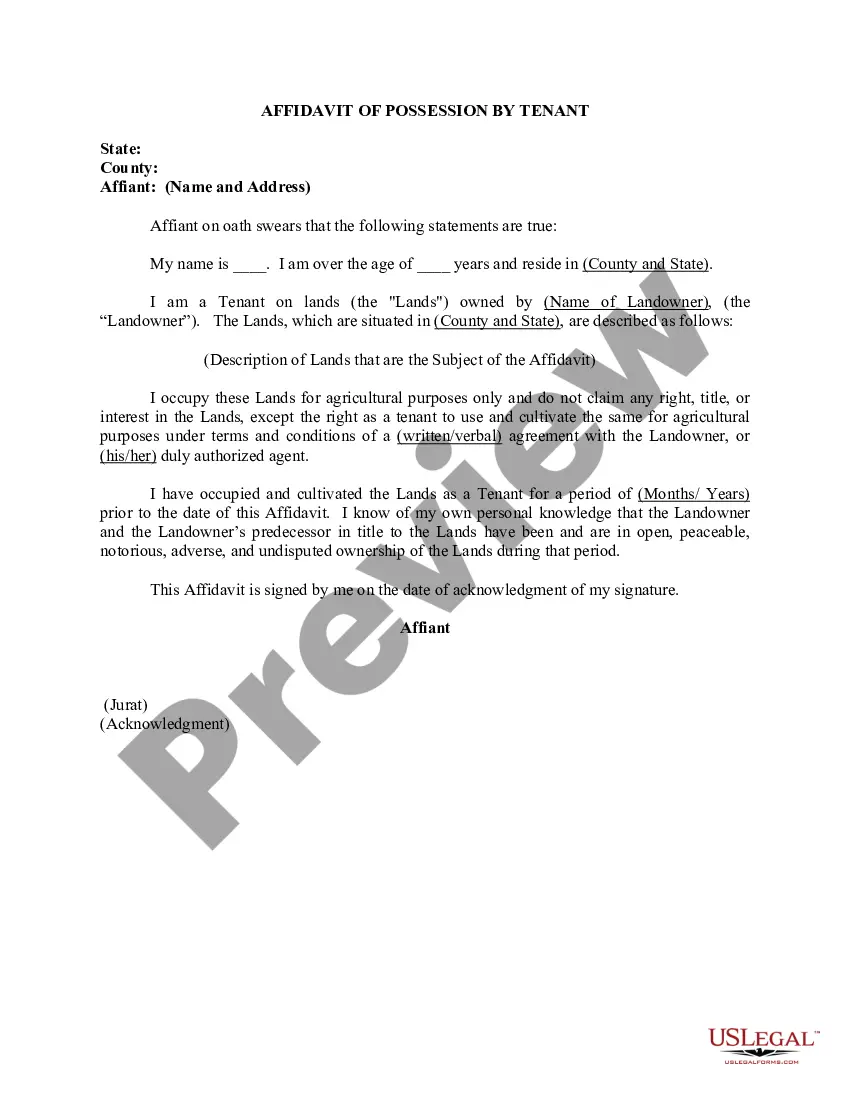

How to fill out Aging Of Accounts Receivable?

Have you ever been in a location where you require documentation for either professional or personal reasons almost every time.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the North Dakota Aging of Accounts Receivable, designed to comply with state and federal regulations.

Once you locate the right form, click on Purchase now.

Select the payment plan you prefer, enter the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the North Dakota Aging of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/region.

- Utilize the Review button to examine the document.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you need, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

The aging period of accounts receivable refers to the duration for which invoices have remained unpaid. Typically, this period is segmented into intervals, such as 0-30 days, 31-60 days, and beyond. In North Dakota, understanding these intervals aids businesses in prioritizing follow-ups and collections based on how long the debts have been outstanding. By using US Legal Forms, businesses can effectively track and manage these aging periods, leading to improved financial health.

To calculate the age of accounts receivable, you start by determining the date of each invoice issued and then subtract that date from the current date. This gives you the number of days outstanding for each invoice. In North Dakota, businesses often group these invoices into aging categories, such as current, 30 days overdue, or more, to better manage collections. Utilizing software solutions from US Legal Forms can further streamline this calculation and facilitate easier tracking.

To write an accounts receivable aging report, start by listing all outstanding invoices and organizing them by due dates. Next, categorize the amounts owed into various aging brackets, such as current, 30 days, or 60 days overdue. This organization provides a clear view of your receivables, enabling effective decision-making. In North Dakota, you can simplify this process with solutions like USLegalForms, which offer templates and tools to create professional reports.

To report accounts receivable aging in QuickBooks, navigate to the Reports section and select the Accounts Receivable Aging report. You can customize the report to fit specific time frames and customers, making it easy to focus on key accounts. This report provides a visual representation of what you are owed, ensuring a thorough understanding of your financial situation. For businesses in North Dakota, leveraging QuickBooks for your aging reports enhances your accounting efficiency.

To calculate the average age of accounts receivable in North Dakota, first gather the total outstanding receivables and multiply each by the number of days they have been overdue. Then, sum these values and divide by the total amount of accounts receivable. This calculation provides insight into your collection efficiency and payment cycles. Using tools available through US Legal Forms can streamline this analysis and enhance your financial decision-making.

Calculating the aging of accounts receivable in North Dakota involves assessing the time elapsed from the invoice date to the current date. You can compare outstanding invoices against their due dates to determine how long each account has been outstanding. This calculation helps identify troubled accounts and improve collection strategies. Consider using US Legal Forms' resources to facilitate accurate calculations and maintain your financial health.

To effectively age accounts receivable in North Dakota, start by compiling a list of all outstanding invoices and their due dates. Create an aging report that groups invoices into categories, such as current, 1-30 days past due, 31-60 days past due, and so on. This system helps you visualize your collection efforts and prioritize follow-ups. Utilizing tools from US Legal Forms can simplify this process and enhance clarity in your accounts receivable aging practices.

Managing the aging of accounts receivable in North Dakota requires diligent tracking and analysis of outstanding invoices. Regularly assess your accounts to identify overdue payments and categorize them based on age. Efficient management strategies can include following up with customers, offering flexible payment options, and using software tools to streamline the process. Platforms like US Legal Forms provide valuable resources to help you establish effective accounts receivable management practices.

To amend your North Dakota tax return, you need to complete the appropriate form, which is generally available on the North Dakota State Tax Department’s website. Make sure to provide all necessary details, including the changes to your income and deductions. If your amendments affect your North Dakota Aging of Accounts Receivable, this is your chance to correct any discrepancies. For a smooth process, consider using USLegalForms to access the right forms and guidance for your amendment.

Yes, you can carry forward a net operating loss in North Dakota. This means if your business incurs a loss in one tax year, you can apply that loss to reduce taxable income in future years. This is especially important for managing the financial aspects of your operations, including the North Dakota Aging of Accounts Receivable. To take full advantage of this provision, ensure you keep accurate records and consult with a tax professional for guidance.