North Dakota Aging of Accounts Payable

Description

How to fill out Aging Of Accounts Payable?

Have you ever been in a situation where you require documents for either business or specific needs every single day.

There are numerous official document templates accessible online, but finding ones you can trust isn’t straightforward.

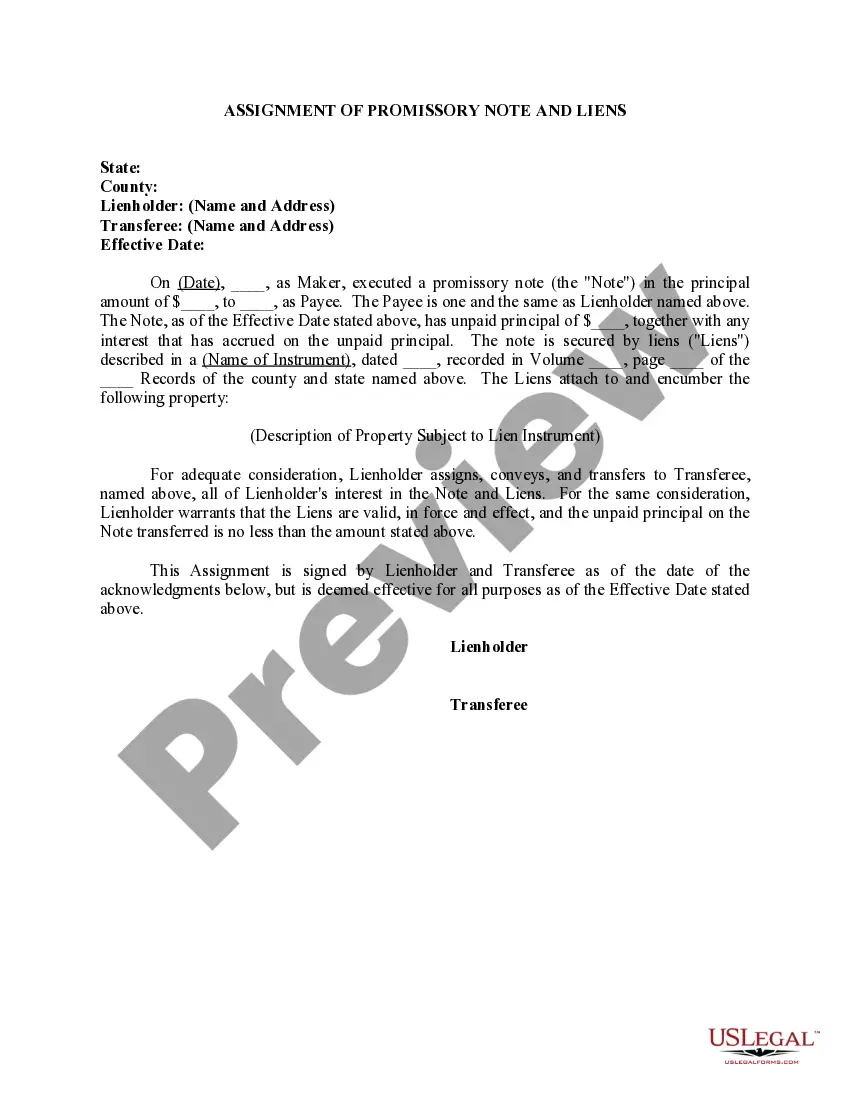

US Legal Forms offers thousands of form templates, such as the North Dakota Aging of Accounts Payable, that are designed to comply with state and federal standards.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or your credit card.

- If you are already aware of the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Aging of Accounts Payable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

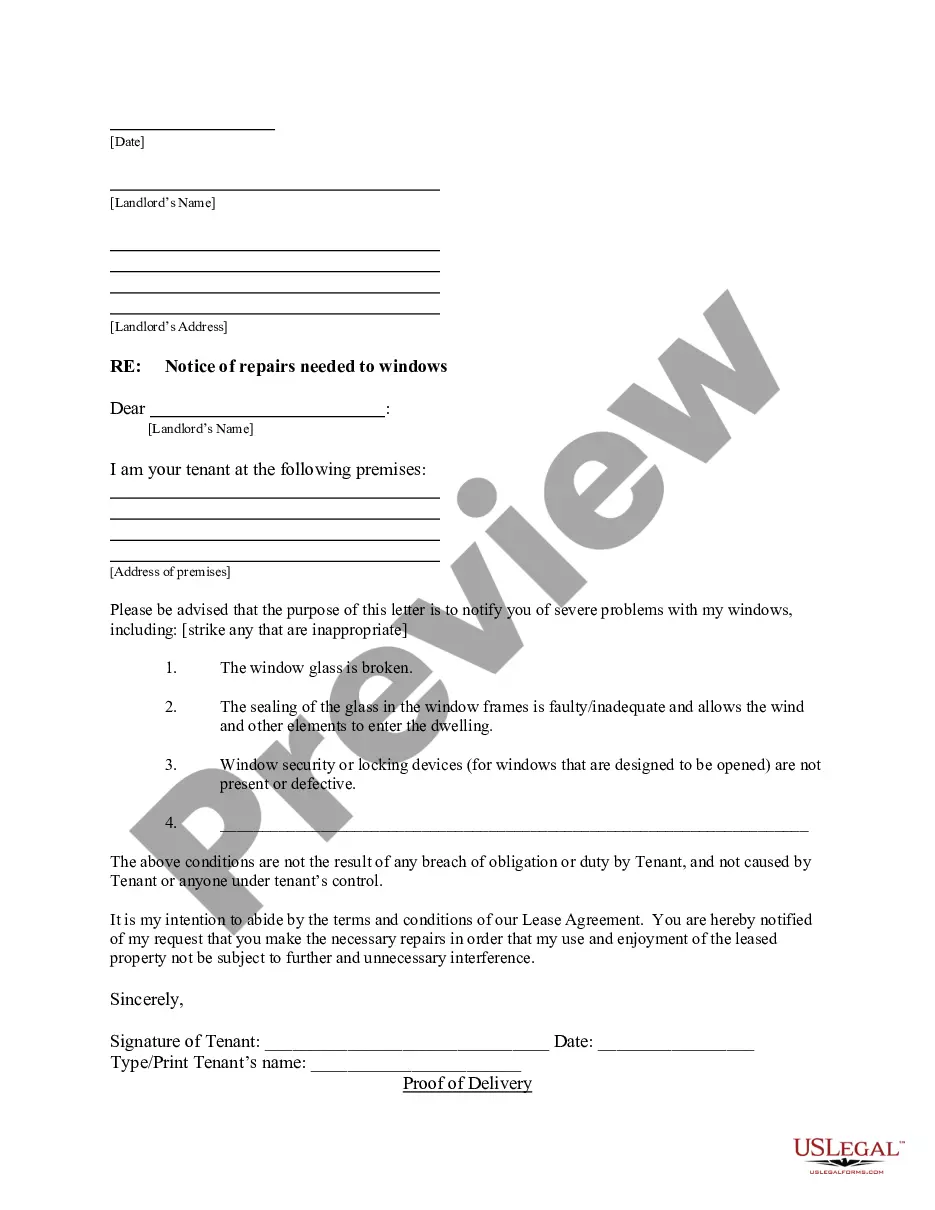

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re seeking, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

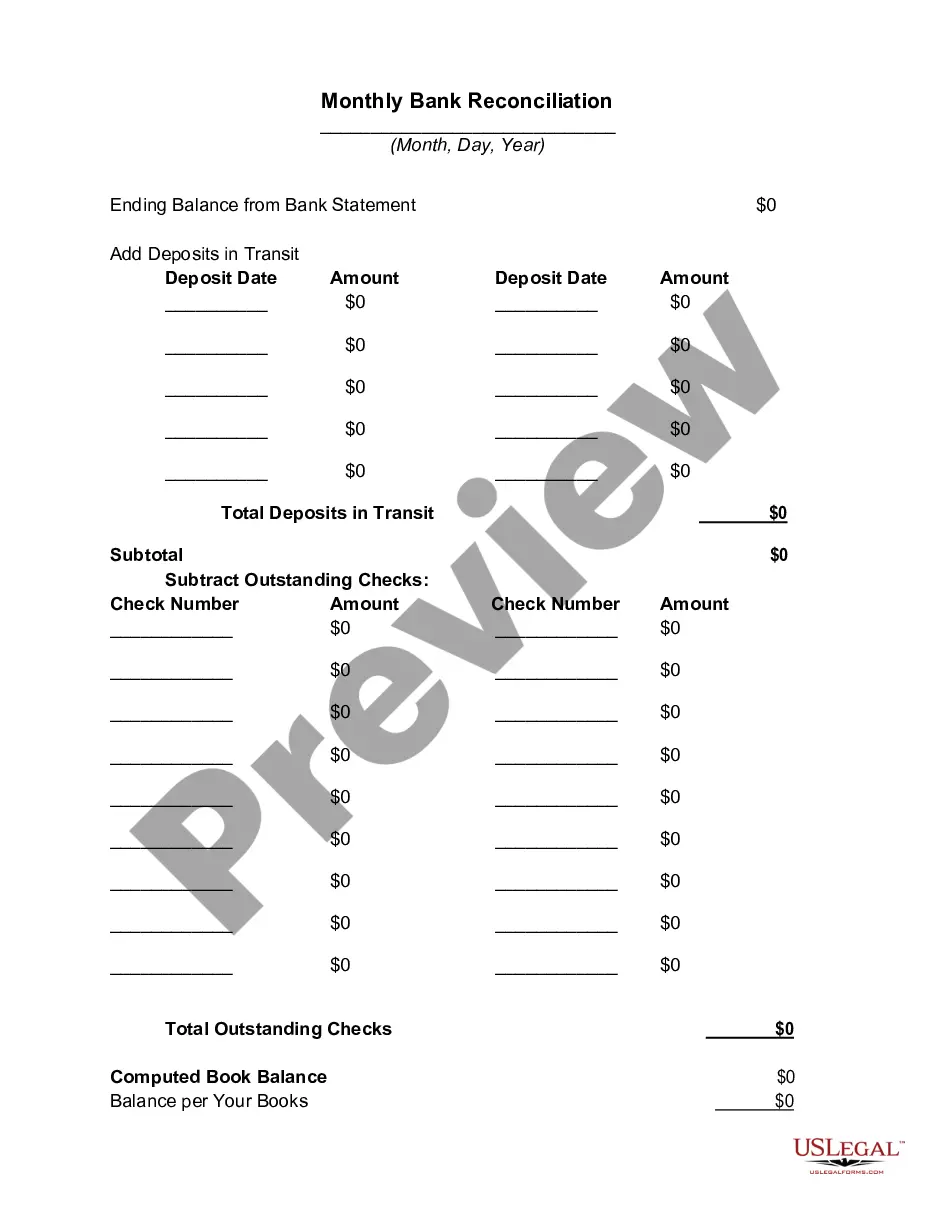

To make an aging report, compile a list of all your outstanding invoices and organize this list by due dates. Next, group these invoices into segments based on their aging, such as current, 1-30 days overdue, or more than 60 days overdue. Platforms like US Legal Forms simplify creating an aging report focused on North Dakota Aging of Accounts Payable, enabling you to manage your finances effectively.

To calculate accounts payable aging, begin by listing all unpaid invoices along with their amounts and due dates. Then, calculate the age of each invoice by subtracting the invoice date from the current date. Using a structured approach in the North Dakota Aging of Accounts Payable allows businesses to stay on top of their financial obligations and avoid late fees.

Creating an aging report in accounts payable requires listing all unpaid invoices with their corresponding due dates and amounts owed. Next, categorize these invoices into specified time frames, such as current, 30-60 days past due, and so forth. Utilizing US Legal Forms can streamline the process, particularly for managing North Dakota Aging of Accounts Payable efficiently.

To create an accounts payable aging report, first gather your outstanding invoices and their due dates. Then, organize these invoices into categories based on how long they have been overdue, such as 0-30 days, 31-60 days, and so forth. The North Dakota Aging of Accounts Payable can be simplified by using software like US Legal Forms, which provides templates and tools for efficient report generation.

ND Form 307 is the North Dakota individual income tax return form, used for reporting personal income and calculating tax due. Whether you're a resident or a nonresident, it's essential to complete this form accurately. Familiarity with ND Form 307 can aid in your North Dakota Aging of Accounts Payable. Our tools can streamline the completion of this form and ensure you meet all requirements.

In North Dakota, certain items such as groceries, prescription drugs, and agricultural products are exempt from sales tax. Understanding these exemptions can assist you in managing your finances and keeping your North Dakota Aging of Accounts Payable in check. Our platform can help you identify which items fall under these tax exemptions.

The Nexus threshold in North Dakota refers to the level of business activity that necessitates a tax obligation within the state. Generally, if your business has a physical presence or meets certain sales thresholds, it establishes Nexus. This understanding is crucial for your North Dakota Aging of Accounts Payable. By utilizing our services, you can better assess your Nexus status and manage related taxes.

Form 307 is a tax form used for reporting income and calculating North Dakota individual income tax. This form can be essential for residents and nonresidents earning income within the state. Knowing how to fill out Form 307 properly is vital for your North Dakota Aging of Accounts Payable. Our platform provides resources to guide you through the process and ensure accuracy.

In North Dakota, you may qualify for a capital gain exclusion on the sale of certain assets, such as qualifying small business stock or property used for farming or ranching. This exemption can significantly impact your tax liability. Properly managing your investments can help with your North Dakota Aging of Accounts Payable. Consider using our platform to better understand your capital gains and related tax strategies.

Yes, North Dakota does issue resale certificates to businesses making wholesale purchases of goods intended for resale. These certificates allow sellers to exempt sales tax when purchasing products that will be resold. Keeping track of these documents is vital for managing your North Dakota Aging of Accounts Payable. Our services can assist in navigating these requirements efficiently.