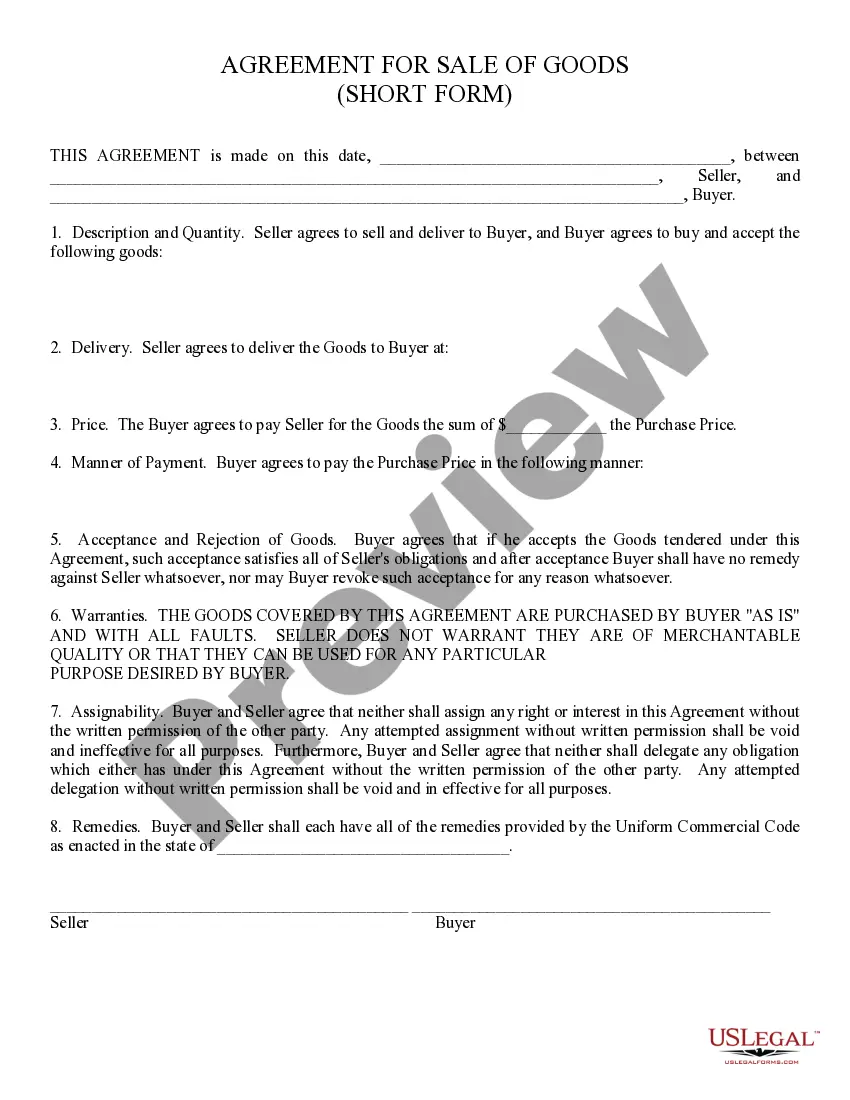

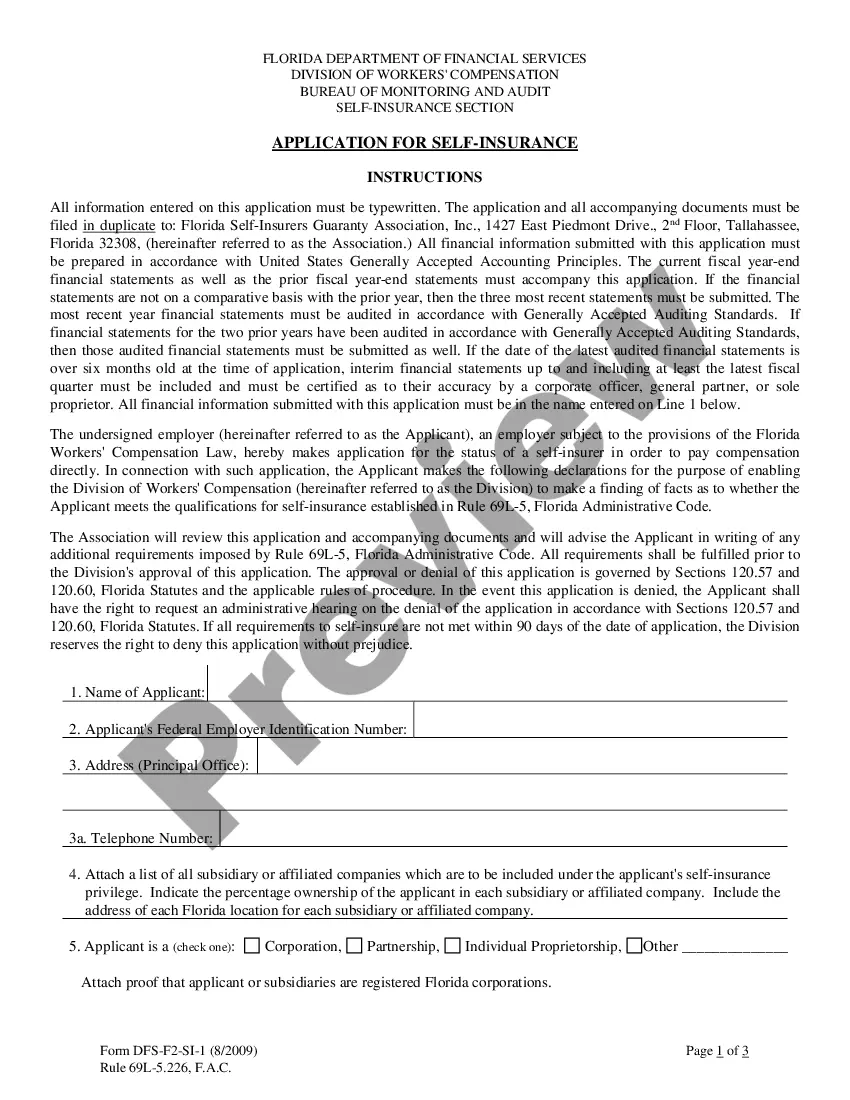

A North Dakota Line of Credit or Loan Agreement between a corporate or business borrower and a bank is a legally binding document that outlines the terms and conditions for borrowing funds from the bank. This agreement serves as a reference point for both parties involved, ensuring that all parties are aware of their rights and responsibilities concerning the Line of Credit or Loan. This type of agreement establishes a financial relationship between the borrower, usually a corporate entity or business, and the lending institution, a bank in this case, enabling the borrower to access a specified amount of funds, known as the Line of Credit or Loan. The borrower can utilize these funds for various purposes, such as working capital, purchasing inventory, expansion, or any other business-related expenses. There are different types of North Dakota Line of Credit or Loan Agreements available, depending on the specific requirements and preferences of the borrower and the lender. Some common types include: 1. Revolving Line of Credit: This type of agreement establishes a borrowing limit, typically based on the borrower's creditworthiness. The borrower can access funds as needed and repay them within a predetermined period. The borrower can repeatedly draw and repay funds within the credit limit, making it a flexible financing option. 2. Term Loan: A term loan agreement specifies a fixed loan amount provided to the borrower for a defined period. The repayment schedule, including interest rates and installments, is determined in advance. This type of loan is suitable for more specific or long-term projects, such as equipment purchase or capital investment. 3. Secured Line of Credit or Loan: In this agreement, the borrower provides collateral, such as assets or property, to secure the loan. This collateral serves as security for the bank, minimizing the lender's risk. The interest rates for secured lines of credit or loans are typically lower compared to unsecured agreements. 4. Unsecured Line of Credit or Loan: Unlike the secured option, an unsecured line of credit or loan does not require any collateral. Instead, the borrower's creditworthiness and financial history determine the approval and terms of the agreement. Due to the higher risk involved for the bank, interest rates for unsecured lines of credit or loans might be higher. The North Dakota Line of Credit or Loan Agreement includes essential details to safeguard the interest of both parties, such as the loan limit, interest rates, repayment terms, late payment penalties, default provisions, and any additional fees or charges. The agreement also highlights any specific conditions or covenants that the borrower must adhere to during the loan term, such as maintaining a certain financial ratio or providing periodic financial statements. It is crucial for both the corporate or business borrower and the lending institution to thoroughly review and understand the terms of the agreement before signing. Seeking legal advice is often recommended ensuring compliance with state and federal laws, protect against potential risks, and ensure that all parties are fully aware of their rights and obligations throughout the borrowing relationship.

North Dakota Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

How to fill out North Dakota Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

You may devote hours online attempting to find the legitimate record template which fits the federal and state needs you will need. US Legal Forms supplies a huge number of legitimate forms that are reviewed by experts. It is simple to acquire or print out the North Dakota Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank from the assistance.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Obtain button. Following that, you are able to complete, edit, print out, or indicator the North Dakota Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank. Each legitimate record template you acquire is the one you have forever. To obtain another copy for any bought type, visit the My Forms tab and then click the related button.

If you work with the US Legal Forms website for the first time, stick to the basic instructions beneath:

- Initially, be sure that you have chosen the right record template for the region/town that you pick. Look at the type outline to make sure you have chosen the proper type. If offered, take advantage of the Preview button to check with the record template as well.

- In order to locate another variation of your type, take advantage of the Search field to obtain the template that meets your needs and needs.

- When you have found the template you want, click on Get now to move forward.

- Pick the pricing program you want, key in your credentials, and sign up for an account on US Legal Forms.

- Total the deal. You should use your charge card or PayPal bank account to fund the legitimate type.

- Pick the formatting of your record and acquire it to the system.

- Make changes to the record if possible. You may complete, edit and indicator and print out North Dakota Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank.

Obtain and print out a huge number of record templates while using US Legal Forms Internet site, that offers the biggest assortment of legitimate forms. Use expert and condition-certain templates to tackle your organization or personal needs.