North Dakota Invoice Template for Chef

Description

How to fill out Invoice Template For Chef?

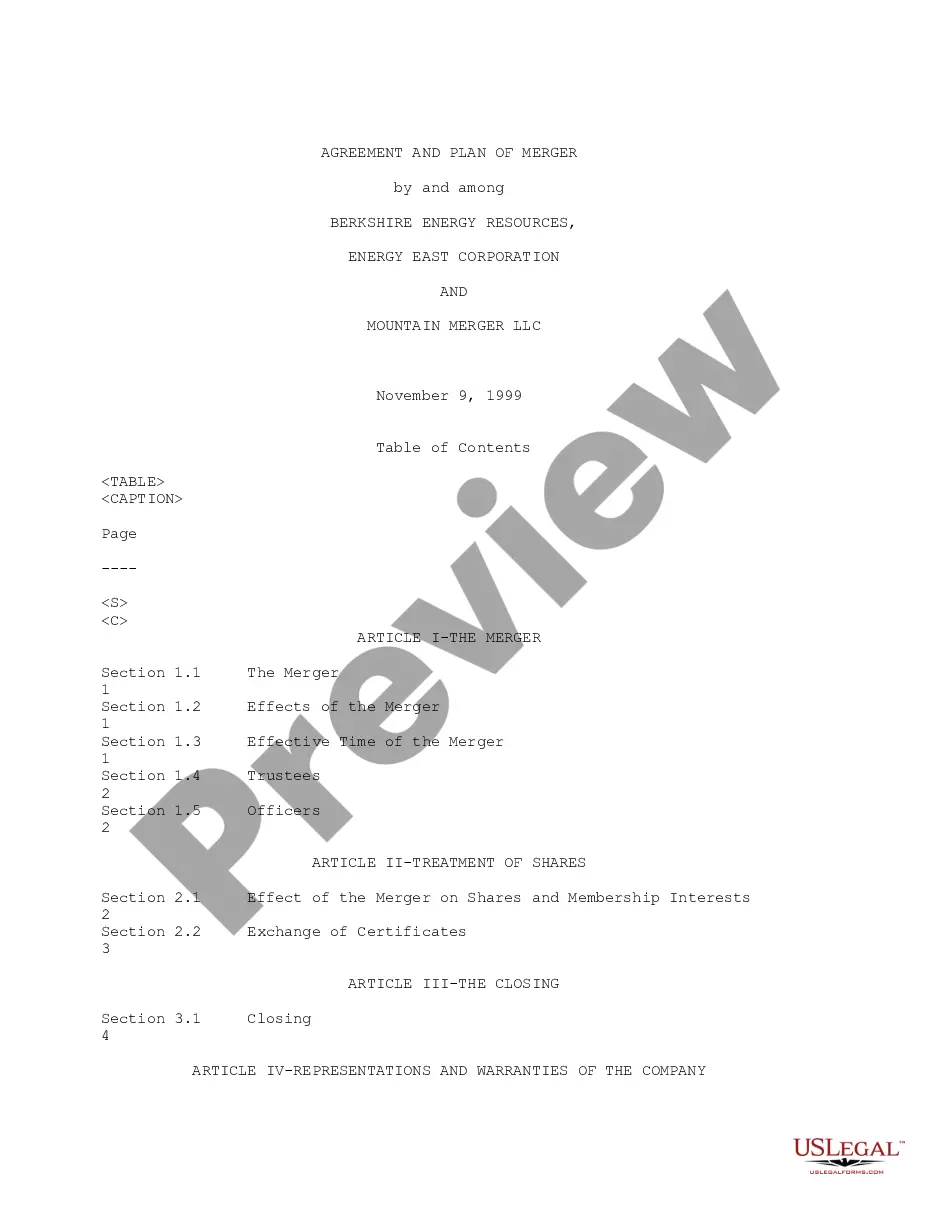

You might devote numerous hours online seeking the authentic document template that meets the federal and state standards you require.

US Legal Forms offers an extensive array of official forms that can be reviewed by professionals.

You can readily obtain or create the North Dakota Invoice Template for Chef through my services.

To find another version of your form, use the Search field to discover the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Following that, you can fill out, modify, create, or sign the North Dakota Invoice Template for Chef.

- Every official document template you acquire is yours to keep indefinitely.

- To get another copy of any purchased form, navigate to the My documents tab and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, adhere to the simple directions below.

- First, ensure you have chosen the correct document template for the county/city of your preference. Check the form details to confirm you’ve picked the right form.

- If available, utilize the Preview button to review the document template as well.

Form popularity

FAQ

When searching for the best website to generate invoices, consider US Legal Forms. This platform offers an easy-to-use North Dakota Invoice Template for Chef, which simplifies the invoice creation process. You can customize your invoice to include all essential details, ensuring professionalism and clarity. Moreover, US Legal Forms provides various templates that cater to different needs, making it a versatile choice for chefs operating in North Dakota.

To effectively advertise yourself as a private chef, leverage social media platforms and local food communities to showcase your culinary skills. Regularly sharing enticing images and testimonials can help you connect with potential clients. Also, using the North Dakota Invoice Template for Chef can enhance your professional image when handling transactions, making clients more likely to trust your services.

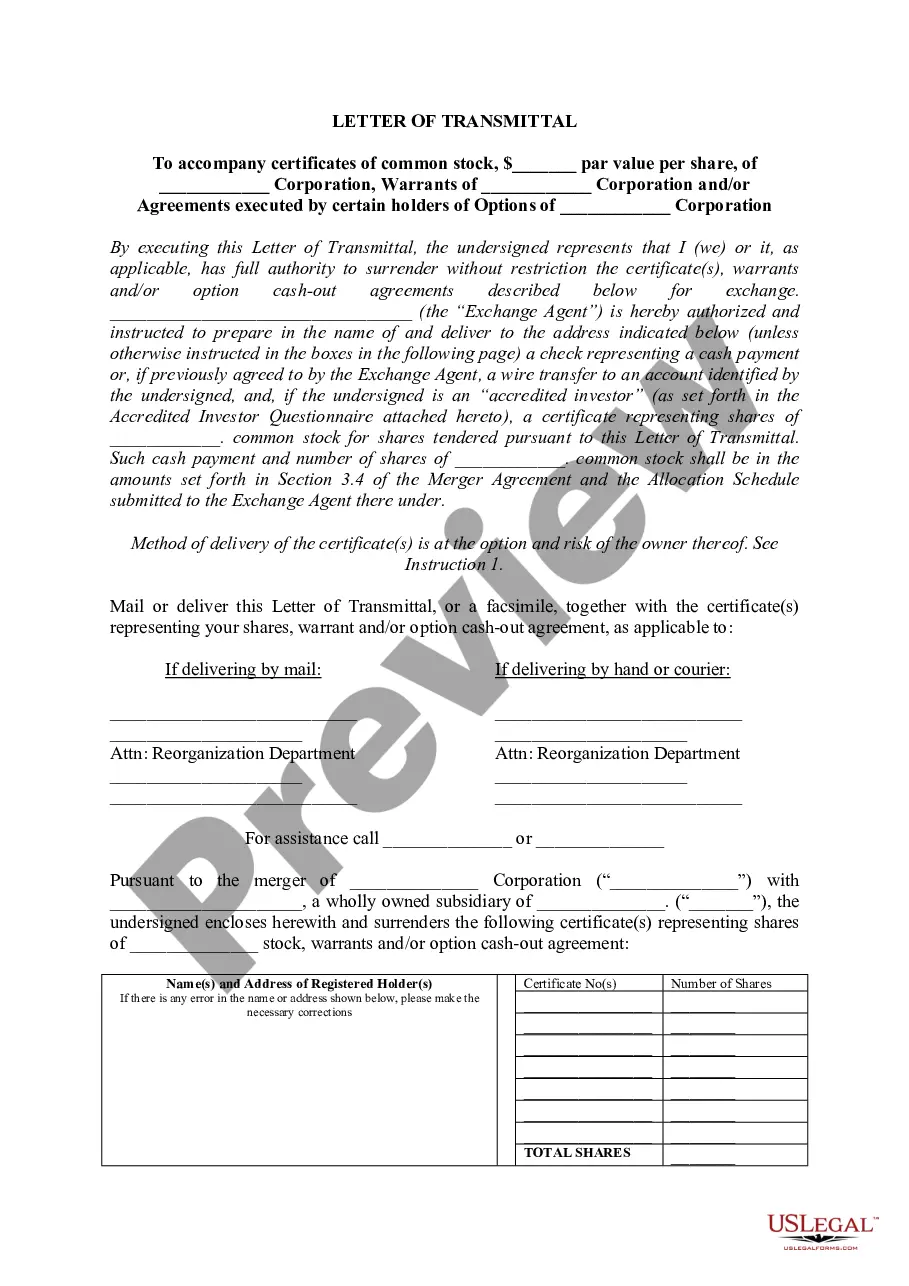

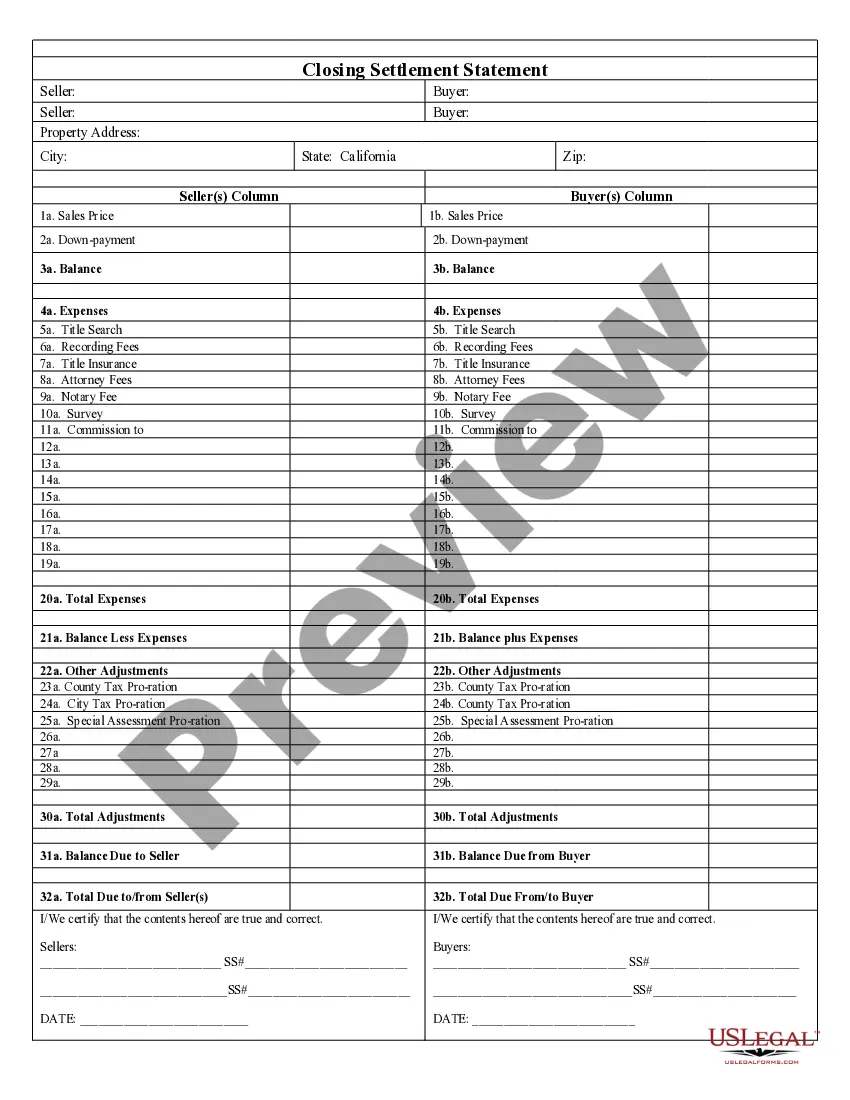

Creating a food invoice can be straightforward. First, outline the food items or services you provided and their respective costs. The North Dakota Invoice Template for Chef offers a structured way to present your invoice professionally, ensuring you include all key details like date, client information, and payment terms.

To issue an invoice as a private individual, start by collecting all necessary information, such as your name, address, and the services provided. The North Dakota Invoice Template for Chef can guide you in formatting your invoice properly. Simply input your information and the total amount, then deliver it to your client promptly.

Yes, you can generate an invoice on your own. Using the North Dakota Invoice Template for Chef simplifies this process. You have the ability to customize it according to your needs and services provided. Just fill in the details, and your invoice is ready to send.

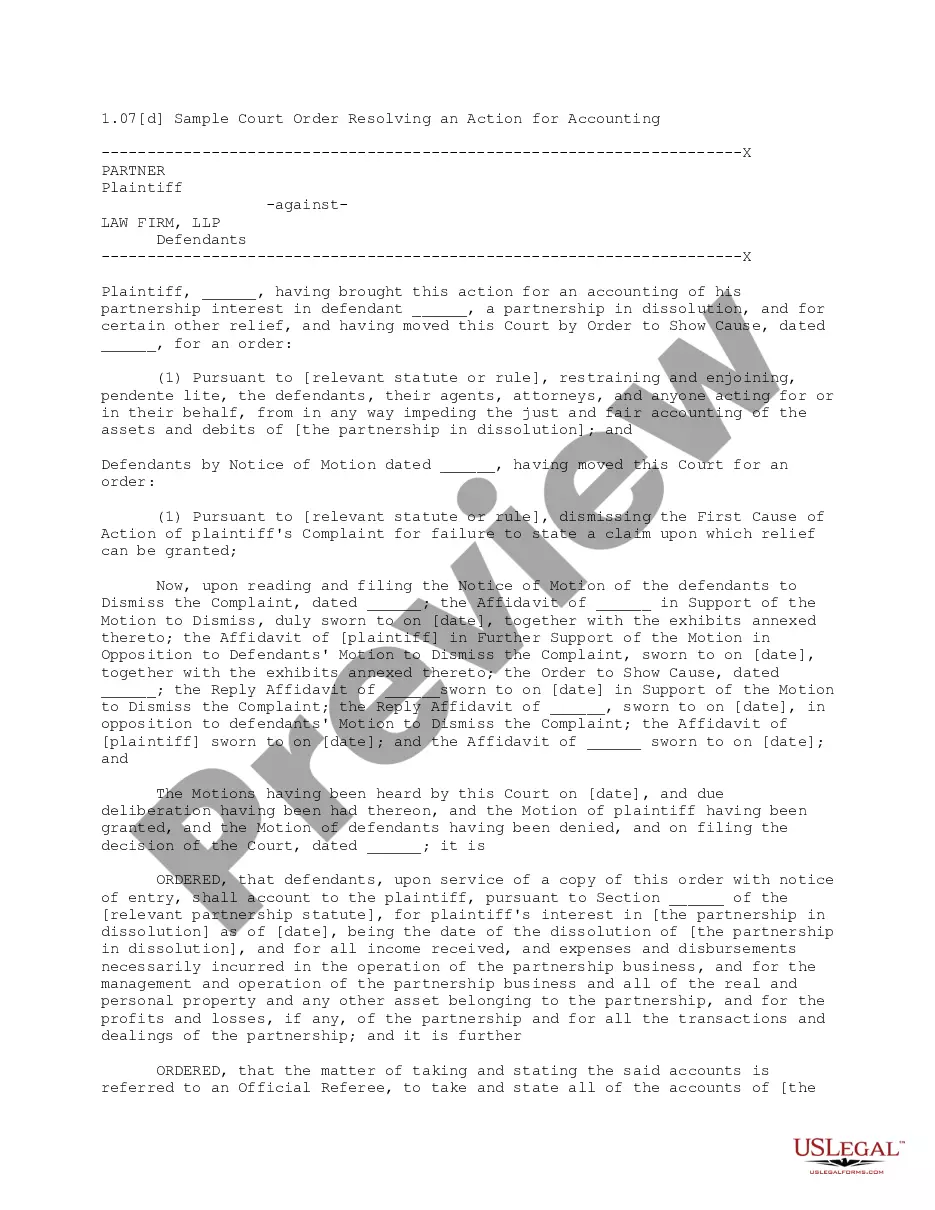

Any nonresident earning income from North Dakota sources, including chefs working temporary jobs or events, must file a nonresident tax return. This requirement ensures that all income generated within the state is reported appropriately. The North Dakota Invoice Template for Chef can simplify record-keeping, making it easier to compile the necessary financial information for your tax return.

Form 307 is another way to refer to the North Dakota sales tax exemption certificate. Businesses use this to document exempt sales from sales tax. Incorporating a North Dakota Invoice Template for Chef helps you record these exempt items effectively. This ensures clarity in your financial documentation and supports your tax compliance.

Generally, services are not taxable in North Dakota, especially for personal services like cooking. However, specific business services may incur taxes. To clarify your billing, having a North Dakota Invoice Template for Chef can assist you in distinguishing between taxable and non-taxable charges, ensuring you maintain compliance.

In North Dakota, certain items are not subject to sales tax, such as groceries, prescription medicines, and some agricultural products. Understanding what is taxable versus non-taxable can help you as a chef manage your expenses effectively. Using a North Dakota Invoice Template for Chef can help you itemize these exempt purchases clearly on your invoices.

ND Form 307 is the North Dakota state sales tax exemption certificate. Businesses, including chefs, may use this form to report exempt sales. By utilizing a North Dakota Invoice Template for Chef, you can ensure that all necessary details for tax reporting are included. This supports your compliance and simplifies your invoicing process.