North Dakota Invoice Template for Bakery

Description

How to fill out Invoice Template For Bakery?

US Legal Forms - one of the largest collections of authentic documents in the USA - provides a variety of legitimate templates that you can download or print.

By using the website, you can find thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the North Dakota Invoice Template for Bakery in moments.

If you already hold a subscription, Log In and download the North Dakota Invoice Template for Bakery from the US Legal Forms library. The Download button will be displayed on every form you review.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill, modify, and print, then sign the downloaded North Dakota Invoice Template for Bakery. Each template you add to your account does not have an expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Gain access to the North Dakota Invoice Template for Bakery with US Legal Forms, the most extensive collection of legitimate document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and desires.

- If you are trying US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have chosen the correct form for your city/state.

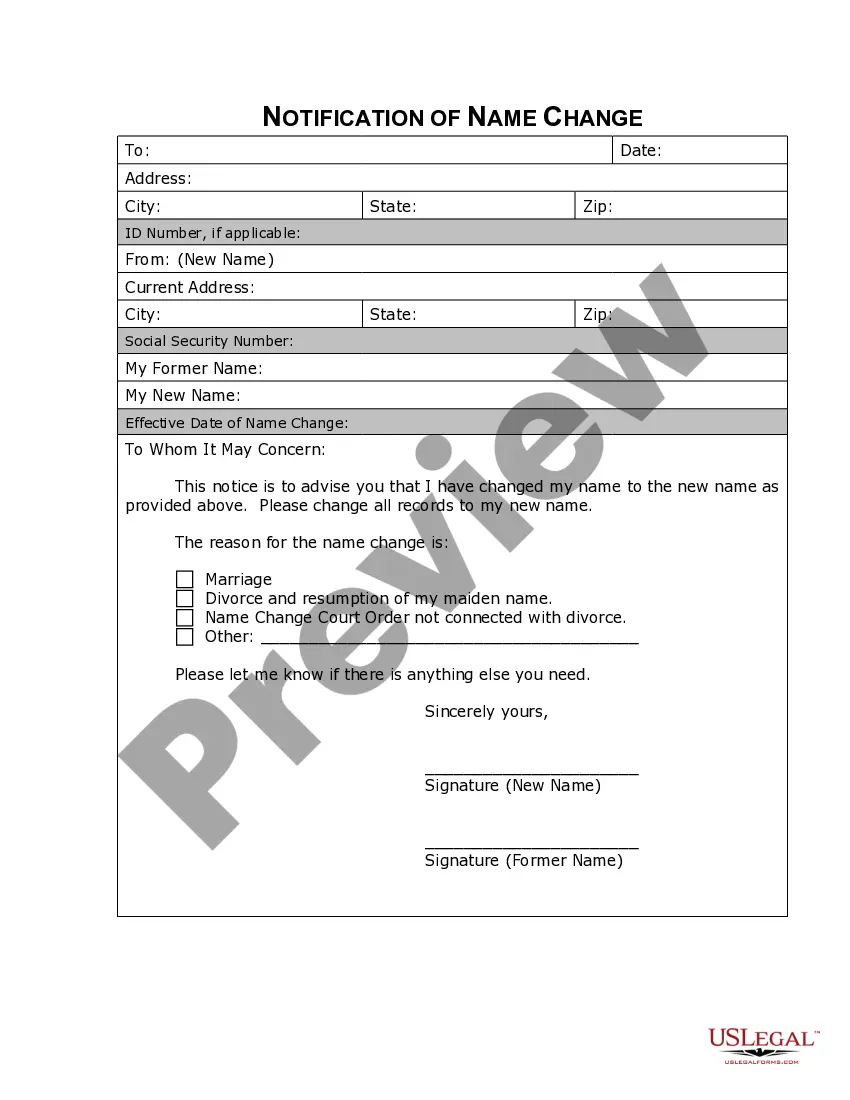

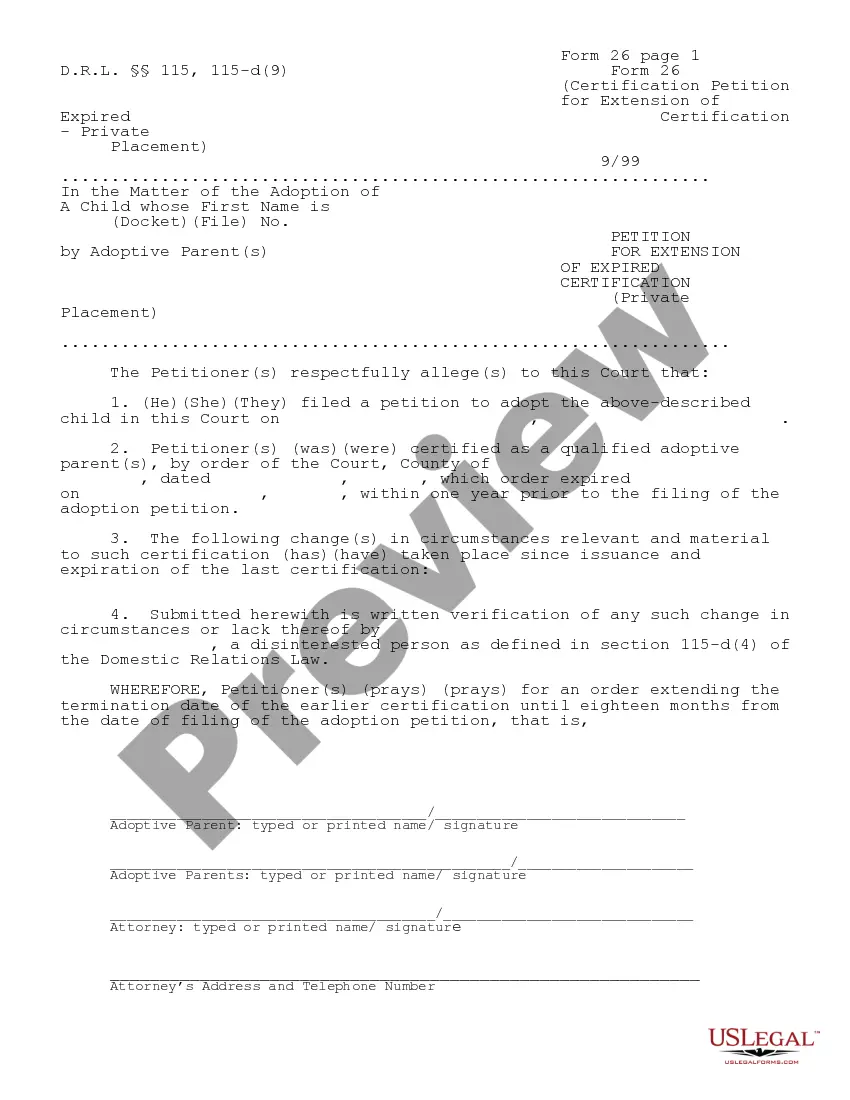

- Click the Preview button to review the form’s content.

- Examine the form summary to confirm that you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are content with the form, validate your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The format of a commercial invoice typically includes sections for your business name, customer information, item descriptions, quantities, prices, and totals. A North Dakota Invoice Template for Bakery can help you adhere to this standard format, ensuring clarity and professionalism. This structured approach not only aids in accurate billing but also enhances your brand's credibility.

To create a commercial invoice template, start by outlining the key components that need to be included, such as your business information, customer details, and payment terms. By using a North Dakota Invoice Template for Bakery, you can access a ready-made format designed specifically for bakers. This approach saves time and ensures you include essential information in a clear and organized manner.

Yes, you can create your own commercial invoice tailored to your bakery's needs. However, using a North Dakota Invoice Template for Bakery can streamline this process and ensure you meet all regulatory requirements. Moreover, templates often include fields essential for clarity, thus enhancing professionalism and customer satisfaction.

To produce a commercial invoice, start by compiling the relevant information such as item descriptions, quantities, prices, and payment terms. Utilizing a North Dakota Invoice Template for Bakery simplifies this process significantly by providing a structured format. You can easily fill in your bakery's details and ensure all necessary information is included for your customers.

A commercial invoice is typically generated by the seller or service provider. In the case of your bakery, you can use a North Dakota Invoice Template for Bakery to create a professional invoice with ease. This document serves as a request for payment and outlines the details of the sale, making it essential for tracking sales and managing your finances.

Yes, you can create an invoice on your own. Utilizing a North Dakota Invoice Template for Bakery can make this task easier and more efficient. Templates provide a structured outline, allowing you to focus on entering your specific information. Creating your own invoices also gives you control over your branding and how you present your business.

To create an invoice for payment, begin by selecting a suitable format or template. A North Dakota Invoice Template for Bakery can simplify this process for you. Include relevant details such as the date, a unique invoice number, billing terms, and a clear breakdown of your goods or services. This clarity helps your clients understand their payments and facilitates timely transactions.

Yes, it is entirely legal to create your own invoices when conducting business in North Dakota. By using a North Dakota Invoice Template for Bakery, you can ensure that all necessary elements are included. This can help you keep accurate records and streamline your billing process. Always remember to include essential details like your business name, contact information, and itemized products or services.

In North Dakota, several items are not subject to sales tax, including most types of food, prescription drugs, and certain agricultural supplies. This can benefit bakery businesses looking to sell exempt items. By using your North Dakota Invoice Template for Bakery, you can accurately reflect what is and isn’t taxed during the sale.

Fargo, North Dakota, follows the same sales tax rate as the rest of the state, which is 5%. This uniformity simplifies the sales process for bakery owners. Remember to include this rate in your North Dakota Invoice Template for Bakery when transacting in Fargo.