North Dakota Acknowledged Receipt of Goods

Description

Goods are defined under the Uniform Commercial Code as those things that are movable at the time of identification to a contract for sale. (UCC ??? 2-103(1)(k)). The term includes future goods, specially manufactured goods, and unborn young of animals, growing crops, and other identified things attached to realty.

How to fill out Acknowledged Receipt Of Goods?

Have you visited a location where you require paperwork for either a business or individual almost every working day.

There are numerous legitimate document templates accessible online, but finding reliable ones is challenging.

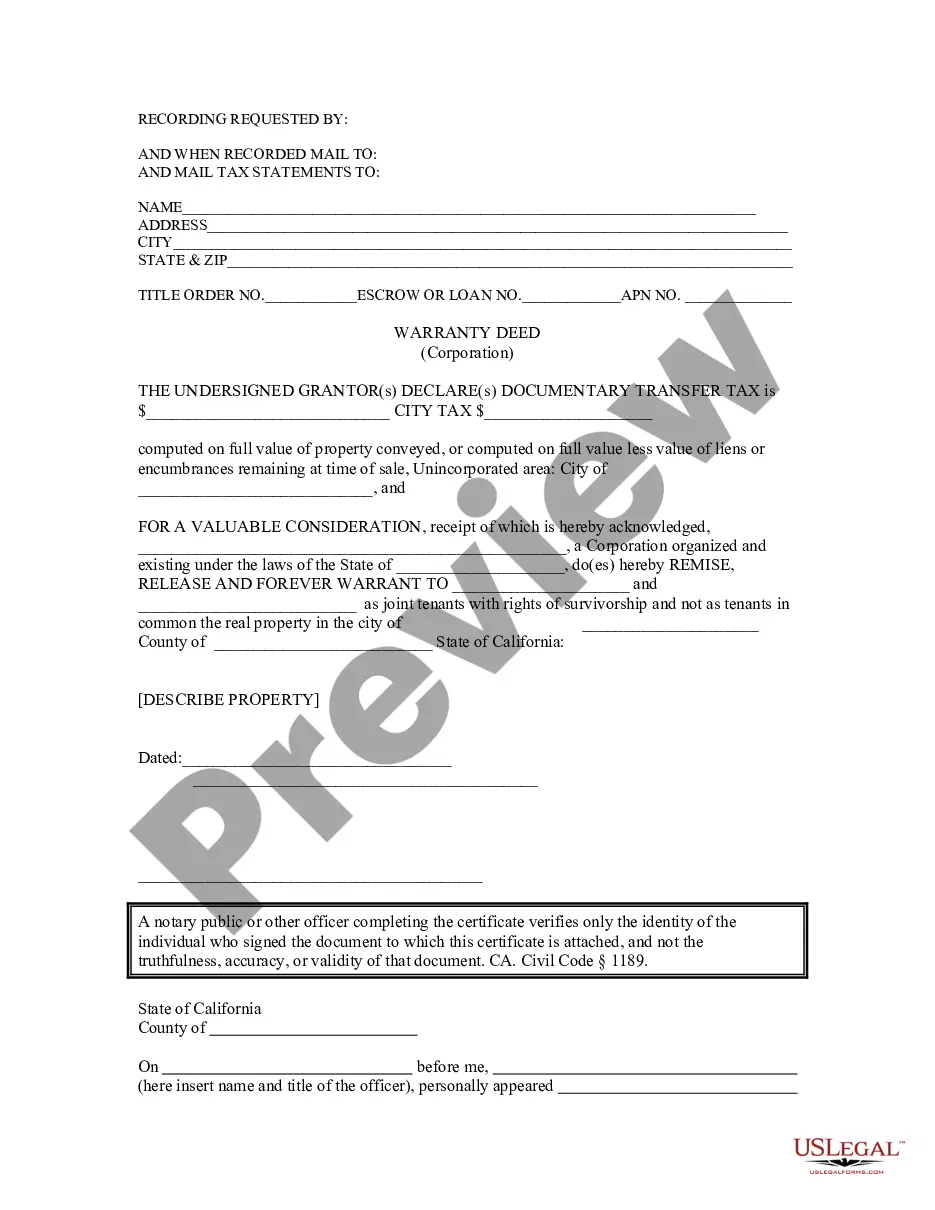

US Legal Forms offers thousands of form templates, including the North Dakota Acknowledged Receipt of Goods, designed to meet state and federal regulations.

Once you find the correct template, click Get now.

Select the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Acknowledged Receipt of Goods template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the template you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Read the description to make sure you have selected the correct template.

- If the template is not what you are looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

The Nexus threshold in North Dakota refers to the sales or transaction amount that establishes tax obligations within the state. As of now, businesses that make over $100,000 in sales or have 200 or more transactions in North Dakota must collect sales tax. Understanding this threshold ensures compliance with state tax laws. Ensure that your business practices align with the North Dakota Acknowledged Receipt of Goods requirements to avoid penalties.

Form 307 is the North Dakota Sales Tax Exempt Certificate. This form allows qualifying organizations, such as nonprofits, to make purchases exempt from sales tax. By completing this form, you affirm your organization's eligibility under North Dakota law. Keeping accurate records related to Form 307 is essential to manage your tax obligations efficiently.

In North Dakota, most businesses need a state-specific business license to operate legally. The requirements can vary based on the type of business activity you conduct. In certain cases, you may also need local permits or licenses. It's advisable to consult local authorities or resources, like USLegalForms, to ensure compliance with all licensing requirements to facilitate smooth operations.

An affidavit of non-receipt is a sworn statement that confirms the non-delivery of goods or items. This document can be useful in disputes regarding shipments when a recipient states that they did not receive the goods. In the context of North Dakota Acknowledged Receipt of Goods, this affidavit serves to protect both buyers and sellers from potential issues. Always consider documenting your shipments to avoid such situations.

The gross receipts tax in North Dakota varies based on the type of business and industry. It is important for business owners to consult state guidelines or a tax professional to understand specific rates and regulations. Staying informed about these taxes can prevent unexpected liabilities. Leveraging tools like the USLegalForms, along with maintaining North Dakota Acknowledged Receipts of Goods, will enhance your financial management.

The capital gains exclusion in North Dakota allows certain taxpayers to exclude a portion of their capital gains from taxation under specific conditions. This exclusion can be particularly beneficial for individuals selling real estate or investments. It is vital to understand the eligibility criteria to take full advantage of this exclusion. Documenting your transactions effectively, possibly with a North Dakota Acknowledged Receipt of Goods, is recommended.

The taxable amount of gross receipts generally includes all revenue generated from sales of goods and services, minus any exempt sales. Businesses must account for this amount accurately for tax filings. Keeping detailed records will help ensure that you report the correct figures. A North Dakota Acknowledged Receipt of Goods can greatly aid in providing proof and transparency in your accounting.

Gross receipts tax is levied on a business's total revenue, whereas sales tax applies to the sale of individual goods and services. This means that gross receipts tax considers all income generated, not just specific transactions. Being aware of the distinction between these taxes helps in better tax planning. Also, documenting receipts using a North Dakota Acknowledged Receipt of Goods can clarify both tax types.

You can find gross receipts by reviewing your business's financial records, including invoices and sales reports. Accurate record keeping is key to identifying your total revenue from sales. Utilizing tools and services, like USLegalForms, can simplify this process. Remember, a North Dakota Acknowledged Receipt of Goods can serve as valuable documentation in determining gross receipts.

North Dakota gross receipts tax applies to businesses that sell goods or services within the state. This tax is based on the total revenue generated from sales, not profit. It's essential for businesses to understand their obligations to remain compliant. Using a North Dakota Acknowledged Receipt of Goods can assist in tracking sales and calculating this tax accurately.