In this agreement, one corporation (the Guarantor) is providing financial assistance to another Corporation (the Corporation) by guaranteeing certain indebtedness for the Company in exchange for a guaranty fee.

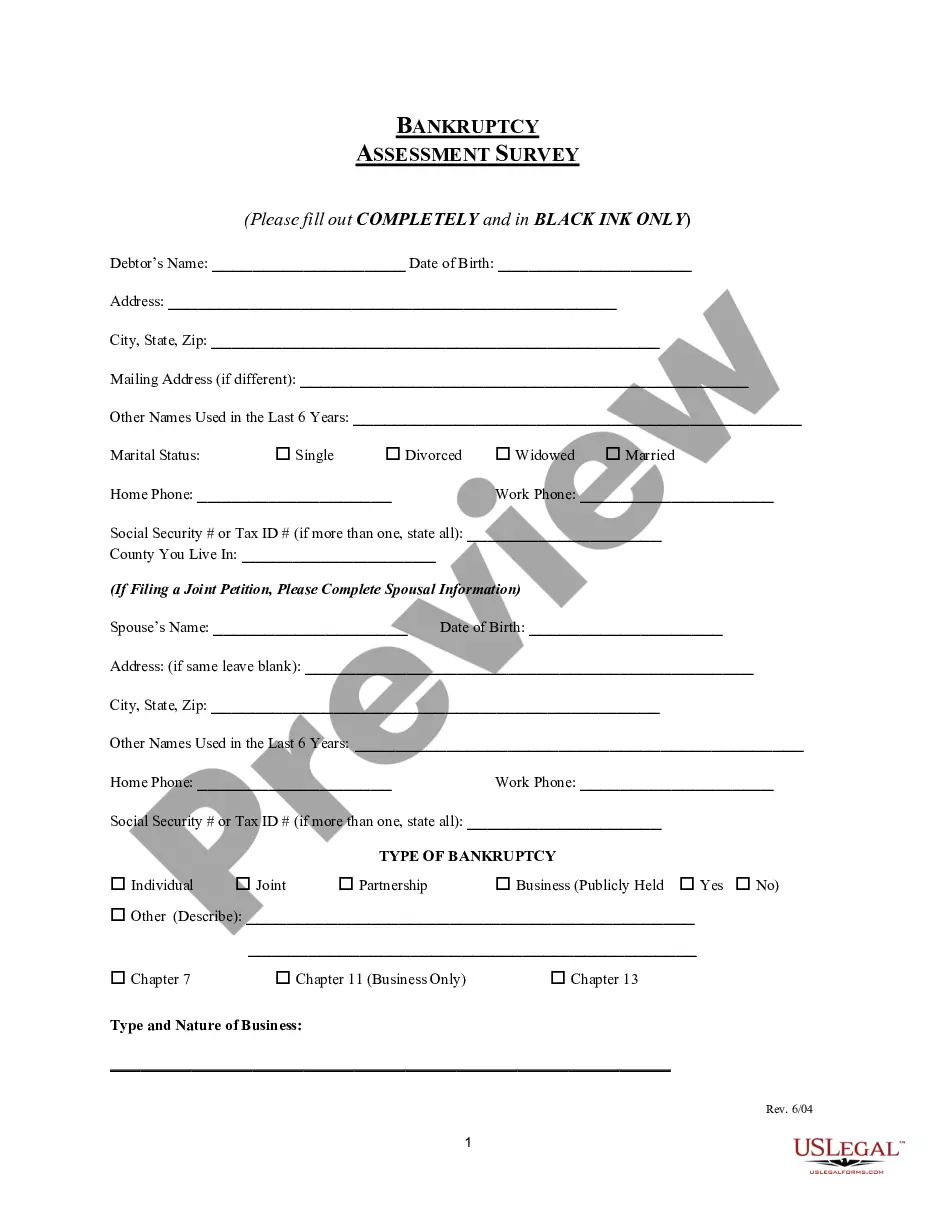

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

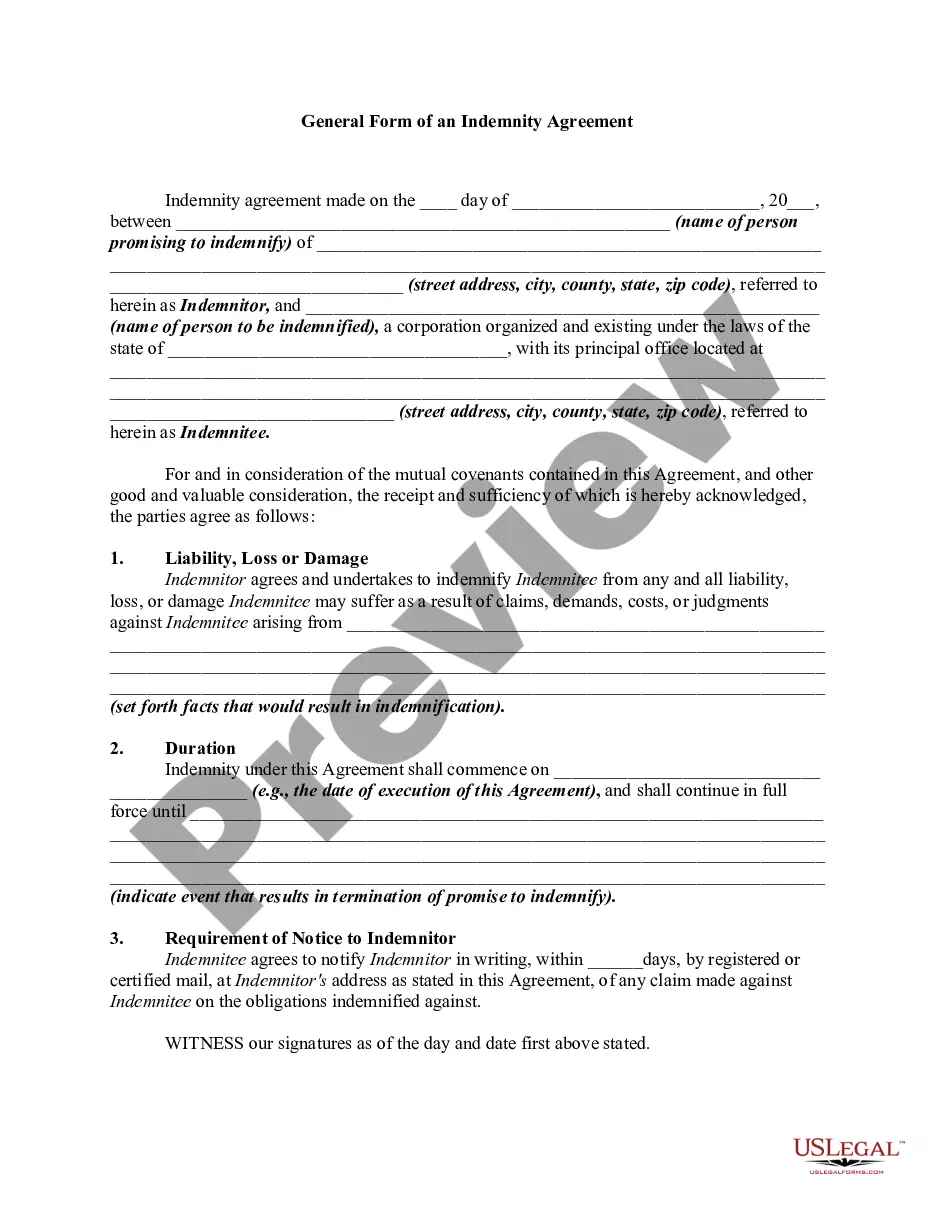

A North Dakota Financial Support Agreement — Guaranty of Obligation is a legally binding document that outlines the terms and conditions of financial assistance provided by one party (the guarantor) to another party (the borrower) with the intention of guaranteeing the repayment of a specific obligation. Keywords: North Dakota, Financial Support Agreement, Guaranty of Obligation, legally binding document, terms and conditions, financial assistance, guarantor, borrower, repayment. There are different types of North Dakota Financial Support Agreement — Guaranty of Obligation, including: 1. Personal Guaranty: This type of agreement is used when an individual personally guarantees the repayment of a loan or financial obligation on behalf of a borrower, typically in the case of small businesses or personal loans. 2. Corporate Guaranty: This type of agreement is similar to the personal guaranty, but the guarantor is a corporation or limited liability company (LLC). It is commonly used in commercial transactions when a lender requires additional security for the repayment of debts. 3. Continuing Guaranty: This agreement is designed to provide ongoing financial support and security to the borrower for future obligations as well. It takes effect upon signing and extends its coverage to any future financial transactions between the borrower and lender. 4. Limited Guaranty: In this type of agreement, the guarantor's liability is limited to a specific amount, specified time frame, or particular transaction. This type of guaranty is often used when a lender wants to provide temporary support or limit the guarantor's obligations to a specific loan or project. 5. Unconditional Guaranty: This type of guaranty is an absolute commitment by the guarantor to fulfill the borrower's obligations. The guarantor is legally bound to repay the loan or obligation, irrespective of any circumstances or potential changes affecting the borrower's ability to meet their financial commitments. In summary, a North Dakota Financial Support Agreement — Guaranty of Obligation is a critical legal document that establishes the terms and conditions of financial assistance between a guarantor and borrower. Understanding the different types of guaranty agreements allows parties involved to choose the most appropriate agreement that best suits their specific needs and circumstances.