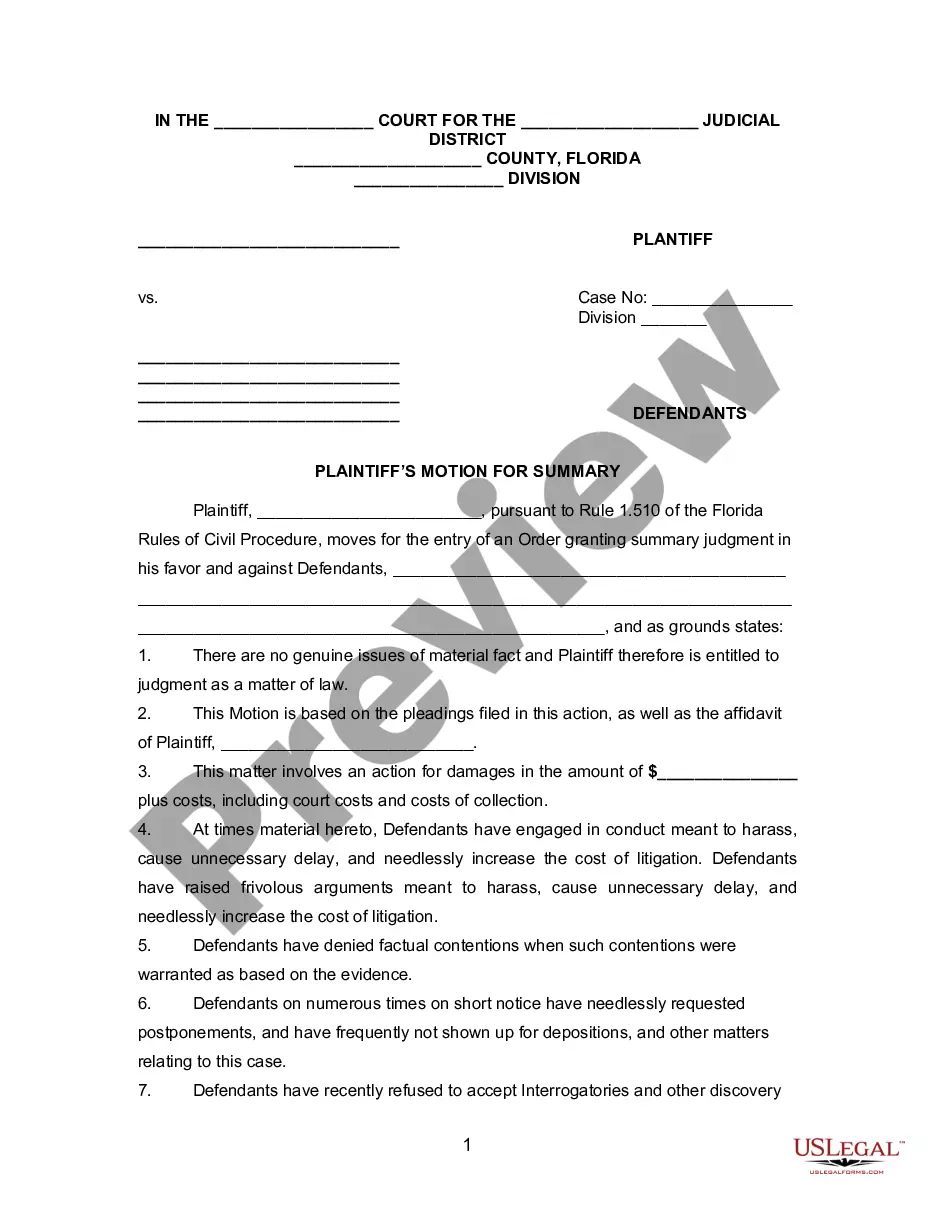

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

North Dakota Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

Choosing the right lawful papers template can be a have difficulties. Naturally, there are plenty of layouts accessible on the Internet, but how would you obtain the lawful type you will need? Take advantage of the US Legal Forms website. The service offers thousands of layouts, for example the North Dakota Bank Loan Application Form and Checklist - Business Loan, which can be used for company and personal requirements. Each of the varieties are inspected by professionals and meet up with state and federal specifications.

When you are currently listed, log in to your accounts and click on the Down load button to get the North Dakota Bank Loan Application Form and Checklist - Business Loan. Utilize your accounts to check throughout the lawful varieties you have bought previously. Check out the My Forms tab of your own accounts and have yet another version of your papers you will need.

When you are a fresh user of US Legal Forms, allow me to share basic recommendations so that you can follow:

- First, make sure you have selected the appropriate type for your personal town/area. It is possible to look through the shape using the Review button and read the shape information to make certain this is basically the right one for you.

- When the type is not going to meet up with your preferences, use the Seach area to get the appropriate type.

- Once you are certain the shape is acceptable, click the Get now button to get the type.

- Pick the costs prepare you need and type in the essential details. Create your accounts and purchase an order utilizing your PayPal accounts or credit card.

- Pick the document structure and obtain the lawful papers template to your device.

- Comprehensive, modify and print out and signal the acquired North Dakota Bank Loan Application Form and Checklist - Business Loan.

US Legal Forms will be the most significant collection of lawful varieties for which you can find numerous papers layouts. Take advantage of the service to obtain skillfully-created paperwork that follow condition specifications.