North Dakota Checklist — Dealing with Shareholders and Investors — Preparing a User-Friendly Annual Report 1. Introduction to North Dakota Checklist: The North Dakota Checklist for dealing with shareholders and investors aims to help companies effectively prepare a user-friendly annual report that meets the needs of their stakeholders. By following this checklist, businesses can ensure transparent communication, build trust with their shareholders, and attract potential investors. 2. Understanding Shareholders and Investors' Expectations: To prepare a user-friendly annual report, companies must first understand their shareholders and investors' expectations. This entails conducting market research and analyzing the preferences of the target audience. Key keywords: shareholders, investors, expectations, market research, preferences. 3. Establishing a Clear Structure: To create a user-friendly annual report, it is crucial to establish a clear structure that enables easy navigation and information retrieval. Companies can divide the report into sections such as executive summary, financial performance, corporate governance, risk management, and future outlook. This facilitates a logical flow and enhances readability. Key keywords: clear structure, executive summary, financial performance, corporate governance, risk management, future outlook. 4. Presenting Key Financial Information: Shareholders and investors expect comprehensive financial information when reviewing an annual report. This includes audited financial statements, key financial ratios, historical performance analysis, cash flow statements, and balance sheets. Providing accurate and easily understandable financial data helps investors make informed decisions. Key keywords: financial information, audited financial statements, financial ratios, historical performance, cash flow statements, balance sheets. 5. Focusing on Corporate Governance: Corporate governance practices play a vital role in maintaining shareholders' trust. The annual report should include information about the board of directors, their qualifications, independence, and committees. Describing the company's code of ethics, whistle-blowing policies, and risk management frameworks also demonstrates a commitment to transparency and accountability. Key keywords: corporate governance, board of directors, qualifications, independence, committees, code of ethics, whistle-blowing policies, risk management. 6. Highlighting Strategic Initiatives: To engage shareholders and attract potential investors, it is essential to highlight the company's strategic initiatives and future prospects. This may include information about market expansion plans, research and development activities, competitive analysis, and innovation strategies. Demonstrating a clear vision and growth potential enhances the company's appeal. Key keywords: strategic initiatives, future prospects, market expansion, research and development, competitive analysis, innovation strategies. 7. Visualizing Data and Incorporating Infographics: A user-friendly annual report incorporates data visualization techniques and infographics to enhance understanding and engagement. Companies can present complex financial information through charts, graphs, and diagrams, making it easier for shareholders and investors to interpret the data. Key keywords: data visualization, infographics, charts, graphs, diagrams. 8. Including Stakeholder Testimonials and Case Studies: To add credibility to the annual report, including testimonials from satisfied shareholders or case studies showcasing successful partnerships can be beneficial. This helps potential investors gauge the company's reputation, reliability, and ability to deliver value. Key keywords: stakeholder testimonials, case studies, credibility, reputation, value. Different Types of North Dakota Checklist — Dealing with Shareholders and Investors — Preparing a User-Friendly Annual Report: 1. Basic Checklist for Annual Report Preparation: This checklist provides a step-by-step guide on preparing an annual report, covering the essential sections and information needed to satisfy shareholders and investors. 2. Advanced Checklist for Annual Report Preparation: This comprehensive checklist goes into more depth, incorporating additional elements such as risk management practices, social responsibility initiatives, and sustainability reporting. It caters to companies aiming to demonstrate a higher level of transparency and corporate governance. 3. Shareholder Engagement Checklist: This checklist focuses on strategies and actions companies can undertake to effectively engage with their shareholders. It covers areas like general meetings, communication channels, and shareholder participation, ensuring a healthy and interactive relationship. 4. Investor Relations Checklist: This checklist outlines the best practices for maintaining strong investor relations, including tips for investor presentations, investor roadshows, timely reporting, and managing investor queries. By carefully following the North Dakota Checklist for dealing with shareholders and investors, businesses can enhance their annual reports to meet the expectations of their stakeholders and attract potential investors.

North Dakota Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report

Description

How to fill out North Dakota Checklist - Dealing With Shareholders And Investors - Preparing A User-Friendly Annual Report?

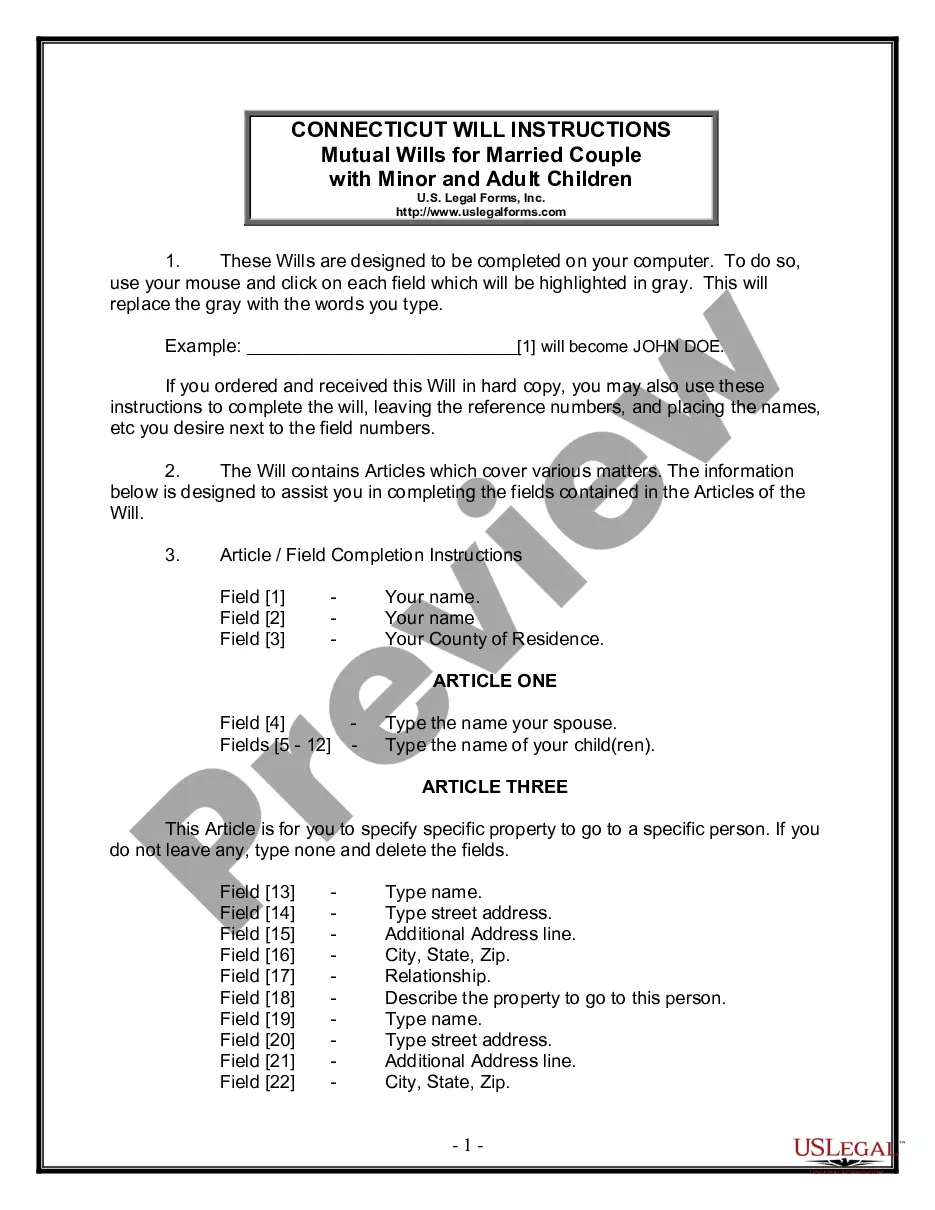

Choosing the right lawful papers template might be a have difficulties. Needless to say, there are a lot of layouts available on the Internet, but how can you obtain the lawful kind you will need? Use the US Legal Forms web site. The assistance gives a huge number of layouts, including the North Dakota Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, which you can use for enterprise and private needs. Each of the types are checked out by experts and fulfill state and federal demands.

If you are already registered, log in to the bank account and click the Download button to obtain the North Dakota Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report. Make use of bank account to search through the lawful types you might have ordered previously. Go to the My Forms tab of your bank account and obtain another copy from the papers you will need.

If you are a brand new end user of US Legal Forms, listed below are simple guidelines for you to comply with:

- Initial, make sure you have selected the correct kind for your personal city/county. You may look over the shape while using Review button and read the shape description to ensure it is the best for you.

- In case the kind will not fulfill your preferences, take advantage of the Seach field to discover the right kind.

- When you are positive that the shape is suitable, select the Purchase now button to obtain the kind.

- Choose the costs program you would like and type in the needed information and facts. Design your bank account and pay for the order using your PayPal bank account or Visa or Mastercard.

- Pick the submit structure and down load the lawful papers template to the device.

- Complete, modify and produce and indication the obtained North Dakota Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report.

US Legal Forms will be the largest catalogue of lawful types in which you can find different papers layouts. Use the company to down load skillfully-made files that comply with status demands.