North Dakota Location Worksheet

Description

How to fill out Location Worksheet?

US Legal Forms - one of the most important repositories of legal documents in the United States - offers a range of legal document templates that you can download or print.

While using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can quickly find the latest versions of forms like the North Dakota Location Worksheet.

If you have a subscription, Log In and download the North Dakota Location Worksheet from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

For modifications, complete, edit, print, and sign the downloaded North Dakota Location Worksheet.

Every template you added to your account does not have an expiration date and is yours forever. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- To get started with US Legal Forms for the first time, follow these simple instructions.

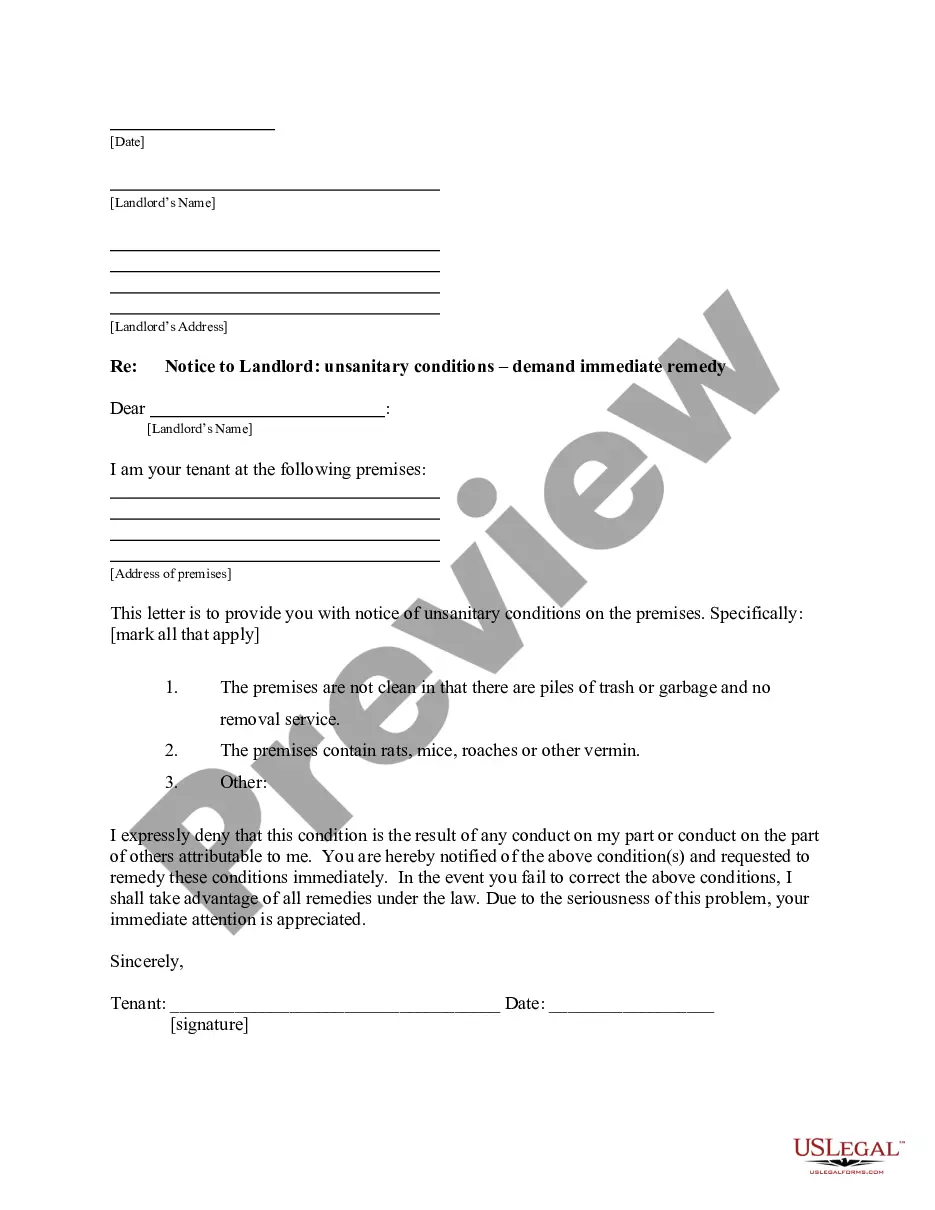

- Make sure you have selected the right form for your locality/region. Click on the Preview button to view the content of the form. Check the form summary to ensure you've chosen the correct document.

- If the form does not meet your requirements, use the Search area at the top of the screen to look for one that does.

- If you are satisfied with the form, confirm your choice by pressing the Buy now button. Then, select your preferred pricing plan and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

North Dakota is known for its vast prairies, rich agriculture, and pioneering spirit. It is the leading producer of sunflowers and flaxseed in the United States. Additionally, the state offers stunning natural parks, like Theodore Roosevelt National Park, which attract nature lovers. Understanding these aspects is vital, and the North Dakota Location Worksheet can provide you with essential context about the area's geography and resources.

The absolute location of North Dakota can be pinpointed at approximately 47 degrees North latitude and 100 degrees West longitude. This precise location allows for a clear understanding of its position on the globe, essential for navigation and environmental studies. Utilizing the North Dakota Location Worksheet can further assist you in comprehending geographical references and their implications.

North Dakota is situated in the northern region of the United States, bordered by Canada to the north, Minnesota to the east, South Dakota to the south, and Montana to the west. This strategic location contributes to its unique climate and landscape. The North Dakota Location Worksheet can help you understand this geography better and provide insights into land use and property regulations.

In North Dakota, if you earn income above a certain threshold, your employer is required to withhold state income tax. This threshold is based on your filing status and income level. To determine your specific situation and ensure proper withholding, consult the North Dakota Location Worksheet for valuable insights tailored to your needs.

Form 307 is the North Dakota Individual Income Tax Return form, essential for reporting taxable income and determining your state tax due. This form aims to provide a streamlined filing process for both residents and nonresidents. To ensure accuracy while completing Form 307, utilize the North Dakota Location Worksheet for comprehensive guidance.

Individuals who earn income from North Dakota sources while residing in another state must file a nonresident tax return. This includes those who work or operate a business in North Dakota but live outside its borders. For more specific guidelines and calculations, refer to the North Dakota Location Worksheet to clarify your filing obligations.

Form 307 is the North Dakota Individual Income Tax Return form, used by residents to report their income and calculate their state tax liability. This form facilitates accurate reporting of various income types, ensuring taxpayers meet state requirements. For assistance and tips on filling out Form 307, check the North Dakota Location Worksheet.

In North Dakota, bonuses are treated as supplemental income and are subject to state income tax. Employers may withhold taxes at a flat rate or aggregate bonuses with regular income for withholding calculations. To navigate the complexities of bonus taxation, consult the North Dakota Location Worksheet for insights tailored to your financial situation.

Yes, residents and nonresidents who earn income in North Dakota must file a tax return. Filing requirements can vary based on income levels and residency status. For specific filing guidelines, you might find the North Dakota Location Worksheet a useful resource to ensure compliance.

North Dakota allows residents to exclude up to 50% of qualified dividends from their taxable income. This exclusion can significantly lower your tax obligation, enhancing your overall financial position. To optimize your tax filings, refer to the North Dakota Location Worksheet for detailed guidance on dividend exclusions.