North Dakota Sample Letter for Garnishment

Description

How to fill out Sample Letter For Garnishment?

You can commit several hours on the Internet attempting to find the legitimate record design that suits the federal and state requirements you need. US Legal Forms provides thousands of legitimate varieties which can be evaluated by professionals. You can easily acquire or printing the North Dakota Sample Letter for Garnishment from your services.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Download button. After that, you are able to total, revise, printing, or sign the North Dakota Sample Letter for Garnishment. Every legitimate record design you purchase is yours for a long time. To get an additional duplicate of any bought develop, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms website the very first time, follow the simple directions listed below:

- Very first, be sure that you have chosen the correct record design for your county/town of your liking. See the develop description to make sure you have chosen the proper develop. If offered, make use of the Preview button to search through the record design at the same time.

- If you would like discover an additional variation of the develop, make use of the Research industry to find the design that meets your requirements and requirements.

- Upon having discovered the design you need, simply click Purchase now to move forward.

- Pick the prices program you need, key in your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal accounts to fund the legitimate develop.

- Pick the structure of the record and acquire it to your gadget.

- Make modifications to your record if possible. You can total, revise and sign and printing North Dakota Sample Letter for Garnishment.

Download and printing thousands of record templates making use of the US Legal Forms site, that offers the biggest selection of legitimate varieties. Use specialist and state-specific templates to tackle your company or individual needs.

Form popularity

FAQ

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

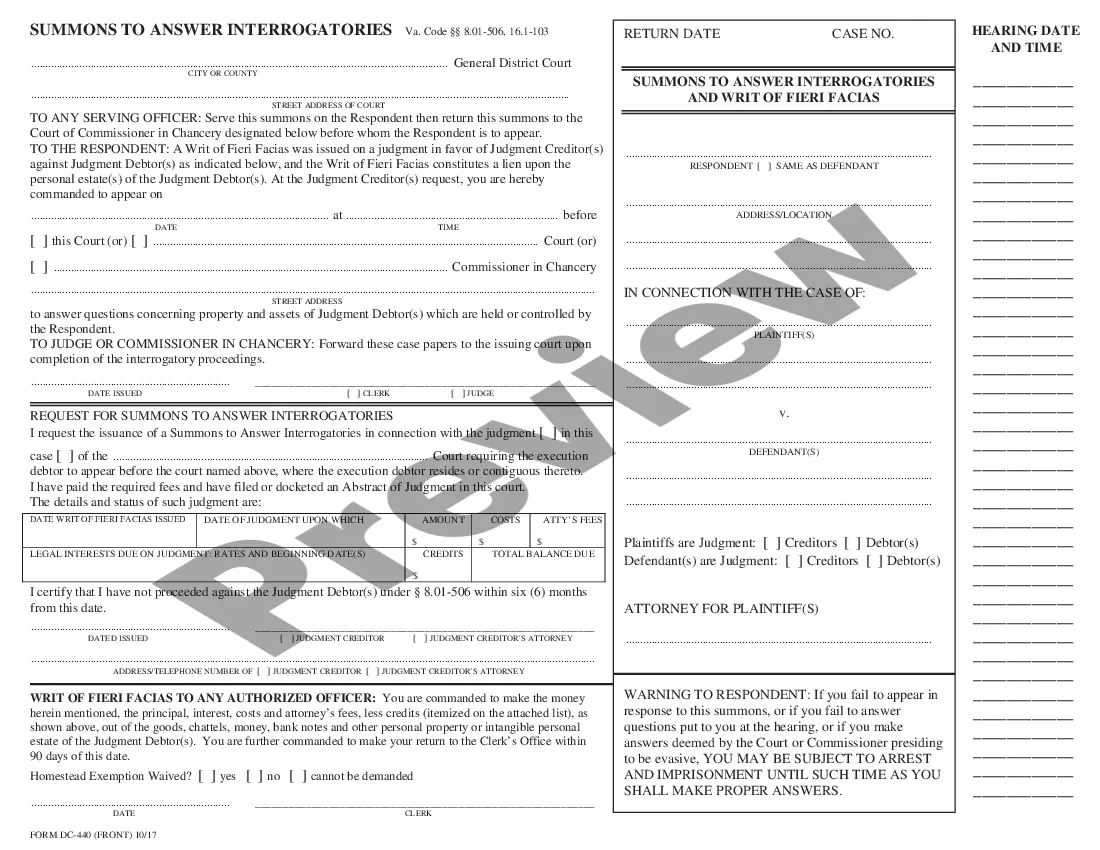

Information in the Letter Other items in the letter are how often the deductions will occur, when they will begin and how long the deductions will last. You must also include who requested the garnishment, such as a state agency, court or business, as well as information on how the employee can stop the garnishments.

North Dakota follows federal law in terms of how much of your disposable income can be garnished by a creditor. Creditors can garnish whichever is less: 25% of your weekly disposable income, or. The amount by which your weekly income exceeds 40 times the federal minimum wage.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

Another way to stop a wage garnishment is by negotiating with your creditor. Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms.

Wage garnishment can be a painful and embarrassing process for the employee.

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Respond promptly to the court order (if the order requires). The employer must return a statutory response form within the required amount of time (set by the court order). The form is typically sent to the employer with the garnishment order. Respond quickly to avoid the risk of a court-issued penalty.