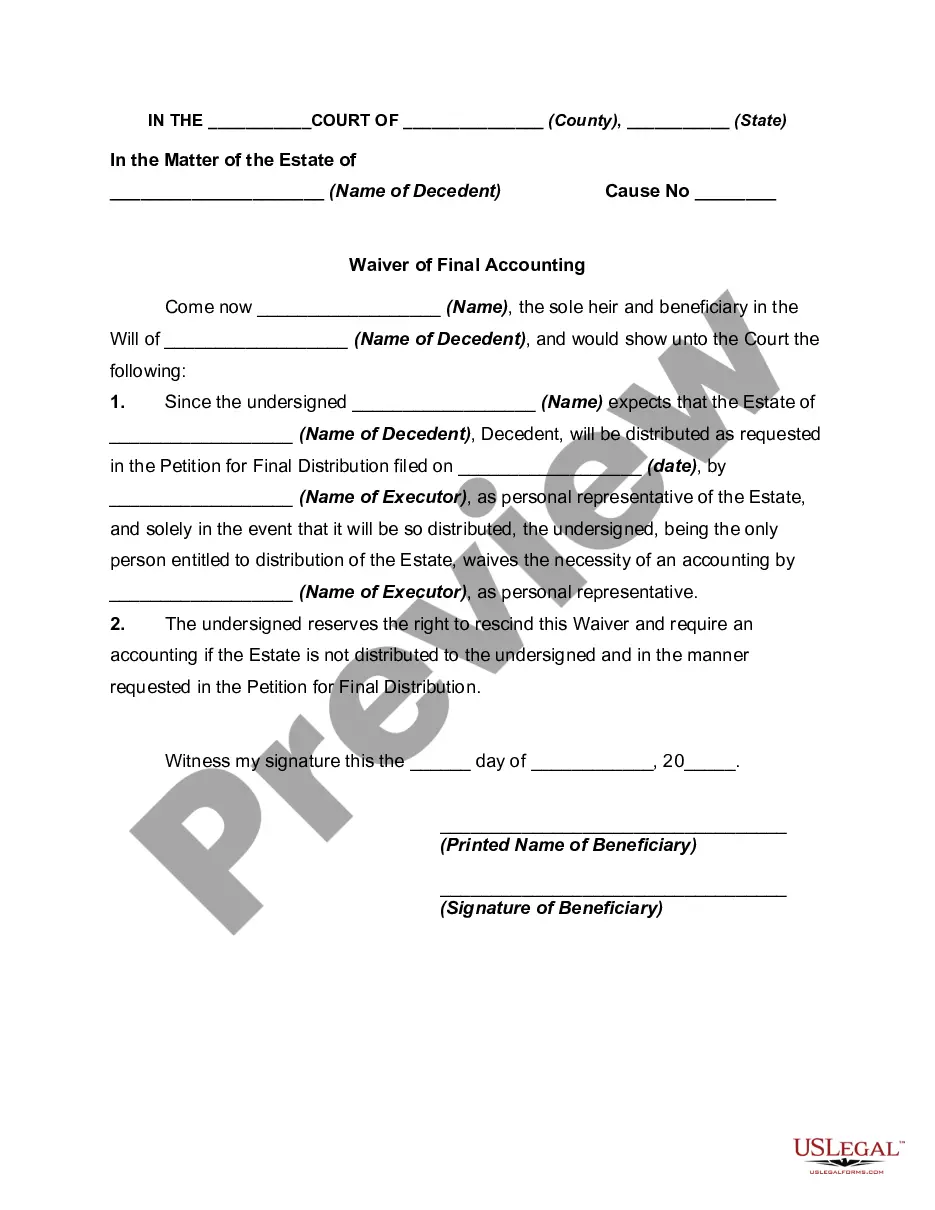

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

North Dakota Waiver of Final Accounting by Sole Beneficiary is a legal document that grants authority to a sole beneficiary to waive the requirement of a final accounting in the administration of an estate. This waiver relieves the executor or personal representative from the obligation of preparing and filing a detailed final account statement with the court. In the State of North Dakota, there are different types of waivers of final accounting by the sole beneficiary, each serving a specific purpose: 1. Voluntary Waiver: This type of waiver is initiated by the sole beneficiary voluntarily to streamline the probate process and avoid the necessity of a final accounting. It reflects the beneficiary's confidence in the executor and willingness to receive their inheritance without any further financial disclosures. 2. Inheritance Waiver: An inheritance waiver may be executed when the sole beneficiary is content with the assets received from the estate and desires to skip the final accounting requirement. This waiver allows the beneficiary to acknowledge their satisfaction and trust in the executor's administration of the estate. 3. Full Release Waiver: A full release waiver is commonly used when the sole beneficiary has received their entire entitlement or distribution from the estate. By signing this waiver, the beneficiary affirms that they have no further claims or demands against the estate and absolves the executor of any future accounting obligations. 4. Final Distribution Waiver: This waiver is specifically utilized when the sole beneficiary receives their final distribution or settlement from the estate prior to the completion of the final accounting. By signing this document, the beneficiary acknowledges the received assets as their complete share and relinquishes the right to request further financial information. These North Dakota waivers of final accounting by the sole beneficiary are important legal tools that simplify the probate process, save time and money, and foster efficient estate administration. However, it is crucial for the beneficiary to carefully review and understand the implications of signing such waivers, as they effectively waive their right to receive a detailed financial overview of the estate's administration. Consulting with a qualified attorney is strongly recommended ensuring compliance with North Dakota laws and to protect the beneficiary's rights.North Dakota Waiver of Final Accounting by Sole Beneficiary is a legal document that grants authority to a sole beneficiary to waive the requirement of a final accounting in the administration of an estate. This waiver relieves the executor or personal representative from the obligation of preparing and filing a detailed final account statement with the court. In the State of North Dakota, there are different types of waivers of final accounting by the sole beneficiary, each serving a specific purpose: 1. Voluntary Waiver: This type of waiver is initiated by the sole beneficiary voluntarily to streamline the probate process and avoid the necessity of a final accounting. It reflects the beneficiary's confidence in the executor and willingness to receive their inheritance without any further financial disclosures. 2. Inheritance Waiver: An inheritance waiver may be executed when the sole beneficiary is content with the assets received from the estate and desires to skip the final accounting requirement. This waiver allows the beneficiary to acknowledge their satisfaction and trust in the executor's administration of the estate. 3. Full Release Waiver: A full release waiver is commonly used when the sole beneficiary has received their entire entitlement or distribution from the estate. By signing this waiver, the beneficiary affirms that they have no further claims or demands against the estate and absolves the executor of any future accounting obligations. 4. Final Distribution Waiver: This waiver is specifically utilized when the sole beneficiary receives their final distribution or settlement from the estate prior to the completion of the final accounting. By signing this document, the beneficiary acknowledges the received assets as their complete share and relinquishes the right to request further financial information. These North Dakota waivers of final accounting by the sole beneficiary are important legal tools that simplify the probate process, save time and money, and foster efficient estate administration. However, it is crucial for the beneficiary to carefully review and understand the implications of signing such waivers, as they effectively waive their right to receive a detailed financial overview of the estate's administration. Consulting with a qualified attorney is strongly recommended ensuring compliance with North Dakota laws and to protect the beneficiary's rights.