Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

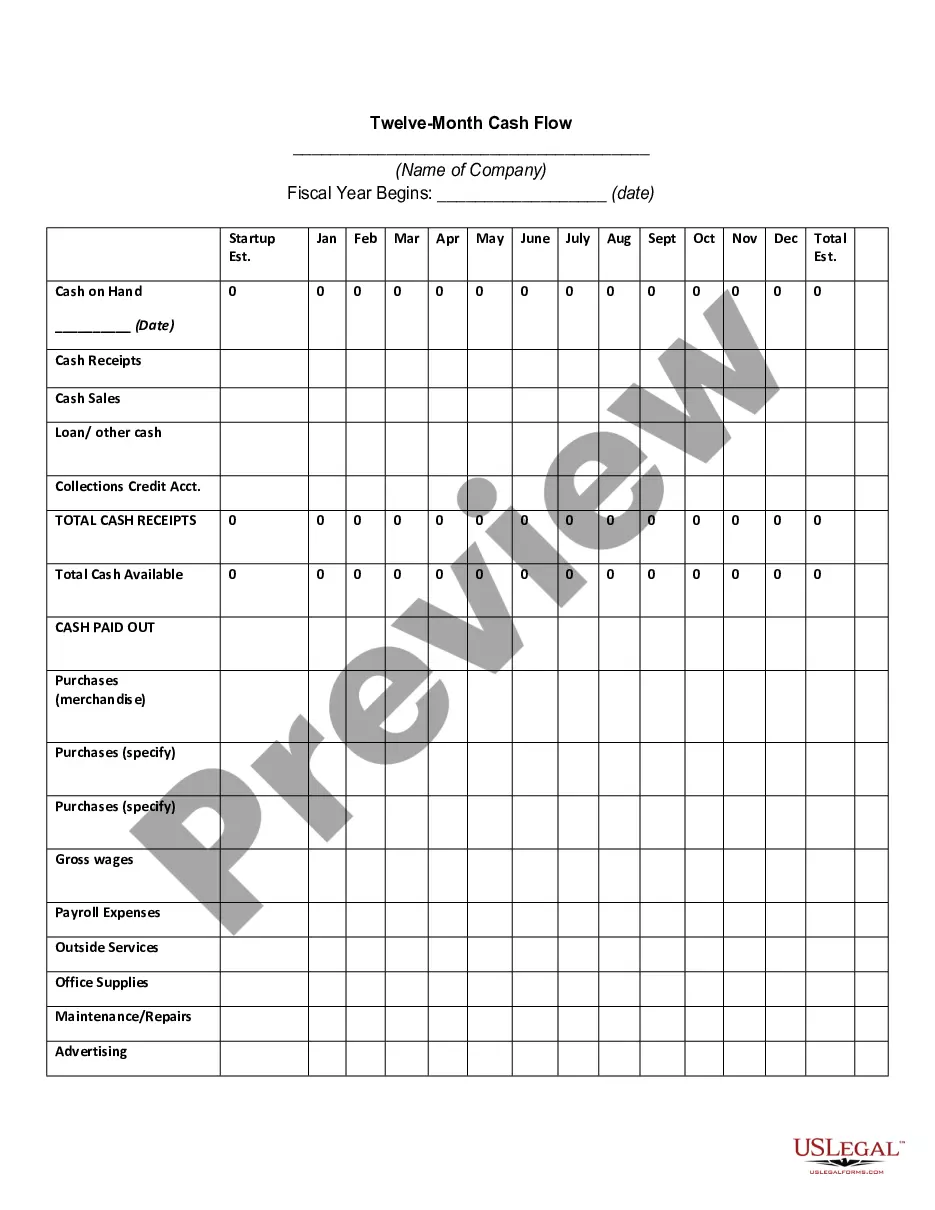

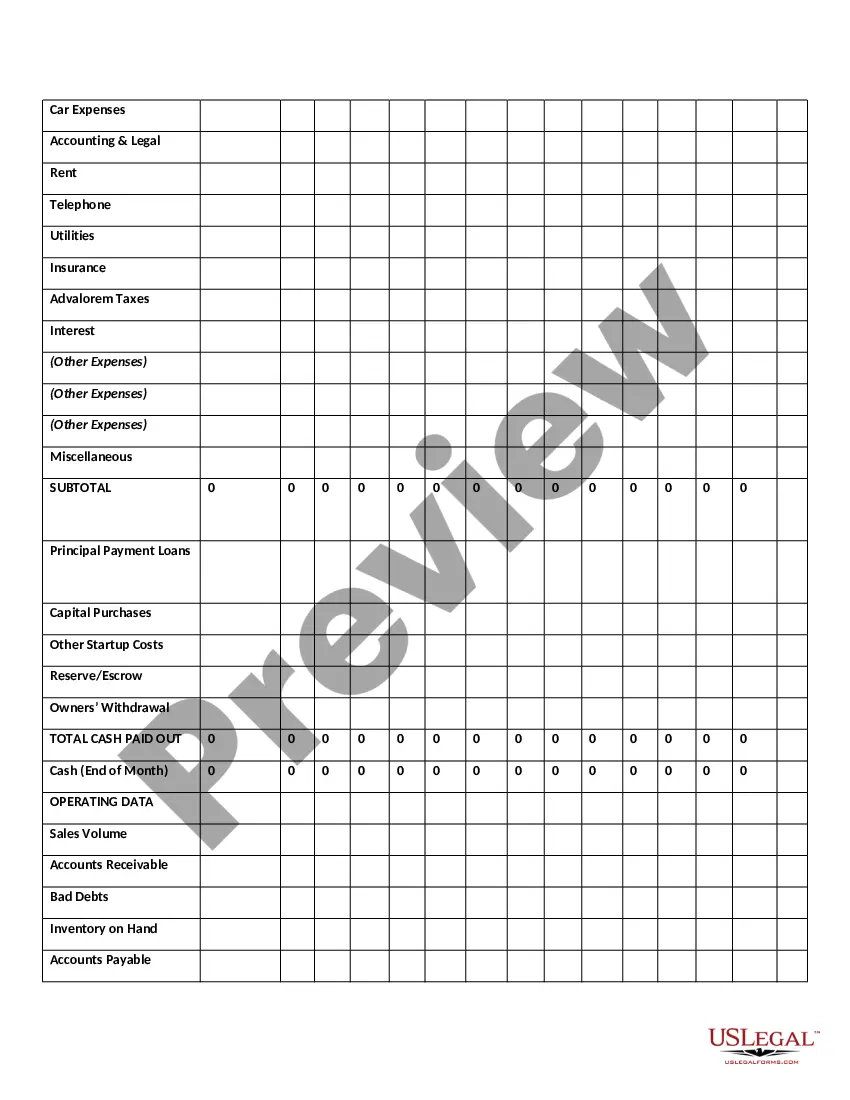

North Dakota Twelve-Month Cash Flow is a financial statement that provides a comprehensive overview of the cash inflows and outflows for a business or individual in North Dakota over a period of twelve months. This statement is an indispensable tool for budgeting, financial planning, and analysis. Keywords: North Dakota, Twelve-Month Cash Flow, financial statement, cash inflows, cash outflows, business, individual, budgeting, financial planning, analysis. The North Dakota Twelve-Month Cash Flow is vital for businesses and individuals seeking to gain a clear understanding of their financial position and make informed decisions. By tracking and analyzing cash inflows and outflows over a twelve-month period, businesses can identify trends, anticipate potential cash shortages or surpluses, and adjust their financial strategies accordingly. There are several types of North Dakota Twelve-Month Cash Flow, each serving a specific purpose: 1. Business North Dakota Twelve-Month Cash Flow: This type of cash flow statement is designed specifically for businesses operating in North Dakota. It tracks the cash generated from sales, accounts receivable, loans, investments, and other sources, as well as cash spent on expenses such as salaries, inventory, equipment, and operating costs. 2. Personal North Dakota Twelve-Month Cash Flow: Individuals residing in North Dakota can also benefit from tracking their cash inflows and outflows over a twelve-month period. This type of cash flow statement allows individuals to evaluate their income, expenses, and savings, helping them to manage their personal finances more effectively. 3. Agricultural North Dakota Twelve-Month Cash Flow: For farmers and agricultural businesses in North Dakota, this cash flow statement focuses on the unique aspects of their industry. It tracks cash generated from crop or livestock sales, government subsidies, and other agricultural-related sources, while also accounting for expenses such as seeds, fertilizers, equipment maintenance, and land rents. 4. Investment North Dakota Twelve-Month Cash Flow: This type of cash flow statement caters to individuals or businesses in North Dakota that have investment portfolios. It tracks cash inflows from dividends, interest, capital gains, and other investment-related sources, as well as cash outflows for purchases, fees, and taxes. Regardless of the specific type, a North Dakota Twelve-Month Cash Flow statement provides a comprehensive snapshot of the financial health and stability of businesses and individuals in North Dakota. It allows them to analyze their financial performance, identify areas for improvement, and make strategic decisions to optimize their cash flow.