North Dakota Sample Letter for Exemption of Ad Valorem Taxes

Description

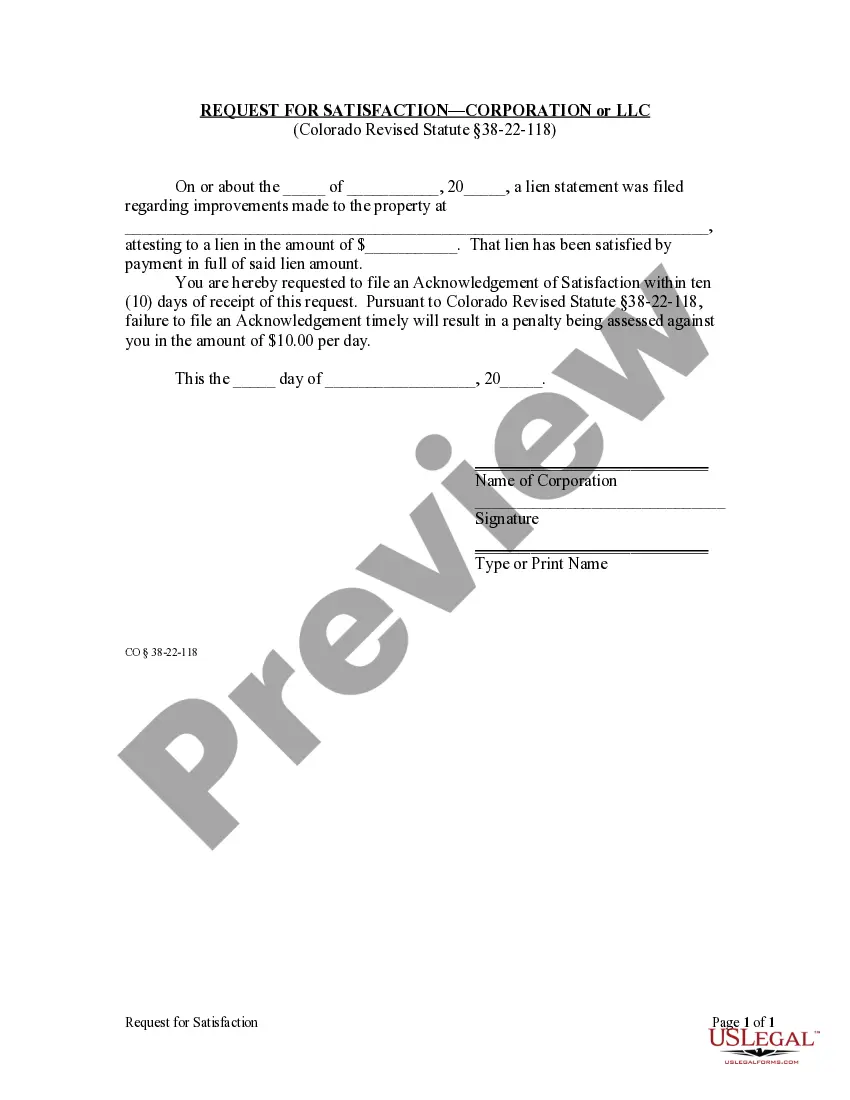

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

Are you currently within a position the place you need to have files for either enterprise or personal reasons nearly every working day? There are plenty of legal record templates available on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms delivers thousands of kind templates, such as the North Dakota Sample Letter for Exemption of Ad Valorem Taxes, which can be published to satisfy federal and state needs.

If you are already informed about US Legal Forms internet site and also have an account, simply log in. After that, you are able to download the North Dakota Sample Letter for Exemption of Ad Valorem Taxes format.

Unless you offer an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for your proper area/state.

- Utilize the Review option to analyze the shape.

- Look at the outline to ensure that you have selected the correct kind.

- When the kind is not what you are looking for, take advantage of the Search field to discover the kind that meets your requirements and needs.

- Once you get the proper kind, simply click Acquire now.

- Pick the costs prepare you need, fill in the required information to generate your bank account, and pay money for an order using your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and download your duplicate.

Discover every one of the record templates you have bought in the My Forms menus. You may get a more duplicate of North Dakota Sample Letter for Exemption of Ad Valorem Taxes any time, if required. Just click on the necessary kind to download or print the record format.

Use US Legal Forms, by far the most comprehensive collection of legal varieties, to save lots of time as well as avoid faults. The assistance delivers expertly manufactured legal record templates that you can use for a selection of reasons. Create an account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

Health Providers Hospitals, skilled nursing facilities, intermediate and basic care facilities, residential end-of-life facilities, and emergency medical service providers licensed by the North Dakota Department of Health are exempt organizations.

North Dakota exempts all personal property from property taxation except that of certain oil and gas refineries and utilities.

Common Exemptions from North Dakota Sales and Use Tax: Prescription Drugs. Oxygen and Anesthesia Gases. Medical Devices, Equipment, and Supplies. Durable Medical Equipment includes equipment for home use, including repair and replacement parts.

Taxes paid by Feb. 15 receive a 5% discount on the total amount. The property tax in North Dakota is an ?ad valorem? tax, which means it is based on the value of the property to which it applies.

Some customers are exempt from paying sales tax under North Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

North Dakota's Homestead Tax Credit Program (NDCC 57-02-08.1) provides assistance to low-income senior citizens and disabled persons in making their property tax payments. Depending on their qualifications, a tax payer can save between 10-100% on their property taxes, up to a maximum taxable value of $125,000.

The 2021 North Dakota Legislature created a tax relief income tax credit for residents of North Dakota. Full-year residents of North Dakota will receive a credit up to $350. For taxpayers who are full-year residents and married filing jointly, the tax credit is up to $700.

But there are certain forms of income that aren't taxable. Exempt income includes things like distributions from some retirement accounts, gifts under a certain amount, certain benefits, and private insurance plans.