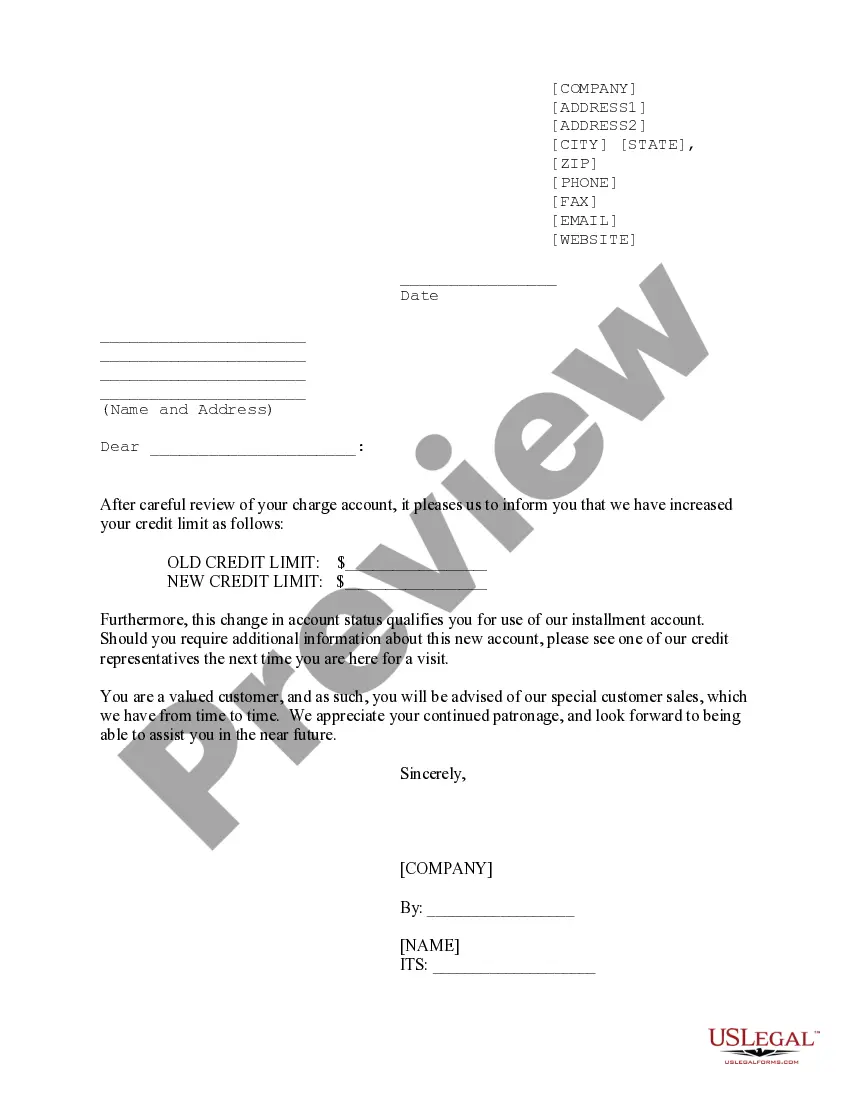

North Dakota Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

If you desire to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Use the website's straightforward and user-friendly search feature to find the documents you require.

A diverse range of templates for corporate and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to find the North Dakota Sample Letter for Notification of Charge Account Credit Limit Increase in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to obtain the North Dakota Sample Letter for Notification of Charge Account Credit Limit Increase.

- You can also access forms you previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other variations of the legal document template.

Form popularity

FAQ

A cardholder can also request the issuing bank for a hike in credit limit. There is usually no additional cost involved, though an increase through a card upgrade may attract charges. A lower credit utilisation ratio improves the card holder's credit score, making him a less risky customer in the eyes of the lender.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Ways to Get a Credit Limit IncreaseYou may be able to submit your request online or on the card's mobile app. In some cases, you may need to call the number on the back of your card and make your request by phone. When you request an increase, you could be asked to provide the following information: Annual income.

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

How to Raise Your Credit LimitPay your bills on time.Ask the card company to raise your credit limit.Apply for a new card with a higher limit.Balance transfer.Roll two cards into one.Increase your income.Wait for an Automatic Credit Limit Increase.Increase your Security Deposit.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

Respected Sir/Madam, I beg to state that my name is (Name) and I am a (Name of credit card) credit card holder of your bank having credit card number (Credit card number). I am writing this letter to complain about the charges being levied on my credit card.