Subject: Comprehensive Guide on North Dakota Sample Letters for Corporation Taxes Dear Corporations of North Dakota, As the tax season approaches, we understand the importance of timely and accurate filings for your corporation's taxes in North Dakota. To assist you in this endeavor, we have prepared a detailed description of North Dakota Sample Letters for Corporation Taxes, providing you with valuable insights and essential information to navigate the taxation process smoothly. 1. Purpose and Importance of North Dakota Sample Letters for Corporation Taxes: North Dakota Sample Letters for Corporation Taxes serve as a formal communication method between corporations and the North Dakota Tax Department. These letters are used for various purposes related to tax filing, including requesting extension, clarifying specific tax matters, seeking waivers, or resolving payment issues. 2. Types of North Dakota Sample Letters for Corporation Taxes: a) Extension Request Letter: If your corporation requires additional time to file the tax return, an extension request letter can be submitted to the North Dakota Tax Department. This letter should explain the reasons for the extension request and provide an estimated filing date. b) Clarification or Correction Letter: In case of any errors or discrepancies in the initial tax return filing, a clarification or correction letter should be submitted. This letter must specify the incorrect information and provide accurate details to rectify the situation promptly. c) Waiver Request Letter: If your corporation is seeking a waiver for any penalties or interest charges imposed by the North Dakota Tax Department, a waiver request letter should be drafted. It should include a clear explanation of the circumstances leading to the request. d) Payment Resolution Letter: In situations where your corporation faces challenges in meeting the tax payment requirements, a payment resolution letter can be used to establish a payment plan or negotiate an alternative arrangement. This letter should include proposed payment terms and an explanation of the corporation's financial situation. 3. Key Contents and Format: When drafting North Dakota Sample Letters for Corporation Taxes, it is crucial to follow proper formatting guidelines. The essential components to consider for an effective letter include: — Clear and concise subject line indicating the purpose of the letter. — A professional salutation addressing the appropriate authority within the North Dakota Tax Department. — Introduction stating the purpose of the letter and the corporation's identification details (e.g., name, tax identification number). — Detailed explanation, providing relevant information and supporting documentation where necessary. — Polite and respectful tone throughout the letter. — Clear and specific requests or proposals. — Contact information for quick and convenient correspondence. Remember to maintain accurate records of all correspondence and to retain copies of the letters for your corporation's records. In conclusion, understanding the various types and purposes of North Dakota Sample Letters for Corporation Taxes is essential for maintaining compliance with tax regulations in the state. By utilizing appropriate letter templates and following the guidelines provided, corporations can effectively communicate with the North Dakota Tax Department, ensuring smooth tax filing processes and minimizing unnecessary penalties or complications. If you require further assistance or specific sample letter templates, please feel free to reach out to our team. We are here to support you throughout your tax journey. Sincerely, [Your Name] [Your Title/Position] [Your Company/Organization Name]

North Dakota Sample Letter for Corporation Taxes

Description

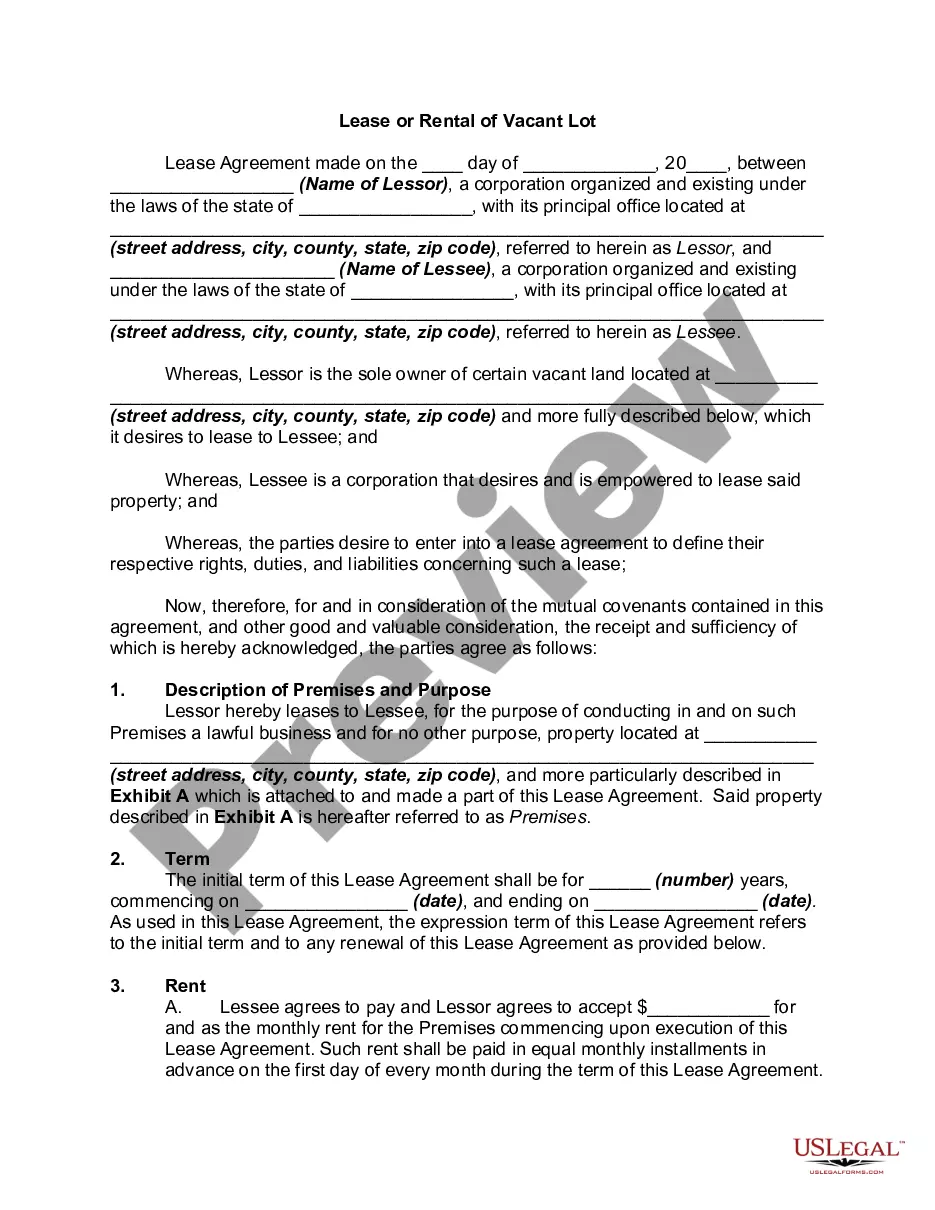

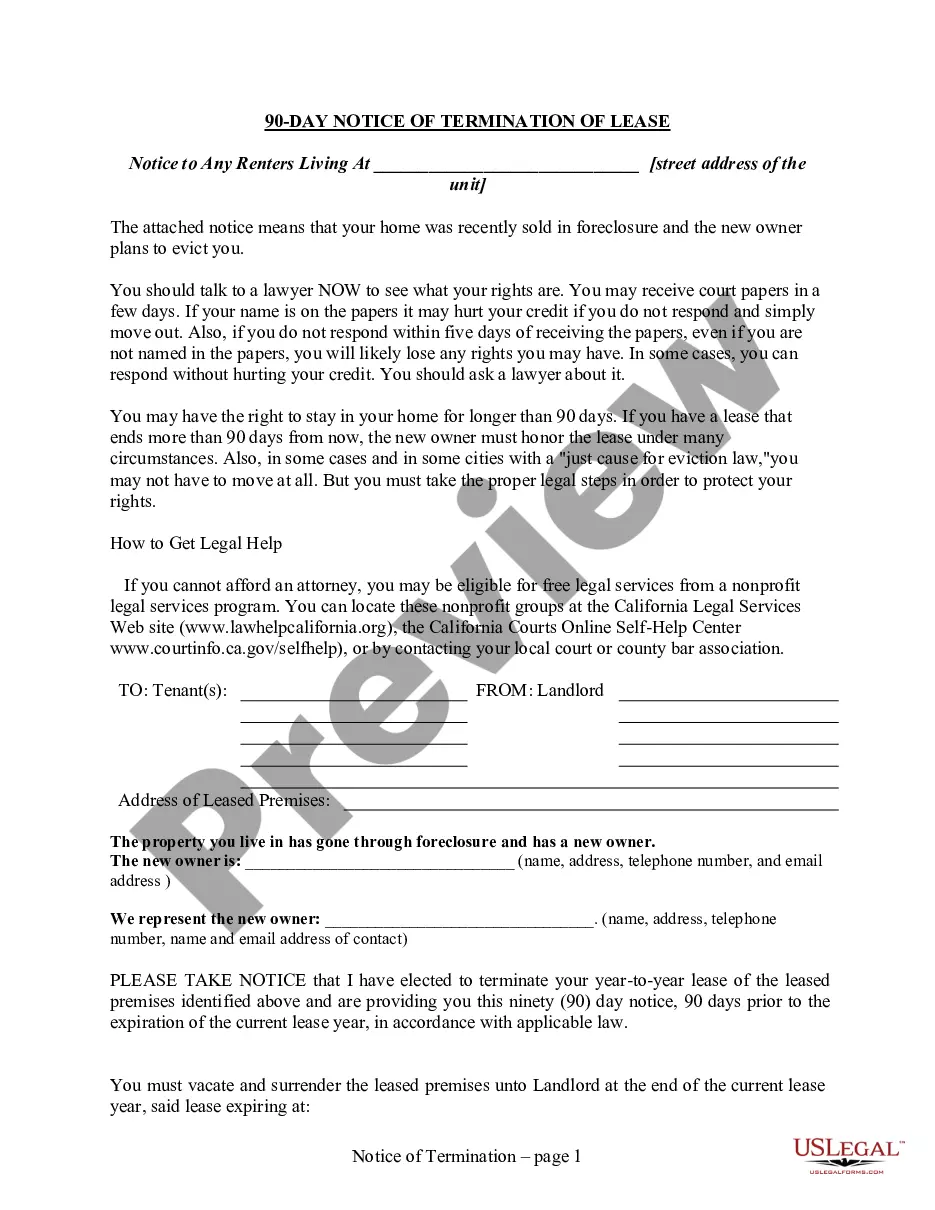

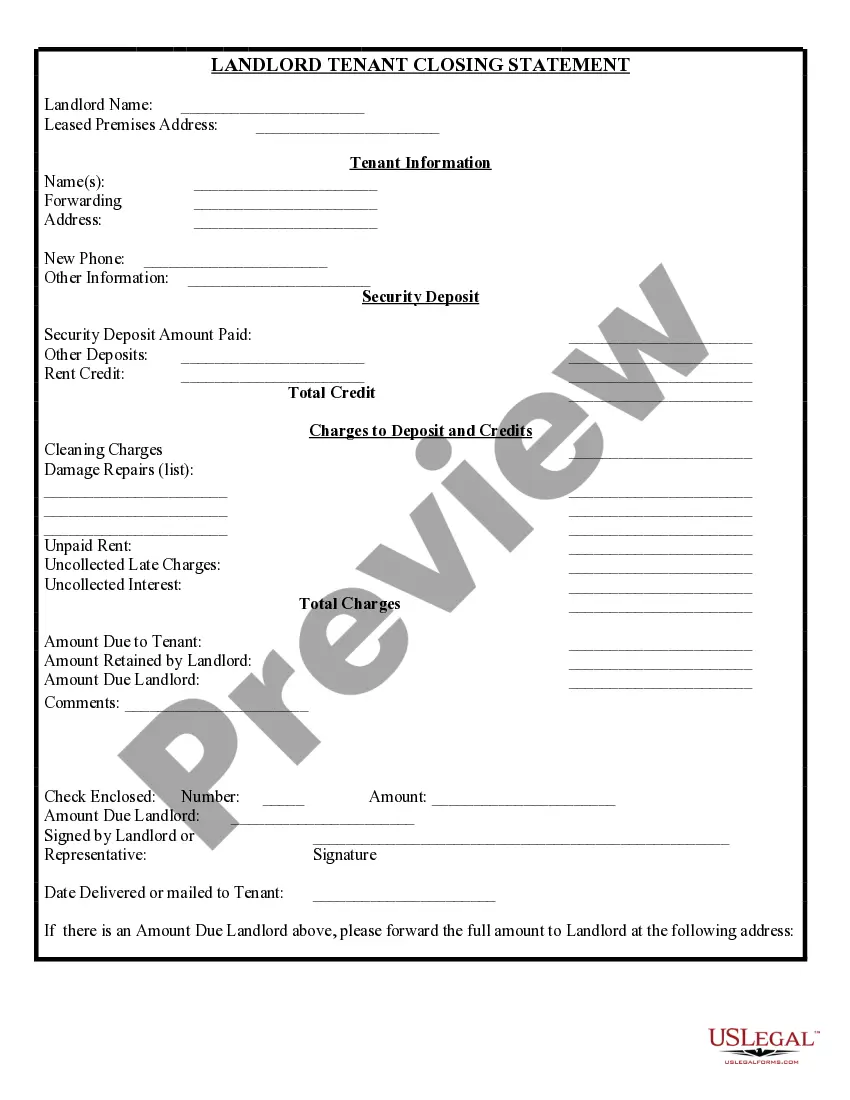

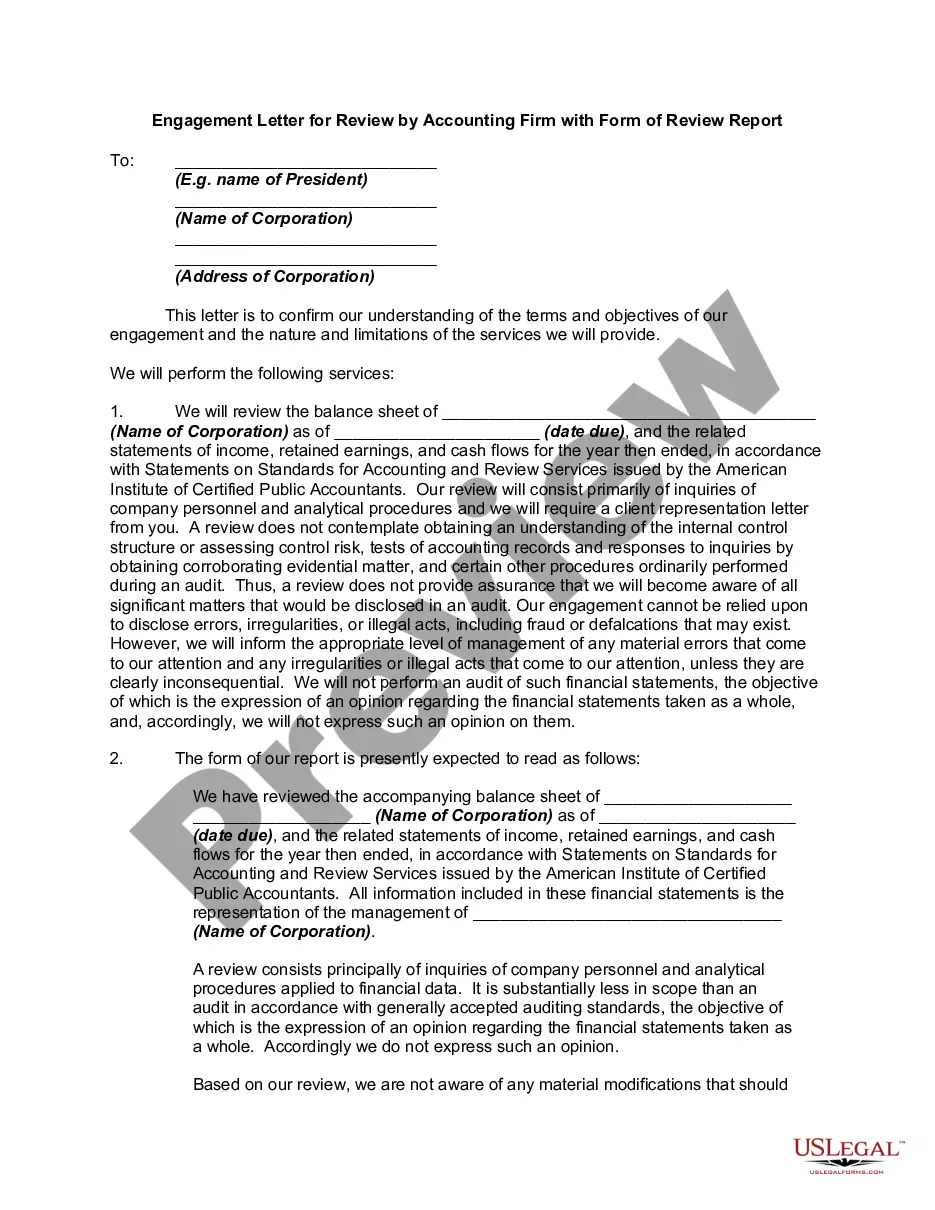

How to fill out Sample Letter For Corporation Taxes?

You may spend hours on-line trying to find the legal document design which fits the state and federal requirements you will need. US Legal Forms supplies thousands of legal varieties which are examined by experts. It is possible to down load or printing the North Dakota Sample Letter for Corporation Taxes from our service.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load button. Following that, you are able to complete, revise, printing, or sign the North Dakota Sample Letter for Corporation Taxes. Each and every legal document design you buy is your own property for a long time. To obtain one more duplicate of the purchased develop, visit the My Forms tab and click the related button.

If you use the US Legal Forms web site initially, stick to the basic recommendations under:

- Very first, make certain you have chosen the correct document design for your state/city of your choosing. Browse the develop explanation to ensure you have picked out the proper develop. If accessible, make use of the Preview button to search from the document design too.

- If you want to get one more variation of your develop, make use of the Lookup area to find the design that fits your needs and requirements.

- After you have found the design you need, click on Acquire now to proceed.

- Select the pricing strategy you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Complete the transaction. You can utilize your charge card or PayPal profile to fund the legal develop.

- Select the formatting of your document and down load it to the gadget.

- Make adjustments to the document if possible. You may complete, revise and sign and printing North Dakota Sample Letter for Corporation Taxes.

Down load and printing thousands of document web templates while using US Legal Forms web site, which provides the largest variety of legal varieties. Use expert and condition-specific web templates to tackle your business or person requires.

Form popularity

FAQ

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information.

North Dakota Transmittal Of Wage And Tax Statement.

A North Dakota tax power of attorney (Form 500), otherwise known as the ?Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,? is used to designate a person as a representative of your interests in tax matters before the concerned tax authority.

The North Dakota Voluntary Disclosure Program (Program) allows a taxpayer that has been conducting business activities in North Dakota or has been collecting but not remitting North Dakota sales tax to voluntarily come forward and resolve potential tax liabilities.

A domestic corporation (including a Subchapter S corporation) must file an income tax return whether it has taxable income or not, unless it's exempt from filing under section 501.

Income Tax Withholding Returns Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more.

IRS Form 8821, Tax Information Authorization, allows the individual, corporation, firm, organization, or partnership that you choose to obtain information about your tax account from the IRS, but they cannot act on your behalf.

North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate.