North Dakota Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

If you wish to acquire, download, or print lawful document templates, utilize US Legal Forms, the most extensive assortment of legal forms, which are accessible online.

Take advantage of the website's user-friendly and straightforward search to find the documents you need.

Various templates for commercial and individual purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Dakota Testamentary Trust of the Residue of an Estate for the Advantage of a Wife with the Trust to Persist for the Benefit of Children after the Wife's Passing. Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Stay competitive and download, and print the North Dakota Testamentary Trust of the Residue of an Estate for the Advantage of a Wife with the Trust to Persist for the Benefit of Children after the Wife's Passing with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to access the North Dakota Testamentary Trust of the Residue of an Estate for the Advantage of a Wife with the Trust to Persist for the Benefit of Children after the Wife's Passing with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to acquire the North Dakota Testamentary Trust of the Residue of an Estate for the Advantage of a Wife with the Trust to Persist for the Benefit of Children after the Wife's Passing.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have chosen the form for your appropriate region/country.

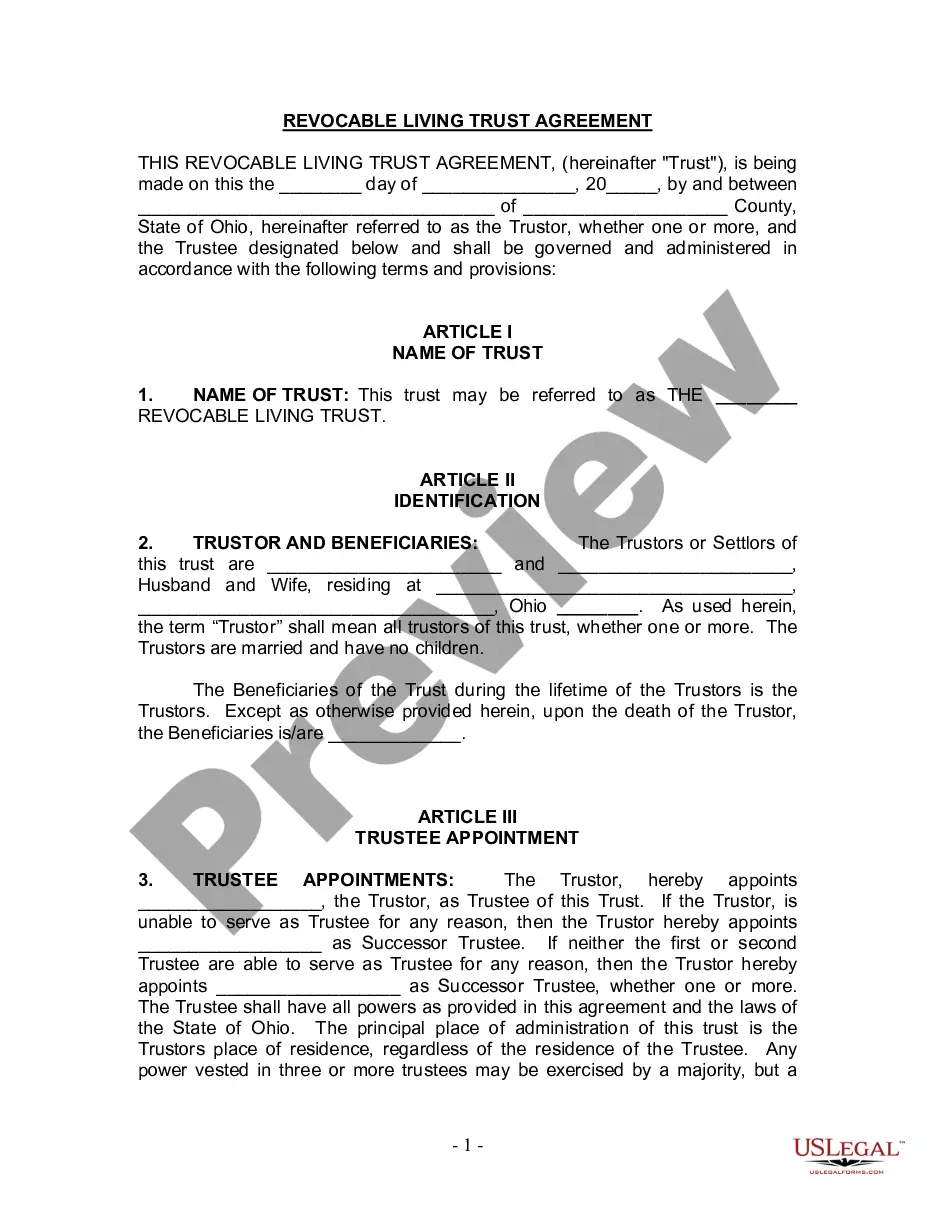

- Step 2. Use the Preview feature to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your details to create an account.

Form popularity

FAQ

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.

A testamentary trust could also be a family trust, which holds assets for your family, while a spousal testamentary trust holds assets for a surviving spouse. If the trust is meant to help minimize your spouse's future estate value, then it might be a bypass trust.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

How does Testamentary Trust Taxation Work? Testamentary Trusts are taxed as a whole, though beneficiaries will not be forced to pay taxes on distributions from the Trust. Note that you could be responsible for the capital gains tax, depending on your state.

The rule in Saunders v Vautier is familiar territory for trust lawyers. In the modern world it is understood to mean that the beneficiaries of a trust, if all of full age and capacity, may together terminate the trust and require the trust property to be transferred to them.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.