[Your Name] [Your Address] [City, State, ZIP] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP] Re: Response to Inquiry — Mortgage Company Dear [Recipient's Name], I hope this letter finds you in good health. I am writing in response to your recent inquiry regarding the mortgage services offered by our esteemed company. As a trusted mortgage provider serving the residents of North Dakota, we are pleased to provide you with detailed information and answer any questions you may have. [Type 1: New Home Purchase] If you are considering purchasing a new home in North Dakota, our mortgage company can assist you in making this dream a reality. Our experienced team of professionals is well-versed in the real estate market of North Dakota and can guide you through the mortgage process step by step. We offer a variety of mortgage programs tailored to meet your specific needs, whether you are a first-time homebuyer or looking to upgrade your current residence. [Type 2: Refinancing] If you currently own a home in North Dakota and wish to lower your mortgage payments, cash out on your home equity, or take advantage of lower interest rates, our mortgage company offers refinancing options. Refinancing your mortgage can help you optimize your financial situation and potentially save thousands of dollars over the life of your loan. [Type 3: Home Equity Loans] For homeowners in North Dakota looking to tap into the equity they have built in their properties, our mortgage company offers home equity loans. Whether you need funds for home improvements, debt consolidation, educational expenses, or any other purpose, a home equity loan allows you to access the value of your home to meet your financial goals. At [Company Name], we understand that every individual's circumstances are unique. Therefore, we provide personalized solutions to ensure that our clients receive the best mortgage options available to them. Our knowledgeable team will work closely with you, taking into account your financial situation and goals, to help you make an informed decision regarding your mortgage needs. We pride ourselves on providing exceptional customer service and a hassle-free mortgage application process. Our competitive interest rates, flexible loan terms, and transparent fees are designed to make your experience with us as positive as possible. To further discuss your specific mortgage requirements or any questions you may have, please do not hesitate to contact our dedicated team at [Phone Number] or [Email Address]. We would be more than happy to schedule a consultation at your convenience and provide you with a personalized mortgage solution. Thank you for considering our mortgage company for your North Dakota home financing needs. We look forward to the opportunity to serve you and assist you in achieving your homeownership or refinancing goals. Warm regards, [Your Name] [Your Title] [Company Name] [Company Address] [City, State, ZIP]

North Dakota Sample Letter for Response to Inquiry - Mortgage Company

Description

How to fill out North Dakota Sample Letter For Response To Inquiry - Mortgage Company?

It is possible to spend several hours online attempting to find the legal papers web template which fits the federal and state demands you will need. US Legal Forms supplies thousands of legal kinds which are analyzed by specialists. You can easily download or produce the North Dakota Sample Letter for Response to Inquiry - Mortgage Company from the services.

If you already possess a US Legal Forms profile, you are able to log in and click the Obtain switch. Following that, you are able to complete, modify, produce, or signal the North Dakota Sample Letter for Response to Inquiry - Mortgage Company. Every single legal papers web template you buy is the one you have forever. To have yet another version for any purchased form, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms internet site initially, adhere to the easy instructions below:

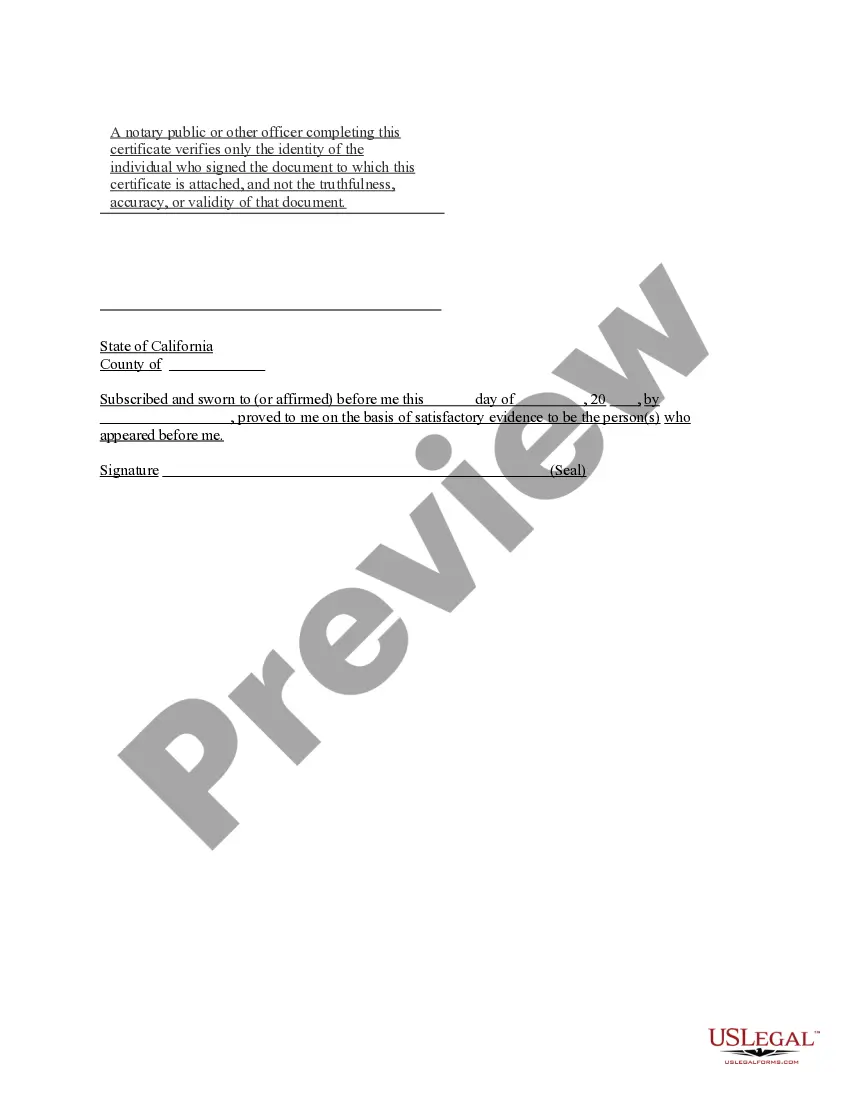

- First, make certain you have selected the best papers web template to the state/town of your choosing. Read the form explanation to make sure you have picked out the appropriate form. If offered, take advantage of the Preview switch to appear with the papers web template too.

- If you wish to get yet another model of your form, take advantage of the Lookup discipline to obtain the web template that meets your needs and demands.

- After you have discovered the web template you would like, click Get now to move forward.

- Choose the rates strategy you would like, enter your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal profile to purchase the legal form.

- Choose the format of your papers and download it for your product.

- Make changes for your papers if possible. It is possible to complete, modify and signal and produce North Dakota Sample Letter for Response to Inquiry - Mortgage Company.

Obtain and produce thousands of papers layouts while using US Legal Forms website, which provides the largest collection of legal kinds. Use specialist and status-certain layouts to take on your business or specific demands.